Quick Links

In the ever-evolving world of finance, central bank digital currencies (CBDCs) have emerged as the latest innovation. These digital currencies, issued by central banks, are becoming a hot topic among crypto investors. But what exactly are they, and why should you, as a crypto investor, care? Let’s dive into the world of CBDCs, leaving no stone unturned and no metaphor unchallenged.

Understanding CBDCs

Central Bank Digital Currencies (CBDCs) are a new form of digital money that is issued and regulated by a country’s central bank. They are the digital equivalent of a country’s fiat currency, meaning they hold the same value as physical cash. For example, a digital dollar would be equivalent to a physical dollar.CBDCs are designed to operate alongside traditional forms of money, such as banknotes and coins, rather than replace them. They are intended to provide a digital alternative to cash, promoting financial inclusion and simplifying the implementation of monetary and fiscal policy.

The way CBDCs work is like how traditional funds operate, but entirely digital. Users would have digital wallets accessible through mobile devices, and blockchain technology enables near-instant payments with minimal fees. This technology also acts as an immutable ledger for transparent transaction tracking.CBDCs are different from cryptocurrencies like Bitcoin and Ethereum. While both are digital assets, cryptocurrencies are privately issued and often subject to extreme volatility. In contrast, CBDCs are issued by central banks and designed for stability.

Many countries, including the UK, USA, China, and the European Union, are exploring or implementing CBDCs. The Bank of England, for instance, is exploring the idea of a CBDC called the digital pound.

The Potential of CBDCs

CBDCs offer several potential benefits. They can promote financial inclusion, simplify the implementation of monetary and fiscal policy, and reduce the costs associated with maintaining complex financial systems and cross-border transactions. CBDCs backed by governments and controlled by central banks can provide secure means of exchanging digital currency and reduce risks associated with volatile cryptocurrencies.

The Risks and Challenges of CBDCs

While CBDCs present a promising future for the financial world, they also come with their fair share of risks and challenges. These potential issues range from financial stability to privacy concerns, cybersecurity threats, and impacts on traditional banking systems.

Financial Stability of CBDC’s

One of the most significant concerns surrounding CBDCs is the potential impact on financial stability. If CBDCs are universally accessible and interest-bearing, they could lead to disintermediation, where individuals and businesses bypass commercial banks and hold their money directly with the central bank. This could result in a reduction in the availability of credit and potentially destabilize the banking sector.

Privacy and Security

Privacy is another critical issue. While CBDCs can enhance the confidentiality of digital payments and protect privacy, they must comply with privacy norms and regulations. The design of CBDCs needs to consider the balance between providing transaction transparency for regulatory oversight and maintaining user privacy.

Moreover, the digital nature of CBDCs makes them a potential target for cyber-attacks. Central banks must ensure robust cybersecurity measures are in place to protect against potential threats and maintain trust in the system.

Impact on Traditional Banking Systems

The introduction of CBDCs could also have profound effects on traditional banking systems. If CBDCs are widely adopted, it could lead to digital currency substitution, where people prefer to use the digital currency over traditional forms of money. This could increase competition in the banking sector and potentially disrupt existing financial structures.

Technical Challenges

Technical challenges also exist, including issues related to internet connectivity, interoperability, and the scalability of blockchain technology. Central banks must ensure that the technology underpinning CBDCs is robust, secure, and capable of handling large volumes of transactions.

The Crypto Landscape and CBDCs

The crypto landscape and Central Bank Digital Currencies (CBDCs) are two sides of the same digital coin, yet they represent fundamentally different philosophies and mechanisms. Understanding their relationship is key to navigating the future of digital finance.CBDCs are a form of digital currency, but they are not cryptocurrencies. While both are digital assets, cryptocurrencies are decentralized and operate on blockchain technology, often without a central authority. In contrast, CBDCs are issued and regulated by a country’s central bank, representing a digital form of fiat currency.

Despite these differences, CBDCs are part of the broader crypto environment. They represent a bridge between traditional finance and the world of digital assets. CBDCs could potentially bring the benefits of digital currencies, such as speed and efficiency of transactions, to the mainstream financial system.

Impact on Cryptocurrencies

The introduction of CBDCs could have a significant impact on the crypto market. On one hand, CBDCs could provide a more regulated and trusted alternative to cryptocurrencies, potentially reducing their appeal. On the other hand, the development of CBDCs could legitimize the concept of digital currencies and promote their acceptance, potentially benefiting the crypto market.

Views of the Crypto Community

The crypto community’s views on CBDCs are mixed. Some see CBDCs as a threat to the ethos of decentralization that underpins cryptocurrencies. They argue that CBDCs, being controlled by central banks, could be used to exert control over individuals’ financial activities, contrary to the freedom and privacy that cryptocurrencies offer. Many influencers like @BernieSpofforth share a worrying sentiment, IMF – On CBDC “programmability” so governments can track & control how you spend your own money. Controlling your behaviour to force societal change. To do this they need Digital ID. One cannot happen without the other. It’s coming if you comply.

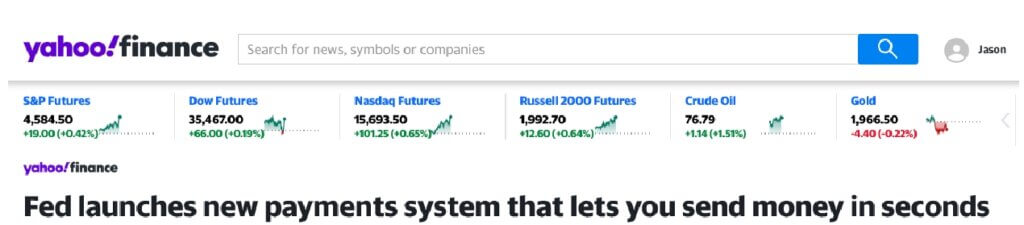

@JasonBassler1 shared a similar sentiment “The Federal Reserve officially launched the “FedNow.” While this isn’t a CBDC, it will set the table for “the convenience” associated with instant payment systems. They are already touting benefits for people “living paycheck to paycheck.” Buckle up. It has begun.”

@WallStreetApes had a very similar comment The WEF says with the Central Bank Digital Currency $CBDC World Governments can restrict private citizens from buying “undesirable purchases” such as ammunition. Why would they need to do that? “Prepare For An Angrier World” – Klaus Schwab, World Economic Forum. This is the Great Reset, New World Order. #Agenda2030

Others in the crypto community see CBDCs as a positive development. They believe that CBDCs could help bring digital currencies into the mainstream, increasing their acceptance and use. This could potentially lead to increased investment and innovation in the crypto space.

CBDCs and Cybersecurity

With the growth of internet and telecommunications networks, the cyber threat landscape has become more complex. Recent attacks in decentralized finance highlight potential operational and reputational risks. Central banks need to acknowledge the complex threat landscape created by CBDC systems and adopt modern technologies for security and resilience.

Conclusion

In conclusion, CBDCs represent a significant development in the world of finance and cryptocurrency. They offer potential benefits but also pose significant challenges and risks. As a crypto investor, it’s essential to stay informed about these developments as they could significantly impact the crypto landscape.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.