Despite the slight downturn, the institutional adoption of Bitcoin continues to increase. Filings with the United States Securities and Exchange Commission show that four wealth management firms have bought shares in Grayscale’s Bitcoin Investment Trust.

A survey of about 42,000 people in 27 countries by product comparison website Finder showed a high adoption rate in Asia. Among the countries polled, Vietnam had the highest adoption rate at 41%, while India and Indonesia had a 30% adoption rate.

OUR BLOG ARTICLES FOR THIS SPECIAL ISSUE GET CASH FOR CRYPTO, MELD’S CRYPTO COLLATERALISED LOANS ARE A GAME CHANGER

CUTTING THROUGH THE NOISE, GAIN PROTOCOL FILLS THE GAPS BY CREATING A SECURE STATIC REWARD TOKEN

We had highlighted in the previous analysis that the negative divergence on the relative strength index (RSI) was warning that the bullish momentum was slowing down and a break below the 20-day exponential moving average (EMA) could pull the price to the 50-day simple moving average (SMA).

Our assumption played out on September 7 as Bitcoin turned down sharply from £38,257.06 and plunged to an intraday low of £31,011. The bulls could not push the subsequent bounce above the 20-day EMA, which suggests that the sentiment has turned negative and traders are selling on rallies.

The important support to watch on the downside is £31,011. If this level breaks down, the selling momentum could pick up further and the BTC/GBP pair could plummet to £27,000.

The first sign of strength will be a break and close above the 20-day EMA. The bullish momentum could pick up if the pair rises above £34,398.41.

Lastly please check out the advancement’s happening in the cryptocurrency world. Enjoy the issue!

Enjoy the issue!

FEATURING IN THIS WEEKS EDITION

– Bondex

– Omnia

– MELD

– Mining

– Gain Protocol

– Aristo

– DeGeThal

CRYPTO TRADE OPPORTUNITIES

BITCOIN – BTC/GBP

We had highlighted in the previous analysis that the negative divergence on the relative strength index (RSI) was warning that the bullish momentum was slowing down and a break below the 20-day exponential moving average (EMA) could pull the price to the 50-day simple moving average (SMA). Read more

ETHEREUM – ETH/GBP

On Ether also we had warned of a possible correction or consolidation being signalled by the negative divergence on the RSI. That played out on September 7 when the price nosedived from £2,852.01 to £2,200. The long tail on the day’s candlestick shows that bulls bought the dip to the 50-day SMA. However, they could not push and sustain the price above the 20-day EMA, indicating a lack of demand at higher levels. Read more

RIPPLE – XRP/GBP

Although bulls pushed XRP above the overhead resistance at £0.938 on September 6, we had warned that bears are unlikely to give up easily and will try to pull the price back below the level and trap the aggressive bulls. That is what happened on September 7 when the XRP/GBP pair plunged to the 50-day SMA. The bulls bought the dip but since then, they have not been able to push and sustain the price above the 20-day EMA. Read more

CARDANO – ADA/GBP

The failure of the bulls to sustain Cardano above £2.16173 could have attracted profit-booking by short-term traders on September 7. The selling picked up momentum on the break below the 20-day EMA and the ADA/GBP pair plunged to the 50-day SMA. The long tail on the September 7 and 8 candlesticks suggests that bulls aggressively bought near the 50-day SMA. Read more

BINANCE – BNB/GBP

Binance Coin turned down and broke below the moving averages on September 7. The long tail on the day’s candlestick suggests that bulls purchased this dip. However, buyers could not push the price above the 20-day EMA during the subsequent recovery. Read more

Subscribe to the latest crypto news digital magazine for the latest updates about profit and loss in cryptocurrency.

