Quick Links

The Power of On-Chain Indicators

Daily Active Addresses – Network’s Pulse

Daily Transactions and Fees – Market Vibrancy

Exchange Supply Indicator – Selling Pressure Gauge

MVRV Ratio – Valuation Thermometer

Investor Sentiment – The Mood Meter

Miners’ Revenue and Hash Rate – Network’s Backbone

HODL Waves – Time-Tested Wisdom

Hi, I’m Adam from Platinum Crypto Academy. My journey in the crypto market has been a blend of challenges and triumphs, largely shaped by my understanding and application of on-chain indicators. These indicators are more than just data points; they are the narratives of the blockchain world, each telling its unique story. Let me walk you through how these indicators have become integral to my trading strategy.

The Power of On-Chain Indicators

When I first started trading, the crypto market felt like a maze. It was on-chain indicators that provided me with a map. These metrics, extracted directly from blockchain data, offer insights into the market’s health and direction, guiding my trading decisions with precision.

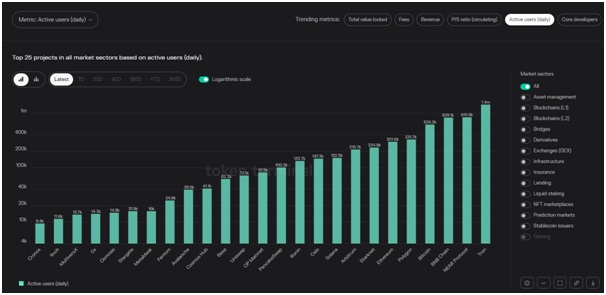

Daily Active Addresses – Network’s Pulse

One of the first indicators that caught my attention was the daily active addresses. It’s fascinating to see how this simple metric can reveal so much about a network’s popularity. I recall a time when I noticed a surge in active addresses on a blockchain that was not on many traders’ radars. This early insight gave me a head start, and I witnessed firsthand how such a surge often precedes a rise in the asset’s value.

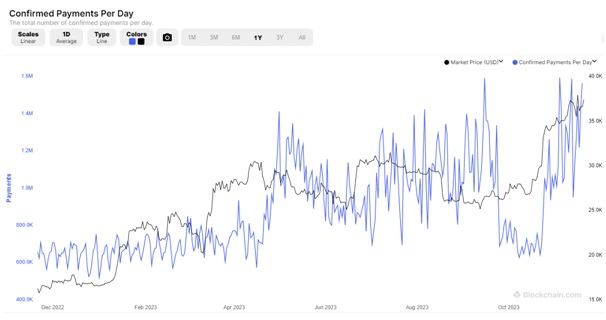

Daily Transactions and Fees – Market Vibrancy

Moving beyond just the number of active addresses, I started to delve into daily transactions and fees. These numbers paint a vivid picture of the blockchain’s activity. I’ve seen days when a spike in transactions hinted at an upcoming rally, allowing me to adjust my portfolio in anticipation of market movements.

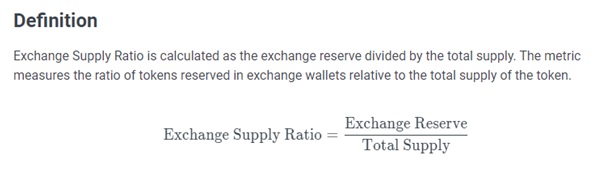

Exchange Supply Indicator – Selling Pressure Gauge

The exchange supply indicator has been a critical tool in my arsenal. It’s like a barometer for the market’s mood. High supply on exchanges often signals a bearish sentiment, while a decrease can indicate bullish conditions. This understanding has helped me time my trades to capitalize on market shifts.

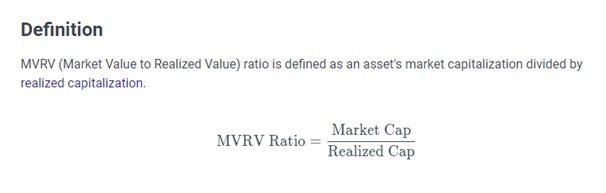

MVRV Ratio – Valuation Thermometer

Discovering the MVRV ratio was a turning point in my trading approach. This ratio has been a reliable indicator of whether an asset is over or undervalued. It’s helped me make more informed decisions, especially when considering long-term investments.

