Quick Links

A decade before, investing or mining in cryptocurrencies was an alien subject. But with huge returns, this asset class became popular over time. The interest in crypto has evolved gradually since its beginning in 2008, with the invasion of Bitcoin. It became a hot topic, and people became more inclined about understanding the cryptocurrency, how it works, and all the related benefits it provides to a crypto miner. As a result, the Crypto space has taken a sharp turn in the investing system and attracted individuals and companies building their ventures through mining crypto.

This article aims to offer an understanding of the prevailing challenges related to mining. It further covers how the innovative solutions provided by MINE Network with the help of DeFi (Decentralised Finance) are helping miners overcome these problems.

Overview of the process related to mining crypto

Most people think that the process related to mining involves the generation of new tokens, though this is partially correct. However, it also consists of validating these tokens and their distribution in the blockchain ledger. Many people have many questions regarding mining crypto. For instance, what is mining in crypto?; what is required to mine cryptocurrency?; is crypto mining profitable? Etc. Here, we will be answering these questions. So, read along!

Digital currency or crypto mining involves solving complex mathematical problems. Any organization or individual can perform this process using hardware or software on their computer; any organization or individual can achieve it. In return, the miners receive rewards for their efforts. The rewards are in the form of a certain percentage of the generated token.

The three essential things for mining crypto include wallet, mining software, and hardware for mining. The wallet is essential; any tokens or coins one will receive need to be stored during mining. Of course, it takes time and money to learn the process initially, but once you master it, you can simply leave it to mine and get significant returns.

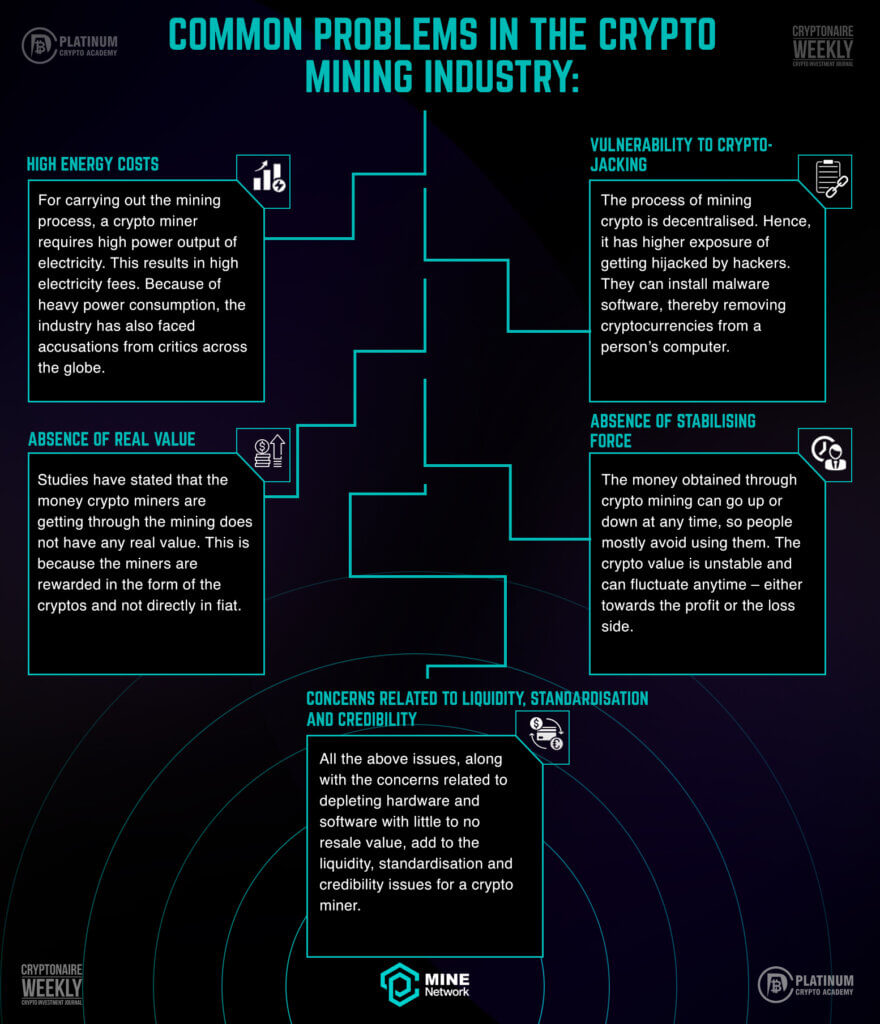

Common problems in the crypto mining industry:

Mining crypto is not a quick buck business. Being a contemporary and lucrative industry, people often wonder what challenges are being faced by cryptocurrency miners! Like any other industry, the power-hungry crypto mining industry has a few challenges to cater to as well. Some of them are listed below:

- High energy costs

For carrying out the mining process, a crypto miner requires high power output of electricity. This results in high electricity fees. Because of heavy power consumption, the industry has also faced accusations from critics across the globe. For instance, one of the studies by Cambridge University revealed that the Bitcoin generation demands more electricity yearly than the whole of Argentina. This finding was significant enough to undermine the environmental image of the industry.

- Vulnerability to crypto-jacking

The process of mining crypto is decentralised. Hence, it has higher exposure of getting hijacked by hackers. They can install malware software, thereby removing cryptocurrencies from a person’s computer. In order to reduce the cost, the miners switch to the cloud. However, using a compromised cloud account increases the vulnerability of malicious attacks. This was also pointed out by Google recently.

- Absence of real value

Studies have stated that the money crypto miners are getting through the mining does not have any real value. This is because the miners are rewarded in the form of the cryptos and not directly in fiat. The cryptocurrency will only have its value once someone else pays the price for it.

