The decentralized monetary system is probably the biggest incident in the world of financial technology and monetary policy. The ownership of any wealth is transferred without the involvement of a third party using a bank-free method. Decentralized finance, mostly known as DeFi, is an umbrella term for a wide range of projects and applications in the blockchain world that opt to eliminate traditional finance theory.

DeFi is referred to as a financial application built on typically using smart contracts. These contracts are automatically enforced agreements that do not require any intermediaries to execute and can be accessed by anyone with a stable internet connection. Most of the decentralized finance applications found today are based on the Ethereum network. However, many alternative public networks are quickly emerging that offer more flexible security, scalability, superior speed, and cost-effectiveness.

WHAT IS GAUGECASH – DECENTRALIZED MONETARY SYSTEM?

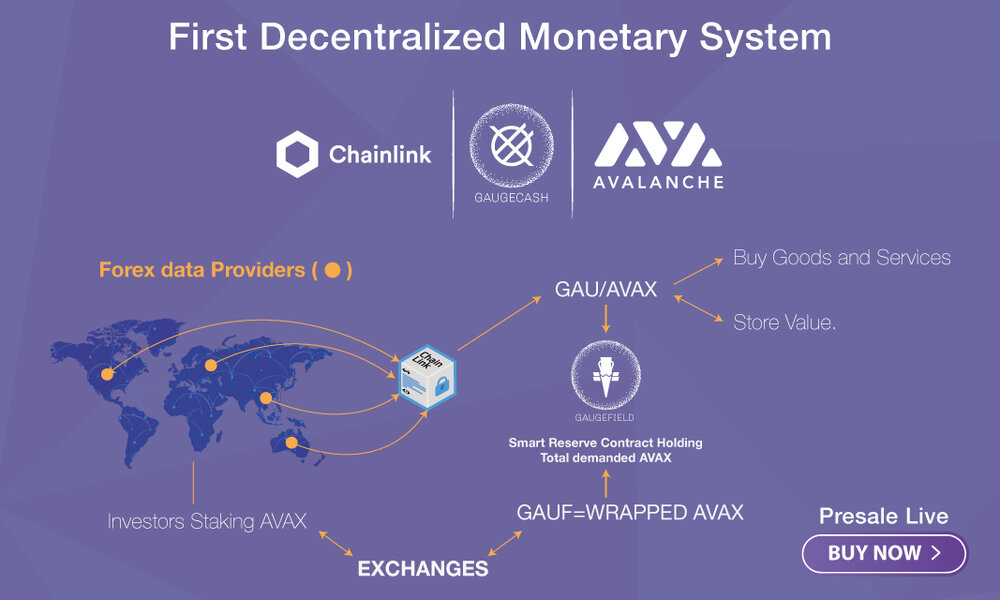

Gaugecash is considered the world’s first decentralized monetary system, capable of competing with the USD/EUR markets. In contrast to most stable coins, the price and value of Gaugecash are based on decentralized financial systems rather than the US dollar. This solves the centralization risk that the US dollar pegs represent. It caters to incentivize sophisticated cryptocurrency investments for the long run. Also, it has a vast impact on the decentralized monetary system and blockchain data technologies and is deeply rooted in modern monetary policy.

Gaugecash has two tokens that are the GAUGECASH (GAU) and GAUGEFIELD (GAUF). Gaugecash is an index of the world currencies and is more stable than any single fiat currency, including the major fiat currencies globally, USD, GBP, and EUR. On the other hand, GAUGEFIELD (GAUF) is the liquidity token that will back up the GAU.

Gaugecash looks to empower users to make stable payments on-chain or store value while hedging against the volatility risks of any single fiat currency. Its backup and price index mitigate centralization risks. It was specially designed for users looking for alternatives to current prominent fiat pegged stable cryptocurrencies. The Gaugecash index system was designed using some math formulas, and it is going to keep the price of Gaugecash as stable as possible.

