Bitcoin plunged close to 10% and the S&P 500 index dropped 4.32% on September 13 after the August inflation print showed an increase of 0.1% for the month while economists had expected a 0.1% decline month-over-month. The report dashed hopes that the Federal Reserve would pull back its aggressive monetary tightening anytime soon.

All eyes will now be glued to the Fed which is expected to announce a 75 basis point rate hike on September 21. The CME FedWatch Tool shows an 82% probability of a 75 basis point rate hike, suggesting that the move may have been priced in. However, if the Fed decides to hike rates by 100 basis points as some expect, then risky assets may witness another bout of selling.

While Bitcoin dropped about 11% last week, Ethereum plunged more than 24%. Ether was a classic case of buy the rumor and sell the news. Ether’s price rallied leading up to the Merge but has since seen aggressive selling, indicating that traders sold even though the Merge went off smoothly on September 15.

During a bear phase, markets react mildly to positive news but tend to sell off on every bit of negative news. Until the sentiment turns around, trading on bullish news could turn out to be a trap.

Some analysts expect Bitcoin to plunge below the June lows. While anything is possible in the markets, investors should not panic and dump their holdings. Although bear markets are mentally and financially taxing, they also offer some of the best opportunities to the smart investor to add to their position or initiate a new one at lower levels. Instead of chasing the price higher, investors may build a position by buying periodically when prices are depressed.

Bloomberg Intelligence senior commodity strategist Mike McGlone, during an interview with Kitco News on September 17, said that Bitcoin and Ether could hit a new high by 2025.

What are the critical levels to watch out for? Read our analysis of the major cryptocurrencies to find out.

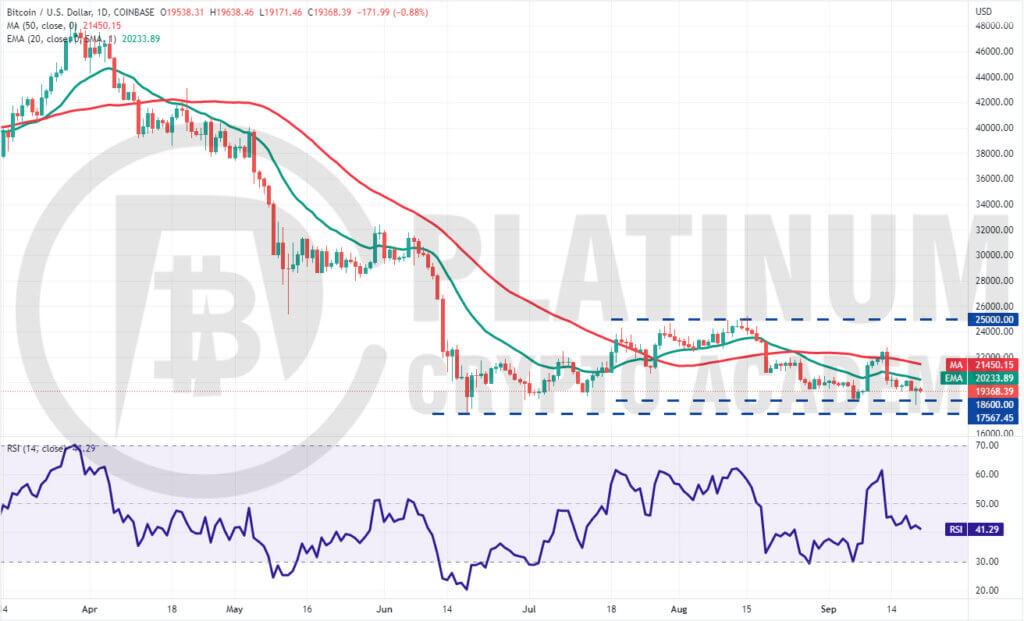

BTC/USD Market Analysis

We said in our previous analysis that bulls will have to sustain Bitcoin above the 50-day simple moving average (SMA) for three days to increase the likelihood of a rally to $25,000 but that did not happen.

