Quick Links

Hubble is a decentralised finance (DeFi) platform built on Solana which will offer several DeFi services. The platform will allow users to borrow USDH, a stablecoin, as well as allow users to yield interest on other crypto assets deposited as collateral.

The protocol’s main services are centred around borrowing USDH against other assets like BTC, ETH, and SOL. By offering multiple assets for deposit as collateral, Hubble is seeking to solve the liquidity challenge and establish itself as a stable borrowing and liquidity solution.

The protocol is built on the Solana network, known for its high transaction speed of up to 65,000 transactions-per-second (TPS). It is this high speed and low gas fees that make Solana very attractive for new DeFi projects.

Hubble Protocol was launched by Marius Ciubotariu in 2021, having participated in the Solana Season Hackathon – an experience that gave him exposure to immense opportunities within Solana and DeFi services. Marius is a former senior software engineer at Bloomberg LP.

The main mission for the establishment of the Hubble Protocol is to partner with developers and innovators on Solana and other platforms to boost DeFi democratisation and the propagation of financial knowledge in a highly dynamic DeFi ecosystem.

Crypto traders are constantly on the lookout for higher-yield earning opportunities, better liquidity, and low fees. This is where Hubble Protocol comes in handy by increasing liquidity in the Solana blockchain.

The protocol is currently in Phase 1 of development and is backed by a native stablecoin USDH, which is pegged to USD.

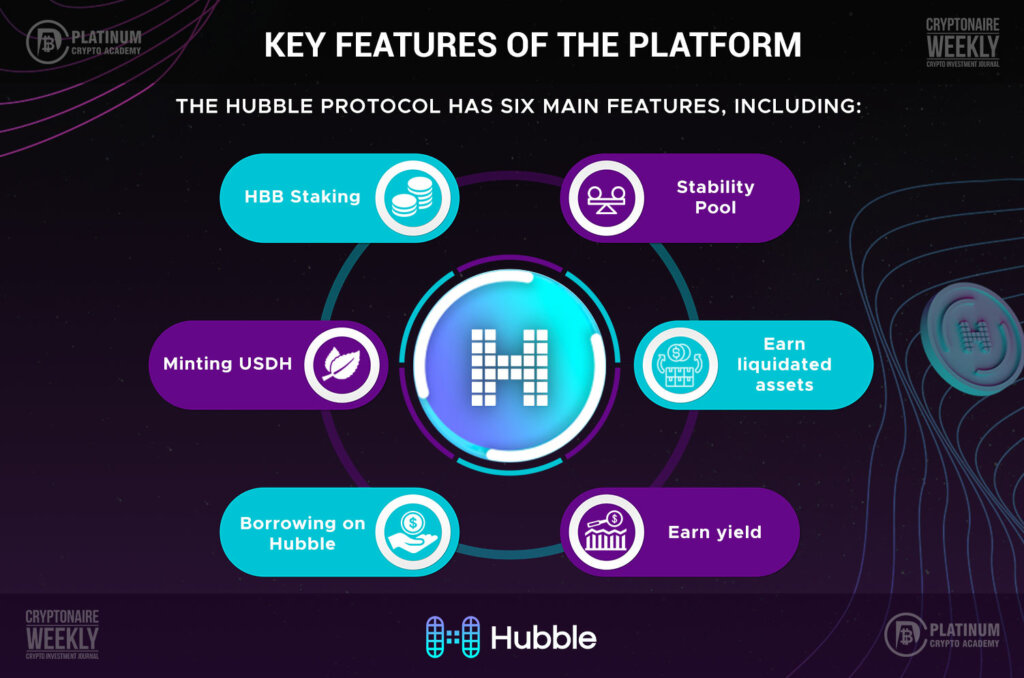

Key features of the platform

The Hubble Protocol has six main features, including:

- HBB Staking

- Minting USDH

- Borrowing on Hubble

- Earn yield

- Earn liquidated assets

- Stability Pool

Below is a detailed overview of each of these features:

HBB Rewards

Hubble Protocol has the Stability Pool, which is comprised of USDH deposits from users. Users can share profits from asset liquidations when a borrowers’ loan-to-value ratio (LTV) rises above 90.9%. Furthermore, users can deposit USDH into the Stability Pool for a chance to earn extra HBB.

