Quick Links

Introduction to MINE Network

MINE Network helps you own real hash-rates without owning mining equipment. It is the first hash-rate token protocol that addresses the liquidity issues miners face on multi-chains, thereby promoting the flow of cash in the mining industry. The network also lowers the barriers present to the entry of retail miners.

MINE Network issues pTokens that are standardized hash-rate tokens. This is done by tokenising the mining power from PoW based cryptocurrencies such as Litecoin, Ethereum, Filecoin, Bitcoin, and others. Each hash-rate token is a synthetic token that represents a fraction of mining power from a unique mining blockchain

The pTokens can be traded over CEXs or they can be integrated into single and cross-chain DeFi protocols. Doing this boosts the liquidity and cash flow for miners who are relying on MINE Network for tokenising their hash-rates. Staking the tokens also allows the individuals interested in mining to earn rewards without owning any mining equipment.

What is Hash-rate?

Hash-rate is a measure of the computational power per second when mining. In simpler terms, it indicates the speed of mining and is measured in units of hash/second. Machines with high hash power tend to be highly efficient and can process a huge volume of data in a second. As a result, each transaction over the cryptocurrency network is added to the blockchain or digital ledger.

Before any transaction data is recorded over the blockchain, the miners have to guess an alphanumeric code that represents the data from the transaction. Each hash over the network is random as well as complex. Hence, it requires significant energy to power these computers. Once the miners solve the hash, a new block is added to a blockchain. Also, a new digital currency unit is rewarded to the successful miners.

Bitcoin, Litecoin, Dogecoin, and Monero rely on the proof-of-work method to verify the transactions and manage the blockchain network. Ethereum also uses proof of work before switching to proof of stake. A proof of stake model does not rely on hashing algorithm to manage a cryptocurrency network. Instead, it relies on awarding computing power and earning rewards depending on how much of the crypto a miner owns.

What is the importance of Hash-rate?

Hash-rate is defined as the total combined computational power utilised for mining and processing the transactions on a Proof-of-Work blockchain, such as Bitcoin and Ethereum. A hash refers to a fixed-length alphanumeric code used for representing words, messages, and data of any length. Crypto projects use a variety of different hashing algorithms for creating different types of hash code. You can think of them as random word generators where each algorithm serves as a different system for generating random words.

The hash-rate is an important metric used for assessing the strength of a blockchain network and, more specifically, its security. This is because miners dedicate more machines to finding the next block, the higher the hash-rate rises and the tougher it becomes for malicious agents to disrupt the network.

As a blockchain network abides by a rule known as the “longest chain rule”, a person or group that controls a majority of the hash-rate could in theory block or reorganize transactions and even reverse their own payments. This would create double spend issues and in turn, would completely undermine the integrity of the underlying blockchain. A fall in hash-rate would therefore imply the reduction in the cost to perform a 51% attack, making the network more vulnerable.

What is the purpose of hash-rate in mining networks?

The Bitcoin mining industry was worth 5 billion USD in 2020. If we consider other minable currencies, then the total value of the industry would exceed 10 billion USD. The segment is developing rapidly and also in value with time. However, some issues need to be addressed.

High requirements for newcomers – As the hash-rate of the entire network is already at a high level, it makes the pre-production capital investment appalling. This makes it difficult for small and medium-sized miners to survive. This issue keeps most individual miners out of the market who hope to obtain stable returns through mining. Mining equipment manufacturers leverage their position as monopolists in a market that is completely dominated by supply and demand. Quantities, prices, and delivery times of new mining machines depend heavily on the connection between the individual miner/mining farms and the manufacturer.

Liquidity problem

Most miners need to invest in mining machines that require a large sum of money. Moreover, those machines are hard to resell, and hence, the miners cannot enjoy sufficient cash flow. Sustainable cash flow management is crucial for any mining company’s corporate culture so that they remain competitive in the future and hence, the liquidity problem needs to be addressed.

There are two major solutions for liquidity problems: centralized cloud mining pools and hash-rate tokens. The Mine Network will assist miners in liquefying their assets by issuing standard hash-rate tokens (pTokens), which could be traded anytime on DEXs, CEXs, or collateralized for borrowing USDT for fixing the liquidity problem. It encourages miners to stake their hash-rate tokens for earning mining rewards, which constrains the liquidity of their hash-rate tokens to a greater extent.

For solving the liquidity problem, the network would issue synthetic tokens referred to as the wTokens for the miners who have staked the issued pTokens into the network’s contract for earning real-time mining rewards. The wTokens can also be used in different DeFi protocols for trading or issuing collaterals.

Standardisation problem

MINE Network protocol integrates an important function, which involves developing standards for different mining powers as well as the minimum standardized hash-rate unit. This is the only way through which the network pool can become a tokenized, open market, which is free to enter and exit.

Credibility

For solving credibility issues, the only legitimate way is to act as a fully transparent DAO. The degree of autonomy of the MINE Network DAO needs to be adjusted to the development stage, especially in the initial stages when both the business and product are immature. If it is fully community-driven, it would affect the development and also, the market opportunities will be missed. Therefore, the autonomy of the MINE Network DAO will continue to increase as the project matures.

Get clean

Climate change and global warming have put increased pressure on finding a clean source of energy. The mining sector is also facing the heat and the experts are looking for ways to become climate neutral. MINE Network will give miners who utilize cleaner sources of energy a privilege for tokenizing their hash-rates. By doing this, the world would be a cleaner place. The network aims to create a fully decentralized mining pool, which is powered exclusively via renewable energy sources.

