How to trade cryptocurrencies is about having a strategy or plan for success and to manage your risks. You should always have a cryptocurrency trading strategy in place before you buy. Your trading strategy will dictate how you should proceed with a trade and what to do in any given situation. A good strategy will also help you keep your cool when emotions run high so that you don’t panic-sell at a dip and buy back at a summit.

But beginners often struggle to create a simplified trading strategy that works for them. Sure, it’s easy enough to understand that you need to buy low and sell high, but to really take your trading game to the next level, you need to be laser-focused on the details.

How to trade cryptocurrency is often a topic we get asked so we’ve put together a list of 7 quick and easy tweaks to get you started. If you still don’t have a trading strategy in place, download our eBook that contains a simple cryptocurrency trading strategy you can start with today.

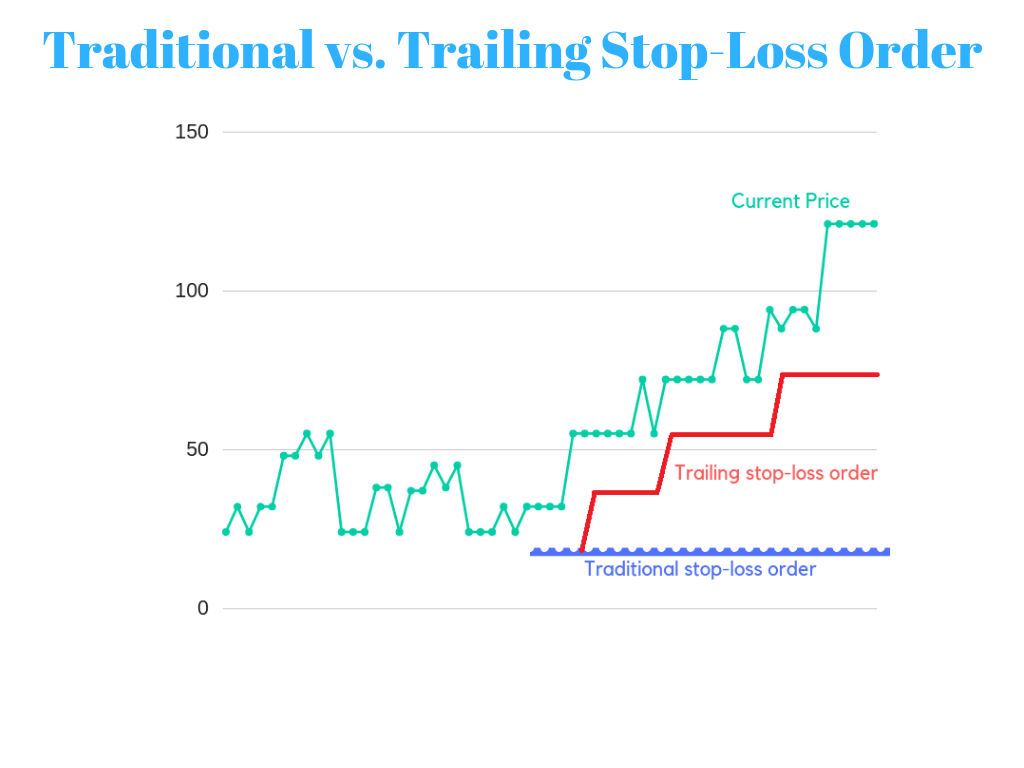

1. HOW TO TRADE CRYPTOCURRENCIES – USE TRAILING STOP-LOSS RATHER THAN TRADITIONAL STOP-LOSS

Having a stop-loss in your crypto trading strategy is very important in order to ensure that you maximize your returns. A stop-loss is simply an order to buy or sell cryptocurrencies if it moves in an unfavorable direction.

In a trailing stop-loss, you set the stop-loss at a particular percentage or USD amount below the market price. When the price of the cryptocurrency goes up, the trailing stop-loss point moves along with it.

Let’s say you buy ETH for $100 and decide that you don’t want to lose more than 10% of this investment. As per your friend’s advice, you set a trailing stop-loss that sends an order to your broker or exchange platform to automatically sell if the price dips more than 10% below market price.

Now, if the price moves against you, the trailing stop-loss will automatically trigger when ETH hits $90. But if the price goes up to $150, the trailing stop-loss point will move up to $135. This can help you lock in most of the gains from the cryptocurrency’s rally.

Currently, there are three exchanges that offer trailing stop-losses: Kraken, Bitfinex, and Bitstamp.

2. HOW TO TRADE CRYPTOCURRENCIES – HAVE AN EXIT STRATEGY AND SET THOSE TAKE-PROFIT ORDERS

Most of the time, beginner cryptocurrency traders don’t have an exit plan and just try to play the market. More often than not, these beginners also tend to lose their profits and motivation for trading. Sometimes they end up racking losses in their portfolio and have to sit with their cryptos until they can break even.

