This article has been a nexo.io review in part and a feature article on the other end that looks at Defi and the opportunities that exist in the crypto space. The nexo.io review has been included here as an example of the potential of how Crypto is disrupting legacy financial systems.

Nexo Review 2022

Nexo is at the forefront of deepening global crypto adoption. According to statista, as of June of 2021, there were about 50 million Blockchain wallets worldwide. This is a steady increase from 2016 when there were less than 10 Million wallet holders. This clearly shows that crypto is here to stay. Even with all this progress, governments around the world are not sure whether to adopt cryptocurrencies or ban them.

For instance, in India, despite a court ruling that overturned a ban on crypto, there are recent developments that show that the country is still committed to ban crypto. On the other hand, China launched trials on their own Central Bank Digital Currency. Well, governments can never be entrusted with revolutionary concepts, especially when it threatens the status quo. As governments dilly dally on this, we are seeing multiple developments in the crypto space and the latest buzz word is Defi.

Talk of democratizing finance, defying legacy financial systems or even open finance. Whatever you want to call it, then that’s what cryptocurrencies and indeed Blockchain can do. A company like Nexo enables you to deposit crypto on your wallet, lend it out across the world and earn interest on it, regardless of your nationality

NEXO AND WHAT IS DEFI

Defi stands for Decentralized Finance. This is a nickname given to financial contracts and applications that have been built on the Ethereum Blockchain. Defi basically falls in the following categories:

Lending

This involves lending and borrowing. The loans that are lent on this platform have been secured. For example, a lending platform may ask you to deposit ETH as security and lend you tokens. A good example of this is Nexo.

Decentralized Exchanges

These are exchanges that allow traders to trade in cryptocurrencies and tokens. No registration is required and the exchanges have no central authority. They rely on smart contracts to execute their trades.

Payments

This category of defi is basically made up of payment networks that have been built on top of Blockchain. These networks enable users to transact with speed.

Asset Tokenization

This involves tokenizing existing assets and putting them on the Blockchain where they can be stored and traded. Smart contracts and protocols can be used to execute trades.

NEXO REVIEW – HOW IT ALL STARTED

Defi is a new movement shaping the crypto space. Crypto entrepreneurs have been buoyed by the fact they can create their own financial instruments outside of mainstream banks and financial institutions. Bitcoin and Ethereum are the main networks used by Defi applications.

In 2021, Defi is one of the reasons why Ethereum continues to be propelled forward as a Blockchain. Some people say that defi stands for “defy”- defying the current legacy financial systems and restructuring existing financial markets. These applications have formed an integral part of Vitalik’s global campaigns on Ethereum technology.

Early pioneers on this space are Maker Foundation, Compound Labs, dydx and 0x. They started at around 2018. Since this period, notable entrants that have entered into this field are Nexo.io, Uniswap, Synthetix and InstaDapp.

From 2018, assets that have been committed to Defi projects were over $1 Billion in February of 2021. As of July of 2021, this number had grown to assets worth over $3 Billion.

Early Defi adopters say that they started working on their applications using Bitcoin Blockchain. However, with the development of Ethereum, they found it easier to build their applications on the Ethereum network. ” What would take us over six weeks to build on the Bitcoin Blockchain, only took us 36 hours to build on the Ethereum Blockchain,” said Joey Krug, founder of the Augur Betting app.

Ethereum Blockchain had been clearly designed with decentralized finance at its core. Looking at the Ethereum whitepaper, you realize that Buterin has these three sections in mind: Financial, semi financial and non-financial. He wanted to impact on these categories and lending and borrowing is at the heart of this. Experts opine that while Bitcoin may have given us money, Ethereum gave us finance.

DAO

At around 2016, the Distributed Autonomous Organization was set up. It raised over $150 Million from investors. The vision of this project was to act as a hub that would help fund startups and projects. The project’s investors would then receive tokens that will give them the rights to vote on the direction of the project, determine the startups and projects that can be funded and share from the profits generated from these projects. All of this would have been done through the use of smart contracts powered on the Ethereum Blockchain.