We had also projected that if the price slips back below the moving averages, the BTC/USD pair could revisit the $18,600 to $17,567.45 support zone and that is what happened on September 19.

Both moving averages are gradually turning down and the relative strength index (RSI) is in the negative territory, indicating advantage to bears. However, we expect the bulls to aggressively defend the support zone.

The first sign of relief to the bulls will be after the price rises above the 20-day exponential moving average (EMA). Such a move will suggest that the selling pressure could be reducing. That could open the doors for a possible rally to the 50-day SMA.

Conversely, if bears sink and sustain the price below $17,567.45, it could signal the resumption of the downtrend. The pair could then plummet to $15,000 but we give this a low probability of occurring.

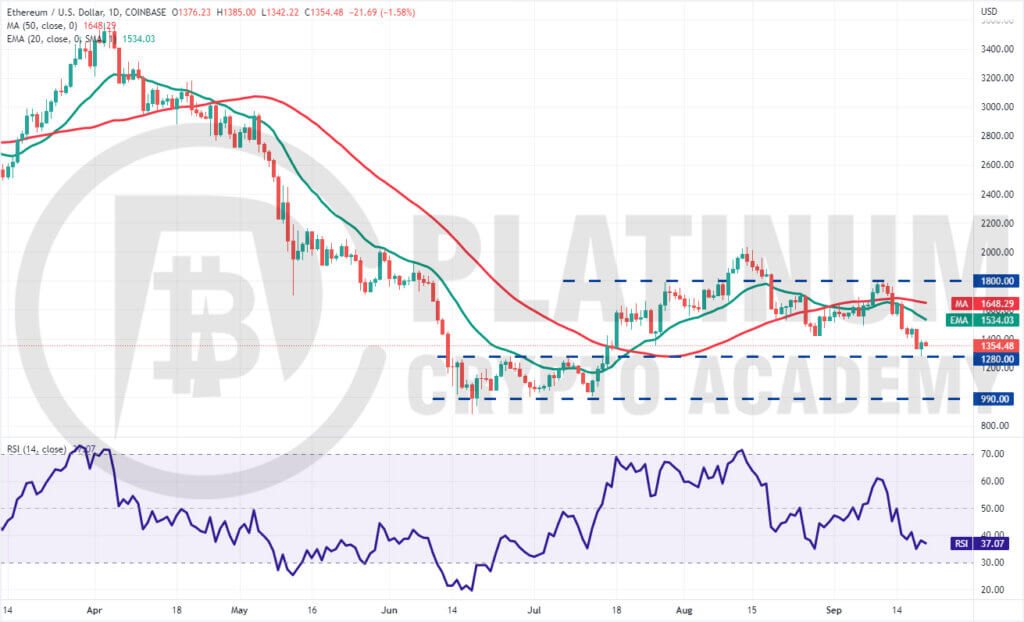

ETH/USD Market Analysis

The bears pulled Ether below the moving averages on September 13. Buyers tried to push the price back above the moving averages on September 14 and 15 but the bears held their ground.

This aggravated selling and the ETH/USD pair dropped to the strong support at $1,280. This is an important level for the bulls to defend because if they fail to do so, the selling could further pick up momentum and the pair could plummet to the psychological level of $1,000.

The 20-day EMA has turned down and the RSI is in the negative territory indicating advantage to bears.

To invalidate this negative view, the bulls will have to push the price back above the 20-day EMA. If they manage to do that, it will suggest that lower levels continue to attract buyers. The pair could then oscillate between $1,280 and $1,800 for a few days.

