Bitcoin rallied above $24,000 on August 8 but the bulls could not push the price above the range it has been stuck in for the past few days. Galaxy Digital Holdings Ltd. CEO and founder Michael Novogratz said in an interview with Bloomberg that Bitcoin is unlikely to rise to $30,000 in the current recovery because the institutional investors have not been buying hugely. Novogratz expects Bitcoin to stay in a range for some more time.

A positive sign is that analysts are increasingly showing confidence that crypto prices may have bottomed out. JPMorgan said in a recent note that limited new contagion from the collapse of the Terra ecosystem and positive data flow from Ethereum’s testnets raised expectations that the merge will happen in 2022. Both these have been the main drivers of the current recovery. Analysts at JPMorgan believe that crypto prices may have “found a floor.”

Bloomberg Intelligence senior commodity strategist Mike McGlone and senior market structure analyst Jamie Coutts said in the August “Crypto Outlook” report that Bitcoin may be building a base “akin to about $5,000 in 2018-19.” The analysts said that the “risk vs. reward tilted favourably for one of the greatest bull markets in history, potentially starting a revival after a sharp retreat.”

Although analysts have been wary of giving out bullish targets in the current negative environment, SkyBridge Capital founder and managing partner Anthony Scaramucci said in an interview with MarketWatch that based on the metrics of adoption, wallet size, use cases, and growth of wallets, Bitcoin’s fair value right now is about $40,000 and Ether’s is $2,800. He also said that Bitcoin may have formed its cycle low “at around $17,500.”

Could Bitcoin and major altcoins break above their overhead resistance and extend the recovery? Read our analysis of the major cryptocurrencies to find out.

BTC/USD Market Analysis

We highlighted in our previous analysis that the 20-day exponential moving average (EMA) was an important level to keep an eye on because a bounce off it could result in a retest of the overhead resistance at $24,666 and that is how it played out.

Bitcoin has formed a series of higher lows though it has not been able to form higher highs. This indicates that bears are posing a strong challenge at $24,666 but bulls are buying on every minor dip.

The rising 20-day EMA and the relative strength index (RSI) in the positive territory suggest that the path of least resistance is to the upside.

If buyers thrust the price above $24,666, the BTC/USD pair could pick up momentum because there is no resistance until $28,000. The bears may attempt to stall the rally at this level but if bulls overcome this barrier, the uptrend could even reach $32,000.

Conversely, if the price turns down from the current level and breaks below the uptrend line, it will suggest that the bulls have given up in the short term and are closing their positions. That could sink the price to the 50-day simple moving average (SMA).

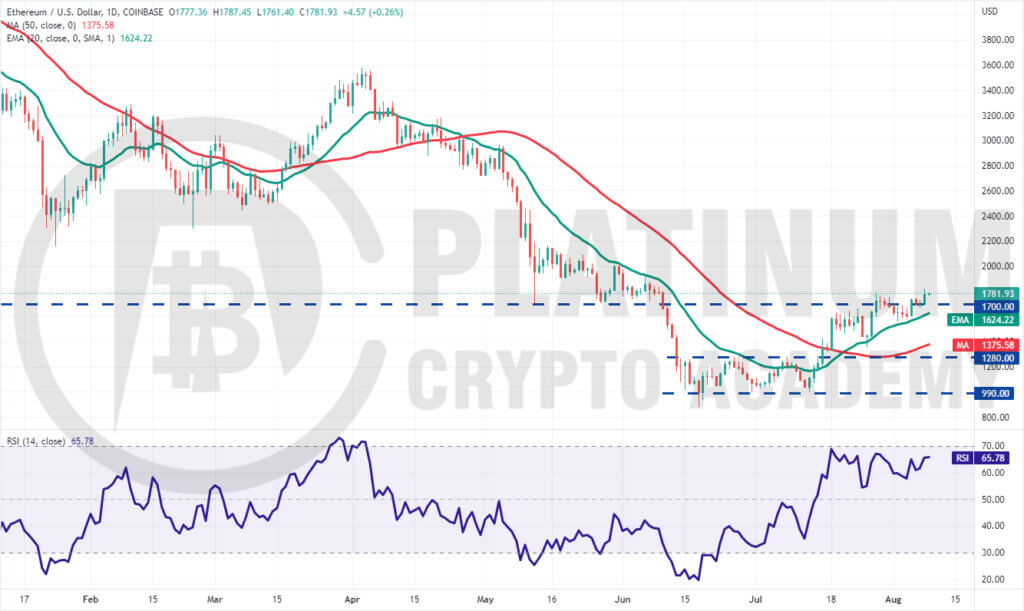

ETH/USD Market Analysis

The bulls successfully defended the 20-day EMA in the past few days and pushed Ether above the $1,700 to $1,800 overhead resistance zone. This indicates that the sentiment has turned positive and traders are viewing the dips as a buying opportunity.