Even though this was a noble project, there were a lot of concerns, both regulatory and operational concerns, on how this project would carry out its mandate.

Later on, due to security flaws on its system, ETH that had been deposited by investors was hacked. Over 3.6 million ETH was stolen. This was worth over $60 million then. By then, Eth was trading at around $17 per coin. Its price on multiple exchanges plunged to less than $13. As a solution to this hack, Ethereum Foundation proposed a fork that would restrict more funds from being drained from the DAO, prevent the hackers from accessing the stolen funds and ultimately repossessing the funds. This resulted in a split in the community and led to the formation of the Ethereum Classic community- original Ethereum.

DAI

At the end of 2017, an entity called MAKERDAO debuted a cryptocurrency called Dai. Dai is an asset-backed cryptocurrency that is fully run in a decentralized manner on the Ethereum Blockchain. 1 Dai is worth 1 US Dollar. All the Dai is backed up by assets that are securely held in a decentralized manner on the Maker platform. Any individual can lock up their assets as collateral and issue Dai against these assets.

Dai essentially became a stable coin. Of course, there were other existing Stable coins such as Tether (USDT). However, proving that they had assets to back up these coins was always shrouded in controversy.

Sometime later, when the markets crashed and Dai held its position, this fueled a new generation of developments in the Blockchain world- the rise of Decentralized Finance.

Fast forward to 2021, looking at Defi pulse, there is a total value locked ( Eth that has been deposited as an asset) of over $4 Billion in the market.

TOP 5 DEFI PLATFORMS

MakerDAO is a decentralized credit platform that is run on the Ethereum Blockchain. It currently has a total value locked of over $ 1 billion. It commands about 30 % of the total market share in decentralized lending.

Anyone can use MakerDAO and deposit collateral such as ETH and BAT and you will be given DAI as debt. Dai continuously generates stability fees. Users can get Dai loans of up to 60% of the value of their collateral. If the value of your collateral in the vault falls below a given ratio, then you incur a 13% penalty and may have your vault liquidated. All the assets that are liquidated by this platform are sold in the open market at a discount of 3%. Maker also has its own token called MKR. MKR token holders get to vote on the direction of the project and can also liquidate their tokens in the event that the collateral value in the system has fallen.

COMPOUND

Compound is a money market protocol that allows users to earn interest on their assets or borrow funds and use their assets as collateral. Any person can join this network and begin to earn interest on their assets known as compounding interest. Some of the assets that are supported in this platform are WBTC, USDC, REP, ETH, DAI, BAT. The rates of interest vary based on available supply and demand. Borrowers can borrow up to 75% of their assets. In the event of liquidation, these assets are sold on the open market at a discount of 5%.

AAVE

This is a non-custodial protocol for lending on Ethereum platform. The protocol mints tokens at a ratio of 1:1 for all the assets that have been deposited on it. The platform supports about sixteen assets. This platform also supports flash loans. Flash loans are loans that can be given and repaid at the same time. Flash loans can be used by developers to create applications that can deepen decentralized financial systems.

This is a wallet that has been developed on Ethereum Blockchain. It enables users to manage their assets and even leverage on their collateral. It also enables its user to migrate their debts from one platform to another. There is also a lending section on the platform where users can deposit their assets and lend them.

