Hi Crypto Network,

For the past few days, Facebook’s Libra project has hogged the limelight. The regulators and politicians around the world are voicing their concern on the project, with only a few in support. This has turned the sentiment decisively negative. As a result, the traders have changed their strategy from buy on dips to sell on rallies.

The cryptocurrency market needs a trigger to start the next leg of the rally. The recent infographic by Bank of China, the world’s fourth-biggest bank by assets, showing the history of bitcoin and how cryptocurrencies work is considered by some as a precursor to a bigger announcement. This rumour and the US sanction on various nations has boosted the price of Bitcoin in the OTC market, where the premium is 10-15% above the spot price.

Not only in China, even in the US investors are showing greater interest in cryptocurrencies. According to a study by Grayscale Investments, 83% of US investors might consider buying Bitcoin. Another interesting observation was that the average age of the Bitcoin investor was 42 years, just a tad below that of the traditional investor at 45 years. This shows that Bitcoin’s appeal is increasing.

Pantera Capital founder Dan Morehead believes that Bitcoin will reach $42,000 by the end of this year, and climb to $356,000 by 2022. While we remain bullish on cryptocurrencies and view the fall as a buying opportunity, we do not want traders to get carried away by these lofty targets. We suggest traders buy when the risk to reward ratio turns in their favour. Let’s see if we spot any buying opportunity this week.

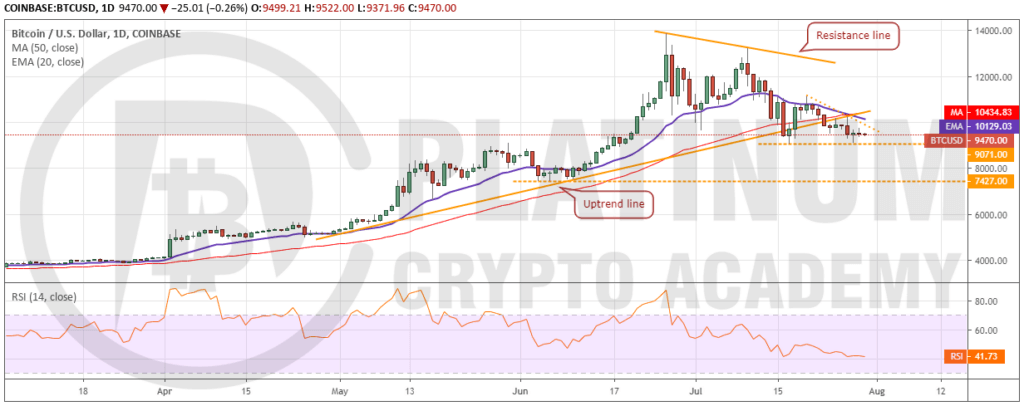

BTC/USD

Though Bitcoin rebounded off the support on July 28, bulls are finding it difficult to sustain the bounce. This suggests a lack of demand at higher levels. The moving averages have completed a bearish crossover and the 20-day EMA has started to slope down. This shows that bears have the advantage in the short-term.

The immediate support is at $9,071. If bears sink the price below this support, the next support on the downside is way lower at $7,427. We expect strong support at this level; hence, it might offer a good buying opportunity to the investors.

Contrary to our assumption, if the digital currency rebounds from $9,071 and breaks out of the 20-day EMA, it can move up to $11,112.31 and above it to the downtrend line. As we believe that Bitcoin has bottomed out, we will suggest long positions after the price sustains above 20-day EMA.