TOKENISING REAL ESTATE – FRACTIONALISING REALITY THE OMNIA WAY

One of the many – but perhaps most exciting – applications of blockchain technology to be launched by the up-and-coming Omnia DeFi project (You can get $OMNIA early by joining their whitelist here) is the tokenisation of real estate, property and land. At any stage of a property development project, tokenisation can be of benefit not only to existing developers, but also first-time buyers, builders, or investors. Read more

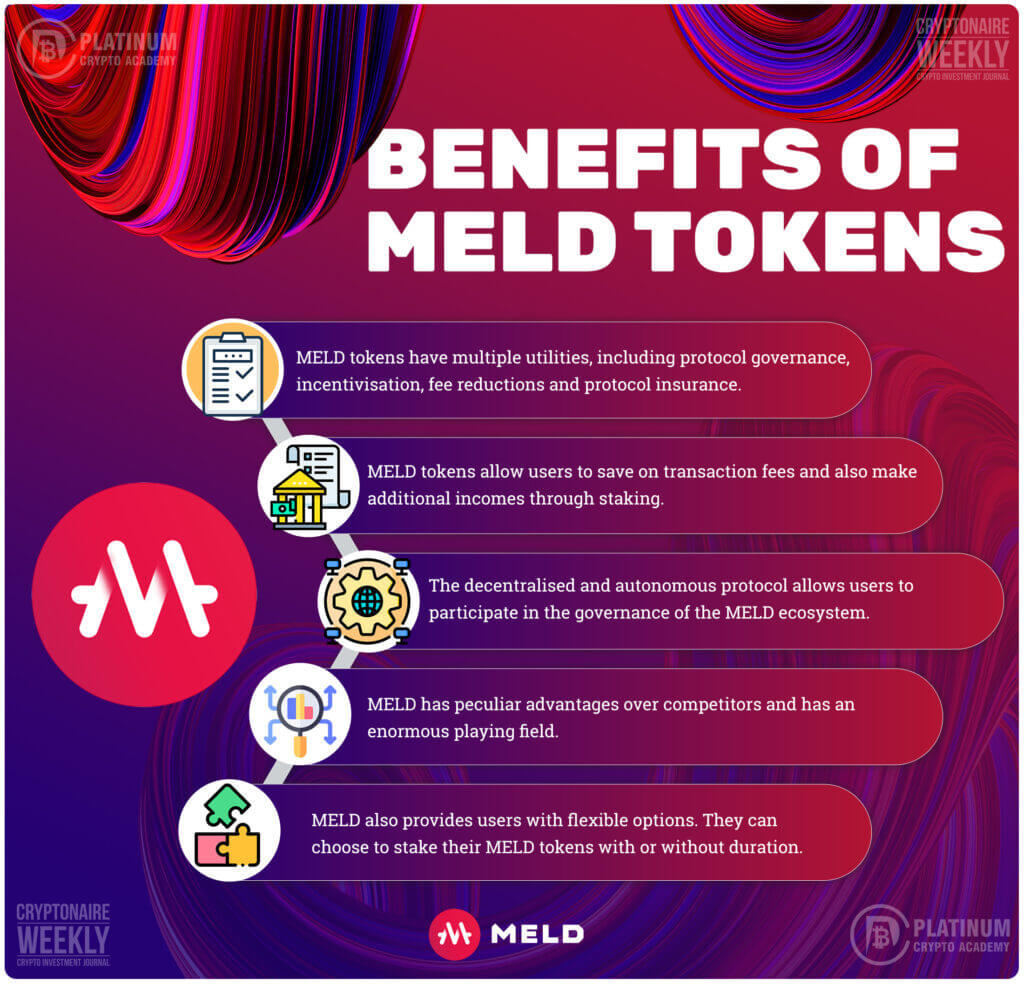

GET CASH FOR CRYPTO, MELD’S CRYPTO COLLATERALISED LOANS ARE A GAME CHANGER

Cryptocurrencies have solidified their position as one of the most profitable asset classes. Despite the market volatility, the top coins by market cap have provided investors with very high returns over the past decade. As an evolving market, we have seen how those who openly claimed crypto and Bitcoins who were in a bubble, are now shifting sides. From conventional investors and asset management firms to Wall Street giants, all are now wanting to get on the boat. Read more

CUTTING THROUGH THE NOISE, GAIN PROTOCOL FILLS THE GAPS BY CREATING A SECURE STATIC REWARD TOKEN

Over the past year, there has been a major shift in how big investors interact with DeFi protocols. According to the latest figures posted by Coinbase, the world’s largest cryptocurrency exchange, more and more institutional investors are now becoming interested in decentralised finance. Read more

