Today’s article explores the new realm of a Digital Asset, primarily focusing on Statera and how they are revolutionising the Defi Space.

The term DeFi is a single term used to describe a collection of applications created in the public blockchain to change the financial industry (Traditional Finance). Endorsed by decentralized ledger technology (blockchain), DeFi is known as financial applications built on the decentralized ledger technologies using a group of codes known as smart contracts.

A smart contract is simply an automated and enforceable agreement that doesn’t require any third-party or intermediaries to execute. As long as you have an internet connection, you can access the smart contracts.

Decentralized Finance (DeFi) consists of a suite of applications and peer-to-peer (P2P) protocols created on blockchain networks requiring no access rights for easier borrowing, lending, and trading of financial tools. Many DeFi’s are currently built on the Ethereum terminal (network). Despite that, there are many emerging alternative terminals that aim to deliver superior speed, high security, more scalability, and lower transaction costs.

Today cryptocurrencies and crypto currency investing have exploded into a trillion-dollar industry, disrupting the financial world. The birth of cryptocurrencies dates back to the 1980s, when cryptography advanced. This also brought with it a whole new technology known as blockchain technology or decentralized ledger technology (DLT).

Since that time, a sequence of events has shaped the world of cryptocurrency investing. In the world of cryptocurrencies Bitcoin is the one that reigns supreme. It’s currently a store of value and even more expensive than gold. Most people that practice cryptocurrency investing call it digital gold.

Even though Bitcoin has grown over the last two decades, many financial institutions like banks and other corporations don’t want to adapt to it due to its highly volatile nature and lack of stability. Some institutions like PayPal and Tesla, however, have seen the value Bitcoin has. This has made them include Bitcoin in their day-to-day transactions and even adapt using it in their system.

Things change pretty fast in the crypto world. DeFi or in full, Decentralized Finance is the current trend in the financial world. The world of DeFi is the most exciting space to be in. For this reason, you’ll want to know all you can about decentralized finance and how it works.

HOW DEFI IS CHANGING THE FINANCIAL INDUSTRY – A NEW TYPE OF DIGITAL ASSET

In the earlier days, humans barter traded goods and services. Nevertheless, as humans morphed into modern man, economies and how to trade also evolved. Since physical goods were almost impossible to divide and used as money, man invented the currency. It was easier to store it, share it, and trade it compared to the earlier money.

The invention of coins and digital assets opened a new door to other innovations and also upgraded the levels of the economy.

From history, you know that Central Regulators gave out currencies that control the economy. This means more power goes to them as people trusted them to regulate this currency. As years went by, the trust initially given to the central regulators have broken over time. People began questioning the central authorities ability to manage their money.

Decentralized Finance was invented ideally to solve the problem of trust by giving each person control over their currency. The prime focus of DeFi is to provide a financial system that’s open to everyone and with as minimal control from any central authority as possible.

It’s assumed that the birth of DeFi was in 2009 with Bitcoin’s launch. Bitcoin was the first peer-to-peer digital asset currency built on top of the decentralized ledger technology network. Through Bitcoin, the theme idea of transforming the traditional financial services using blockchain technology kicked in. The goal was to create a decentralized financial system where everyone was given control over their currency.

Ethereum’s launch (the second generation blockchain and web 3.0) and smart contracts back in 2015 made the development of decentralized Finance possible. The Ethereum network unleashes the ultimate potential of blockchain technology by allowing business enterprises to create and deploy their DeFi apps using smart contracts.

DeFi’s development brought with it a suite of opportunities in the financial world that brings forth transparency and security without any regulations whatsoever from central authorities.

In 2017, the actual turning point of financial applications took place. Projects appended more functionalities in addition to money transfer and digital assets.

Decentralized Finance has grown into an ecosystem guided by predefined protocols and design applications that give value to billions of users worldwide. There are digital assets worth 30 billion dollars locked in DeFi’s ecosystem. This makes Decentralized Finance one of the fastest-growing economies in the public decentralized ledger technology space.

THE FOLLOWING ARE HOW DEFI IS CHANGING THE FINANCIAL INDUSTRY:

1. Lending and borrowing– DeFi enables borrowing and lending. This opens a whole new world to what is called Open Finance. If you practice cryptocurrency investing or hold crypto, DeFi offers you lending opportunities to earn yearly yields. The main aim for allowing lending and borrowing in DeFi is to serve the financial user cases in addition to fulfilling the cryptocurrency community’s needs.

2. Decentralized Exchanges– this is also known as DEx. They are one of the prime functions of Decentralized Finance. In cryptocurrency investing, DEx allows users to exchange their tokens or any of their digital assets without any third-party involvement. Centralized exchanges provide similar options, but the price to pay is too high. This means massive transaction costs and fees in addition to paying intermediaries for the safety of your digital assets.

3. Prediction markets– prediction markets are terminals where investors can make forecasts on the realization of future occurrences in the economy and globally as well. DeFi opens these markets for individuals to participate. Smart contracts in the DeFis make predictions possible.