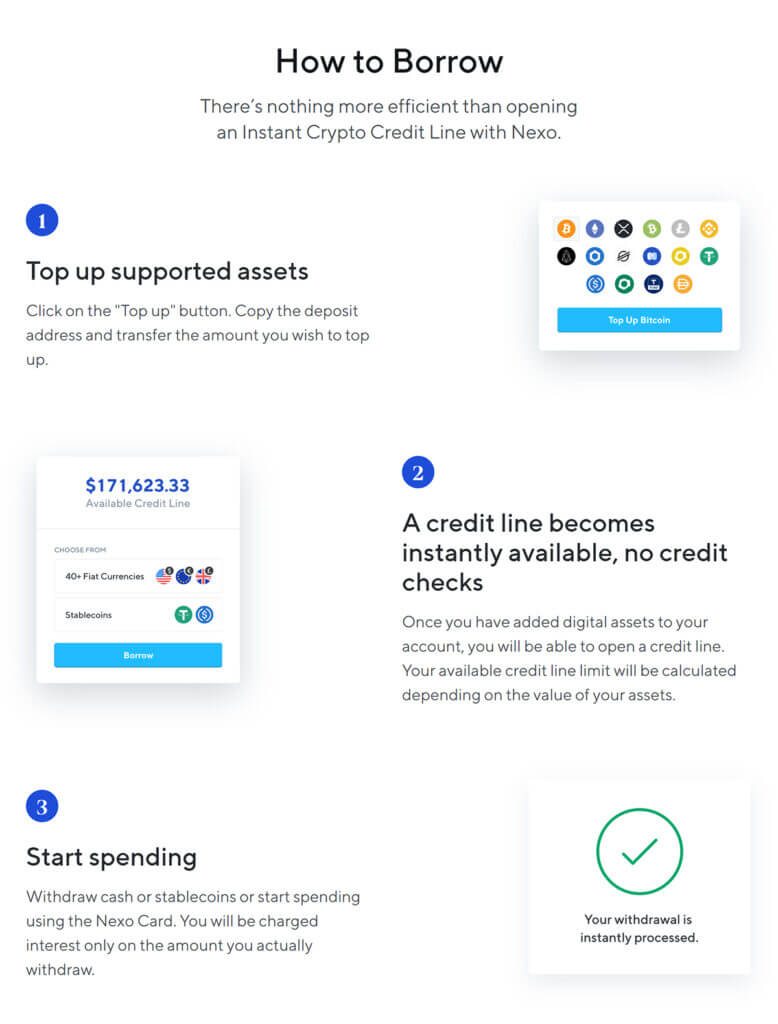

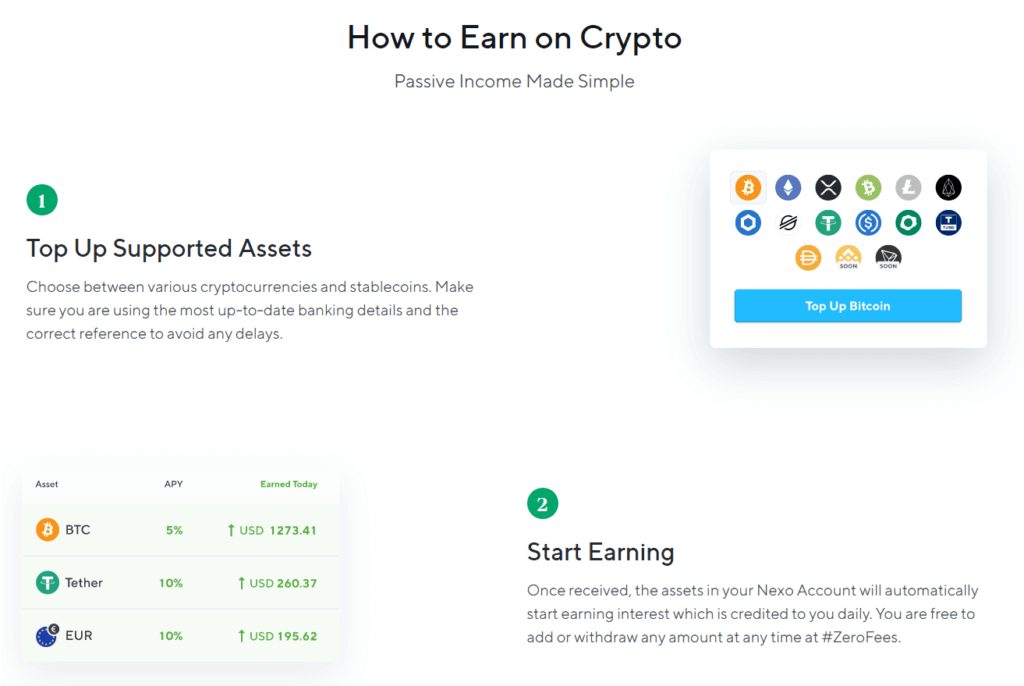

Nexo is a platform that enables its users to earn a compounding interest that is paid out daily. Though it may not be exclusively considered as a Decentralized app, it uses Blockchain technology and protocols to execute transactions on its platform. You can earn interest on your crypto, EUR, GBP and USD. The platform also enables you to borrow crypto using your crypto coins as collateral. On this platform, you can borrow from a minimum of USD 500 and a maximum of USD 2 Million. Additionally, this platform also has a crypto card, called the Nexo Card, that can be used in over 40 million merchants worldwide.

