Noon Capital has officially launched its public beta in January, entering a saturated stablecoin market with a sharp focus on yield efficiency, user-aligned incentives, and unprecedented transparency. Noon is backed by a growing list of ecosystem partners, including Euler Finance, Tulipa Capital, Lagoon Finance, ZeroLend, TAC Build, Turtle Club, Stork, Dinari, Halborn, and Quantstamp, among others.

While many stablecoins promise returns, Noon backs its design with a protocol architecture built to deliver sustainable yield through delta-neutral strategies while returning over 90% of its value back to users.

The powerhouse of Noon’s model is $USN, it’s a 1:1 USD-pegged stablecoin, and $sUSN, the yield-bearing staked version. Users mint $USN with USDT or USDC and can stake it to receive $sUSN, which appreciates in value daily as the protocol generates returns.

Rather than relying on a single strategy, Noon intelligently rotates between delta-neutral strategies like funding rate arbitrage and tokenised treasury bills, based on market conditions, technical indicators, and real-time risk assessment. This approach allows Noon to target the highest through-cycle returns without taking on market-directional exposure.

“We’ve designed Noon to generate top-tier returns regardless of market conditions,” said Fauve Altman. “By staying delta-neutral and automating capital allocation between strategies, we’re able to provide both yield and peace of mind. No unnecessary risk, no hype, just results.”

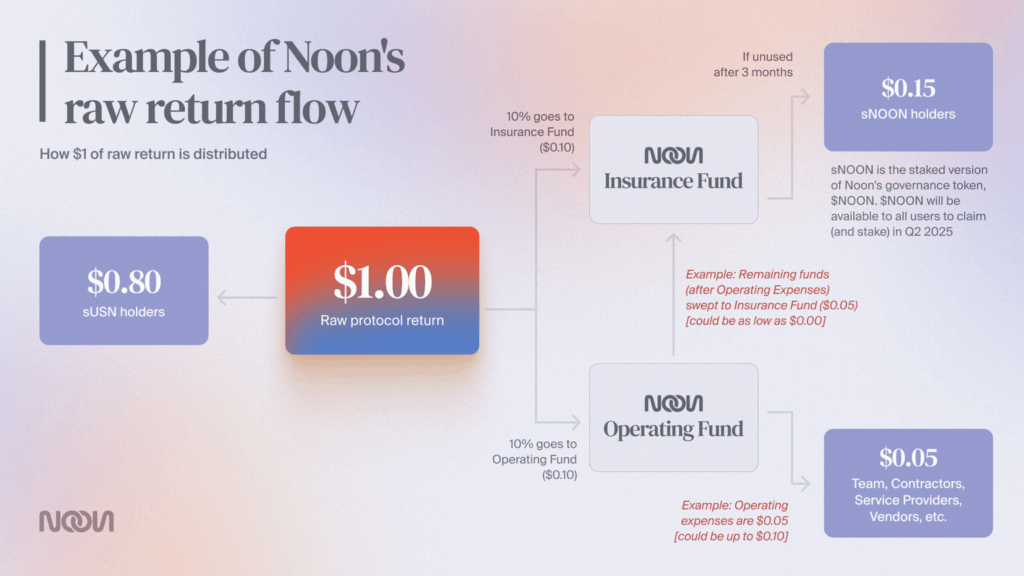

The value proposition is clear:

- 80% of raw returns are directed to $sUSN holders.

- 10% is allocated to the Noon Insurance Fund, which protects users and distributes any unused funds to staked governance token holders ($sNOON).

- 10% goes to the Operations Fund, which, after covering core expenses, re-routes remaining funds to the Insurance Fund.

USN holders, on the other hand, forgo raw yield in exchange for significantly higher governance token rewards, making it a lower-risk moonshot for users who want to accumulate $NOON ahead of the protocol’s TGE in Q2 2025.

