Quick Links

A New Chapter in Ethereum’s Story

Hello everyone, I’m Louise, a DeFi crypto trader at Platinum Crypto Academy. Today, I’m excited to delve into the latest development in the crypto world – the launch of Blast, Ethereum’s new Layer 2 network. As a crypto enthusiast who has been part of this dynamic industry for years, I’ve been eagerly tracking every twist and turn of this groundbreaking platform. This isn’t just another update in the blockchain space; it’s a pivotal moment that could redefine Ethereum’s future.

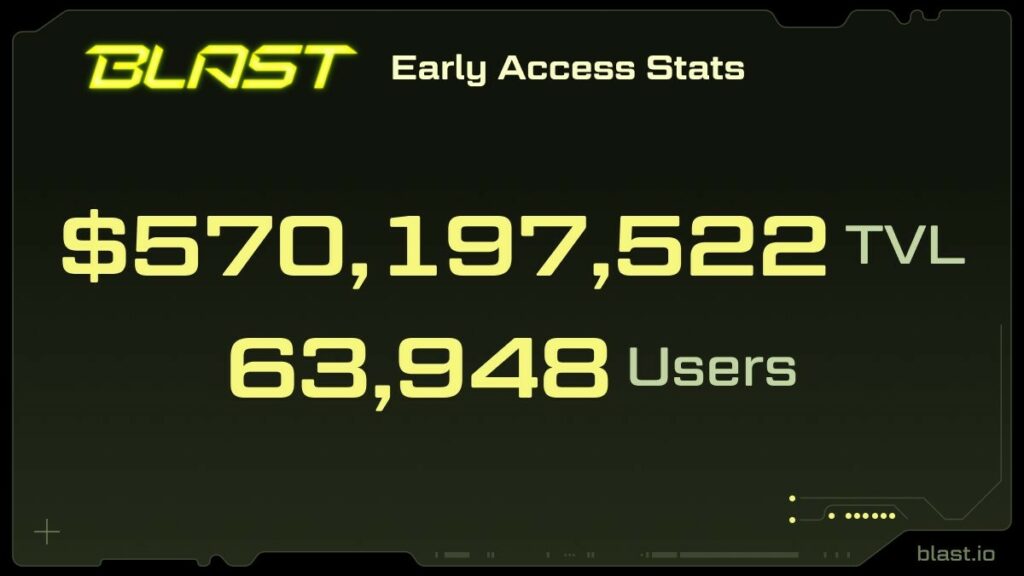

When I first heard about Blast’s launch and the impressive $55 million it raised within hours, I knew we were witnessing a historic moment in blockchain technology. This level of financial backing and the subsequent locking up of over $535 million in user funds is a clear indicator of the crypto community’s readiness for more scalable, efficient, and cost-effective blockchain solutions. As a trader, I understand the significance of these numbers – they represent a collective expectation of a more efficient blockchain ecosystem.

Why Blast Stands Out for Investors

- High User Engagement and Trust: The fact that Blast locked up over $535 million in user funds shortly after launch is a strong indicator of market trust and interest. This level of engagement suggests a robust user base and potential for long-term growth, key factors I consider when evaluating investment opportunities.

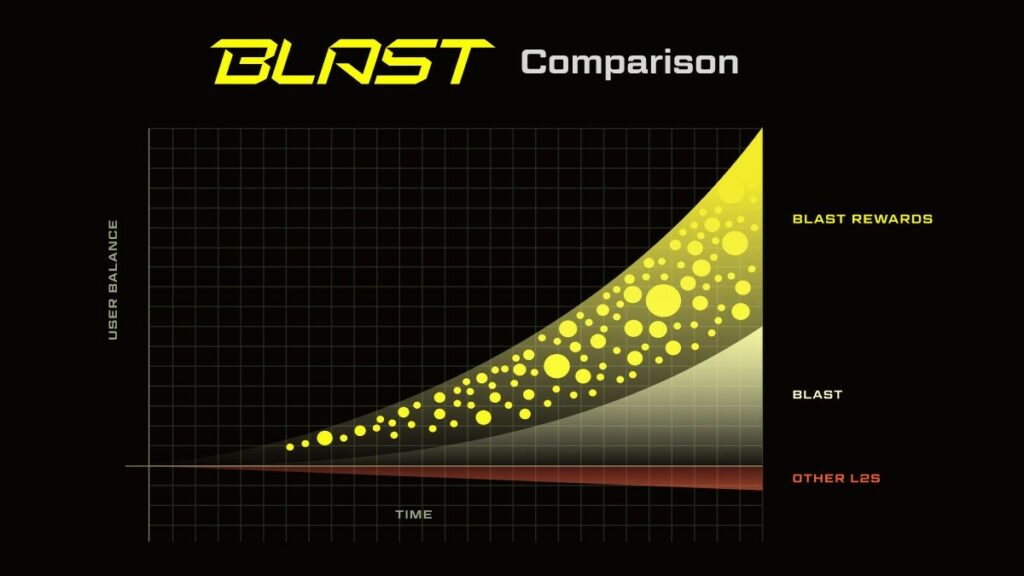

- Innovative Yield Model: Blast’s built-in yield model, offering significant returns for ether and stable coins, is particularly attractive. This feature not only enhances the platform’s utility but also presents a compelling case for both short-term gains and long-term investment potential.