WHAT IS TVL

TVL stands for Total Value Locked. It is mostly used in decentralized finance to determine the market value of an asset that has been locked or held as collateral in vaults within various decentralized platforms. These assets are used to lend or as collateral for borrowing. The dominant asset that is locked in vaults is ETH. However, different platforms may add other tokens and cryptocurrencies that may be used as collateral on their vaults.

Since 2016, the TVL has been on an upward trajectory from less than a billion in 2019. In February 2021, it surpassed a billion dollars. By July of 2021, TVL surpassed 2 billion dollars. The current TVL is over 4 billion dollars.

INTEREST RATES CHARGED ON LOANS

Interest rates charged on loans will depend on the platform from which you seek the loan from. They are also dependent on the type of asset that you are borrowing or use as collateral.

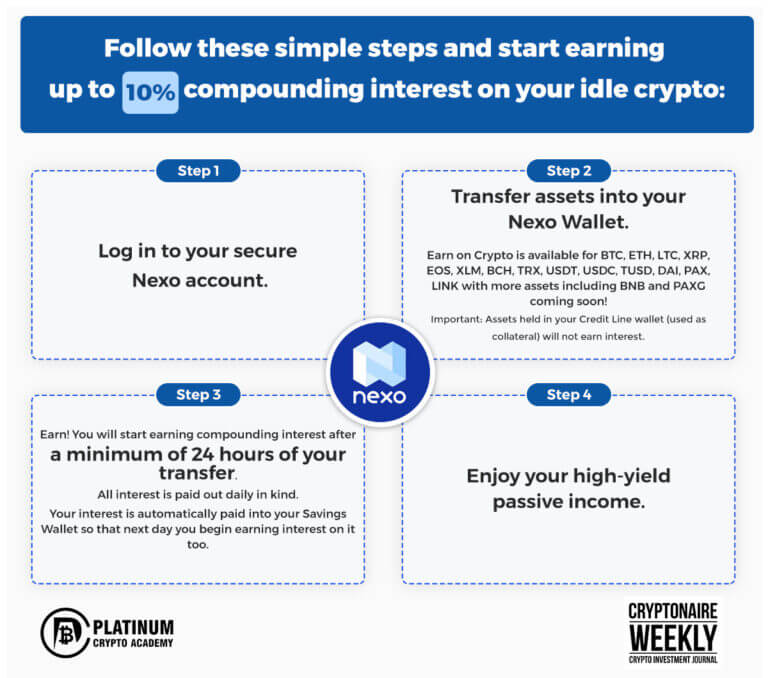

Nexo charges an interest rate that starts from 5.9% annually on its borrowers. On the other hand, lenders have a chance to get a compounded interest of up to 10% that is compounded daily.

On Compound, the interest rates charged for borrowers is currently at 2.7%. Lenders on the platforms get an interest of 0.2%. On the dydx platform, lenders get an interest of 0.1% while borrowers are charged an interest of 1.0%. These rates have been quoted on ETH backed loans and assets

NEXO REVIEW – HOW DEFI HAS IMPACTED GLOBAL FINANCE

This has significantly impacted the world of lending. Legacy systems would never lend to someone they do not know or hasn’t opened an account with them. If you are not from their jurisdiction, forget it! If you have assets that you would like to use to collateralize your loan, but do not have an account with them or you have no transaction history with another bank. Forget it! You won’t get any loan. End of story. Then came Defi J

In the lending space, we find that individuals have a chance to earn interest on their funds while lending to other people across the world. They do not need to check their credit history and all the other information that comes with legacy systems.

