Blockchain insurance has been widely spoken about and with the insurance sector always looking to embrace new technologies, open networks, and innovative information systems. Given the above scenario, Smart Contracts and Blockchain are fully capable of automating the insurance markets, through locking as well as unlocking of funds.

As far as the blockchain technology is concerned, it has created ripples in the market, especially with the massive success of Bitcoin as well as other cryptocurrencies.

Blockchain offers a simple yet effective premise for resolving logistical and financial problems. It is highly useful in cases where several parties are involved in completing transactions. Blockchain is also used where confidential data requires sharing, costs of transactions are high, as well as transparency is of paramount importance, such as in the insurance sector. Read on to find out how more about the future of blockchain in the insurance sector and how

BLOCKCHAIN INSURANCE – WHY BLOCKCHAIN?

Blockchain, in essence, functions as the distributed ledger system. It works as a single database of encrypted and validated transactions adhering to a defined protocol. It permits a validated, central data repository comprising of all the rules and transactions instead of each participant such as the insurer, customer, or the intermediary, managing their database-which may or might not be fully up-to-date and coordinated. Thus, blockchain entails a range of data as well as transactional validations by different parties in the chain. These parties are the ones that participate in an insurance contract and at times who aren’t, like the insurance tech firms included within the insurance ecosystem.

BASICALLY, THERE ARE 3 MAIN CATEGORIES WHERE BLOCKCHAIN CAN BE USED. THESE INCLUDE:

Data Exchange and Storage: Blockchain can be used for storing several files and data. The technology offers easier to trace and secure records when compared to other existing storage options.

P2P Electronic Payment: Bitcoin, as well as other blockchain-enabled cash systems, offers a cryptographic and proof-based electronic system of payment (rather than one based on trust). This particular feature makes blockchain highly efficient while also ensuring traceability and transparent electronic transfer.

Smart contracts: They work as digital protocols wherein numerous parameters are established in advance. When these pre-set parameters have been met, smart contracts execute several tasks without the need for human intervention, thereby increasing efficiency.

At present, the technical benefits of blockchain can be seen in the efficiency with which data can be exchanged, aside from the large-scale acquisition of data. However, smart contracts through blockchain will become more important in the days to come. By then, blockchain-enabled technology will have an excellent effect on the working model of many insurance firms.

HOW BLOCKCHAIN-BASED INSURANCE CAN BENEFIT THE INSURANCE INDUSTRY?

Blockchain, unlike any other technology, can improve how insurers record risks, enhance their speed, transparency, and accuracy of processes. Blockchain use cases indicate the advantages of technology such as improved revenue, efficiencies, and cost savings. In the days to come, underwriters will get plenty of opportunities to experience the true power of P2P networks, as well as underwrite better with the help of AI as well as for analytics.

Within the retail segment, insurance firms can join hands with larger networks to make the lives of their customers much easier and convenient. Blockchain insurance can offer many benefits such as seamless automatic claims reporting and validation of actual claims as well as paying customers in the pre-defined mode/account.

BLOCKCHAIN APPLICATION WITHIN THE INSURANCE SECTOR

Macro-level: Blockchain insurance supporters believe that technology has immense potential to break barriers related to data acquisition as well as revolutionize data exchange and data sharing in the insurance industry. Small as well as medium-sized insurance companies can use blockchain to acquire high quality and more extensive data, providing them with access to fresh opportunities as well as growth via product design and accurate pricing in niche markets.

On the other hand, blockchain insurance or/and reinsurance exchanges, which may include several parties, would look to upgrade their processes.

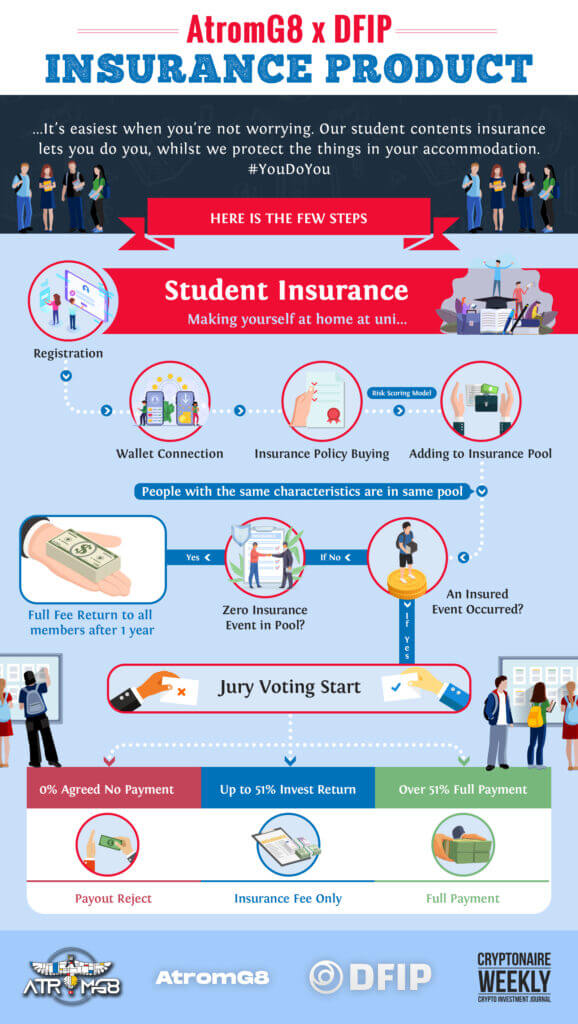

Mutual insurance: Blockchain works on the P2P system, through the Decentralized Automatic Organization or DAO, as the virtual decision-maker, and the premiums that are paid by every insured get stored within the DAO. Thus, every participant that has been insured gets voting rights and thus decides the final settlement amount after a claim has been triggered. Blockchain insurance system makes this process highly efficient and transparent with the safe premium collection, management as well as claim payment, owing to its decentralized nature.