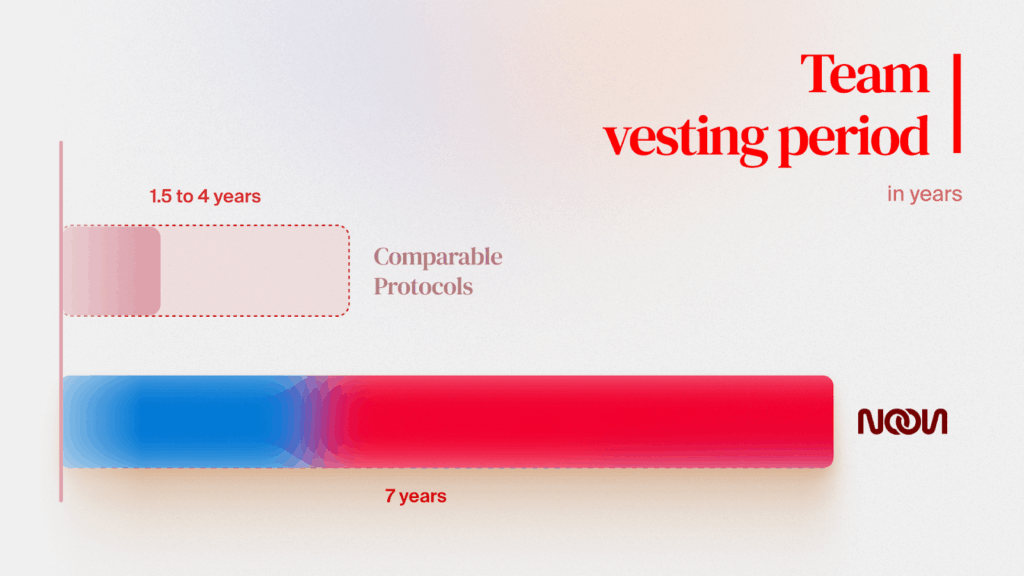

What sets Noon apart structurally is its user-first tokenomics. There are no VCs or private investors with pre-allocated tokens. Instead, 65% to 80% of all $NOON tokens are reserved for the community. The remaining 20% is allocated to the core team, with a linear 7-year vesting schedule, the longest of its kind in the industry.

“Too many protocols are designed to serve insiders first,” said Fauve Altman. “We’ve removed early investors from the equation entirely. If you’re using Noon, you’re earning Noon. That’s the only way in.”

To ensure credibility and user trust, Noon is also the first stablecoin to publicly offer real-time proof of solvency verified by a third party. Partnering with Accountable, a data verification platform, Noon provides continuous reserve audits using on- and off-chain data sources.

Collateral is securely held with custodians like Alpaca Securities and Ceffu, ensuring assets remain segregated and protected even in extreme market scenarios.

This transparency-first model isn’t an afterthought; it’s foundational. As part of its long-term plan, Noon has prioritised rigorous asset custody protocols and contract-level security, including role-based access control, multi-signature protections, and real-time monitoring of critical events.

“We’ve built Noon to be intelligent, fair, and resilient,” said Fauve Altman, Marketing and Community Lead. “But more than that, we’ve built it for users who are tired of being sidelined in protocols they helped grow. With Noon, they’re finally at the centre.”

Furthermore, Noon is currently live on Ethereum, ZKsync Era, and Sophon blockchain networks. Therefore, the users participating now can access Noon across these chains and interact with USN and sUSN across different ecosystems.

Both USN and sUSN are also actively tradable on diverse DEXs and lending protocols such as Uniswap, Syncswap, Zerolend, RFX, Spectra, Sophon Farms, and Euler. This allows users to easily swap, lend, and yield strategies across multiple venues while having ample liquidity and composability.

The protocol also has a staking and rewards architecture built in, which is tied to an ongoing points program that rewards users based on their activity. Points are earned for holding $USN or $sUSN, and can be boosted by actions like DEX liquidity provision (up to 4x), yield vault participation (up to 3x), and lending protocol activity (up to 2x). A tiered multiplier system rewards users who commit to staking $NOON for longer durations, up to 5x for 12 months.

All of these activities are listed on Noon’s reward page, where users can track progress and plan their engagement based on current campaigns.

Once the TGE goes live in Q2, 2025, users will be able to convert points earned during the beta phase into $NOON and choose to stake it to receive $sNOON. Staked governance token holders will be responsible for voting on protocol decisions, such as strategy additions, and will receive redistributions from the insurance fund once it surpasses minimum capital requirements.

Noon is now live in public beta. Users can join directly at www.noon.capital, start staking $USN, and begin accruing points ahead of the $NOON token generation event scheduled in Q2, 2025, which is very soon. The team expects a broader rollout across multiple chains in the coming months.

For media inquiries, please contact:

Fauve Altman

Marketing and Community Lead

About Noon Capital

Noon Capital is a web3-native yield-generating stablecoin protocol focused on delivering intelligent, fair, and sustainable returns to its users. By using delta-neutral deployment strategies and a radically user-first tokenomics structure, Noon aims to set a new benchmark for what stablecoins can achieve in DeFi.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.