One only needs to download an app, connect their wallet to the app, deposit some crypto and voila! You are good to go. On the other end, if you would like to borrow funds, you can easily use your crypto as collateral and borrow as much as you can as long as you are within the required ratios. This is good because in case of an emergency, you no longer need to liquidate your crypto assets but you can borrow against them. Lenders on the other hand get to earn interest that is generated from the tokens that are issued and compounded on a daily basis, so you can see how much you are making at any one time. All this is done anonymously!

In some apps, like Nexo you can deposit your crypto and use them across any merchant in the world.

WHAT IS THE FUTURE OF DEFI PLATFORMS?

We see new developments coming into this field. A platform like InstaDApp enables you to leverage the funds that you get and access even more loans from lenders.

Yield farming enables you to switch from one platform to another, staking tokens and earning interest on these tokens. This should help the industry develop more products around finance that will ultimately even onboard hedge fund managers across the world. Flash loans, on the other hand, use smart contracts and enable tech-savvy programmers to borrow funds and repay those funds at the same time all in one transaction. These flash loans can be used on arbitrage opportunities between different exchanges. Flash loans can also help individuals offset their loans by borrowing from one platform that offers cheaper loans, paying off their existing loans, and retain part of the funds.

Defi leverages trustless networks. There is no need to have a credit history before transacting on these platforms.

Defi platforms also enable individuals to become automatic lenders and they can lend to other users across the world, like is the case with Nexo. We should see more people join this platform as a way of storing their crypto, staking and also lending them out.

ARE DEFI PLATFORMS SAFE TO USE

Generally speaking, Defi platforms are safe to use. Most of the dominant platforms out there have experienced little or no security breach.

This is not to say that they are completely secure. As we have seen in recent cases, smart contracts may have flaws. This is usually exploited by hackers who siphon funds from platforms if they breach some of these contracts.

On the other hand, if you take loans on defi platforms, there is a ratio that you are supposed to maintain between your asset on the vault and the loan that you have taken. In the event that the price of your asset drops past a certain minimum, then you have to top up the deficit to fill up this void. Failure to do this, your loan may incur a penalty or even be liquidated. In certain instances, especially when there is a flash crash on the price of a dominant crypto, loan borrowers usually face this liquidation risk and may end up losing all their cryptocurrencies stored as collateral.