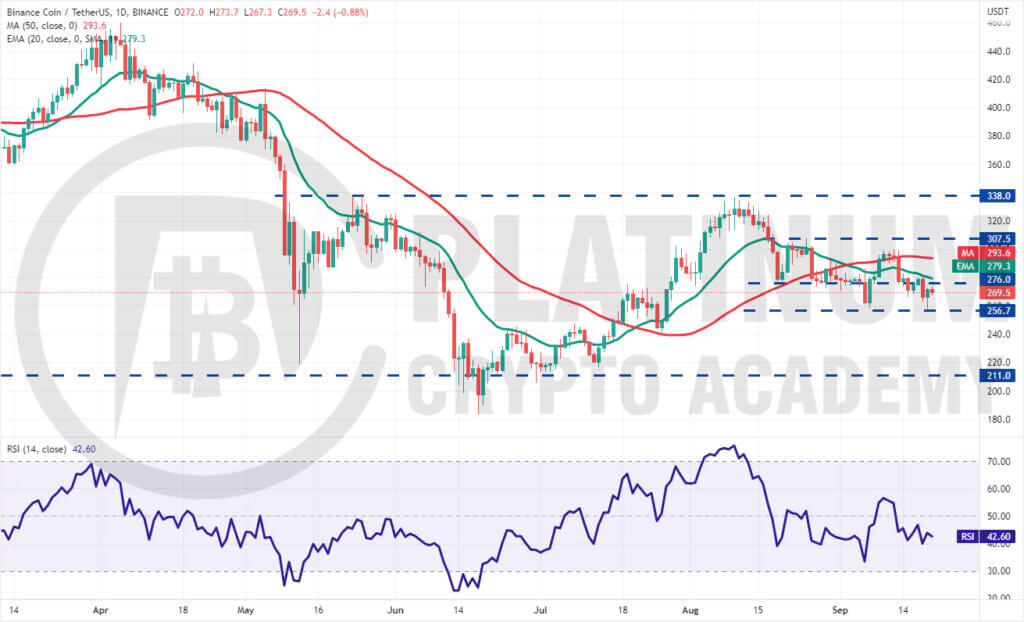

BNB/USD Market Analysis

The bulls failed to push the price to the overhead resistance at $307.50, indicating that the bears are defending the moving averages with vigor. Binance Coin turned down sharply and broke below the moving averages on September 13.

Buyers attempted to push the price back above the 20-day EMA on September 17 and 18 but the bears defended the level aggressively. If the price sustains below the 20-day EMA, the likelihood of a break below $256.70 increases.

That could open the doors for a possible drop to $240, which could act as a strong support.

Alternatively, if the price turns up and breaks above the 20-day EMA, it will suggest that the bulls are attempting to form a floor near $256.70. The pair could then rally to the 50-day SMA. The bulls will have to push and sustain the price above this resistance to gain the upper hand.

XRP/USD Market Analysis

The bulls failed to push the price to the overhead resistance at $307.50, indicating that the bears are defending the moving averages with vigor. Binance Coin turned down sharply and broke below the moving averages on September 13.

Buyers attempted to push the price back above the 20-day EMA on September 17 and 18 but the bears defended the level aggressively. If the price sustains below the 20-day EMA, the likelihood of a break below $256.70 increases.

That could open the doors for a possible drop to $240, which could act as a strong support.

Alternatively, if the price turns up and breaks above the 20-day EMA, it will suggest that the bulls are attempting to form a floor near $256.70. The pair could then rally to the 50-day SMA. The bulls will have to push and sustain the price above this resistance to gain the upper hand.

ADA/USD Market Analysis

Cardano slipped below the moving averages on September 13 and the bears thwarted attempts by the bulls to push the price back above the 50-day SMA on September 17 and 18.

The bears will now attempt to sink the price below the immediate support at $0.42 and challenge the crucial support of $0.39.

The ADA/USD pair has been oscillating inside the large range between $0.39 and $0.60 for the past several days. Hence, the bulls are expected to defend the $0.39 level aggressively.

If the price rebounds off this support and breaks above the moving averages, it will suggest that the consolidation may continue for some more time.

The bears will have to sink and sustain the price below $0.39 to indicate the start of the next leg of the downtrend.

.

Hopefully, you have enjoyed today’s article for further coverage please check out our crypto Blog Page. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.