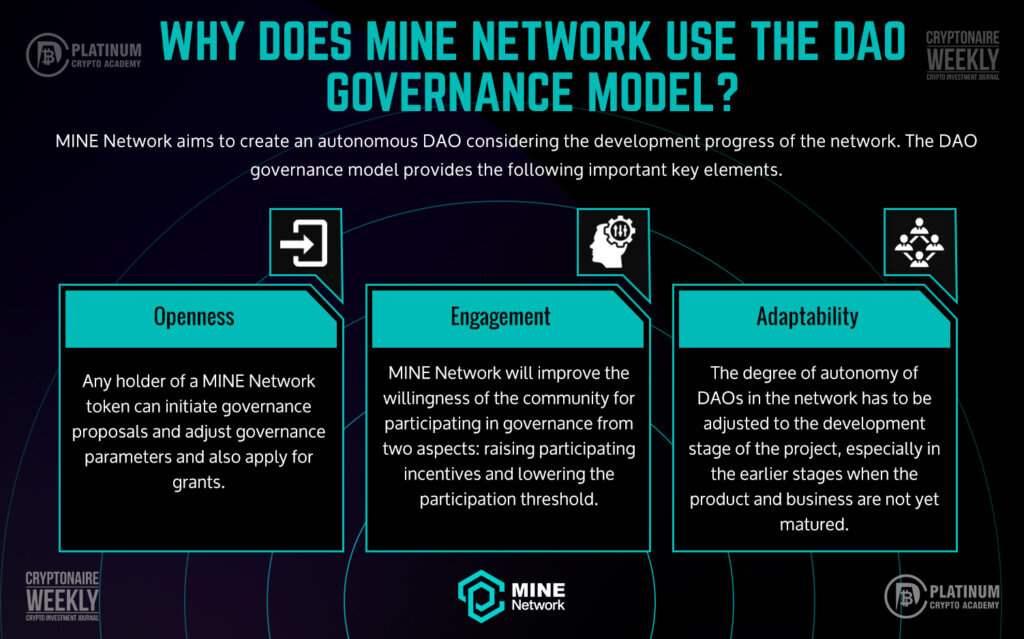

Why does MINE Network use the DAO Governance Model?

MINE Network aims to create an autonomous DAO considering the development progress of the network. The DAO governance model provides the following important key elements.

Openness – Any holder of a MINE Network token can initiate governance proposals and adjust governance parameters and also apply for grants.

Engagement – MINE Network will improve the willingness of the community for participating in governance from two aspects: raising participating incentives and lowering the participation threshold.

Adaptability – The degree of autonomy of DAOs in the network has to be adjusted to the development stage of the project, especially in the earlier stages when the product and business are not yet matured. If it is entirely community-driven, the development would be hindered, and also, the market opportunities will be missed. Hence, the autonomy of the network would continue to increase as the project matures. Eventually, it will end up becoming a decentralized protocol with complete autonomy.

DAO Governors

The network has 2N+1 Mine Network governors. N will be set to a fixed number and would be varied as and when the project develops. To become a DAO governor, you need to stake certain MNET tokens in the network and apply for them. The network DAO invites KOLs, auditing institutions, well-known mining pool leaders, and DeFi protocol founders to join the network DAO as governors.

Once you are a governor, you can participate in governance activities in the network, which include setting the standards for the pool, reviewing the qualifications for mining pool partners, and reviewing the operations and revenue data.

How does MINE Network risk Control System work?

As MINE network is responsible for managing mining pools, which is a unique domain, the pools may have to bear some of the following crypto risks.

- Equipment risks such as power blackout and damage to the mining machine

- Policy risk in the area where the mining pool is located

- Unexpected events such as natural calamities

- Any power policy that boosts the operating cost to an unacceptable level

- Any loopholes in the security in smart contracts

MINE Network aims to reduce the crypto risk in the following ways:

- Choosing a region that is mining-friendly and convenient for placing mining machines

- Choosing experienced mining pool operators and improving the maintenance of mining machines

- Locating mining pools to various spots for diversifying the risks

- Purchasing insured products for minimizing the risks

- Before smart contracts and blockchain are launched, audits are performed by several professional code security audit institutions

Liquidity risk

As hash-rate tokens are still in their infancy, the users need some time in adapting to the related applications and products. Hence, MINE Network may face the risk of insufficient liquidity of pTokens in the secondary market. If pTokens lack liquidity, the network may not be able to solve the asset liquidity problem for the miners. It is imperative that the network tries to maintain the liquidity of pTokens. For ensuring liquidity in the secondary market, the network would adopt the following measures.

- Cooperate with the most popular centralized exchanges for facilitating the listing of pTokens

- Rolling out pToken-related trade pairs on decentralized exchanges

- The network will also participate in liquidity market-making of pTokens in the secondary market for maintaining the stability of the price of pTokens

MINE Network has taken all possible measures to keep crypto risk in check and implement everything to keep the network safe and secure for the miners.

Conclusion

MINE Network is an emerging blockchain project that is dedicated to revolutionizing the mining sector. The project aims to solve several plaguing issues over multiple blockchains that tend to impede miners. With leading-edge technological applications and a novel open-source system that incorporates the most popular aspect of cryptocurrencies like gaming, NFTs, and the metaverse. The standard hash-rate token protocol is poised to revolutionize the next wave of crypto mining that will transform the mining industry while taking care of crypto risk and liquidity problems. The decentralized mining system concept will also profit the miners in all ramifications and would also benefit the environment.

The network is dedicated to influencing the segment in a positive manner by providing all the necessary tools to the end-users so that they can easily implement their mining configurations without having to invest in expensive mining gear and spend on upgrades and maintenance. They can operate in a self-sustaining and highly credible ecosystem, as well as contribute to the adoption of clean energy in the mining sector.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.