Bitcoin and the broader cryptocurrency market continued their downtrend last week as traders expect the FTX contagion to spread and cause further damage in the crypto space. Although several firms have been affected by the collapse at FTX, two entities are speculated to be struggling for survival.

A report by The Wall Street Journal on November 15 said that crypto lending platform BlockFi has been considering filing for Chapter 11 bankruptcy after halting withdrawals of customer deposits. The report citing sources added that BlockFi had “significant exposure” to FTX and was planning to lay off workers.

Another firm speculated to be on the brink of bankruptcy is digital-asset brokerage and lender Genesis, a subsidiary of Digital Currency Group (DCG). Bloomberg news reported on November 22 that Genesis was finding it difficult to raise fresh capital and warned investors of a potential bankruptcy if efforts failed. Genesis was reported to be seeking a capital infusion of at least $1 billion for the past several days but had not met with any success.

However, a representative of Genesis denied that it was planning to “file bankruptcy imminently,” as it was having “constructive conversations with creditors.” The denial does not seem to have calmed the market’s concerns as DCG’s Grayscale Bitcoin Trust, which is one of the largest holders of Bitcoin, has seen the discount between the value of its holdings and the spot price of Bitcoin widen to about 50%.

The negative sentiment has resulted in record institutional inflows into short investment products, according to CoinShares Digital Asset Fund Flows report released on November 21. This was “deeply negative for the asset class” and had brought down the total assets under management to $22 billion, the lowest in 2 years, the report added.

Markets hate uncertainty and buyers usually stay away during such periods. That could be one of the reasons for the incessant fall in several cryptocurrencies. Although the price looks attractive, it is better to wait for the crypto markets to find a bottom before venturing to buy. Read our analysis to find out the strong support levels on major cryptocurrencies where the decline could end.

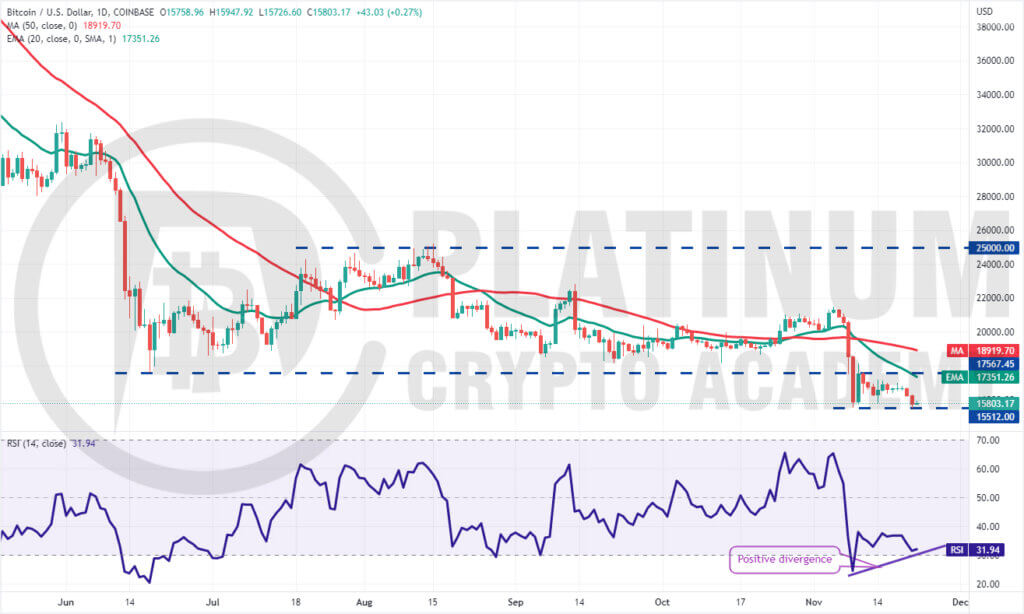

BTC/USD Market Analysis

Bitcoin remains stuck inside the range between $15,512 and $17,567.45 as projected in the previous analysis. The BTC/USD pair dipped marginally below the support on November 21 but the bulls managed to defend the $15,512 level on a closing basis.

Although the downsloping moving averages indicate advantage to bears, the relative strength index (RSI) is attempting to form a positive divergence. This suggests that the selling pressure could be waning.

However, during a bear phase, positive divergences tend to fail several times. A weak rebound off the current level could indicate a lack of aggressive buying by the bulls. That may increase the likelihood of a break and close below $15,512.

If that happens, the pair could resume its downtrend. The first support on the downside is $13,456 and thereafter $12,000.

