BitMEX Review 2022

BitMex, also known as Bitcoin Mercantile Exchange, is essentially a platform designed for leveraged trading that is widely used by professional and experienced traders. Owned as well as operated by the HDR Global Trading Limited, registered in Seychelles, BitMex has offices across the globe. It was co-founded by Ben Delo, Samuel Reed and Arthur Hayes, who hails from Hong Kong. The platform enables traders to purchase as well as sell contracts in exchange for cryptocurrencies (not the real coins though) while also using high leverage for trading.

Thus, BitMex is a P2P trading platform, which provides leveraged contracts that are sold and bought in Bitcoins and not fiat currency. It must be noted that Bitmex handles only Bitcoin and offers margin trading even when a trader purchases and sells altcoin contracts.

BITMEX REVIEW 2022: WHAT ARE DERIVATIVES?

Before we proceed any further, it is important to understand that concept of derivatives. In essence, investors utilize financial instruments like Futures & Derivatives for hedging risks. These risks are present in the form of financial liabilities, fluctuations in commodity price as well as other factors. Thus, within the investment realm, Derivatives are referred to as contracts whose prices are decided based on one or many more underlying financial assets. The asset could be a stock, currency, commodity or even a security. Often, Derivatives are utilized for trading within specific sectors like equity, foreign exchange, electricity, treasury bills, temperature, weather etc. Also, there are many kinds of Derivatives contracts such as Futures, Forwards, Options and Swaps.

HOW TO USE THE EXCHANGE?