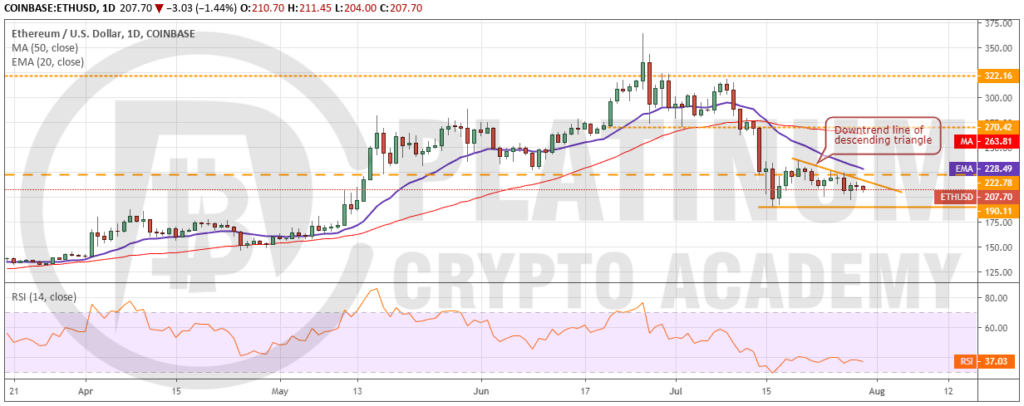

ETH/USD

The bulls are purchasing the dip to $190.11 but are unable to scale the overhead resistance of $222.78. Ether has formed a small descending triangle pattern, which will complete on a breakdown of $190.11. The target objective of this bearish pattern is $143.64. With both moving averages sloping down, the advantage is with bears.

Conversely, if bulls push the price above the downtrend line of the descending triangle, it will invalidate the pattern. Failure of a bearish pattern is a bullish sign. After breaking out of 20-day EMA, we expect the cryptocurrency to rally to 50-day SMA and above it, a retest of $322.16 is possible.

However, we suggest traders wait for the price to sustain above 20-day EMA before initiating any long position.

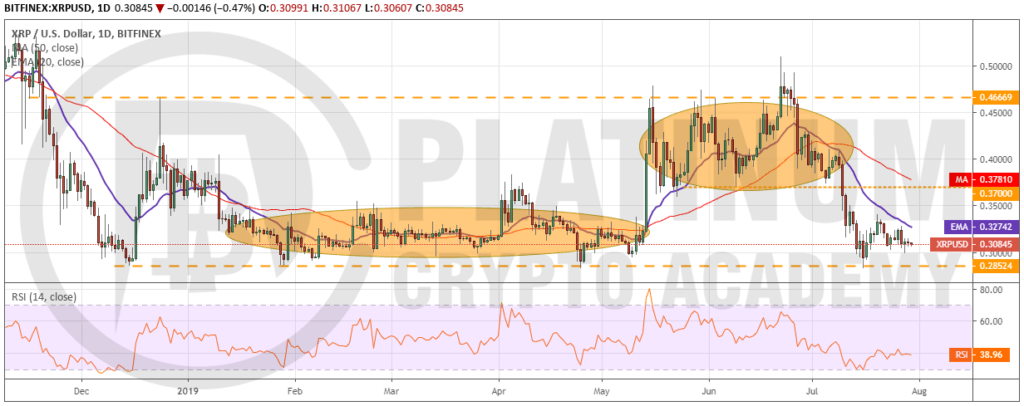

XRP/USD

XRP is range bound between $0.28524 on the downside and $0.46669 on the upside since mid-December last year. While such a large range can be traded by buying near the support and selling near the resistance, the digital currency has a history of staying either in the bottom-half or in the top-half of the range for extended periods (as shown by ellipse). This makes it difficult and frustrating for the traders.

However, long-term investors can buy close to the bottom and hold it with a stop just below $0.28524, expecting the price to reach $0.46669. While this gives an attractive risk to reward ratio, it needs patience.

For swing traders, there are no trades yet as the price remains below both moving averages, which are sloping down and the RSI is in negative territory. We anticipate bears to attempt to breakdown of the range once again. If successful, it will be a huge negative as the slide can extend to $0.22.

On the other hand, if the price rebounds off the support once again and breaks out of $0.34097, it can move up to 50-day SMA and above it to $0.46669.

