The Weekend of Woe – NFT Markets Plummet

The NFT market recently experienced a tumultuous weekend, with prominent PFP collections such as Bored Ape Yacht Club, Mutant Apes, Azuki, and Memeland Captainz witnessing a drastic 30 – 60% drop in value.

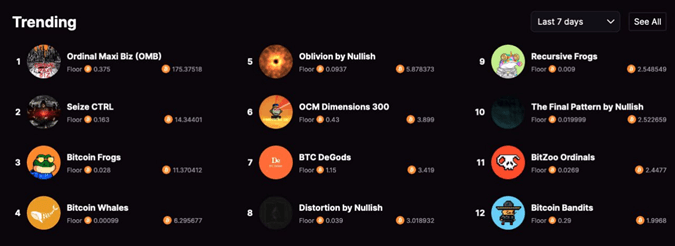

This selling frenzy painted a bleak picture for these collections, marking a black weekend for NFTs. Despite the market’s downturn, BTC NFTs, notably OMB, emerged victorious. With a floor price of 0.375 BTC (~5.8 ETH), minters of these NFTs saw a significant return on their investment.

This success amidst the chaos raises intriguing questions about the potential impact of the ETH NFT downtrend on the burgeoning Ordinals.

The Azuki Saga – Outrage Amongst Holders

The Azuki NFT community recently found itself in the eye of a storm, with a series of unfortunate events leading to a significant controversy. The trouble began with the Elementals mint, a new project launched by Azuki. The mint was expected to be a major event in the NFT space, but it quickly turned into a disaster. The Elementals mint was plagued with issues from the start. Many holders reported problems with the minting process, and the situation was further complicated by a hack. This cyber-attack resulted in significant losses for the community, with thousands of dollars’ worth of NFTs stolen. The fallout from the hack was immediate and severe. Outraged Azuki holders united to demand a refund of $39 million, representing the losses they had incurred due to the hack. This demand marked a significant escalation in the controversy and highlighted the risks inherent in the NFT market.

The Bored Apes’ Dive In Price

The Bored Ape Yacht Club (BAYC), one of the most iconic NFT collections in the crypto space, recently experienced a significant drop in its floor price. This plunge has sparked a flurry of speculation and analysis within the NFT community.

BAYC has been a flagship project in the NFT world, known for its unique art and exclusive membership benefits. However, the recent dip in its value has left many wondering about the reasons behind this sudden downturn. One of the speculated reasons is market saturation. The NFT market has seen an explosion of PFP (Profile Picture) projects in recent times, leading to a glut of options for investors. This saturation could be leading to a dilution of interest and investment in established projects like BAYC. Another potential factor is the high minting cost associated with BAYC. As the project gained popularity, the cost of minting a Bored Ape increased, potentially putting off new investors and leading to a slowdown in demand.

BAYC has been a flagship project in the NFT world, known for its unique art and exclusive membership benefits. However, the recent dip in its value has left many wondering about the reasons behind this sudden downturn. One of the speculated reasons is market saturation. The NFT market has seen an explosion of PFP (Profile Picture) projects in recent times, leading to a glut of options for investors. This saturation could be leading to a dilution of interest and investment in established projects like BAYC. Another potential factor is the high minting cost associated with BAYC. As the project gained popularity, the cost of minting a Bored Ape increased, potentially putting off new investors and leading to a slowdown in demand.

The Novelty Wearing Off Some also suggest that the novelty of the Bored Apes could be wearing off. As with any trend, the initial excitement and hype can fade over time, leading to a decrease in demand and, consequently, value.

The Impact of New Game Launch – BAYC

Interestingly, the recent launch of Yuga Labs’ new crypto gaming offering, HV-MTL, coincided with the drop in BAYC’s floor price. The game, which combines Minecraft-style world-building with character guardianship elements reminiscent of Tamagotchi and Neo-pets, was launched with much fanfare. However, the associated NFTs have seen their floor price decline significantly since their debut, which may have indirectly impacted the perceived value of other Yuga Labs’ projects, including BAYC.

The Bigger Picture – BAYC

The decline in BAYC’s floor price is part of a larger trend affecting the entire NFT market. Data from Dune Analytics reveals a significant decrease in daily trading volume, with a decline of over 50% in June alone. This lack of interest and activity has become a challenge for the NFT industry, prompting prominent NFT marketplaces to employ various incentives to attract users and stimulate platform trading. Despite the recent dip, many in the community believe that BAYC’s strong brand and dedicated community will help it weather this storm and bounce back. However, the recent events serve as a reminder of the dynamic and unpredictable nature of the NFT market. It underscores the importance of careful research and due diligence when investing in NFTs. As the market continues to evolve, it will be interesting to see how BAYC and other similar projects navigate these challenges and adapt to changing market conditions.

The CryptoPunks Burn Phenomenon

In a surprising twist, people have been burning CryptoPunks to mint Ordinals NFTs. This trend, driven by the Bitcoin Bandits, a Web3 collective, has raised eyebrows in the Web3 community, given the iconic status and high value of CryptoPunks. The burning of CryptoPunks is seen as a bold move to emphasize the potential of the Bitcoin blockchain for innovation in the NFT space.

The Future of NFTs

Despite the recent turmoil, the NFT market continues to evolve and innovate. The emergence of “Smart PFPs” with customizable and tradable traits points to the potential for more sophisticated and interactive NFTs in the future. However, as the market matures, it will be crucial for investors to stay informed and cautious. The recent black weekend serves as a stark reminder of the market’s volatility and the potential for significant losses.

In conclusion, the NFT market remains a fascinating and dynamic space, full of potential for innovation and profit. However, it’s also a market that requires careful navigation, with the recent events serving as a stark reminder of the risks involved.