Microinsurance: One of the examples of short-term insurance can be for car booking or car-sharing providers. These products are primarily pre-bought by service providers and later bought by the end-users. However, blockchain insurance allows the end-users to buy insurance coverage as and when they want to and based on their actual use, inception as well as expiring date/time. This makes it easy to maintain accurate records, and thus avoid any disputes.

Auto financial settlement: Thanks to the technical features of blockchain, it offers inherent benefits in the area of the financial settlement. When combined with the smart contracts, blockchain technology can be securely and efficiently applied throughout the insurance premium collection, underwriting, reinsurance, and even indemnity process.

Parametric insurance: The parametric insurance sector needs real-time data exchange and interfaces among multiple parties. Even though it works as an efficient way to transfer risk, it has plenty of room for cost improvement further. For instance, in the case of insurance related to parametric agricultural as well as flight delays, a great deal of human-led intervention is needed for payment and settlement of claims. Using blockchain insurance mechanism, data exchange efficiency can be massively improved. Smart contracts also help to minimize human intervention concerning indemnity payment, claim settlement, etc. which will minimize the insurance firms’ operating costs. Apart from this, operational efficiency is enhanced, thereby increasing customer satisfaction.

Auto and Homeowners Insurance: Blockchain is widely applied in the area of homeowners and auto insurance when used along with the IoT. There are many applications, including that of single-vehicle and portfolio. From the perspective of a standalone vehicle, the entire history of every vehicle gets stored in numerous blocks. This particular feature enables insurers to access precise information about every vehicle, along with accidents, maintenance, history, condition of vehicle parts, as well as the driving habits of the owner. This data provides a more accurate price, which is based on the information available for every vehicle. From the perspective of the insured, the combo of IoT and blockchain insurance simplifies the process of claims service as well as settlement efficiency.

Apart from the above-mentioned areas, blockchain technology can also impact other fields such as cargo insurance, claim/premium management, claim frauds, claims settlement, and internal management systems.

HOW CAN ATROMG8 HELP?

ATROMG8 is a multi-blockchain system that is powered by MixNet 5.0 superstructure. It is a secure and fast ecosystem for coworking, conversations, data exchange, PSP transactions, Diploma on Blockchain as well as social that offers complete privacy and security.

Today, privacy is a major concern of the digital world. To ensure end-to-end safeguarded communication, and to address the challenge, ATROMG8 harnesses the power of blockchain to design a ledger system that works on decentralization. This ledger can be accessed and used by numerous networks for building their digital token within the ATROMG8 blockchain, and to connect with other projects that form a part of the ecosystem.

COMMUNICATION WITH THE HIGHEST LEVEL OF SECURITY

Given the importance of communication in our society, ATROMG8 utilizes existing technologies to ensure every communication stays private. The ATROMG8 offers solutions based on MixNet that offers maximum security through the incorporation of metadata and other mechanisms.

As the decentralized DPoS enabled and blockchain-based system, ATROMG8 ensures improved communication as well as learning, organizing, and managing in a much simpler, secure, and fast manner. Thanks to its innovative multi-DLT as well as blockchain architecture, it plans to enhance human communication as well as value exchange while ensuring complete security and privacy. ATROMG8’s MixNet superstructure (https://kryptomoney.com/mixnet-5-0-superstructure-powered-blockchain-ecosystem-atromg8-soon-to-be-listed-on-global-trading-exchange-probit-south-korea/) concept helps to design a unique real-time system on digitally-enabled platforms that are safe for all types of small as well as large group interaction. Student Insurance is the first insurance product launched and other insurance with different approaches will be tested as well.

Thus, numerous blockchain networks can access the decentralized enterprise as well as an open-source ledger of the platform for the execution of transactions through direct satellite communication when required. This makes the ecosystem much safer, both in terms of privacy and security. Powered by the ATROM token, the platform will facilitate numerous activities across ATROMG8’s ecosystem. These include receiving and sending data, services costs, financial transactions, as well as compensation expenses for the stakeholders and node operators.

Apart from functioning as the P2P transaction channel, AG8 digital tokens will provide a means for exchange, as well as a store for value and a unit for accounting. Thus, users of AG8 digital token will get access to the ATROM network as well as utilize its products/services. For the ones who don’t understand Defi and are afraid unfortunately this is the only way! Like traditional only on Blockchain for data Integrity.

BLOCKCHAIN INSURANCE – CONCLUSION

To sum up, decentralization helps to strengthen information sharing while minimizing monopoly benefits. Given such a scenario, insurance firms will have to pay a great deal of attention to product development, pricing claims services, as well as reputation risk. On the other hand, insurance companies must focus on ensuring that the original information is accurate at the beginning itself. Thus, understanding what response needs to be given to fake declarations will be critical.

At present, the investments related to the adoption of blockchain technology and the system is a huge consideration for several firms. Insurance firms and reinsurance firms need to operate different systems, as well as take the decision of integrating blockchain technology seriously.

Overall, blockchain technology has immense potential to impact individual insurers positively, which makes ATROMG8 (https://atromg8.com/) project perfect for the insurance industry.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.