The long wick on the August 8 candlestick shows that bears are trying to stall the rally near $1,800 but if the price does not dip back below $1,700, it will suggest that the bulls have flipped the level into support.

That could increase the possibility of a rally to $2,000 and then to $2,200. The upsloping moving averages and the RSI in the positive territory indicate advantage to buyers.

To invalidate this bullish view, the bears will have to sink the price back below the 20-day EMA. If that happens, it will suggest that the break above $1,800 may have been a bull trap. The ETH/USD pair could then decline to the 50-day SMA and remain range-bound for a few days.

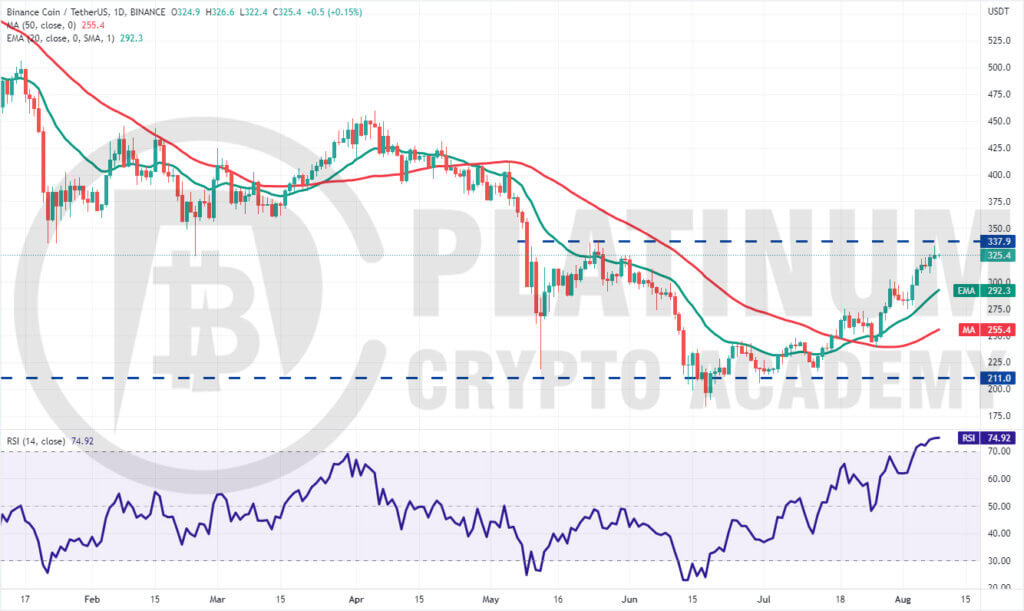

BNB/USD Market Analysis

We mentioned in our previous analysis that if the price rises from the 20-day EMA, the pair could again try to break above $300 and if that happens, the rally could extend to $340. That is what happened and Binance Coin rose to $334 on August 8.

Both moving averages are sloping up indicating advantage to buyers but the RSI is in the overbought zone, suggesting that a minor correction or consolidation is possible in the near term.

The 20-day EMA remains the critical level to watch out for on the downside. If the price rebounds off this level, the bulls will again attempt to clear the overhead hurdle at $338. If they manage to do that, the BNB/USD pair could rally to the psychological level of $400 and then to $414.

Conversely, if the price plummets below the 20-day EMA, it will suggest that traders are booking profits after the recent rally. That could open the doors for a possible decline to the 50-day SMA.

XRP/USD Market Analysis

The bulls have successfully defended the 20-day EMA but have failed to clear the overhead hurdle at $0.38. This has squeezed XRP inside a tight range for the past few days.

Usually, tight range trading is followed by a range expansion. The rising 20-day EMA and the RSI in the positive territory indicate the path of least resistance is to the upside.

If buyers thrust the price above the $0.38 to $0.41 range, the bullish momentum could pick up and the XRP/USD pair may challenge the stiff overhead resistance at $0.45. The bulls will have to clear this hurdle to signal that the pair may have bottomed out.

Contrary to this assumption, if the price turns down sharply from the current level and breaks below the 50-day SMA, it will suggest that the pair may extend its stay inside the $0.29 to $0.38 range for a few more days.

ADA/USD Market Analysis

We mentioned in the previous analysis that Cardano may trade between $0.45 and $0.55 and that is what happened. The ADA/USD pair rebounded off the moving averages on August 5 and reached the overhead resistance at $0.55 on August 8.

The long wick on the August 8 candlestick shows that bears continue to defend the overhead resistance aggressively. However, a minor positive is that the bulls have not given up much ground. This suggests that traders are not booking profits as they expect the pair to break above $0.55.

If that happens, the pair could pick up momentum and rally to $0.67 and then to $0.70. The bears are expected to mount a strong defence at this level.

Alternatively, if the price turns down sharply from the current level and breaks below the 20-day EMA, it will suggest that the pair may remain stuck in a tight range for a few more days.

Hopefully, you have enjoyed today’s article for further coverage please check out our crypto Blog Page. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.