4. Digital Asset management– this is another classification of service Decentralized Finance provides. The intention is to make investing faster, inexpensive, transparent, secure, and democratized

WHAT IS STATERA AND WRAPPED STATERA?

Statera (STA) is a smart contract powered Indexed Deflationary Token (IDT), which synergizes with a trustless and community-driven portfolio of class-leading cryptocurrencies

Deflation decreases volatility and increases positive price pressure of the liquidity pools it lives in. The deflationary mechanism also benefits the ecosystem it works in, by increasing volume (trades), which increases chances for rebalances/swaps, therefore producing tighter spreads and increased access to arbitrage.

This means that the value it brings increases the ability of the system to function more efficiently (tighter spreads, less slippage, better fees for users).

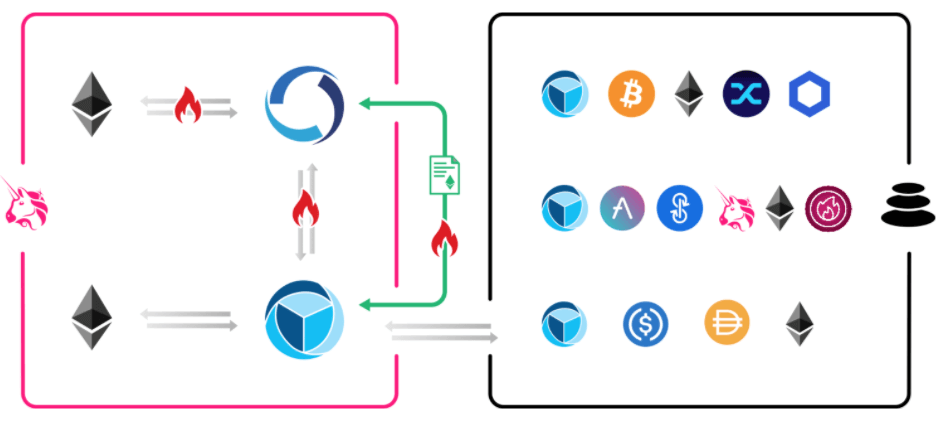

Wrapped Statera (wSTA) is a second token that doesn’t use any deflationary mechanism, permitting wSTA to be integrated into systems that do not traditionally operate with deflationary tokens. This token can only be minted by wrapping STA, and can be wrapped or unwrapped at any period for an equal number of tokens, minus 1% burn. This results in deflation occurring safely outside of systems where it could otherwise be taken advantage of.

HOW DOES STATERA WORK?

Statera is an ecosystem made up of a variety of liquidity pools within which all tokens hold a share of a portfolio’s value via smart contracts portfolio managers. When a digital assets ratio rises (appends) relative to other digital assets, the portfolio rebalances itself by selling the token that has increased in value.

wSTA can only be minted through wrapping the STA token, however it is also tradeable with STA or ETH on Uniswap or other DEXs. This results in a natural price equilibrium between STA/wSTA, as arbitrageurs will take advantage of any price disparity between the tokens. This arbitrage results in Statera’s deflation and in higher volume across the ecosystem.

wSTA is then safely implemented in any third-party protocol – such as Balancer, where Statera’s Index Pools reside. As the component assets’ prices fluctuate, they are constantly rebalanced – increasing deflation and arbitrage opportunities which then leads to further volume. This self-perpetuating cycle results in higher fees paid to liquidity providers.

HOW STATERA IS BRINGING DEFI TO THE MASSES – A NEW TYPE OF DIGITAL ASSET

The Statera community believes that DeFi is the future of Finance. Their main aim is to make the DeFi tools available in their network accessible to everyone who wishes to join the Statera community. By lowering the barrier to entry, Statera hopes to bring with it a sustainable stream of passive income to the masses.

With its processes of decreasing volatility and boosting passive income potential, the Statera community believes that Statera is established to be the excellent force-multiplier for any indexed fund of digital assets.

Liquidity Pools and How Statera is Utilizing Multi-Asset Liquidity Pools

Statera’s extended ecosystem consists of various liquidity pools. The liquidity pools are the places where all the Statera tokens (STA and wSTA) maintain a share of the portfolio’s value. This maintenance is made possible through the use of a smart contract portfolio manager.

When an asset’s ratio rises relative to the others, the portfolio will rebalance itself by trading the token that has amassed value. These pools constitute Uniswap pairs (containing 50/50 STA or wSTA with any other digital asset), Balancer Pools, and on any other index fund or liquidity pool platform.

All of these pools interact to generate more volume, arbitrage, profitable markets, and deflation across the network.

CONCLUSION- STATERA A NEW TYPE OF DIGITAL ASSET

To sum up, DeFi is indeed the future of Finance. Statera, a new type of digital asset, is the epitome of what potential DeFi has. By simply utilizing the features Statera has, one can easily make a recurring stream of passive income simply through trading.

And since everything in the network is done in a decentralized way, one has full control and access over his/her assets without any hurdles.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

TOP 10 UK CRYPTOCURRENCY BLOGS, WEBSITES & INFLUENCERS IN 2021

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.