The first sign of strength will be a break and close above the breakdown level of $17,567.45. Such a move could suggest that the downtrend could be ending. The pair could then rally to the psychological level of $20,000.

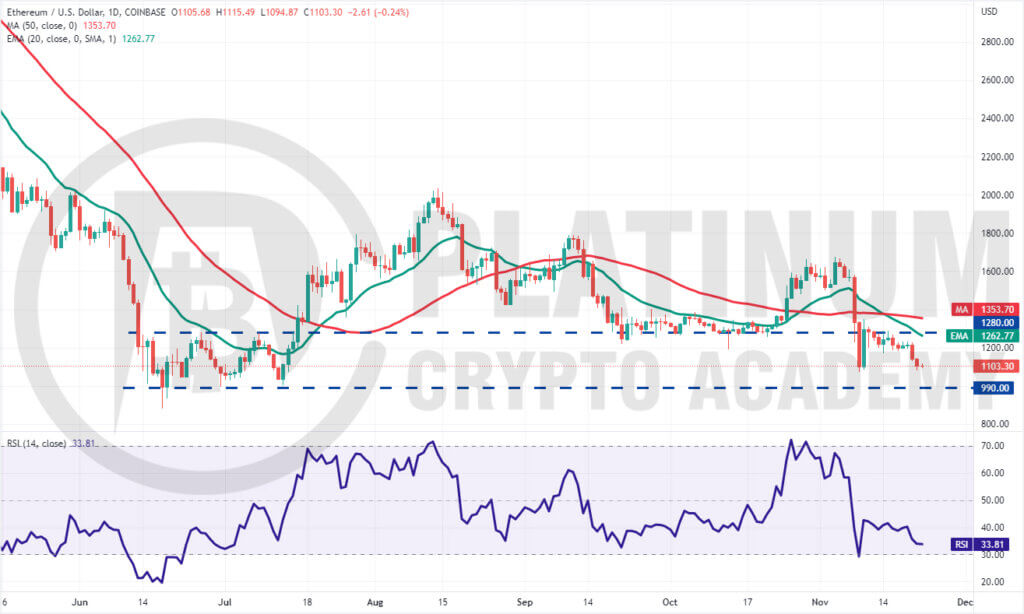

ETH/USD Market Analysis

Ether’s failure to sustain above $1,280 may have attracted selling by the bears. This pulled the price to the strong support at $1,099.90 on November 21. If bears sink the price below this support, the ETH/USD pair could slide to $990.

The downsloping 20-day exponential moving average (EMA) and the RSI below 34 suggest that the path of least resistance is to the downside. If the support at $990 cracks, the pair could retest the June low of $879.80.

The bulls are expected to defend the zone between $990 and $879.80 with all their might because if they fail to do that, the pair may resume its downtrend. The next support on the downside is $741.

Contrary to this assumption, if the price rebounds sharply off $1,099.90, the pair could again rise to the overhead resistance at $1,280. A break and close above this level will suggest that the corrective phase may be over. The pair could then attempt a rally toward $1,700.

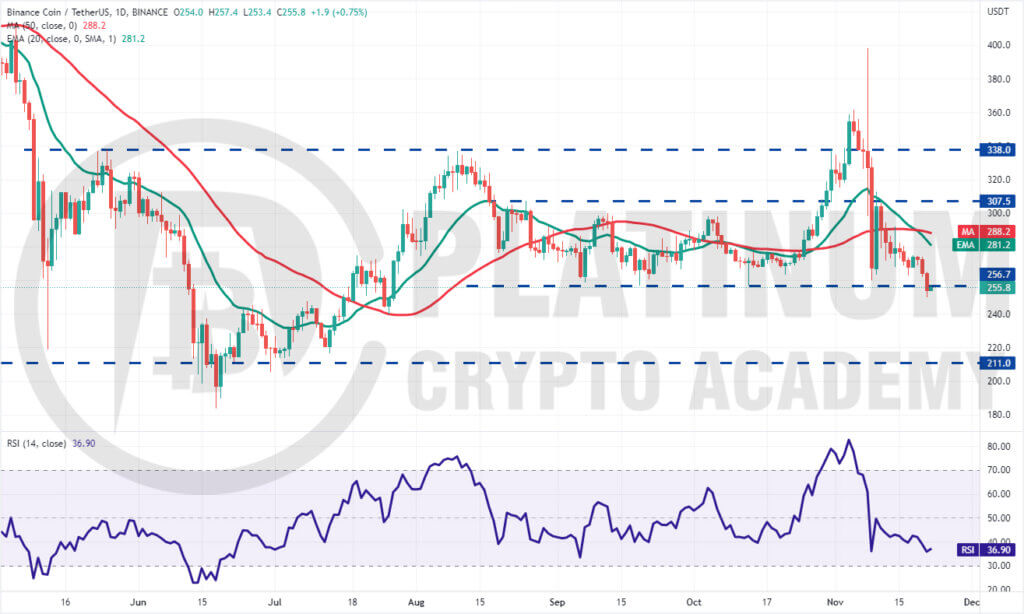

BNB/USD Market Analysis

Binance Coin continued its downward move and plunged below the critical support at $256.70 on November 21. The downsloping 20-day EMA and the RSI in the negative territory indicate that bears are in control.