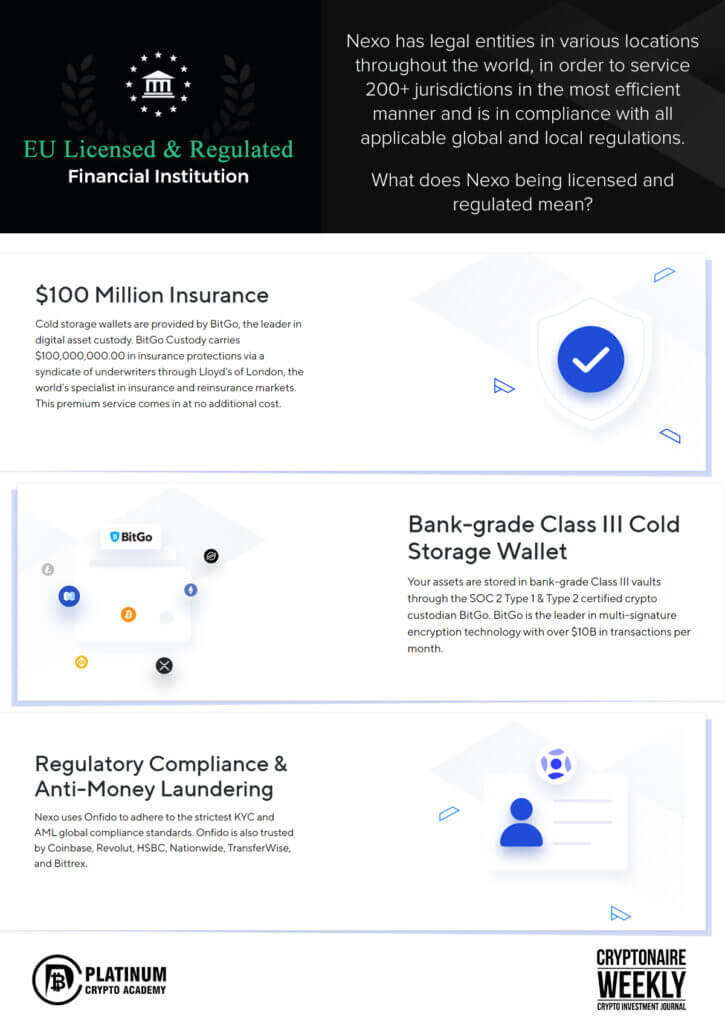

If you store your crypto assets on a platform like Nexo.io, they also use a combination of both hot and cold storage to store your asset. The cryptocurrencies are also insured so that in the event of a hack, you can always get your crypto assets back.

HOW TO GET STARTED USING DEFI PLATFORMS

To start using defi platforms, you first need to have access to ETH. You can buy these from exchanges. After this, you can store your crypto in a hardware wallet or a platform such as MyETHerWallet.

You can then access your ERC-20 tokens from here. You will then need to choose an app you would like to use for lending or borrowing. The next step is to download the app and connect your wallet to this app. From here, you can deposit your ETH or any other acceptable cryptocurrency on this app and use it to lend or borrow against it.

The only fee you will incur is the gas fees when sending the tokens and ETH from one address to another.

What is yield farming?

This is basically moving your assets from one platform to another to increase your yields. This is the process of depositing your crypto on lending and staking platforms, and leveraging on this platforms and protocols to increase the amount of yield you get on your crypto assets. In some instances, this yield may be as high as 100% annually. It is paid out daily. It may involve using a crypto asset to take a loan, then leveraging on this loan to take another loan on a different platform.

With yield farming, what a user needs to be careful about is the collateralization ratio. You need to keep an eye on this so that you may not have your asset liquidated.

WHAT ARE FLASH LOANS AND HOW DO THEY WORK

Flash loans are ingenious ways of leveraging on smart contracts and decentralized finance where a loan is borrowed and paid on one transaction. For now, one may need to have some background with coding and the use of smart contracts to initiate these kinds of loans. There are platforms that have been set up that give these kinds of loans. This is a new development in the Defi ecosystem and we are yet to see the full potential of this tool. However, one of the possible scenarios where this financial instrument can be used is in arbitrage trading. It can also be used in clearing loans from one platform by taking a cheaper loan on another platform.

WHAT ARE THE DRAWBACKS OF DEFI LENDING PLATFORMS?

We are still in the early days of Defi and crypto-backed loans so we are yet to realize its full potential. Because of this, there may be a few security gaps here and there in the implementation of smart contracts. So, one should not be surprised if a few defi apps are hacked and funds stolen along the way.

Taking crypto-backed loans also exposes the borrower to liquidation in the event that the collateralization ratios fall below the required minimum. So, in the event of a flash crash, and assuming you have been over-leveraged, then you may lose all your cryptocurrencies.

Lex Sokolin, a Fintech expert, recently said that Eth Blockchain and Defi legitimize Ponzi schemes and that these should be weeded out of the system. Some of the financial tactics being carried out like yield farming haven’t been tried before on conventional financial systems. So, we are basically learning as we proceed.

One notion is that the interest on some of the tokens that are earned on the lending platforms will always rise. While this may be the case now, it is not guaranteed that this will always be the case in the future.

WHAT IS THE FUTURE OF DEFI PLATFORMS?

We see new developments coming into this field. A platform like InstaDApp enables you to leverage the funds that you get and access even more loans from lenders.

Yield farming enables you to switch from one platform to another, staking tokens and earning interest on these tokens. This should help the industry develop more products around finance that will ultimately even onboard hedge fund managers across the world. Flash loans, on the other hand, use smart contracts and enable tech-savvy programmers to borrow funds and repay those funds at the same time all in one transaction. These flash loans can be used on arbitrage opportunities between different exchanges. Flash loans can also help individuals offset their loans by borrowing from one platform that offers cheaper loans, paying off their existing loans, and retain part of the funds.