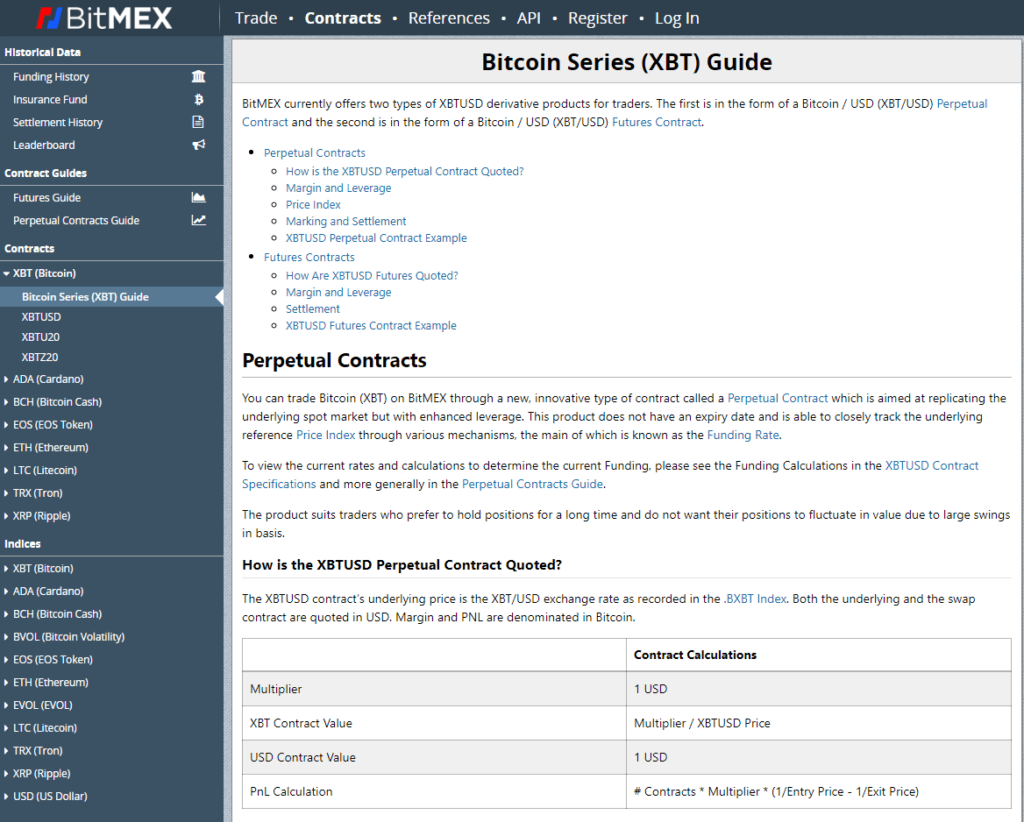

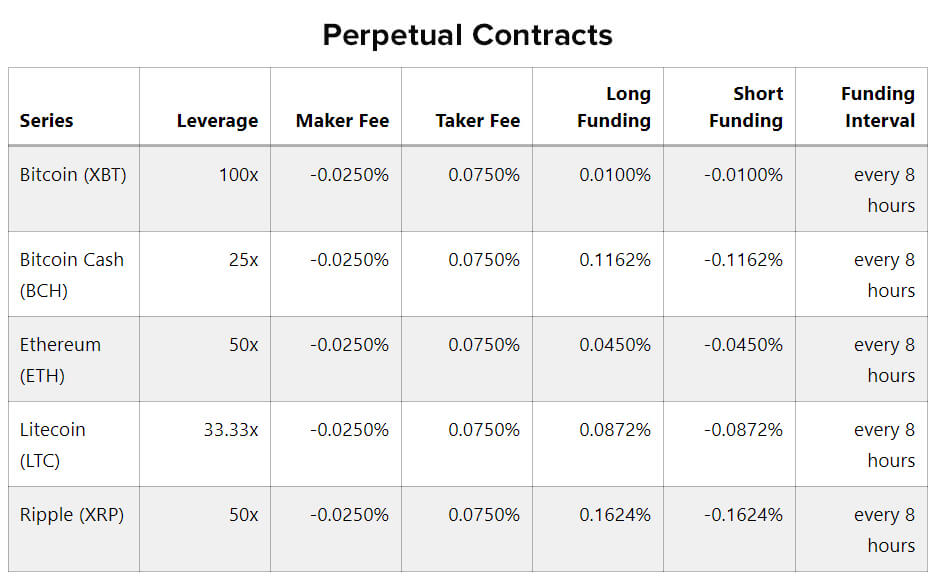

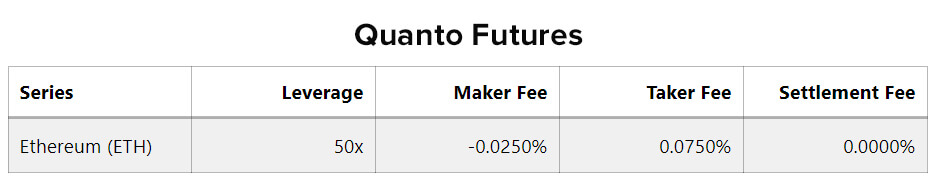

As far as BitMex is concerned, the exchange offers two different types of contracts including Futures and Perpetual Contracts. When compared to the futures contract, perpetual contracts don’t come with expiry dates and hence they are not required to be settled.

On the other hand, a Perpetual contract comes with a funding rate that occurs after every eight hours. Investors who choose to hold their position based on the funding time and date either receive or pay. Thus, at the time of settlement of the future contracts, all the users holding their positions are settled on the basis of the settlement price of the contract. This means you can go long as well as short on the futures and perpetual contracts by selling or buying them. In fact, you can also sell when you aren’t holding any contracts, thus making BitMex an excellent tool for shorting purposes.

When it comes to using the derivatives exchange, users must use the following tabs:

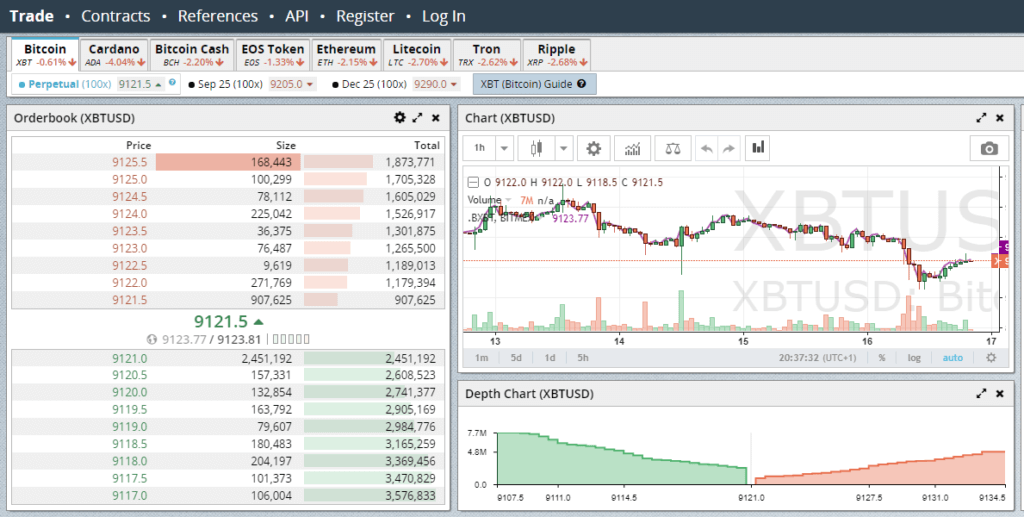

Trade:

BitMex’s trading dashboard allows you to pick the financial instrument that you intend to trade, choose leverage, find out the position information and view crucial information mentioned within the contract. You can use this tab to place or cancel your orders.