It’s very important for you to have an exit plan in your cryptocurrency trading strategy. This is usually calculated by first assessing a risk-to-reward ratio that you’re willing to go for. A take-profit order allows you to limit your risk or exposure to the market by turning in your trades as soon as the market reaches a favorable price point for you.

We understand that traders usually don’t want to exit a trade when the going is good. Everyone wants to ride that upward trend line as long as possible but no one knows when it will start to pummel down. An effective strategy is to set a take-profit order and sell your cryptocurrencies in stages instead. This will ensure that you cash in at least a percentage of your profits while still being able to ride the surge.

3. START DIVERSIFYING YOUR INVESTMENTS

When it comes to how to trade cryptocurrencies, putting all your eggs in one basket is the easiest way to threaten your entire investment. Whether you’re just starting to trade or have been in the trenches for some time now, your trading strategy should be based on a diversified portfolio.

Not only is this important to reduce the risk, but it also boosts your profits. Suppose you perform research and short-list 4 altcoins that you think are going to net you good profits over time. Instead of choosing only the best altcoin of these 4 and pumping all your money into it, you should rank them and invest incremental amounts of money from bottom to top.

This will allow you to make a profit if the coin you considered the best of the 4 tanks in price while the other 3 perform better than your expectations. Diversification should be an important aspect of your cryptocurrency trading strategy.

4. HOW TO TRADE CRYPTOCURRENCIES – SPEND 70% OF YOUR TIME RESEARCHING AND LEARNING; DON’T OVERTRADE

It is easy to get addicted to trading. Watching the fluctuations of cryptocurrency can become very enticing for a few traders. An important element that traders don’t take into account when creating their trading strategy is how much time they’ll spend executing it.

In our experience, cryptocurrency traders can easily become overzealous over the whole trading process. Instead of staring at charts and executing your trades all day, you should spend most of your time doing research to uncover which coin has the most potential to net you profit. Conduct fundamental analysis in your free time instead of looking up charts on different platforms.

Successful traders also have a component of learning in their trading strategy. They keep reading all the new research on technical analysis they can get their hands on. They also like to read and digest a number of books every month on trading techniques and trading psychology. It is actually what traders learn outside the trading field that contributes to their success more.

5. KEEP A CRYPTOCURRENCY TRADING JOURNAL AND LEARN FROM YOUR MISSES

There are two types of winners when it comes to trading: those who got lucky and those who persevered. You shouldn’t hope to get lucky in the cryptocurrency market because that’s planning to fail. The only option left for you is to work at it, learn from your mistakes, and slowly optimize your trading strategy.

Trading journals will help you track your trades and ideas throughout the day. Many beginner traders don’t understand the importance of noting down their trades, the market conditions in which they made the trades, and their own mental condition while making the trades.

You can take a screenshot of the trading day chart with smart annotations where you mention all that you’ll need to improve your skills. At the end of each week, you can go back to your journal to analyze your week, notice common pitfalls that trap you, and understand your strengths.

6. LIMIT THE CLUTTER ON YOUR CRYPTO TRADING CHART

Traders prefer using technical indicators to analyze the market and plan their next move. There are several helpful indicators for cryptocurrency trading: Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), Ichimoku Cloud, etc.

Rookie traders often think that using multiple indicators is useful in order to catch trades that have a high probability. This causes one of the two things: either all the indicators will show you the exact same thing or they will present conflicting information which will leave you confused about a good trade setup.

The best thing to do then is to rely on only one or two indicators at most. You should also have a good theoretical knowledge about how the indicators work in order to make sure you’re using the right one in a given situation. You’re probably better off just reading price action which happens to be the most timely market information.

7. HOW TO TRADE CRYPTOCURRENCIES – ALWAYS BE ON THE LOOKOUT FOR QUALITY CRYPTO COINS

Even in the bear market, keen traders can spot opportunities and coins that will hold strongly. Even though the rest of the market might be experiencing a plunge, some companies will be able to competently weather the storm. It may be because of the underlying idea, technology, or whale investors who believe in the team behind the coin.

You should keep an eye out for such coins to include them in your portfolio and tweak your trading strategy as required. Understand the underlying idea, technology, and the team behind the coin. Good teams are more likely to achieve success with more certainty, ensuring that their coin offerings steadily increase in value over time.

Have no doubt about it, this is how the whales operate in the cryptocurrency trading sea as well. They are always on the hunt for ICOs that have a good business model or the problem they’re trying to solve is prevalent or their solution is novel and promising. Investing in such coins will require a long-term holding component in your cryptocurrency trading strategy, which means you’re diversifying your investment – a good thing in the crypto world.