INSTITUTIONAL TRADERS FLOCK TO SOLANA AS DEMAND FOR ETH AND BTC FLATTENS

Institutions were betting big on Solana investment products last week, with SOL-tracking products attracting 86.6% of institutional inflows to digital asset products last week. Institutional traders have flocked to Solana (SOL) as demand for Ether (ETH) and Bitcoin (BTC) exposure has flattened, with SOL investment products representing a whopping 86.6% of total weekly inflows Read more

RMRK LAUNCHES THE MOST ADVANCED NFT SYSTEM IN THE WORLD

RMRK, an advanced non-fungible token (NFT) project, has released their Kanaria bird NFT project, ushering in the first wave of nextgeneration NFTs. Mahalleinir from D1 Ventures, an early backer, said, “The long-anticipated release of Kanaria has been well met by the community, and Bruno Škvorc, [project founder of Kanaria], who has a vision beyond his time, has been able to achieve with the RMRK standard on Kusama what many on Ethereum are still trying to accomplish.”

SBI-ACQUIRED TAOTAO EXCHANGE IN JAPAN RELISTS XRP

JEven though XRP’s status is under SEC’s scrutiny in the United States, the asset was embraced by Ripple Labs’ major partner, the SBI Group located in Japan. Due to this crucial partnership, XRP has not yet been dismissed as a digital asset in the country. This was visible as many exchanges that had earlier delisted XRP have been relisting it. Read more

BRITISH POST OFFICE ID APP TO SELL BITCOIN VOUCHERS NEXT WEEK

Technology from the Post Office is being used to sell vouchers that can be redeemed on decentralized exchange Swarm Markets. British citizens can buy crypto through the Post Office’s app next week. The state-owned Post Office has teamed up with DEX Swarm. Read more

COINBASE TO RAISE $1.5 BILLION IN BOND SALE

C oinbase Global Inc. is seeking to raise $1.5 billion in its first junkbond offering, a deal that provides another stamp of approval for cryptocurrency and a sign that the nineyear- old firm is gaining mainstream acceptance even as regulators ramp up scrutiny. The deal would provide cheap financing for the cryptocurrency exchange, which just received a warning from regulators about its plans to expand into the lending business. The bonds earned a BB+ rating from S&P Global Ratings and a Ba1 from Moody’s Investors Service, just one notch below investment.

NBA STAR STEPH CURRY JOINS TOM BRADY AS FTX AMBASSADOR

S am Bankman- Fried’s trading empire adds another professional athlete to its cap table. In the crypto exchange’s continued push to court sports fans everywhere, Golden State Warriors guard Stephen Curry has been signed as an “FTX global ambassador.” Read more

CRYPTO WHALES BOUGHT THE RECENT BITCOIN DIP, ACCORDING TO ON- CHAIN ANALYST WILLY WOO

Idely followed on-chain analyst Willy Woo says that whales, or entities holding 1,000 BTC or more, bought Bitcoin during the recent correction rather than sold. The popular analyst tells his 718,000 followers that Bitcoin’s most recent downturn had little to do with whales selling their crypto. “Contrary to common opinion, that latest price pullback was not from whale selling. They’ve been in a significant region of buying.” Read more

MAJOR UK HEDGE FUND BREVAN HOWARD LAUNCHES CRYPTO DIVISION

Brevan Howard also hired former CMT Digital CEO Colleen Sullivan to lead private and venture investments in crypto. Brevan Howard, a United Kingdom-based hedge fund, plans to “significantly expand” its cryptocurrency and digital assets, according to a new report from Reuters.

RUSSIAN ASSEMBLY SEEKS TO REGULATE CRYPTO MINING AS A BUSINESS

Following its decision to endorse the cryptocurrency industry in January, the Russian government is now trying to regulate crypto mining activities. Local lawmakers appear to be serious about regulating the crypto industry as proponents of the sector push to attract global crypto mining operators. The current chairman of the Russian State Duma Committee on Financial Markets, Anatoly Aksakov, asserted that Read more