Due to a dependence on traditional money for backup, some cryptocurrencies do not exhibit stable prices. In contrast, centralization risks are mitigated by Gaugecash’s price index and backup. These are designed to look for possible alternatives to current notable fiat-pegged stable cryptocurrency investments. Considering that it is decentralized and aims at stabilising wealth, it could be an effective means of sustaining wealth.

WHAT ARE THE CHALLENGES OF THE TRADITIONAL MONETARY SYSTEM?

Typically, traditional financial institutions include banks and credit unions, which are regulated financial institutions. These institutions offer a wide range of loan, deposit, and investment products to individual and business clients. Others provide services and products tailored to specific types of customers. The government is entrusted with dictating economic policy based on the trust society places in it. Ideally, the traditional monetary system acts as a tool to develop monetary policies that reflect the complexities behind an economy to the best of its ability. However, these traditional monetary institutions face serious challenges during policy and decision-making. The traditional monetary system will be examined here in some detail.

Outdated technologies and corruption

Traditional monetary systems face the greatest challenge of corruption. Individuals who manage financial institutions can easily exploit the system. If corrupt or irresponsible individuals are in charge, they can enact policies that make them rich. Moreover, the central government’s policy is derived from economic data that does not reflect real-time economic activity. As a result, policies are ineffective since outdated data is used to make decisions. It may take a long time for some decisions to have an impact on the economy. The authorities and society are using outdated technology, which is responsible for this delay in data collection.

Inequality

There are huge gaps of inequality in the traditional monetary system, with the rich getting richer. Almost all of the paper money in circulation comes from banks, and they are the primary agents for lending. To repay these loans, you have to pay interest; this interest transfers money from the bottom 90 percent to the top 10 percent. Additionally, inflated prices and financial instability contribute to society’s wide inequality gap.

Financial Crisis and Recessions

The government prints fiat currency, so they can decide to print more than we need. As a result, a currency may devalue, and recessions may occur. The excessive interest rate on loans can lead to an economic downturn. The government has historically inflicted interest rate increases to protect the value of its currency.

Debt

Traditional monetary systems trap us under mountains of debt and mortgages. Banking is the only source of money for the economy, so getting extra cash is only possible by borrowing money from banks. Borrowing money from a bank creates new money, giving the impression that the economy is doing well, but this is not the case. Due to rising debts, the amount of money goes up, leading to problems such as maintaining the value and avoiding economic meltdowns. Traditional monetary systems are not transparent, since nobody is aware when borrowing increases.

Prices

The main argument in favor of high housing prices is that there are not enough houses for everyone. Over the years, prices have doubled, and traditional monetary systems are unable to regulate them. In recent years, the prices of houses have risen faster than wages.

WHY DOES GAUGECASH USE A DECENTRALIZED MONETARY SYSTEM?

Decentralized finance is an emerging industry that promises to better what the traditional financial institution has to offer. The need for a transparent, open, and secure financial system is the key driver behind a decentralized monetary system. Decentralized finance is based on blockchain technology, and it can outride traditional finance because it is a financial tool outside of government regulation and control. The creation of a decentralized financial institution by individuals has put governments worldwide into panic, and they are trying their best to regulate the new technology.

Gaugecash uses a decentralized monetary policy because that is the only way it can become a stable coin without the influence or regulation from the government. The Gaugecash index system is going to be used to break the fiat pegged cryptocurrency cycle.

GAUGECASH brings two innovations in Financial History!

Gaugecash is the first decentralized monetary system, and it brings revolutionized changes in monetary policies through blockchain data and decentralized finance. Notably, there are two innovations that Gaugecash brings in financial history. They are discussed below:

Innovation of Gaugecash Index

GaugeIndex is the first innovation; the Index System will determine the price of GAU. The index does not pertain to any central bank, and it will have an enormous advantage for regulation purposes and decentralization. Gaugecash is going to be more expensive than any other currency against the US dollar. This will give it a positive purchase power effect. The current types of cryptocurrency investments are often backed by the price of a dollar, which brings in the question of decentralization. Facebook’s Diem project is a typical example of a crypto that will solely hold its value regarding the price of the dollar. Gaugecash is an independent coin that will operate on its own without interference from any individual or government. It is the first stable coin that will operate on decentralized monetary policies.