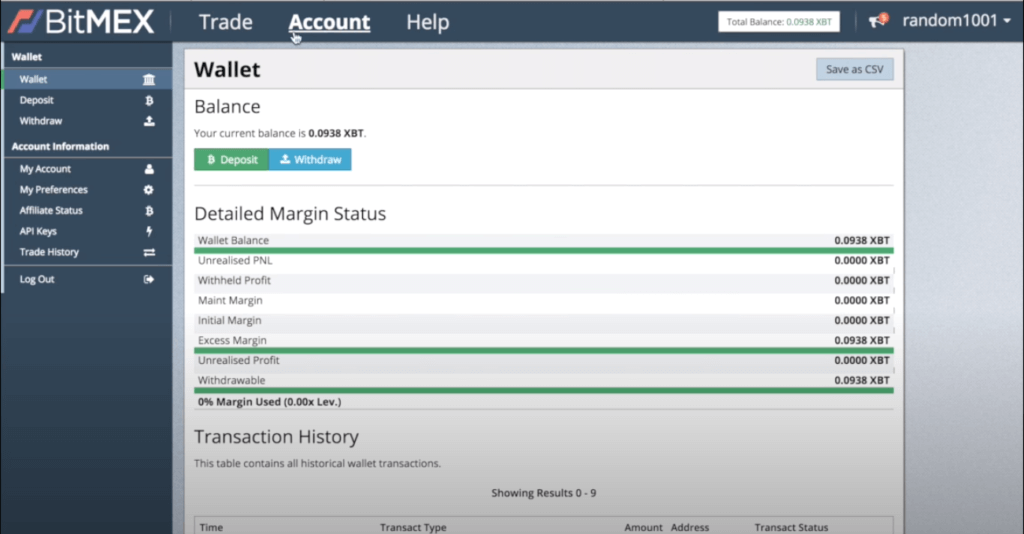

Account:

Next is the account tab, which provides information about different account types including current Bitcoins that are available. It also displays information about deposits & withdrawals, margin balances and affiliate information as well as trade history. Thus, traders can open their preferred accounts and deposit the necessary funds to initiate trading.

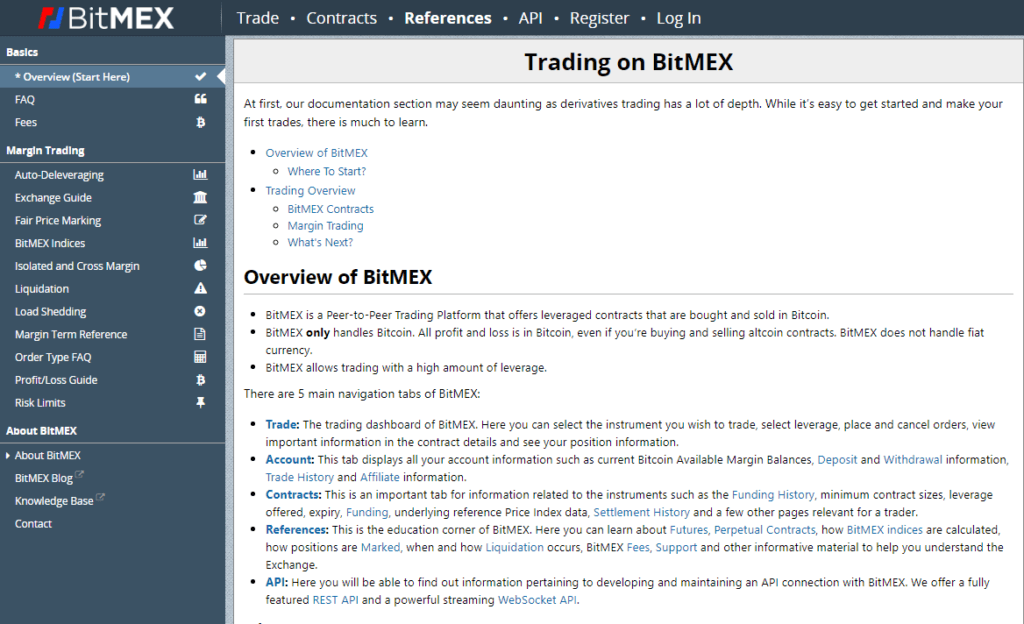

Apart from this, there are other tabs such as Contracts, References and API. While, contracts tab provides important information about financial instruments such as the minimum size of the contract, funding history, expiry, the leverage provided, funding, settlement history and more.