- Addressing Ethereum’s Limitations: By tackling the scalability, speed, and cost issues of Ethereum’s Layer 1, Blast is positioned to play a crucial role in the future of blockchain technology. Platforms that solve real problems tend to have staying power in the market, making them appealing for strategic investments.

Investment Opportunities in Blast

As someone deeply involved in the DeFi space, I’m always on the lookout for promising investment opportunities, and Blast has certainly piqued my interest. Here’s why:

High User Engagement and Trust: The rapid locking up of over $535 million in user funds in Blast is a strong indicator of market trust and interest. This level of engagement suggests a robust user base and potential for long-term growth, which are key factors I consider in any investment opportunity.

Innovative Yield Model: Blast’s built-in yield model, offering significant returns for ether and stable coins, is particularly attractive. This feature not only enhances the platform’s utility but also presents a compelling case for both short-term gains and long-term investment potential.

Addressing Ethereum’s Limitations: By tackling the scalability, speed, and cost issues of Ethereum’s Layer 1, Blast is positioned to play a crucial role in the future of blockchain technology. Platforms that solve real problems tend to have staying power in the market, making them appealing for strategic investments.

However, investing in Blast, like any new blockchain technology, comes with its set of risks and rewards. The controversies surrounding its withdrawal policies and the mixed reactions from the crypto community are factors that need careful consideration. As a crypto native, I believe these discussions are vital for the network’s evolution and the broader blockchain industry.

Delving Deeper into a Calculated Investment Strategy

As a seasoned DeFi trader at Platinum Crypto Academy, my approach to investing in emerging technologies like Blast’s Layer 2 network is always methodical and deeply informed. Here’s an expanded look at how I navigate such investment opportunities:

- In-Depth Analysis of Development Progress: I prioritize staying updated on Blast’s development milestones. This includes tracking updates on their technology, any new features or services being added, and how these developments align with their initial roadmap. Understanding the pace and direction of their progress is crucial in assessing their potential for long-term success.

- Monitoring User Adoption and Community Sentiment: User adoption rates are a key indicator of a platform’s viability. I delve into user statistics, growth trends, and how the platform is being received in the broader crypto community. Additionally, I pay close attention to community forums, social media discussions, and feedback from early adopters to gauge overall sentiment and satisfaction.

- Resolving Current Controversies and Governance Issues: The controversies surrounding Blast, especially regarding its withdrawal policies, are a significant concern. I closely follow how the Blast team addresses these issues, communicates with users, and implements any necessary changes. The resolution of these issues and the transparency of the governance process are vital factors in evaluating the network’s trustworthiness and stability.

- Understanding Broader Market Trends: The cryptocurrency market is influenced by a myriad of factors, including regulatory changes, technological advancements, and shifts in investor sentiment. I analyze how these broader market trends might impact Blast, especially considering its position as a Layer 2 solution on Ethereum. This involves keeping an eye on the overall health of the DeFi market, regulatory news, and technological trends in blockchain and cryptocurrency.

- Risk Assessment and Diversification: Investing in any new blockchain technology involves inherent risks. I conduct a thorough risk assessment of Blast, considering factors like market volatility, technological risks, and competition. Based on this assessment, I strategize on diversification to mitigate potential risks. This might involve spreading investments across different assets or sectors within the crypto space.

- Long-Term Vision vs. Short-Term Gains: While Blast presents opportunities for short-term gains, especially with its innovative yield model, I also consider its long-term potential. This involves evaluating its sustainability, potential for widespread adoption, and how it might evolve in the ever-changing landscape of blockchain technology.

- Active Engagement and Continuous Learning: Finally, as with any investment, staying actively engaged and continuously educating myself about the latest developments in Blast and the broader DeFi ecosystem is crucial. This includes participating in community discussions, attending webinars or conferences related to Ethereum and Layer 2 solutions, and constantly updating my knowledge base.

Blast Sceptics Raise Doubts Over Ownership Smart Contract?

The security integrity of Blast’s smart contracts has been a major point of debate. The core of the scepticism lies in the control and access mechanisms governing the deposited funds. The smart contracts, crafted by Pacman, are perceived as a potential risk due to the possibility of centralized access to all deposited funds.

The heart of the issue is the transfer of contract ownership to a multi-signature Gnosis Safe, necessitating the agreement of three out of five signatories for transactions. Despite the widespread use of such arrangements for trust and flexibility in Web3 projects, the anonymity and newness of the signatories’ wallets in Blast’s case have raised red flags. This obscurity in the identities of those who can alter the smart contract’s terms is seen as a significant vulnerability.

Jarrod Watts, a developer from Polygon, has voiced these concerns, emphasizing the reliance on an unfamiliar multi-sig group for any contract modifications or fund recovery, which he views as a precarious setup. Although Watts doesn’t outright predict a misappropriation of funds, he points out the governance and transparency issues that cloud Blast’s future prospects, despite acknowledging the innovative aspect of its L2 yield generation concept.

Conclusion

My investment in Blast is a blend of strategic decision-making and a personal belief in the transformative power of blockchain technology. As a DeFi trader, I approach Blast with a dynamic strategy, balancing the excitement of being part of a groundbreaking technology with the pragmatism required in the volatile world of crypto investments. For me, Blast represents not just a potential financial gain but a step towards a more efficient and scalable blockchain future.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.