Defi leverages trustless networks. There is no need to have a credit history before transacting on these platforms.

Defi platforms also enable individuals to become automatic lenders and they can lend to other users across the world, like is the case with Nexo. We should see more people join these platforms as a way of storing their crypto, staking and also lending them out.

NEXO REVIEW – HOW TO GET STARTED USING DEFI PLATFORMS

To start using defi platforms, you first need to have access to ETH. You can buy these from exchanges. After this, you can store your crypto in a hardware wallet or a platform such as MyETHerWallet.

You can then access your ERC-20 tokens from here. You will then need to choose an app you would like to use for lending or borrowing. The next step is to download the app and connect your wallet to this app. From here, you can deposit your ETH or any other acceptable cryptocurrency on this app and use it to lend or borrow against it.

The only fee you will incur are the gas fees when sending the tokens and ETH from one address to another.

What is yield farming?

This is basically moving your assets from one platform to another to increase your yields. This is the process of depositing your crypto on lending and staking platforms and leveraging on these platforms and protocols to increase the amount of yield you get on your crypto assets. In some instances, this yield may be as high as 100% annually. It is paid out daily. It may involve using a crypto asset to take a loan, then leveraging on this loan to take another loan on a different platform.

With yield farming, what a user needs to be careful about is the collateralization ratio. You need to keep an eye on this so that you may not have your asset liquidated.

WHAT ARE FLASH LOANS AND HOW DO THEY WORK

Flash loans are ingenious ways of leveraging on smart contracts and decentralized finance where a loan is borrowed and paid on one transaction. For now, one may need to have some background with coding and use of smart contracts to initiate these kinds of loans. There are platforms that have been set up that give these kinds of loans. This is a new development in the Defi ecosystem and we are yet to see the full potential of this tool. However, one of the possible scenarios where this financial instrument can be used is in arbitrage trading. It can also be used in clearing loans from one platform by taking a cheaper loan on another platform.

WHAT ARE THE DRAWBACKS OF DEFI LENDING PLATFORMS?

We are still in the early days of Defi and crypto-backed loans so we are yet to realize its full potential. Because of this, there may be a few security gaps here and there in the implementation of smart contracts. So, one should not be surprised if a few defi apps are hacked and funds stolen along the way.

Taking crypto-backed loans also exposes the borrower to liquidation in the event that the collateralization ratios fall below the required minimum. So, in the event of a flash crash, and assuming you have been over-leveraged, then you may lose all your cryptocurrencies.

Lex Sokolin, a Fintech expert, recently said that Eth Blockchain and Defi legitimize Ponzi schemes and that these should be weeded out of the system. Some of the financial tactics being carried out like yield farming haven’t been tried before on conventional financial systems. So, we are basically learning as we proceed.

One notion is that the interest on some of the tokens that are earned on the lending platforms will always rise. While this may be the case now, it is not guaranteed that this will always be the case in the future.

NEXO.IO INTRODUCTION

Nexo is a platform that enables you to bank on crypto. Users can borrow from this platform and they are charged an interest rate of 5.9%. On the other hand, lending from this platform gives you an interest of 10% that is compounded and paid out daily.

All the cryptocurrency on Nexo has been insured by BitGo. Currently, there is an insurance cover of over $ 100 million that has been taken. This platform also has over 800,000 clients who are using it. You can check some of the nexo.io reviews online just so you are sure about this.

Over the last two years, over $3 Billion has been processed on this platform. Nexo also takes neo banking to a whole new level through the use of a crypto card. This card lets you spend your crypto directly from your card. You also get instant cashback on all the purchases you make using this card.

There is also no minimum contribution and there are zero fees charged. If you borrow cryptocurrency from Nexo, the interest charges start from 5.9 %. The minimum that one can borrow from this platform is $500 and the maximum is $2 million.

Features of Nexo.io

Lending out crypto assets on Nexo earns you an interest of 10% that is compounded and paid out daily. Another thing is that you are free to deposit and withdraw funds from this platform whenever you want.

