Good morning Platinum Crypto Network,

Today’s article is focusing on something which I think will help all our followers at any level of experience. But before we get into today’s topic I wanted to invite the network to an exclusive session with myself to discuss how you can make significant crypto profits in 2018!

Today’s article is a guide to Initial Coin Offering. With over 170 ICOs and over $5.9 billion raised between the new year and now (17th April 2018), the industry has already surpassed last year’s mark of $3.8 billion.

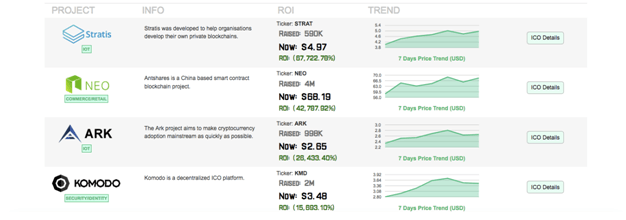

See the chart below for an idea of what is possible when looking at Initial Coin Offerings (ICOs).

In 2018 so far, the trend is not showing any signs of slowing down. With 176 ICOs into the year, the amount raised so far exceeds $5.9 billion, according to data from Coin schedule.

The top three Initial coin offering categories so far in 2018 include Communications, Finance, and Trading & Investing. At this rate, ICO projects could raise well over $20 billion USD by the end of 2018.

A COMPREHENSIVE GUIDE TO INITIAL COIN OFFERING

Initial Coin Offering, also referred to as ICOs have taken centre stage ever since the launch of the concept. Such is the popularity of ICOs that start-ups are now using it for raising capital, instead of resorting to other methods like crowdfunding, IPO (Initial Public Offering) or seeking the help of VCs (Venture Capitalists). Read on to find out more about ICOs and the way they work.

ICOS EXPLAINED

Cryptocurrencies have taken the global financial market by storm. In fact, organizations have successfully raised millions of dollars through ICOs and Cryptocurrencies. It must be noted that the first Initial Coin Offering was announced in 2013 by Mastercoin. The company raised funds close to 600,000 U.S. dollars for creating an exchange for Bitcoin and related transactions.

WHAT IS AN INITIAL COIN OFFERING?

So, what is an Initial Coin Offering? Put simply, an ICO is much similar to an IPO or Initial Public Offering and is designed for raising capital. ICO is essentially a type of investment that provides investors with cryptocurrencies, in return for investing their money into the company, unlike securities that are issued in the case of the IPO.

A company that announces its ICO basically issues tokens, which are essentially coins. These coins are considered to be equal to shares and are known as Crypto-coins. The tokens provide investors with the right to ownership as well as the right to vote. In specific cases, tokens also qualify investors for the company’s dividends.

FUNDING FOR CRYPTOCURRENCY BASED PROJECT

Thus, Initial coin Offering is basically a method for crowdfunding a cryptocurrency-based project, which also involves the sale of tokens. At the end of the process, the company manages to raise enough capital for funding their operations, whereas the investors get tokens for funding the project. ICOs are open either for a couple of weeks or even for an entire month. In fact, some ICOs can be open for a longer period of time. It’s also important to understand that the prices of the ICO are set up by the project, economy or DAO creators.

HOW ICOS WORK?

A start-up basically announces the ICO by setting up a blockchain, as well as the rules and the protocols. After this, the creator needs to initiate the mining process for coins that would be sold at the time of the announcement of the ICO.

This is done with the help of popular social media websites as well as other cryptocurrency-based websites, which further allows the company to effectively market their ICO as well as attracting large numbers of investors.

Apart from creating hype on the internet and social media sites, the creators also look forward to generating enough interest for pushing the prices of their ICO further.

CRYPTO EXCHANGES AND ICOS

After the marketing initiatives, the company sets up a cryptocurrency exchange in order to provide investors with a platform for acquiring tokens. Companies release the tokens on the blockchain either by collecting the specified capital listed on the ICO and later dividing as well as distributing the tokens among the ICO investors. On the other hand, tokens are also available through exchanges for the purpose of trading.

STEPS TO CONSIDER WHEN LOOKING FOR AN ICO

Step 1: Research which are the up and coming ICO offerings

Knowing which ICOs are about the be released or ones that are coming in the near future is crucial to your preparation.

There are some very useful sites and resources available like

- Top ICO List

- ICO Watchlist

- Cryptonaire Weekly (Our Weekly Trading Magazine -Sign up for free)

A whitelist ICO means that you have to register in advance to participate in the ICOs, which are usually hallmarks of popular ICOs that have a limited number of coins to offer.

Step 2: Check The Project Out Fundamentally

Investing and buying into ICOs is like anything in life, you need to perform certain checks before you consider being part of a particular ICO opportunity. You can speak with a trader today to discuss our methodology. However here are some quick tips to consider:

- Check the project out.What does it offer and how does it benefit the world or their audience?

- Explore the team, the setup, public visibility, their communication with the community, and the access to their team through telegram or direct phone calls. You will be surprised how many ICOs do give out easy-to-obtain contact details.

There are also more and more sites popping up that give their verdict on ICOs which are worth checking out or using as a resource.However, I would always suggest taking the time to do your own research into the project.

Step 3: Process of joining an ICO

After completing your research and determining you wish to proceed with participating in the ICO, then you should open a fiat-accepting cryptocurrency exchange account to convert your domestic fiat currency into the popular cryptocurrency, Bitcoin (BTC) or Ethereum (ETH).

Most ICOsaccept either BTC or ETH, some accept other coins but you will then need to follow the ICO’s particular instructions to complete the exchange. Having received your tokens, you will also need to consider storage. There are several offline storage devices, Nano S and Trezor which you can use, or you can set up an online wallet using appropriate sites like MyEtherWallet.

Step 4: Taking profits

There are several strategies which the Platinum Crypto Academy provides as part of our Masters and Cryptonaire, depending on your personal goals.

You can focus on short/medium/long-term strategies so once the coin is listed on the exchanges you can either wait to hit your price target, or judge accordingly when to cash out on the exchanges.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Richard Baker

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer:

The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.