- Absence of stabilising force

The money obtained through crypto mining can go up or down at any time, so people mostly avoid using them. The crypto value is unstable and can fluctuate anytime – either towards the profit or the loss side.

- Concerns related to liquidity, standardisation and credibility

All the above issues, along with the concerns related to depleting hardware and software with little to no resale value, add to the liquidity, standardisation and credibility issues for a crypto miner. New mining models demand new machines, which does not affect one crypto miner but the complete industry. The unorganised mining pools have restricted standardisation. Moreover, the prevailing centralised system makes the credibility of information related to costs and output questionable. Hence, the decentralization of the processes is the need of the hour.

Initially, mining was a profitable business for all. However, with the increasing difficulty levels of the algorithms and the entry of large institutions, economics has changed. The mining pools now dominate the industry, and thus, individual miners are at the losing end. But with the solutions proposed by MINE Network, even the individual miners can grab their share of profits through a thorough cost return analysis.

MINE network overview

As mentioned earlier, mining crypto includes solving the mathematical problem for which the crypto miner will be rewarded with the cryptocurrency. But, still, not everyone gets the return! The crypto miner to get rewarded needs to be the first to respond with the right or closest answer to a mathematical problem. Hence, the cost is fixed, but returns are not. And the need to upgrade the assets from time to time puts a significant burden on the miners. This problem is acknowledged and solved by MINE Network’s native utility token MNET recognizes and solves the problem.

MINE Network is the first-ever decentralized standard hash-rate token protocol that caters to the liquidity concerns of miners on multi-chains, including but not limited to Bitcoin, Litecoin, and Ethereum. It utilizes DeFi, metaverse gaming, and NFT (non-fungible tokens) for improving the crypto-mining experience.

Although being in the virtual world, this metaverse still satisfies the miners by helping them socialize beyond sharing images and documents. Moreover, it gives the option to users and players to “play and earn.” They can earn NFTs, which can be further traded in the marketplace.

How does MINE Network solve the problems related to mining crypto?

MINE Network solves the problems related to liquidity, standardization, credibility, and energy use. It standardizes the mining power from various mining pools and issues hash-rate tokens and synthesized tokens. The synthetic tokens represent the mining power of a unique mining blockchain. These tokens can be traded or collateralized to get USDT, thereby solving the issues related to liquidity. The market makers who will provide liquidity on DEX will be provided MNET in return.

The second alternative to solving the concerns related to liquidity is MINEverse. Through this gaming experience, miners and NFT collectors can freely interact in the ever-expanding virtual space. It allows the miners and NFT holders to strategically test their mining skills against each other. Its Play-To-Earn feature motivates and facilitates participation in MINE Network and MINEverse.

MINE Network has introduced the first-ever solution to use their hash-rate tokens on multi-chain, using different DeFi protocols for numerous projects like Bitcoin, Ethereum, Litecoin, etc. MINE Network stands ahead of the pack because miners can enter and exit the standardized mining pools after the mining power standardization.

The process of standardization in MINE Network includes specific steps:

- First, all the mining machines should have the same energy consumption ratio, whether self-built or external pools. Hence, the first and foremost energy consumption ratio is to be set.

- Once this ratio is determined, it’s time to assess it on various parameters like infrastructure, quality of the power, compliance capabilities, etc.

- Now, when the condition of the mining machines is assessed, the target energy consumption ratio should be set.

When the mining pool delivers the weighted efficiency as per MINE Network’s target, it can join the standard mining pool of the system.

Lastly, in the crypto space, it is essential to control the circulation of the tokens to maintain their demand, growth, and returns. To solve this concern, MINE Network uses a certain percentage of the transaction fee in burning the token.

Why does MINE Network run on DeFi space?

Some of the significant benefits of DeFi relating to cost, speed, and security make it popular amongst crypto entrepreneurs. The supporters suggest that DeFi can do everything an online and offline bank can do with better speed and transparency. DeFi includes applications developed on decentralized blockchain and is easy to access. Users can use these apps for lending, borrowing, or trading cryptocurrency, which is the core objective of the Mine Network. The miners can lend their money and earn interest as a lender, similarly to a traditional bank. Moreover, the instant settlement of the transactions and easy accessibility make DeFi a dependable space.

Also, the interest rates being provided by DeFi are high and more attractive among miners, and the barrier is low for entry to borrow compared to the traditional banking system. The miners only need to provide their ability to function with other crypto assets to take a loan and perform NFTs through the use of the DeFi protocol.

The most popular cryptos are the original DeFi applications, such as Bitcoin and Ethereum. They are controlled and managed by extensive networks of computers. There is no central authority in regulating these cryptocurrencies. The growth of these two cryptos proves DeFi Space’s efficacy.

Conclusion

The interest in crypto investments has skyrocketed. Earlier, Bitcoin and Ethereum were the only popular cryptocurrencies that investors swore on. But this year, we witnessed performance and returns from many altcoins or meme coins. This surged people’s interest in all things, from NFTs to DeFi, consequently increasing the growth opportunities for crypto miners. Like other business activities, crypto mining also has both pros and cons. The disadvantages include volatility, no government regulations, irreversible and limited use, whereas the advantages include accessibility and liquidity, user transparency, independence from a central authority, and high return potential. After all the efforts and investments, the returns a crypto-miner attains make this process fruitful.

The industry is constantly changing according to the emergence of new technologies. The highly professional miners use it to earn more rewards by changing their mining strategies according to the scenario and performing accordingly. But miners who are beginners need little time and understanding. Still, it is never too late to start mining crypto. Just keep an eye on price fluctuations to achieve the rewards. Make use of the solutions offered by MINE Network, and you will save a lot of time handling the primary challenges, especially the ones related to liquidity, standardization, and credibility.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.