Bitcoin dropped more than 5% last week as regulatory uncertainty, risks of a recession, and talks of a possible US debt default kept investors on the edge. The Consumer Price Index rose 4.9% annually in April, which was slightly better than estimates of 5% but the better-than-expected data could not excite investors. That may be because even after the fall in inflation, it remains way above the Federal Reserve’s 2% target range.

Over the next few days, the focus will shift from inflation to debt ceiling talks between the White House and the Congress. While speaking to Bloomberg, JPMorgan Chase CEO Jamie Dimon warned that a sovereign debt default by the US will be “potentially catastrophic” and could affect other markets around the world. He expects the stock market’s volatility to increase as the potential default nears.

Among all the uncertainty, there is a silver lining for crypto investors. A Bloomberg survey of about 637 respondents showed that Bitcoin was the third most preferred asset class to take shelter in the event of a default. While this is a positive sign, traders should avoid buying on this pretext alone because a default by the US will lead to unprecedented turmoil in the financial markets and it is difficult to predict investor’s reaction beforehand. It is better to avoid taking large risks during times of uncertainty.

Institutional investors seem to be booking profits on their crypto gains. CoinShares’ weekly report showed an outflow of $54 million from digital asset investment products. This was the fourth consecutive week of outflows, taking the total outflow to $200 million.

Hedge fund manager Paul Tudor Jones said on CNBC that the regulatory environment in the US and reducing inflation make Bitcoin less attractive to hold. However, he added that he will continue to always hold a small amount of Bitcoin in his portfolio.

What are the important support and resistance levels to watch out for? Let’s study the charts of Bitcoin and the major altcoins to find out.

BTC/USD Market Analysis

Sellers will again try to pull the price toward the support line but buyers are likely to have other plans.

If the bulls drive the price above the 20-day EMA, the BTC/USD pair may rally to the resistance line of the channel. This level may again pose a strong challenge to the bulls.

If the price turns down from the resistance line, it will indicate that the pair may extend its stay inside the channel for some more time.

ETH/USD Market Analysis

Ether remains in a corrective phase. The bears pulled the price to $1,737 on May 12 but lower levels witnessed aggressive buying as seen from the long tail on the day’s candlestick.

The bulls tried to clear the overhead hurdle at the moving averages but the bears held their ground. This suggests that the sentiment has turned negative and traders are selling on rallies.

The bears will again try to sink the price to $1,700, which is likely to act as a strong support. A break below this level could open the doors for a possible fall to $1,600.

Contrarily, if the price turns up from the current level and breaks above the 50-day simple moving average (SMA), it will signal a pick up in demand. The ETH/USD pair could then soar to the psychological level of $2,000.

BNB/USD Market Analysis

We said in the previous analysis that Binance Coin could drop to $300 where buying is likely to emerge and that is what happened. The BNB/USD pair bounced off $301 on May 12 and reached the 20-day EMA on May 15.

The pair is currently stuck in the bottom half of a descending channel pattern. The 20-day EMA is sloping down and the RSI is in the negative zone, indicating a minor advantage to the bears.

Sellers will try to yank the price below the support line and start a downward move toward $280.

On the other hand, buyers will try to propel the price above the moving averages. If they manage to do that, the pair could rise to the resistance line of the channel.

A break and close above the channel will be the first indication of strength. The pair could thereafter rally to $350.

XRP/USD Market Analysis

Buyers have been defending the $0.41 level for the past few days but they have failed to push the price above the 20-day EMA. The long wick on the May 12 candlestick shows that the bears are selling the rallies to the 20-day EMA.

A tight consolidation near a support increases the risk of a breakdown. If the price slips below $0.41, the XRP/USD pair could pick up momentum and tumble to the next support at $0.36.

The downsloping 20-day EMA and the RSI below 37 indicate that bears are in control.

The first sign of strength will be a break and close above the 20-day EMA. Such a move will suggest that the bears may be losing their grip. The pair could then rally to the 50-day SMA.

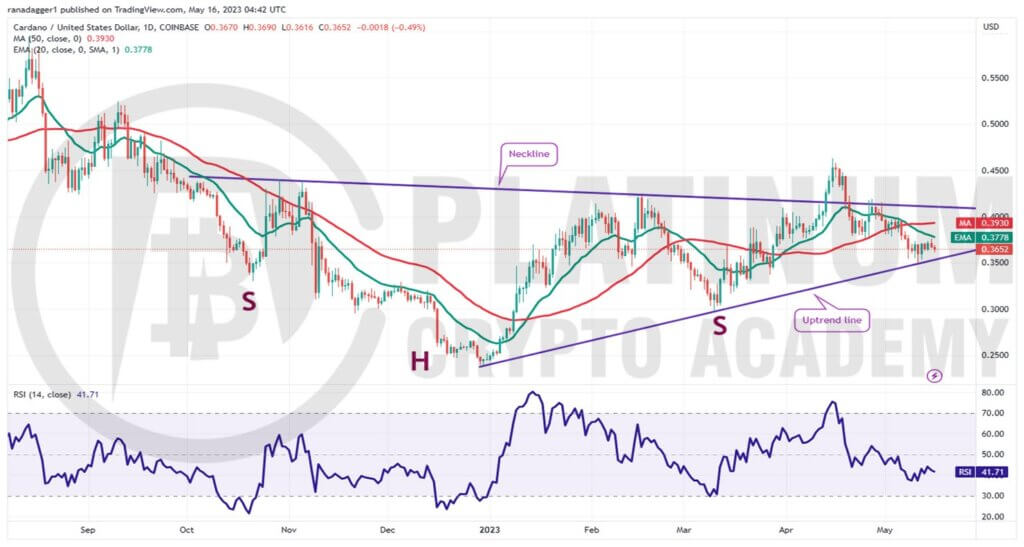

ADA/USD Market Analysis

The bulls are trying to keep Cardano above the uptrend line but a minor negative is that they have not been able to drive the price above the 20-day EMA.

This suggests that the bears are not willing to let go of their advantage. Sellers will again try to tug the price below the uptrend line. If they succeed, the selling could intensify and the ADA/USD pair could slump to $0.30.

On the contrary, if the price rebounds off the uptrend line, it will suggest solid buying on dips. The bulls will again try to overcome the obstacle at the 20-day EMA.

If they can pull it off, the pair may rise to the neckline of the inverse head and shoulders pattern. This remains the key level for the bears to defend because a break and close above it may start a new up-move.

Hopefully, you have enjoyed today’s article for further coverage please check out our crypto Blog Page. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.