Quick Links

In the wild, untamed frontier of the NFT marketplace, a new player has emerged, striding into town with the swagger of a gunslinger. This isn’t just any old cowboy, though. This is Blur, and with its Blend protocol, it’s turning the NFT marketplace into a high-stakes poker game where the chips are NFTs, and the players are…well, anyone with an internet connection and a penchant for risk.

How does Blur Lending work?

Imagine you’re at a carnival, and you’ve just won a giant stuffed bear at the ring toss. You’re proud of your prize, but you’re also eyeing that Ferris wheel and wishing you had more tickets. Then, a man in a top hat and a twirly moustache approaches you and offers to give you a loan for more carnival tickets, using your bear as collateral.

That’s essentially how Blend works but replace the bear with NFTs and the carnival tickets with Ethereum (ETH). Blend allows users to use their NFTs as collateral to access ETH liquidity. It also offers a buy-now-pay-later function, enabling users to gain access to expensive blue-chip NFTs for a small down payment. Blend loans are set at fixed rates and have no expiration date, accruing interest until the loan is repaid. Borrowers can repay their loan at any time, and if they fail to do so, lenders can initiate a Dutch auction refinancing option.

The Blur Lending Game

The Blur lending game is like a strategic game of chess, where lenders offer loans that are attractive enough to earn points but unlikely to be accepted. It’s like offering a piece of broccoli to a kid – you know they probably won’t take it, but hey, you get points for trying.

Lenders earn points for loan offers which will lead to a Blur token ($BLUR) airdrop. They earn interest for making loan offers and no interest on active loans. Therefore, for someone playing the point game, getting one of your loan offers accepted is not desirable as it could hurt your earning potential. It’s like throwing a party and hoping no one comes so you can eat all the snacks yourself.

The Risk and Reward

While Blur lending can be profitable, it also comes with significant risks. It’s like riding a roller coaster – thrilling and fun, but there’s always a chance you might lose your lunch. If a borrower fails to pay the full amount at the expiration time, lenders can initiate a Dutch auction refinancing option. If there are no interested bidders on the loan, the original lender then gets ownership of the collateralized NFT. However, its value is unlikely to cover the amount of the loan they gave out. It’s like lending someone money for a car, and when they can’t pay you back, you get the car, but it’s a 20-year-old clunker with a broken air conditioner.

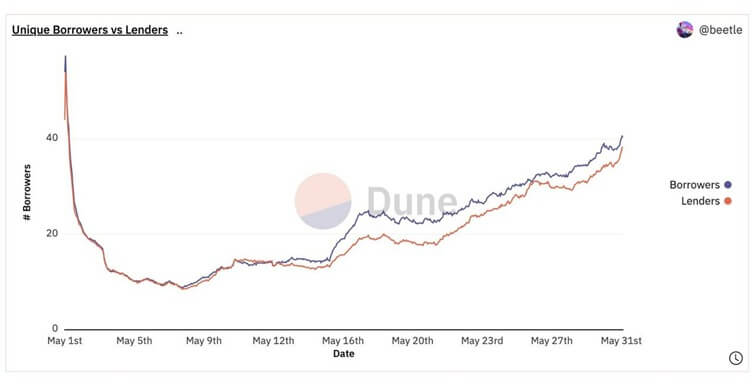

On the other hand, Blur is offering rewards to users who offer loans, incentivizing them to offer favourable terms. This has led to a surge in lending activity on Blend, making it the number one lending protocol both by volume and users on the Ethereum blockchain within the first 24 hours of its release. It’s like being the most popular kid in school on the first day because you brought the best snacks.