How Nexo Works for 10% Interest Payments

There are no credit checks required and clients get automatic approvals. This platform also supports multiple assets. Some of these are EOS, BCH, NEXO, XLM, BNB, LTC, XRP, PAXG, ETH and BTC. TRX has also been recently added as collateral. If you take a loan, you can withdraw it into fiat currencies. There are over 20 fiat currencies that are supported in over 200 countries.

This platform offers a crypto card that gives you the same capabilities as legacy credit and debit cards. With the Nexo card, users have a chance to spend the exact value of their crypto without necessarily selling their crypto before they use it. Another feature of the Nexo card is that you get an instant 2% cashback on all the purchases you make. This card is accepted in over 40 million merchants across the world. Users can also make payments using local currency. There are also no monthly or annual fees charged for using this card.

This platform also has an award-winning wallet where you can access credit lines or lend out funds and earn yields from lending. The wallet can be downloaded on IOS and Android phones. If you check out nexo.io reviews online, you will see this wallet has received numerous five-star reviews.

NEXO – HOW TO GET STARTED

Firstly, log in to the Nexo website and click on the open account button. From this section, you will be prompted to insert some details that the platform will use for verification. All that is needed on this are email and password. After this, you will need to fill a CAPTCHA.

The next step is to verify your email by clicking on the link that has been sent to your email address. Once you click on this link, you will be redirected to your account where you can look at the crypto-assets that you can deposit, your credit line and the total amount that you have earned. There is also a section where you can withdraw funds that you have taken as credit and send it to your bank account. This should be deposited in a day or two. You can also buy NEXO tokens and start earning from this. You stand to get up to 30% in dividends. The platform recently stated that they will be paying over $6 million as dividends to NEXO token holders. This is an increase of over 154% from the dividends paid last year.

Users can perform all their transactions using the web browser or download an app that is supported on Android and iOS phones. The app syncs with the web app in the event that you make any transactions from there.

The interface also gives you a breakdown on the amounts that you may have spent when you check the transaction history.

Users can also activate two-factor authentication on their platforms to improve security.

NEXO – PROS AND CONS

Pros:

- Supports multiple currencies that users can lend and earn interest from

- There is no credit check done when borrowing

- Users can borrow and deposit the cash as fiat currencies sent to their local bank account

- The platform has been insured so in the event of a hack, you know that your funds will be protected

- Most of the crypto assets are kept on cold storage

- Nexo card can be used in multiple merchant stores across the world.

- If you check out an io review on a trusted platform like Trust Pilot you will see that it is rated as Excellent.

Cons

- It requires users to input their email address, so it may not be completely anonymous

- Being a centralized platform may mean that it may not be completely immune to hacker attacks.

NEXO AND DEFI OPTIONS PROTOCOLS IN RECENT NEWS

Yes, more needs to be done as this space matures. Even though there are instances of hacker attacks, like the recent one on Opyn, where over $300,000 was lost, generally the industry is bullish and we should see more investments in this space. Opyn is a protocol that offers options for Defi tokens, ETH and also ensures Compound Deposits. Over $370,000 was recently lost from attacks on the platform. The platform responded and managed to save about $572, 000 from being lost. On yet another story in the Defi space, it is reported that recently assets worth over $8 million were auctioned for free on Maker Dao. Investigations reveal that this may have been caused by bots that filled the Ethereum network with transactions that needed to be verified, thus, congesting this network. They then went ahead and made bids on MakerDAO thereby purchasing assets that were being liquidated without paying auction fees.

As this industry grows, we will see more VCs and companies setting up Defi products. Recently, it was reported that it will not be long before the amount of assets locked in Defi protocols hits $5 billion. We are also seeing an increase in investments across most Defi Categories: Derivatives, exchanges, Assets and Lending. The value of ETH has also been up over 70% in the last 30 days ( July to August 2021). This shows increased confidence in the Ethereum Blockchain and its products. Like Chamath Palihapitiya, a billionaire investor, recently said on CNBC, “everyone should have at least 1% of their wealth in Crypto.”