The United States Federal Reserve hiked rates by 25 basis points in their February 1 meeting, which was in line with analyst expectations. Fed Chair Jerome Powell said he doesn’t see a rate cut in 2023 but he used the word “disinflation” 13 times during the FOMC press conference. This encouraged traders to speculate that the interest rate hiking cycle may have ended.

However, the expectations of a rate cut diminished after the strong January jobs report, which showed that the economy added 517,000 jobs, much higher than the market estimate of 187,000. The unemployment rate continued to decline and fell to its lowest level since May 1969.

Due to the strong jobs market and no clear signal from the Fed on rate cuts, the bulls have turned cautious in the near term. Some traders may have booked profits, which started a pullback in Bitcoin. But a positive sign is that the bulls are trying to keep the price above $22,500.

The rally in January has helped turnaround sentiment among small traders. Crypto analytics firm Santiment said that 620,000 new Bitcoin addresses were added since January 13. The rally above $20,000 may have triggered buying interest among traders.

It is not only the smaller traders who have turned bullish. Investment management firm Ark Invest has maintained its positive long-term view on Bitcoin. In its annual Big Ideas 2023 report released last week, analysts at ARK Invest said that “Bitcoin’s long-term opportunity is strengthening.” Their bull case prediction for Bitcoin by 2030 is $1.48 million per coin. Even their bear case forecast of $258,500 will turn into an eleven-bagger from current rates.

In the near term, there has been a lot of chatter about the golden cross on Bitcoin. A golden cross occurs when the 50-day simple moving average (SMA) rises above the 200-day SMA. While this is generally considered positive, Bitcoin’s price has seen a mixed response after the formation of the cross. Out of eight golden crosses in Bitcoin, three resulted in a strong bull market, three turned out to be bull traps and two were indecisive. How will Bitcoin and the major altcoins perform in the short term? Let’s study the charts to find out.

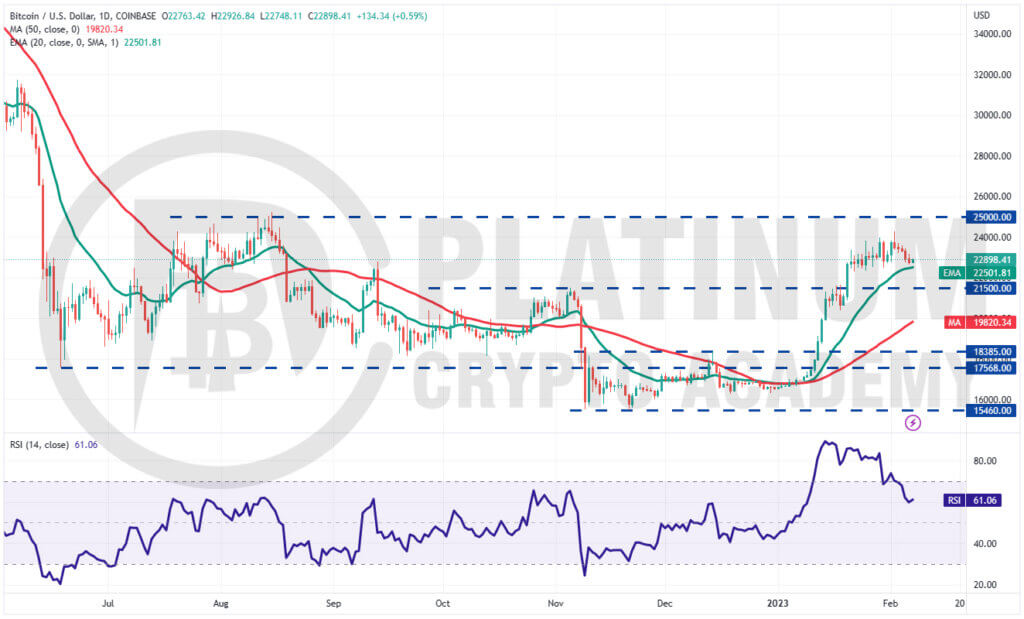

BTC/USD Market Analysis

Buyers tried to propel Bitcoin to the crucial overhead resistance of $25,000 but fell short. This attracted profit-booking from short-term bulls and selling by the aggressive bears, which pulled the price to the 20-day exponential moving average (EMA) as we had suggested in the previous analysis.

The 20-day EMA is flattening out and the relative strength index (RSI) has declined near 60, hinting at a possible range formation in the near term.

If bears sink the price below the 20-day EMA, the next support is at $21,500. The bulls are expected to defend this level aggressively. A strong rebound off it will increase the possibility of a range-bound action between $21,500 and $25,000.

Such a move will be a positive sign as it will signal consolidation following the sharp gains made in January.

The bulls will have to thrust the price above $25,000 to start a new uptrend. There is no major resistance between $25,000 to $30,000 so the pair could travel this distance quickly.

On the downside, if the $21,500 support cracks, the bears will be encouraged to pull the BTC/USD pair to the 50-day SMA.

