Quick Links

Understanding the Fear & Greed Index

The Psychology Behind the Index

Analysing the Index’s Track Record

Incorporating the Index into Crypto Investment Strategies

Risks of Overreliance on the Index

Adam’s Strategies for Index Utilization

Risk Management in Crypto Trading

Introduction

The Fear and Greed Index has emerged as a beacon for navigating the tumultuous markets. ‘Cryptonaire Weekly’ invites you to a session with Adam, our platinum crypto trader, who brings over six years of trading wisdom to demystify this tool. With Adam’s guidance, we’ll delve into mastering the Fear and Greed Index to enhance your trading acumen.

Understanding the Fear & Greed Index

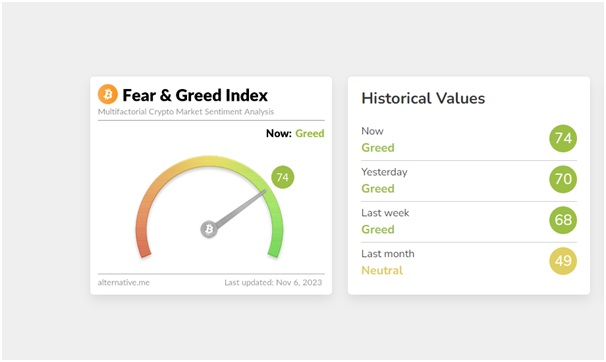

The Fear and Greed Index for cryptocurrency, inspired by CNNMoney’s version for the stock market, serves as a consolidated measure of market sentiment. It distils complex data into a single figure, ranging from 0 to 100, to represent the market’s emotional temperature. Lower scores indicate prevailing fear, suggesting a potential undervalued market, while higher scores denote greed, which could signal an overvalued market.

Key Data Points

Adam, with his seasoned eye, breaks down the index’s components for us:

- Volatility: The index measures the extent of price fluctuations over time, with extreme variations often signalling a fearful market.

- Market Momentum/Volume: It compares current trading volumes and momentum against historical averages to determine if the market activity is unusually high or low.

- Social Media: Sentiment analysis of crypto-related discussions on social media platforms can provide real-time insight into investor sentiment.

- Surveys: Regular polling provides a direct line to investor thoughts and their bullish or bearish inclinations.

- Dominance: The relative market capitalization of the top cryptocurrency is a telling sign of market over- or under-concentration.

- Trends: Search engine trends reveal the public’s interest in cryptocurrency, with spikes often correlating with increased buying pressure or market peaks.

Adam leverages these data points to interpret the index’s signals, guiding his trading strategy with a nuanced understanding of market sentiment.

The Psychology Behind the Index

Adam emphasizes the psychological warfare that traders battle daily. “The index quantifies the emotional pulse of the market, which, if ignored, can lead to costly decisions,” he says. Understanding the fear of loss and the greed for more can help traders avoid emotional pitfalls.

Analysing the Index’s Track Record

Sceptics question the index’s reliability, but Adam counters with history. “There have been clear moments when extreme fear indicated a bottom and extreme greed signalled a top,” he notes. He shares instances when he’s witnessed the index’s predictions play out, affirming its value as part of a comprehensive strategy.

Incorporating the Index into Crypto Investment Strategies

Adam advocates for a multi-faceted approach when incorporating the Fear and Greed Index into investment strategies. “It’s a tool for timing,” he explains. “When combined with market analysis and a solid understanding of blockchain fundamentals, it can help identify the market’s emotional extremes.” He suggests using the index to complement technical analysis, such as resistance and support levels, moving averages, and trend lines. By aligning the index’s sentiment with technical indicators, traders can discern whether the market sentiment is justified or merely a reaction to recent price movements.

Risks of Overreliance on the Index

The index, while insightful, is not infallible. Adam warns of its seductive simplicity, which can lead to an overreliance and a false sense of security. “It’s crucial to remember that the index is backward-looking,” he points out. “It reflects what has already happened in the market, not necessarily what will happen.” He emphasizes the need for critical thinking and independent analysis, advising traders to look at the index as one of many tools, rather than the sole guide to market entry and exit.

Adam’s Strategies for Index Utilization

Adam uses the Fear and Greed Index to inform his risk appetite. “In times of extreme greed, I tighten my risk parameters,” he shares. “Conversely, when fear is palpable, I look for undervalued opportunities that may have been overlooked by the market.” He also uses the index to assess the general market environment, adjusting his portfolio’s exposure to more volatile assets accordingly. Adam’s strategy involves setting clear rules for when to act on the index’s signals, such as only considering buying when the index falls below a certain threshold.

Risk Management in Crypto Trading

For Adam, risk management is paramount. He uses the index to sense the market’s mood swings and adjusts his positions to manage potential downside. “I use it to determine when to hedge my bets or take out insurance in the form of options,” he says. Adam also stresses the importance of setting stop-loss orders to protect against sudden market downturns, which can be especially useful when the index suggests heightened volatility.

Diversification and the Fear & Greed Index

Diversification is a key defence against the unpredictability highlighted by the Fear and Greed Index. Adam encourages a portfolio that spans various cryptocurrencies, sectors, and even investment classes outside of digital assets. “The index can signal when to rebalance your portfolio,” he notes, “shifting between altcoins, stablecoins, and other assets to manage risk.” He views diversification not just as a spread of assets but as a strategic alignment with the index’s sentiment, ensuring that his investments are not overly concentrated in assets that may be subject to the whims of fear or greed.

Conclusion: Synthesizing Wisdom with Data

Adam concludes by reiterating the importance of using the Fear & Greed Index as part of a balanced, well-researched trading strategy. “It’s a tool for the wise, not a crutch for the reckless,” he asserts.No indication alone can forecast the future. To ensure traders remain successful, it is suggested to combine multiple indications with technical analysis skills. In addition, the trader must be their own judge and come to a sensible decision on their own, since two traders might read the same data and arrive at completely different conclusions.

According to experts, due to its volatility, the Crypto Greed and Fear Index is often used to forecast short- and medium-term cryptocurrency prices. It is not recommended to use it for long-term price prediction, since the indicator is prone to quick fluctuations and is rapidly influenced by new elements.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.