The References tab is where one can find all the educational materials at BitMex. In this section, you will learn more about perpetual contracts, futures, indices calculation on BitMEX, liquidation and more. The API tab provides information regarding developing as well as maintaining the API connect with the platform.

Before you start trading at BitMex, it is important that you learn more about the platform’s terms & conditions and the concepts of marker fee and taker fee. Apart from this, you can also refer to the Exchange Guide to understand more about open positions, stop loss and PNL calculations.

BITMEX REVIEW 2022: PERPETUAL CONTRACTS

WHAT ARE PERPETUAL CONTRACTS?

As already mentioned above, BitMex allows you to trade perpetual contracts through its platform. Perpetual contracts are basically derivative products that are the same as the traditional futures contracts but come with a few different specifications. For instance, there isn’t any settlement or expiry with perpetual contracts. They mimic spot market based on margin and therefore trade closer to the reference index prices. Thus, the primary method for tethering to spot pricing is funding.

HOW DO PERPETUAL CONTRACTS WORK?

In order to trade perpetual contracts on BitMex, traders are required to attain clarity on different processes of the trading market. The main components that the traders must know about are:

Position Marking: A perpetual contract is marked in accordance with the fair pricing marking mechanism. Thus, Mark Price is used for determining the Unrealized PNL as well as liquidation prices.

Initial & Margin: These major margin levels are used for determining the leverage that one can easily trade with as well as the point at which liquidation occurs.

Funding: This is the payments which are exchanged between seller and buyer after every eight hours. In case the rate comes positive, then long are required to pay whereas the shorts receive the rate, and when the rate comes out negative than vice versa. Traders only receive or pay funding when they hold positions at Funding Timestamp.

Funding Timestamp: The timestamps are 04:00 UTC, 12:00 UTC as well as 20:00 UTC.

Thus, traders can view the existing rate of funding for any contract under the tab “Contract Details”. At the same time, one can also observe the rate in their individual ‘contract specification’.

BITMEX REVIEW 2022: FUTURE CONTRACTS

WHAT ARE FUTURE CONTRACTS

Unlike Perpetual Contracts, Future Contracts are derivative products and are basically agreements to purchase or sell any commodity, currency as well as other financial instruments at a price that has been pre-determined as well as at specific timing in future. These contracts are either settled in cash or physically.

HOW DO FUTURE CONTRACTS WORK ON BITMEX

As far as Bitmex is concerned, the platform provides most of its products as Future Contracts along with cash settlements. In the case of futures contracts, traders are not required to post a hundred percent collateral as the margin. As a result, they can trade using the leverage of up to a hundred times on a few BitMex contracts. All the margins on BitMex are denominated in Bitcoins, and therefore traders can easily carry out their speculations on the value of BitMex’s products in the future using only Bitcoins.

HOW TO TRADE FUTURE CONTRACTS ON BITMEX?

When it comes to trading the futures contracts, traders must make themselves aware of the ways in which the futures market operates. The main components that they must be aware of include:

Multiplier: Traders must first identify the contract’s worth. This information can be viewed in Contract Specifications for every instrument.

Position Marking: A Futures contract is marked as per the Fair Pricing Marking methodology. This mark price helps in determining the Unrealized PNL as well as liquidations.

Initial & Maintenance Margin: These main margin levels helps in determining the leverage that one can use for trading and the point at which liquidation occurs.

Settlement: When and how the futures contracts expire or are settled, is something that traders must know. BitMEX uses averaging over certain a time period before settlement in order to avoid any price manipulations. This time period can vary from one instrument to another and traders must read the contract specifications in order to find out the expiry time as well as the settlement procedure of individual contracts.

Basis: The basis basically refers to the amount of discount or premium futures contracts trade at in comparison to underlying spot pricing and is typically quoted as annualized %. The reason why basis exists is that a futures contract expires in future as well as there exists either a negative or positive time value component that is attached to this uncertainty around expiry.

MARGIN TRADING

WHAT IS MARGIN TRADING?

As one among the largest cryptocurrency exchanges (with respect to trade volumes), BitMex allows its traders to make use of margin trading. In essence, margin trading entails trading assets such as cryptocurrencies with the help of funds borrowed from 3rd parties. Margin trading, as such, is utilized by experts and highly professional traders in order to have large funds for trading in the financial market. Despite being profitable, this method can be highly risky since positions can be liquidated quickly.

HOW DOES MARGIN TRADING WORK ON BITMEX?