If the price sustains below $256.70 for a couple of days, the BNB/USD pair may extend its decline to $239 and thereafter to $211.

Contrary to this assumption, if the price turns up from the current level and rises back above $256.70, it will suggest strong buying on dips. The pair could then rise to the 20-day EMA where it may face stiff resistance.

If the price turns down from this level, it will suggest that the sentiment remains negative and traders are selling on rallies. That could increase the possibility of a drop to $211.

If bulls want to invalidate this negative view, they will have to push and sustain the price above $307.50.

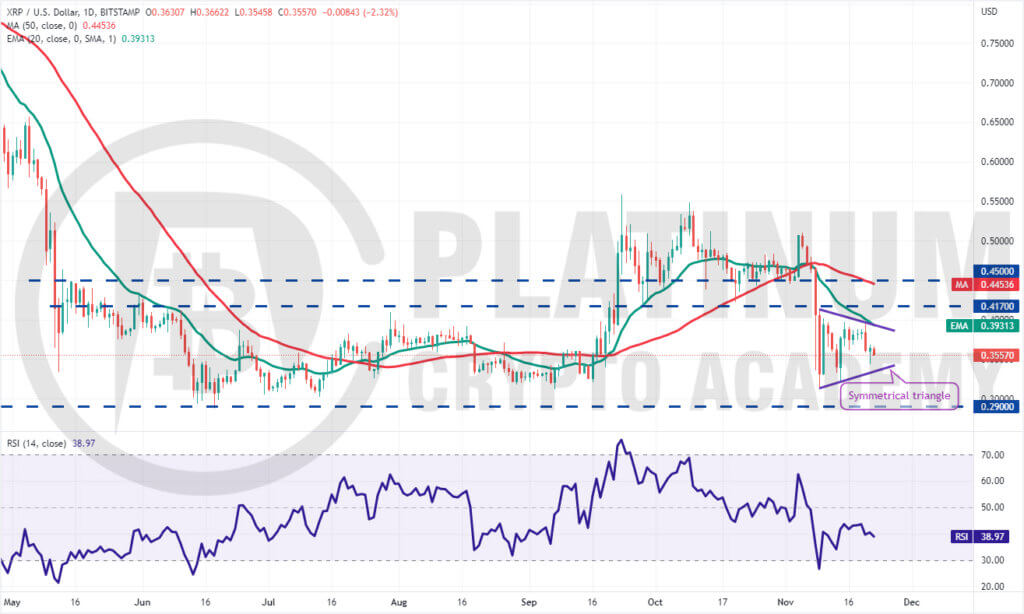

XRP/USD Market Analysis

XRP tried to break above the 20-day EMA on November 20 but the bears held their ground. This suggests that sellers are active at higher levels. The price action of the past few days has formed a symmetrical triangle pattern, which generally acts as a continuation setup.

If the price plummets below the triangle, the XRP/USD pair could drop to the crucial support at $0.29. A break and close below this level could extend the decline to $0.25.

The downsloping moving averages and the RSI below 40 indicate that bears have a slight edge.

This bearish view will be invalidated in the near term if the price turns up from the current level and breaks above the triangle. The pair could then rise to $0.45. A break above this resistance could open the doors for a retest of $0.55.

ADA/USD Market Analysis

Cardano remains in a strong downtrend. Aggressive selling by the bears pulled the price below the support at $0.31. If the price sustains below this level, the ADA/USD pair could drop to the support line of the descending channel pattern.

Buyers are likely to aggressively defend the support line because a break below the channel could intensify selling and pull the pair to $0.20.

A minor positive for the bulls is that the RSI is trying to form a positive divergence. This suggests that the downward momentum could be slowing down.

If the price turns up from the current level, the bulls will try to propel the pair above the 20-day EMA. If that happens, the pair could rise to the downtrend line. The bulls will have to clear this hurdle to signal a potential trend change.

Hopefully, you have enjoyed today’s article for further coverage please check out our crypto Blog Page. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.