The Milady NFT: A Real-Life Example

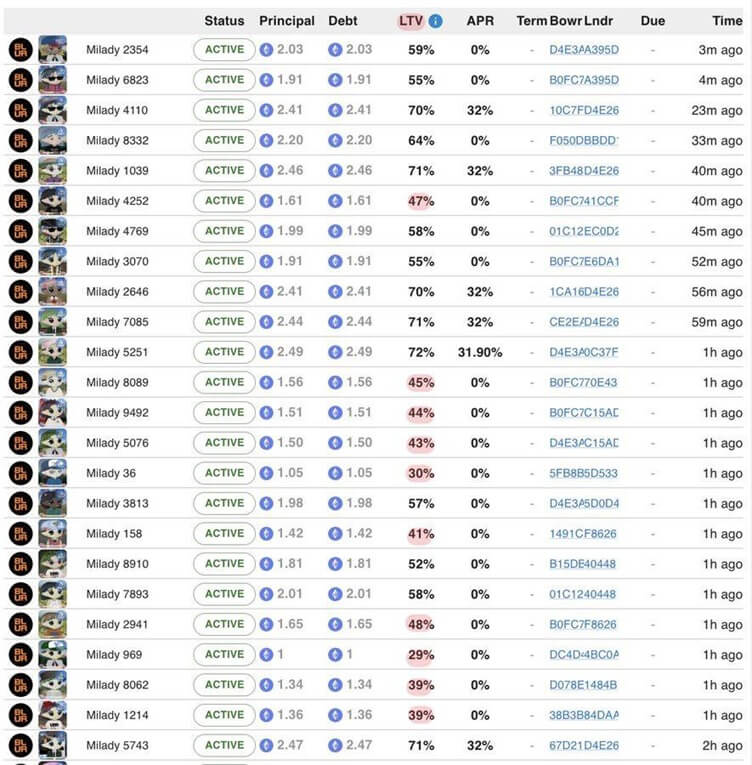

To better understand the Blur lending game, let’s look at a real-life example: the Milady NFT. Milady is the clearest example of PVP lending. There are hundreds of active loans below the best available offer. Those Milady lenders don’t want to lend out the money… they just wanted Blur points.

So, they recall their loans (after the 24-hr penalty period) and the loans roll into the next best offer IF another loan offer has an equal or greater ETH value & equal or lower APY. If there isn’t a better loan offer, the loan will go into auction where the terms become increasingly attractive to lenders. If it goes unclaimed after 30 hours, the NFT will be liquidated.

This is a perfect example of the Blur lending game in action. Lenders are offering loans not with the intention of having them accepted, but to earn Blur points. It’s like throwing a fishing line into the water, not to catch fish, but to attract seagulls.

However, this strategy can backfire. Milady gave us a preview of what this could look like last was when the collection floor price went from 5—>2.9 ETH. It’s like riding a roller coaster that suddenly takes a steep drop – thrilling, but also a little terrifying.

This example illustrates the potential risks and rewards of Blur lending. It’s a game of strategy and risk management, and those who understand the rules and play wisely can win big. However, it’s crucial to stay informed and be prepared to de-risk immediately if alarms start going off in your head. Losing a couple of hours of points isn’t worth risking a ton of ETH.

A Strategy for Success

Here’s a step-by-step guide to winning at the Blur lending game:

- Borrow Moderately: Borrow a moderate amount of ETH against your NFTs. It’s like going to a buffet – you want to fill your plate, but not so much that you can’t walk afterward. You don’t want to go for max LTV because you don’t want your NFT to go to auction. If it does, you’ll either must pay back your loan (and pay gas) or the APY will increase.

- Offer Loans: Offer loans to earn points. Remember, you’re aiming for loans that are attractive but unlikely to be accepted. It’s like asking your boss for a million-dollar raise – worth a shot, but don’t hold your breath. The most profitable lending strategy is offering loans that won’t get accepted but are strong enough to earn points because points are rewarded based on the loan’s attractiveness.

- Recall Loans: If your loan gets accepted, recall the loan as soon as possible to get your ETH back. It’s like lending your favourite book to a friend and then immediately asking for it back because you just remembered you haven’t finished it yet. The people with loans out on 10 collections may earn 10x more than people with loans on one collection. So, one loan getting accepted could hurt your earning potential 10x.

- Stay Informed: Monitor overall market leverage & LTV ratios, track LTV by collection and loans in auction, set floor price notifications to catch crashes, and join a community like to learn and stay updated. It’s like keeping an eye on the weather forecast before a picnic – you don’t want to be caught in the rain. You can lessen your risk of getting rekt by monitoring these factors.

Impact on the NFT Space

Blur’s Blend protocol has been making waves in the NFT space like a surfer at a beach. It’s brought a new level of liquidity to the market, allowing NFT holders to unlock the value of their assets in a way that was previously unheard of. It’s like discovering you can use your grandma’s old stamps to get a loan.

The introduction of Blend has also stirred up the NFT space, making it a game of liquidity whack-a-mole. People are beginning to accept more loans and accept lower LTV loans to take the free money. But it’s more than just free money… the money can be used to earn more points in the Blend economy, leading to a surge in lending activity.

However, as with any new venture, it’s not without its risks. As the Blur lending game continues to evolve, it will be interesting to see how strategies and risks change along with it. It’s like watching a reality TV show – you never know what’s going to happen next. In conclusion, Blur lending is a risky but potentially profitable venture. It’s a game of strategy and risk management, and those who understand the rules and play wisely can win big. However, it’s crucial to stay informed and be prepared to de-risk immediately if alarms start going off in your head. Losing a couple of hours of points isn’t worth risking a ton of ETH. As with any investment, it’s important to do your research and unde

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.