With BitMEX, traders get up to 100 times leverage on certain products. This implies that they can purchase as many as 100 Bitcoins (of contracts) whereas only one Bitcoin backs it. However, traders must remain careful because with higher leverage comes higher profit and also the risk of higher losses. It must be noted that BitMEX uses the concept of Auto Deleveraging and thus in few rare situations, positions leveraged in profit can be reduced at specific time frames in case a liquidated order is difficult to execute in the trading market.

BitMEX Review 2022: HOW THEY MAKE MONEY?

In case you are wondering how BitMex makes money, then you must know that the exchange does it by providing leverage to traders. BitMex changes a flat percentage fee as per the value of trades. Thus, those who take orders pay as much as 0.025%. By providing 100x leverage, the orders’ value is increased and thus, the fee amount charged as well as collected also goes up.

TRADING FEES 2022

It must be noted that BitMEX doesn’t take any fee on deposit and withdrawals. At the time of withdrawing Bitcoins, the minimum fee gets dynamically set on the basis of the blockchain load which can be observed on its Withdrawal page itself.

However, the exchange does charge trading fees for every trade completed. Fees are highly competitive on the exchange. In fact, BitMex’s users will notice that these charges are almost negligible in relation to the huge profits that they make, especially for savvy traders. The taker fees have been fixed at around 0.0750%, whereas the maker fees are 0.0250%. Thus, the maker basically gets a small rebate on the trades.

IS THE BITMEX EXCHANGE SAFE IN 2022?

BitMex is highly concerned about the security and safety of client funds on its platforms. The exchange has adopted rigorous measures to ensure security is never compromised. In fact, BitMEX offers a unique multi-signature deposit & withdrawal scheme, which means all the addresses on the exchange are multisignature, as well as all the storage is maintained offline. Thus, even when there is a complete system compromise, including that of web servers, database and trading engine, attackers will not have enough keys to steal the funds.

Apart from this, all the withdrawals on the exchange are audited personally by 2 employees of BitMex before they are finally sent. Also, they do not keep any private keys on the cloud server whereas the exchange uses cold storage for the bulk of the funds. In addition to this, all deposit related addresses, which are sent by BitMex, are duly verified by the external service provider to ensure that they consist of the keys which are controlled by none but the founders. In case the public key does not match, the entire system is instantly shut down, while trading comes to a halt.

Apart from the above, BitMex requires multiple authentications for access, which also includes hardware tokens. The exchange carries out full risk checking after every order is placed, traded, deposited, settled as well as even when withdrawals take place.

BitMEX also offers PGP encryption (on an optional basis) for automated emails. Traders who wish to benefit from this, can visit its Security Centre as well as insert their PGP public key within the form. Once enabled, BitMex will encrypt as well as sign the automated emails sent to traders on their accounts by their support team.

BITMEX REVIEW 2022: CUSTOMER SUPPORT

Bitmex offers excellent customer support to traders. In fact, their support is available through email tickets, which is quite the industry norm. Also, the announcement box is used for keeping the traders updated about issues and updates. The live chatting option is also available to traders in the form of Trollbox. However, this allows traders to chat with other traders of Bitcoin via the exchange.

BITMEX REVIEW: WHAT CRYPTOS ARE SUPPORTED?

At BitMex for futures or Derivatives contracts, one can buy or sell cryptocurrencies such as Bitcoin (XBT), Cardano (ADA), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), EOS Token (EOS) and Ripple (XRP).

BITMEX REVIEW 2022: TOP DEBATES AND VIDEOS FROM LEADERS AT BITMEX

Ben Radclyffe’s Crypto Asia Keynote

The Tangle in Taipei with Arthur Hayes and Nouriel Roubini

BITMEX IN RECENT NEWS

The news surrounding BitMEX is often highlighted as being very controversial, in the recent news the company is undergoing some restructuring as well as the relation between the recent twitter hack of many famous people and the fact the culprit has been found to have an account on BitMEX.

BitMEX parent company appoints new chairman amid regulatory scrutiny

Twitter Hacker Is a BitMEX Trader, On-Chain Data Suggests

Bitcoin Selling Pressure on BitMEX Is at Multi-Month Highs: Analyst

BITMEX REVIEW 2022: CONCLUSION

To sum up, BitMex is a highly potent trading platform or one of the best cryptocurrency exchanges in the world that allows investors to access global financial markets with the help of Bitcoin. With daily trading volumes of more than 35,000 BTC as well as more than 540,000 accesses on a monthly basis, BitMex is undoubtedly a giant trading platform. The platform allows a BitMEX user to perform highly complex trades using leverage. Their wide range of contracts including Future, Derivatives as well as Perpetual contracts is ideal for earning high profits.