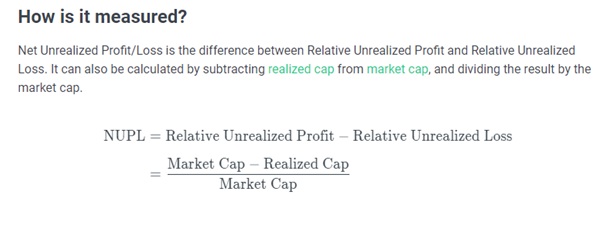

Identifying Market Extremes

In the crypto market, timing is everything. Indicators like NUPL have been invaluable in helping me spot potential market tops and bottoms. These tools have allowed me to enter and exit trades at optimal points, maximizing my gains.

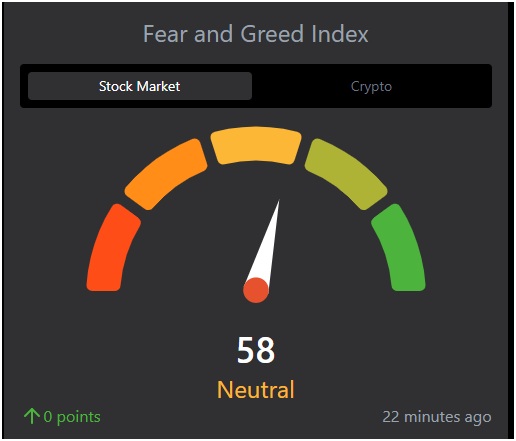

Investor Sentiment – The Mood Meter

I quickly learned that market sentiment could be as volatile as the market itself. Sentiment analysis tools have been crucial in understanding the collective mood of investors, allowing me to align my strategies with the market’s emotional tide.

Miners’ Revenue and Hash Rate – Network’s Backbone

The health of a blockchain is often reflected in its miners’ revenue and hash rate. A robust hash rate, in particular, indicates a secure and active network. Monitoring these metrics has given me confidence in the networks I choose to invest in.

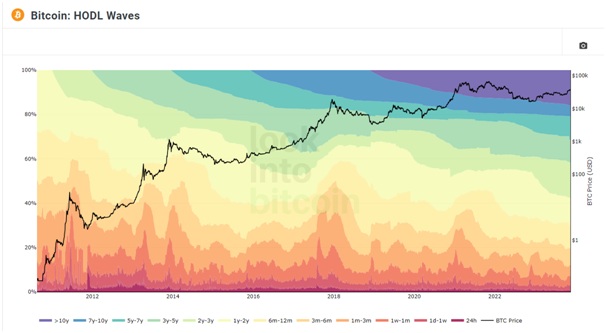

HODL Waves – Time-Tested Wisdom

HODL waves offer a unique perspective on the age of coins in circulation. This historical view has been key in predicting market shifts, especially when long-term holders start moving their assets. It’s like watching the tides of the market ebb and flow.

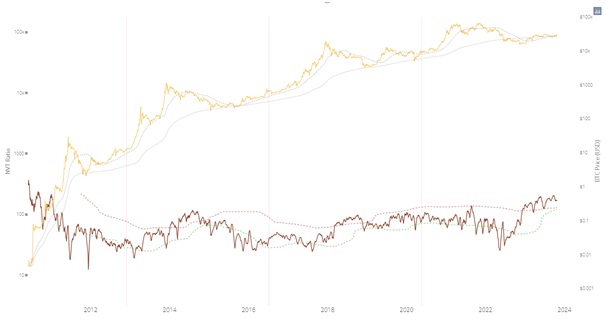

NVT Ratio – Financial Health Check

The NVT ratio is akin to a financial health check for cryptocurrencies. It’s been instrumental in helping me discern the intrinsic value of an asset, guiding me towards investments with solid fundamentals.

Smart Money Labels – Following the Leaders

Finally, tracking the investment patterns of the market’s most informed players has been enlightening. Smart money labels often reveal hidden trends and opportunities, guiding my investment decisions towards more profitable avenues.

My journey with on-chain indicators has been a path of continuous learning and adaptation. These tools have not only enhanced my trading skills but also deepened my understanding of the complex dynamics of the crypto market. At Platinum Crypto Academy, we believe in empowering our traders with this knowledge, ensuring they are well-equipped to navigate the ever-evolving landscape of cryptocurrency trading. Remember, in the world of crypto, informed decisions are the key to success.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.