Backed by Blockchain

Gaugecash will be backed by the blockchain class in itself, taking advantage of its economic scarcity properly. Gaugecash was created based on an index coming from the final market making of the forex market to solve the problem of volatility and wealth preservation on the peer-to-peer cash system. Using a decentralized format, GAU does not belong to any central bank, and it will inherit the entire monetary policy. It will also be more stable than any other pair of currencies in the world, including silver and gold. The Gaugecash mechanism will be simple going forward to maximize blockchain data’s advantages. DeFi cryptocurrency investors can track the liquidity and value of the development process using the model.

WHAT IS CHAINLINK?

The Chainlink protocol provides smart contracts with reliable and tamper-proof inputs and outputs. Chainlink is a medium to power universally-connected smart contracts securely, and it is the most widely used medium and vastly recognized in the whole world. Chainlink enables developers to connect any blockchain data with high-quality sources from other blockchains, including real-world data. The new contracting model relies on a global network of thousands of people to manage the contracting.

WHY IS GAUGECASH INTEGRATED WITH CHAINLINK?

With its integration with Chainlink, Gaugecash has access to a decentralized price feed for GAU/USD. As a market leader in Oracle networks, Chainlink will provide Gaugecash with the plug-and-play Oracle solution that currently secures billions of US dollars across the DeFi ecosystem. Chainlink provides the GAU/USD price feed, which ensures that the Gaugecash Index is quoted against the US dollar at the current fair market value and is free of any kind of corruption. As Gaugecash’s new Oracle, Chainlink will contribute significantly to its design in integrating off-chain currency market data into blockchain ecosystems.

The reason Gaugecash chose Chainlink was based on its superior technologies, security, and market dominance. Chainlink will significantly increase the value of Gaugecash, and they are as follows.

The values include:

– Chainlink Oracles include credentials management functionality, which allows them to access premium password-protected forex data used to build GaugeIndex.

– The Chainlink smart contract is decentralized, eliminating the threat of Sybil-resistant nodes disrupting or manipulating the data.

– Chainlink lets users verify that they are getting fair market rates using transparent visualisations of Oracle’s network performance.

Chainlink is the most popular and secure way to connect smart contracts. The Chainlink service enables developers to connect to any blockchain with quality data sources from other blockchains and the real world. The project is managed by a global community of hundreds of thousands of people. Chainlink is creating a fairer model for contracts. Currently, its network secures billions of dollars for smart contracts in the decentralized finance, insurance, and gaming ecosystems.

Gaugecash project is a new decentralized monetary system that will enable users to make stable payments and store value on-chain to combat the volatility risks of a single fiat currency. On the other hand, Chainlink’s Oracle infrastructure will enable its clients to receive fair market exchange rates for pricing their goods and services worldwide.

GAUGECASH A DECENTRALIZED MONETARY SYSTEM – CONCLUSION

There have been several non-domestic currency debt crises, resulting in the loss of wealth and money for millions. Crypto-space couldn’t solve the problems of decentralization and the long-term stability of currencies. Gaugecash is the first decentralized monetary system that is available worldwide. Gaugecash Index is derived from the final market making of the forex market, and its value is supported by blockchain data, as well as the economic scarcity property. In a decentralized and immutable manner, it creates a self-reinforcing economic system that would provide extraordinary value for the consumers. For the first time in our history, it will be possible to compete in the largest financial market in the world with a perfect decentralized monetary solution. This makes it a highly profitable venture for cryptocurrency investors worldwide.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

TOP 10 UK CRYPTOCURRENCY BLOGS, WEBSITES & INFLUENCERS IN 2021

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.