Statera’s extended ecosystem is made up of various liquidity pools, in which all tokens maintain a share of the portfolio’s value through the use of a smart-contract portfolio manager. Every trade for Statera creates an arbitrage opportunity, which increases volume across the entire Statera ecosystem resulting in higher fees paid to liquidity providers.

DECENTRALIZATION THROUGH SMART CONTRACTS – A DEFLATIONARY CURRENCY

In simple terms, Statera is a smart contract powered deflationary token, which is indexed and works with leading community powered cryptocurrencies. Being a deflationary asset means that Statera automatically burns 1% of every transacted amount in order to control its supply by slowly creating scarcity as a hedge against market inflation.

As previously mentioned, Statera uses a locked smart contract audited by Hacken, which can never be changed or altered. No new tokens can ever be minted, making Statera’s supply secure. In addition, the entire supply of Statera has been released, and is 100% in circulation. This makes Statera one of the most diversely distributed tokens in DeFi. The distribution of the tokens in users’ wallets is so spread out that no single wallet has more than 2% of the total tokens in circulation.

Statera’s ecosystem uses several liquidity pools which function as a smart-contract portfolio manager to ensure all tokens maintain a fixed share of the portfolio’s value. If an asset’s ratio is higher than others, the portfolio automatically balances itself by selling the token of higher value until the set ratios are again in place. In addition, these pools are part of a wider exchange network. Trades made by other users that route through the pool are subject to a swap fee, which is then passed along to those who participate by being a liquidity provider.

SUPERCHARGING ANY LIQUIDITY POOL

In the Statera Ecosystem, each fund participates in a multi-asset liquidity pool whose underlying assets are traded on decentralised exchanges (DEXs). Every time a trade is initialised, a set percentage is taken out of the trade as a swap fee, and paid to liquidity providers The fees are then compounded to increase the value of your funds. As more Statera holders participate in the pools, raising the available liquidity, larger trades are able to be conducted and larger fees passed on to LP providers. This is a fairly common feature in DeFi, however Statera innovates on this by having a built in volume boosting feature through the introduction of a second token, Wrapped Statera

WRAPPED STATERA

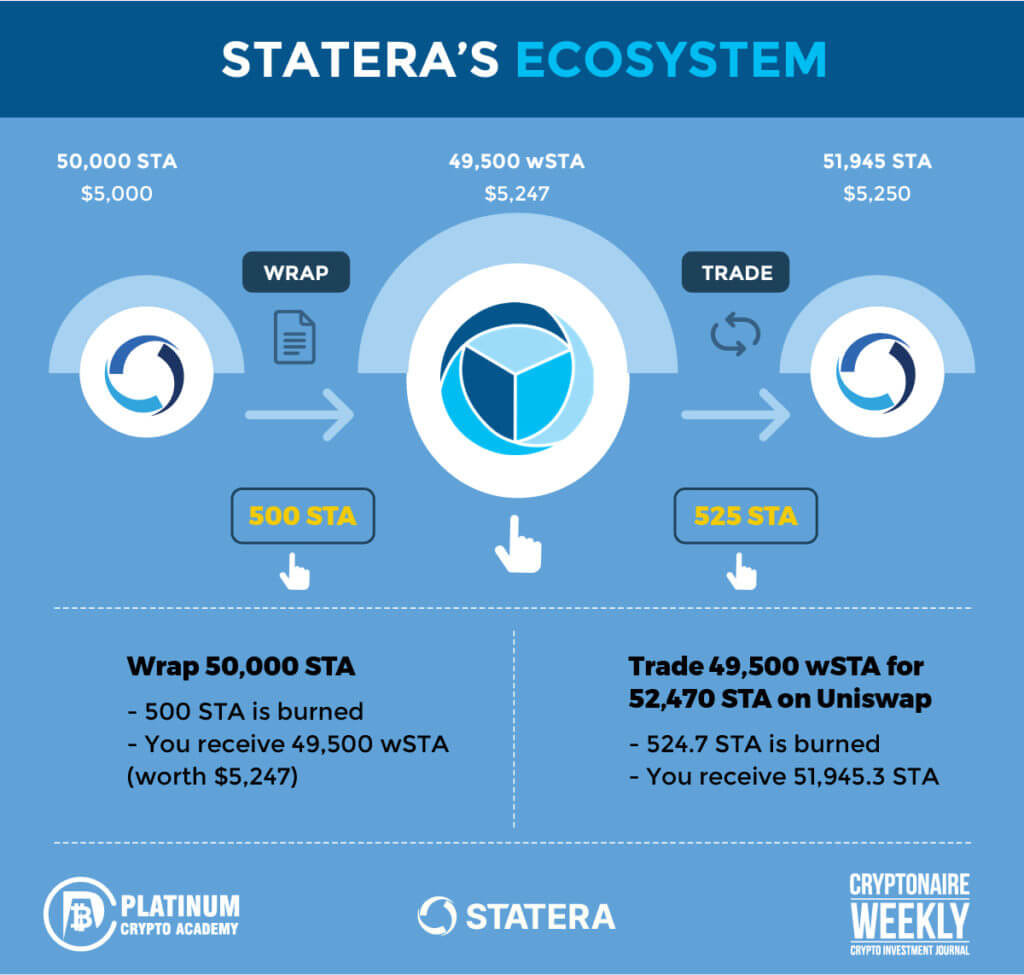

Since the STA token is deflationary, it is not compatible with some platforms and exchanges such as Balancer, and DEX aggregators like Matcha. This prompted the launch of the wrapped Statera contract wSTA. It is a new token that can only be minted or unminted from Statera’s token using the wrap and unwrap functions of the wSTA contract. Once STA is converted to wSTA, it ceases to deflate with every transaction. It is, however, important to keep in mind that every wSTA or the conversion of STA to wSTA still creates deflation. For instance: wrapping 100 STA will return 99 wSTA, due to the 1% burn. It is due to this innate convertibility that creates arbitrage opportunities for traders and bots, driving additional volume that results in higher fees paid to liquidity providers within the Statera ecosystem.

