For the better part of the last three decades, Japan has been the silent giant massive in capital, modest in growth, and quiet in its collapse. But right now, that collapse may no longer be quiet. In fact, it might just be the first domino in a global unravelling.

For years, Japan has kept the world lulled with zero interest rates and quantitative easing on autopilot. It was the model for managing debt through financial alchemy. But now, after decades of artificial balance, cracks are splintering fast, and they could take the rest of us with it.

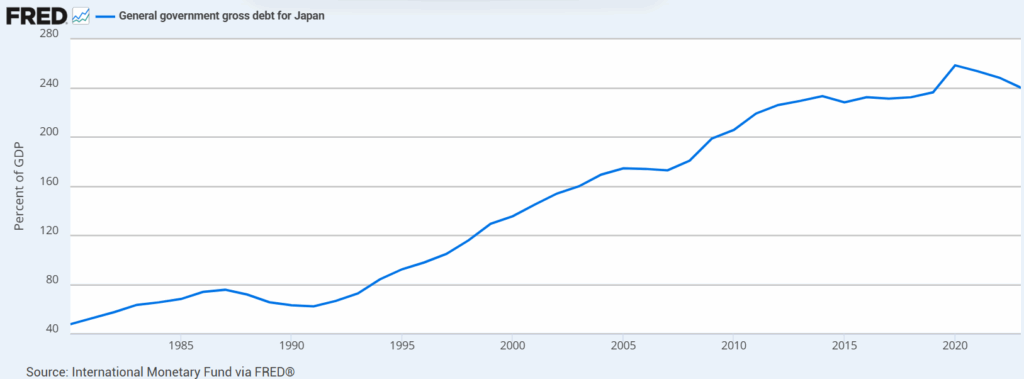

The Japanese yen is in freefall. The Bank of Japan’s recent interventions failed to slow it. Inflation has returned to a country famous for two decades of deflation. And beneath the surface, Japan’s debt burden, now over 260 percent of GDP, is becoming a trap with no elegant exit.

The scary part? Japan is not some isolated economy. It is a core pillar of the global financial order.

Why Japan Matters More Than You Think

Japan is not just another large economy it is the world’s largest creditor nation, with over 3 trillion dollars in foreign assets. That includes massive holdings in:

- U.S. Treasuries (1.1 trillion dollars plus)

- European bonds

- Emerging market assets

The Japanese yen has experienced significant depreciation against the U.S. dollar, with the exchange rate reaching around 143 JPY per USD in June 2025. This weakening of the yen impacts import costs and can influence global currency markets

Japan maintains its status as the world’s largest creditor nation. As of December 2024, its net international investment position was approximately $3.48 trillion, highlighting its extensive foreign asset holdings.

If the yen collapses further and Japan’s institutions scramble to bring capital back home, it would create global shockwaves. The repatriation of capital means dumping foreign assets, and fast.

That could lead to:

- Surging U.S. Treasury yields (bad for equities and debt financing)

- Bond market volatility in Europe

- Liquidity shortages in emerging markets

Countries like Indonesia, Brazil, South Korea, and Italy are acutely exposed.

A Global Credit Unwind in Real Time

Japan’s economy is creaking under the weight of unpayable promises. The bond market is pinned by the Bank of Japan. But the peg is cracking. If the Bank of Japan loses control of the long end of the curve, a debt spiral could be triggered, forcing emergency liquidity programmes and more capital repatriation.

The irony? The Bank of Japan pioneered modern monetary experiments like yield curve control, and now it may become the first central bank to fail at its own invention.

That failure will not stay in Tokyo. Global pension funds, banks, and insurers are all long Japanese debt. If Japanese Government Bonds implode, global portfolios get margin-called, triggering a cross-asset sell-off. We have seen this before think 2008, but from the East.

The Dollar Dilemma

With the yen imploding, the dollar soars. But a strong dollar is its own curse:

- It squeezes U.S. exporters

- Increases the cost of dollar-denominated debt worldwide

- Drives capital out of emerging markets

This creates a deflationary undertow that drags down global growth. It is a vicious loop: Japan weakens, the dollar strengthens, liquidity tightens, risk assets sink.

Ironically, the United States will be forced to step in with rate cuts or dollar liquidity facilities to avoid breaking things at home. A foreign crisis becomes a domestic emergency.

Is This Bullish for Crypto?

Yes and no.

Short term? Risk-off mode means everything sells, including Bitcoin. But longer term, the narrative around fiat failure and central bank fragility becomes the most bullish macro backdrop crypto could ask for.

Bitcoin does not have a central bank. Ethereum is not running negative real yields. Solana does not hold sovereign debt.

As trust in fiat systems erodes and global capital searches for hard, decentralised alternatives, crypto will become more than a trade it will become a lifeboat.

Add to that:

- Japan’s deflationary spiral echoing globally

- Accelerated de-dollarisation

- Unmoored bond markets

And suddenly, that Bitcoin thesis of “do not trust, verify” hits differently.

Final Thoughts

The collapse of Japan’s model is not just a regional issue. It is a preview. A signal. A slow-motion warning that the debt-based growth engine of the past 50 years is out of fuel.

Whether it is the United States, the European Union, or China, everyone is now dealing with some version of the same problem: too much debt, too little growth, and no good way out.

Crypto will not fix everything. But it might be the only asset class that benefits from total distrust in the system.

The storm may start in Tokyo, but do not be surprised when it rains on Wall Street.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.