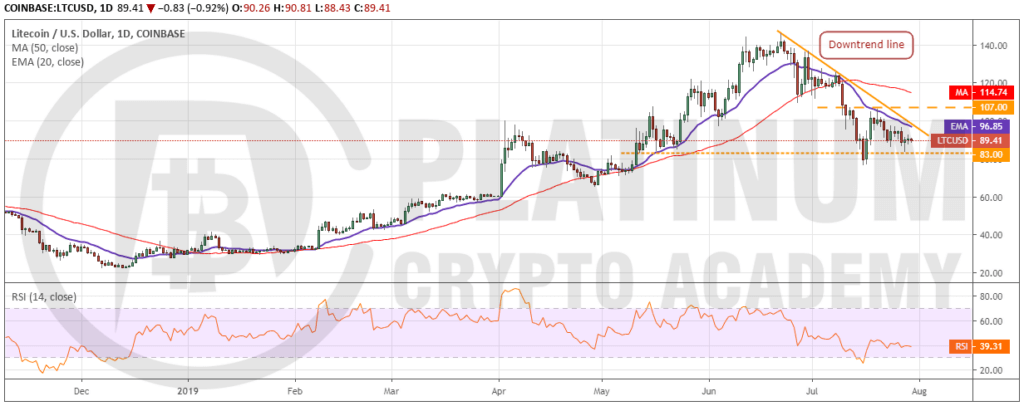

LTC/USD

Litecoin bounced off the support at $83 on July 28 but bulls are struggling to carry the price above the downtrend line. This shows that buying dries up at higher levels. If the price does not climb above the downtrend line within the next few days, we anticipate bears to attempt to breakdown the support once again.

Both moving averages are sloping down and the RSI is in the negative zone. This shows that bears are in command. A break below $83-$76.63 support zone can plummet the price to $64.86-$60 support zone.

Our bearish view will be negated if bulls propel the price above the downtrend line. That will be the first indication that buyers are back in action. However, we will wait for the price to scale above $107 before proposing a trade in it.

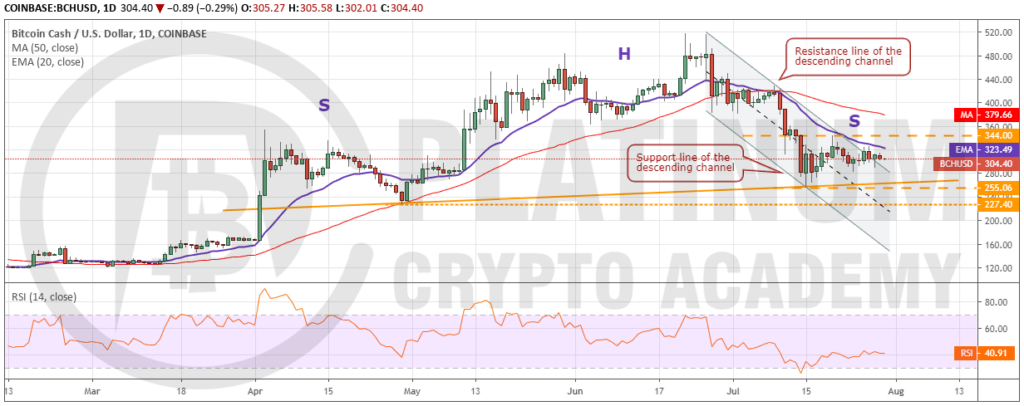

BCH/USD

Bitcoin Cash has broken out of the descending channel but has not been able to breakout of the 20-day EMA. It might now become range bound between $255.06 and $344. However, as both moving averages are still sloping down and RSI is in negative territory, bears have the upper hand.

If bears sink the price below $255.06, it will complete a bearish head and shoulders pattern, which will be a huge negative. There might be a pullback from $227.40, but if it fails, the cryptocurrency might plunge to $166.98 and lower.

Our bearish view will be invalidated if the bulls propel the price above 20-day EMA and the overhead resistance of $344. Above this level, the price can move up to $428.98, with minor resistance at 50-day SMA. We do not find any bullish setup at the current levels; hence, we remain neutral on it.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.