Quick Links

Few developments have garnered as much attention as Blackrock’s foray into the Bitcoin space. As the world’s largest asset manager, Blackrock’s movements in the crypto realm are not just newsworthy; they’re market moving. Let’s deep dive into the intricate dance between Blackrock and Bitcoin, and what it means for seasoned crypto investors and traders.

Blackrock’s Bitcoin Ambitions

In the grand tapestry of financial evolution, Blackrock stands as a titan, casting a long shadow over traditional investment avenues. Historically, its vast corridors echoed with discussions of stocks, bonds, and conventional assets. But recently, a new whisper has been making its rounds – Bitcoin.

Imagine a world where the old financial guard starts to recognize the potential of what was once considered a mere digital novelty. Blackrock’s journey into the heart of the crypto realm is akin to a seasoned sailor charting unknown waters, driven by tales of immense treasures and opportunities. The whispers grew louder when insiders began hinting at Blackrock’s plans to integrate Bitcoin into its vast portfolio. The application for a spot Bitcoin ETF wasn’t just a bureaucratic move; it was a declaration of intent, a signal to the world that Blackrock believes in the golden digital future that Bitcoin promises.This pivot isn’t just about diversification. It’s a narrative of transformation. In the grand financial theatre, when a player like Blackrock takes centre stage with a script like Bitcoin, the audience – institutional players, retail investors, and market spectators – take notice. The ripples of this performance could very well redefine how the world perceives crypto investments.

Understanding ETFs: The Basics

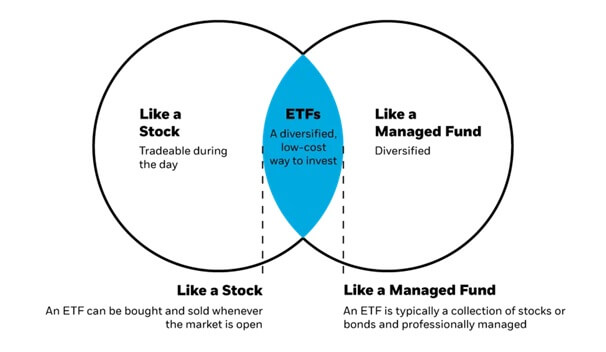

An Exchange-Traded Fund, commonly known as an ETF, is a type of investment fund and exchange-traded product. At its core, an ETF combines the diversification benefits of mutual funds with the flexibility of stocks. But what does this mean, and why have ETFs become such a popular investment vehicle? Let’s break it down.

What is an ETF?

Basket of Assets: An ETF holds a collection of assets, such as stocks, bonds, commodities, or even real estate. Instead of buying each asset individually, investors can purchase a single ETF that provides exposure to a group of assets.

Trade Like Stocks: Unlike mutual funds, which are priced once at the end of the trading day, ETFs are listed on stock exchanges. This means they can be bought and sold throughout the trading day at market prices, just like individual stocks.

Diversification: One of the primary benefits of ETFs is diversification. Since they hold a variety of assets, investors can achieve broader exposure to the market, reducing the risk associated with individual securities.

Key Features of ETFs

Transparency: Most ETFs are structured to track an index, such as the S&P 500. Because of this, their holdings are generally well-known and are disclosed regularly, providing transparency to investors.

Cost-Effective: ETFs typically have lower expense ratios compared to mutual funds. Additionally, because they trade like stocks, investors can employ stock trading techniques, including short selling and using stop orders.

Dividends: Just like stocks, many ETFs pay dividends based on the income generated by the underlying assets. These dividends can be reinvested or taken as cash.

Tax Efficiency: Due to their unique structure, ETFs can offer tax advantages compared to other investment vehicles. Investors are usually only liable for capital gains tax when they sell their ETF shares, potentially allowing for more efficient tax management.

Types of ETFs

While the concept of an ETF is straightforward, the world of ETFs is diverse. They come in various Flavors, including:

Stock ETFs: Track a particular stock market index.

Bond ETFs: Focus on government or corporate bonds.

Sector and Industry ETFs: Provide exposure to specific sectors like technology, healthcare, or finance.

Commodity ETFs: Track the price of a commodity, such as gold or oil.

International ETFs: Offer exposure to foreign markets or global market indices.

Thematic ETFs: Focus on specific themes or trends, such as clean energy or artificial intelligence.

The Bitcoin ETF Game

Exchange-traded funds (ETFs) have long been the cornerstone of traditional investment portfolios. These funds, which track indices, commodities, or a basket of assets, offer investors a way to buy a broad portfolio of assets without having to purchase each one individually. The allure of ETFs lies in their simplicity, liquidity, and cost-effectiveness.

Now, transpose this concept to the world of cryptocurrencies, and you have a potential game-changer. The introduction of a Bitcoin ETF, especially from a financial titan like Blackrock, signifies more than just another investment product; it represents a seismic shift in the way institutional investors approach the crypto space. Key points to consider: –

Legitimacy and Acceptance: A Bitcoin ETF, backed by the reputation and trust of a firm like Blackrock, lends significant legitimacy to cryptocurrency. For many institutional investors sitting on the fence, a Bitcoin ETF might be the nudge they need to enter the crypto realm.

Liquidity Boost: ETFs are known for their high liquidity, allowing investors to quickly enter or exit positions. A Bitcoin ETF would bring this liquidity to the crypto market, potentially reducing volatility and making the market more stable.

Simplified Investment: For many, the world of crypto can be daunting. Wallets, private keys, and blockchain can be overwhelming. A Bitcoin ETF simplifies this. Investors can gain exposure to Bitcoin without the complexities of direct ownership.

Regulatory Clarity: One of the significant hurdles for institutional investors has been the murky regulatory landscape of crypto. ETFs, being well-regulated financial instruments, provide a clearer framework for investors, potentially mitigating some of the perceived risks associated with crypto investments.

The Broader Implications

It’s essential to note that they aren’t the only players in the game. Other financial heavyweights like Invesco, Fidelity, and WisdomTree are also vying for a piece of the Bitcoin ETF pie. This collective push from multiple industry leaders underscores the growing consensus about Bitcoin’s potential and its future role in global finance.

However, the journey to a Bitcoin ETF hasn’t been without its challenges. Regulatory hurdles, market volatility, and scepticism from traditional financial circles have posed significant challenges. But the tide seems to be turning. With each passing day, the narrative is shifting from “if” a Bitcoin ETF will be approved to “when.”

Market Implications

The potential approval of Blackrock’s Bitcoin ETF could have profound implications for the crypto market. Institutional interest in Bitcoin has been on the rise, and a spot Bitcoin ETF could provide a more cost-effective and regulated way for these entities to gain exposure. This could lead to an influx of institutional money, further solidifying Bitcoin’s position as the premier crypto asset.

Moreover, Blackrock’s interest isn’t limited to institutional players. David Wells, CEO of Enclave Markets, suggests that Blackrock is equally keen on the retail market. This dual approach could broaden Bitcoin’s appeal, attracting both big-ticket investors and everyday traders.While the future looks promising, it’s essential to approach this news with a balanced perspective. The crypto market is known for its volatility, and while institutional interest is a positive sign, it’s not a guarantee of perpetual bullishness. Seasoned traders understand the importance of due diligence and staying informed. As with all investments, it’s crucial to do your research and understand the market dynamics before making any moves.

Conclusion

Blackrock’s entry into the Bitcoin space is undoubtedly a significant development. It’s a nod to Bitcoin’s growing stature and the broader acceptance of crypto as a legitimate investment vehicle. For seasoned crypto traders and investors, this presents both opportunities and challenges. As always, the key lies in staying informed, understanding the market, and making strategic moves.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.