When STA is converted to wSTA, it can blend in well in any ecosystem, increasing the STA network effect as it can spread far and wide. It also helps STA to be used in more systems.

Since the launch of wSTA, there are about 19% of STA tokens in supply wrapped. The wrapped tokens are used in both dual and multi-asset liquidity pools, which leads to high transaction volumes and dividends from pooling fees. The balancer index pool, a flagship pool consisting of wSTA, BTC, wETH, LINK, and SNX, has over $1.5m liquidity in less than a month and delivered 50% more return from comparably-sized pools.

STATERA ECOSYSTEM OPTIONS

Statera makes participating in crypto finance much easier, as it offers several ways to use the utility of Statera based on your risk appetite. Users can now use one token to access a wide range of funds. Some of the different portfolio options include:

Statera (STA) or wrapped Statera (wSTA): Statera is the base of the Statera ecosystem, which is deflationary to increase the price pressure and reduce volatility. wSTA is minted by wrapping the STA. From every 1 STA, there is 0.99 wSTA created after deflation.

Statera Yielding Pool (Infinity): This was created by combining 50% STA and 50% wSTA to the Uniswap liquidity pool. They are both linked to Statera’s price; hence there is a minimal loss. It is also known as the infinity pool since it has been designed to accrue more Statera.

Multi-Asset funds: Consisting of the Titan Fund (containing blue-chip crypto assets), High-Risk Fund (containing some of the leading projects in DeFi), and Low-Risk Fund (containing stablecoins), these funds allow liquidity providers to diversity their portfolio while enjoying high fee returns by virtue of Statera’s volume-boosting nature.

THE CURRENT GLOBAL FINANCIAL SPACE VS STATERA ECOSYSTEM

Currently, Bitcoin remains the top store of value for crypto currency users worldwide. However, the BTC blockchain is slow, has high fees, and is easily manipulated by the largest wallet holders. This can lead to an extremely volatile choice for those who hold it, putting their financial contribution at greater risk.

Statera is better suited to compete in the global financial space since it is a store of value with added benefits. The digital currency ensures there is utility, network effect, and trust, making it valuable. It ensures trust by using a smart contract that is locked. The token’s total supply is in circulation; hence, it is fully distributed with no user having more than 2% of the total supply. This is made possible by using liquidity pools to improve efficacy through increased arbitrage opportunities and volume. That means that the more it is distributed, the higher its value.

Making a stronger case for Statera is the upcoming adoption of EIP-1558, which will introduce a deflationary burn on transactions for Ethereum on a network-wide scale. Statera gives holders not only the store of value in its native token, but the ability to risk-mitigate and diversify with its indexed pools, allowing a user to un-pool in any of the class-leading assets that are placed with wSTA in each individual basket.

WHY THE STATERA ECOSYSTEM IS A GAME-CHANGER FOR THE FINANCIAL SPACE

Statera is a game-changer in the financial space as it has a diverse portfolio option for cryptocurrency investing and is deflationary in nature. Some of the reasons it is a game-changer include:

Deflationary: With the high volatility in the market and a high risk of inflation, Statera is a good alternative as it is deflationary. Users can be confident that 1% of the value transacted is destroyed. Even though the STA is deflationary, it can access a pool that is not deflationary and bring in the deflationary aspect with the wSTA token.

Decentralization: Unlike the majority of other digital assets, with Statera, no wallet has more than 2% of the token in distribution. Not only that, but the entire supply of Statera is in circulation. That means you can be confident you are shielded from pump and dump schemes, or manipulation by bad actors.

Permanence: Since the ledger is immutable, users are assured of safety and transparency and as the contract keys have been burned, no developer or “team” could ever change the fundamental properties or tokenomics of Statera. This future-proofs the currency and ensures it will always exist, much in the same way that Bitcoin is here to stay, yet unlike the vast majority of other cryptocurrencies.

Diversification: Using Indexed Pools, Statera, you can access a pool of funds and different portfolios by just using one token. The token can help you access different investments that suit your risk levels.

Secure: Statera has done multiple audits for its tokens. The balancer pool has been in the spotlight by hackers, but Statera collaborated with Balancer to use an ERC-20 compliant wSTA for safety reasons.

WHY IT’S THE PERFECT TIME FOR THE STATERA ECOSYSTEM

The pandemic has led to the awareness of how volatile the market is. It is an opportune time to take advantage of decentralized finance options such as cryptocurrency, and Statera is a textbook example of what a fully decentralized asset can be.

With interest rising in digital assets and the recent thirst for diversifying investments, Statera is a good solution to fill the gap. It is the perfect time for Statera as investors can access different investment pools and funds.

Since it has been made to be deflationary, you can be sure that there will never be an oversupply since part of the funds are destroyed during each transaction. Users can easily increase funds simply by holding as when the volume is high, the fees are high, and that compounds to increase the value of the investment. That means that your investment is bound to increase with time, and done so without gimmicks like hyper-inflated APY % in a farming set-up, or having to become a lender. Statera truly is one of the best examples of what it means to be a defi asset, and could very well become the prominent store of value on the Ethereum blockchain and indeed even a competitor to Bitcoin itself one day.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

TOP 10 UK CRYPTOCURRENCY BLOGS, WEBSITES & INFLUENCERS IN 2021

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.