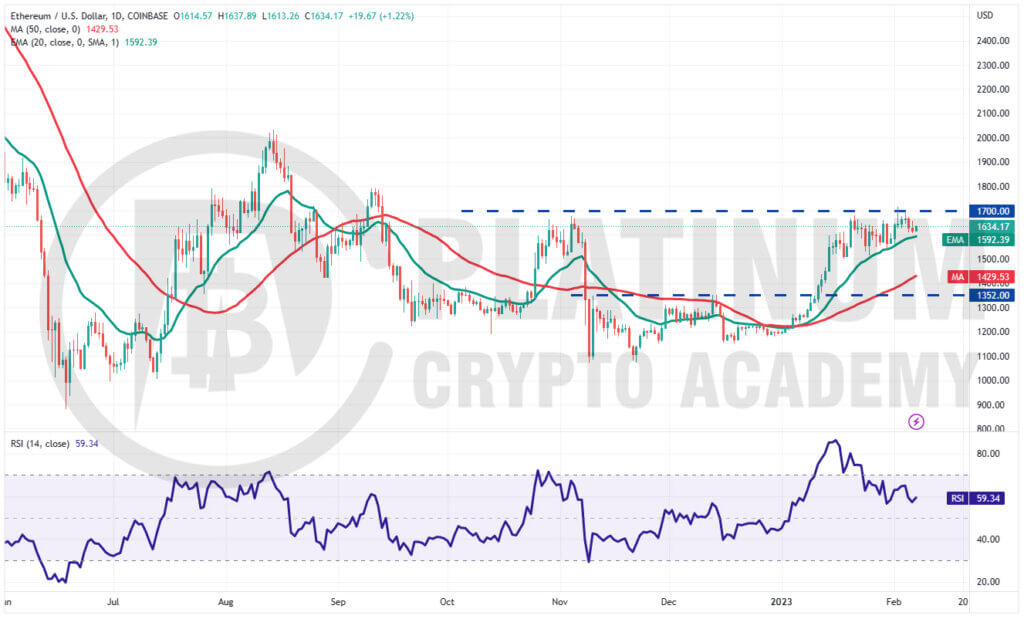

ETH/USD Market Analysis

The bulls nudged Ether’s price above $1,700 on February 2 but the bears sold at higher levels and sent the price back below the breakout level.

Buyers again tried to clear the overhead hurdle on February 4 but the bears did not budge. This has kept the ETH/USD pair inside the tight range between the 20-day EMA and $1,700.

This means the bulls are not allowing the 20-day EMA to break and the bears are fiercely protecting the $1,700 level. Usually, such tight ranges are followed by a sharp trending move.

But the problem is that it is difficult to predict the direction of the breakout. Hence, it is better to stay on the sidelines and enter when the break happens.

The upsloping 20-day EMA and the RSI in the positive territory give a slight edge to the bulls. If the price closes above $1,700, the pair could pick up momentum and start its northward march toward $2,000 with a brief stop at $1,800.

On the other hand, if the price plummets below the 20-day EMA, the pair could reach $1,500. The bears will have to sink the price below this level to gain the upper hand.

BNB/USD Market Analysis

We suggested in our previous analysis that the likelihood of a break and close above $318 was high and that happened on February 2.

Following a breakout from a strong resistance, the price generally returns to retest the breakout level. That happened on February 6 when the price dipped near $318.

If the BNB/USD pair rebounds off $318 with strength, it will indicate that the bulls have flipped the level into support. It will then act as a floor during future declines.

The upsloping 20-day EMA and the RSI in the positive territory suggest that bulls remain in charge. That enhances the prospects of a rally to $360.

Contrary to this assumption, if the price plummets below the 20-day EMA, it will suggest that the break above $318 may have been a bull trap. The next support is at $300 and then the 50-day SMA.

XRP/USD Market Analysis

We highlighted last week that XRP could be entering a consolidation and that is how it has been. Buyers tried to gain the upper hand by pushing the price above $0.41 on February 4 but the bears were in no mood to relent.

The flat 20-day EMA and the RSI just below the midpoint suggest a balance between supply and demand.

A break and close above $0.42 will tilt the advantage in favor of the bulls. There is a minor resistance at $0.45 but if bulls push the price above it, the path to $0.51 opens up.

Another possibility is that the price continues lower and plummets below the 50-day SMA. That may encourage the bears to sell aggressively and sink the XRP/USD pair to $0.33.

ADA/USD Market Analysis

Cardano turned up from the 20-day EMA on February 1 and rose above $0.40 on February 2 but the bulls failed to touch the overhead resistance of $0.44. This means the bears have not given up and continue to sell on rallies.

The negative divergence on the RSI remains intact, which suggests that the buying pressure is reducing. This view will gain strength if the price tumbles below the 20-day EMA.

The bears will then try to grasp the opportunity and try to pull the ADA/USD pair to the 50-day SMA. Such a deep correction may delay the start of the next leg of the up-move.

If bulls want to strengthen their hold, they will have to quickly drive the price above $0.41 and reach the stiff overhead resistance of $0.44.

Hopefully, you have enjoyed today’s article for further coverage please check out our crypto Blog Page. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.