HBB token holders earn 85% of the USDH rewards generated by the protocol, while the remaining 15% is deposited in Hubble’s treasury. The treasury will fall under the community’s control when Hubble launches the Decentralised Autonomous Organisation (DAO) and decentralises governance. The community will also have control over sharing of proceeds between community members and the treasury.

Minting USDH

USDH is a stablecoin on Solana and can be paired with several other tokens for trading or storage of value. USDH is pegged to the dollar to ensure its stability. This means the token is redeemed at the face value of 1:1 against the dollar.

The USDH token is designed and programmed to be backed by collateral at all times. USDH holders can also deposit the tokens in the Stability Pool for a chance to earn a share of liquidation when the market slumps. This helps to avoid bad debt and keep the system healthy.

Borrowing on Hubble

In its first phase of development, Hubble will focus on maximising value for both Solana tokens and HBB holders by offering cheap and capital-efficient borrowing options. The platform will first accept deposits of seven assets as collateral before expanding to welcome additional kinds of assets for deposit on the platform.

Hubble Protocol allows users to earn interest from their staked assets, as well as use them as collateral for loans. Users can take out loans of up to 90.9% of the collateral’s value and reclaim their assets upon completion of loan payment.

Borrowers can pay off their loan at any time without a due date or maturity.

Earn Yield

In addition to accessing liquidity, the Hubble Protocol allows users to continue earning interest from their assets pledged as collateral for loans. Through opting in to yield strategies on Hubble, users can also have their collateral assets allotted to partner protocols in order to increase their yields.

Users can move their assets between Solana and Hubble to profit from the rise in SOL price as well as earn from Solana PoS yield. Other lending protocols in the ecosystem also pay yields on other collaterals, hence users can easily change from one crypto asset to another to maximise their return.

Earn Liquidated Assets

Hubble users can borrow up to 90.9% of their multi-asset collateral. The collateral may be liquidated if the borrowed assets in USDH reduce in value and a loan’s health rises over the loan-to-value (LTV) ratio of 90.9%. When a borrower’s collateral is liquidated, and each USDH depositor in the Stability Pool is given their equal share of liquidations..

You can personally trigger loan liquidations on Hubble as long as a user’s LTV rises above 90.9%, although this is usually done automatically by bots. Users earn 0.5% of the liquidated assets for triggering liquidations, and the remainder is distributed to those with USDH deposits in the Stability Pool.

Stability Pool

The Hubble stability pool serves two main purposes – to keep the system healthy and reward the platform’s users. USDH is programmed to be always backed by collateral, and it’s the Stability Pool that offers the assurance that loans can be repaid. Moreover, the Stability Pool helps to democratise the liquidation process for users who stake their assets in the pool.

Users who deposit in the Stability Pool have to ensure USDH obligations are repaid when the collateral ratio goes below the required level. Again, those who place their assets in the liquidity pool qualify to earn an equitable portion of the collateral from the liquidated accounts. The earning is a reward for their participation in the smooth and efficient running of the protocol.

Depositors in the pool also earn HBB tokens as compensation for participating in the pool. This is an additional incentive to deposit their USDH in the pool and ensure the smooth and healthy running of the system.

Why use Hubble?

Below are the advantages of using the Hubble Protocol;

- Users have a chance to deposit a wide range of assets, which helps free up more liquidity and boost the collateral ratio.

- Users can continue earning interests from the assets pledged as collateral. This allows them to maximise their yields within the Solana ecosystem.

- High yields. Users earn up to 11x yields from their deposits, thanks to the protocol’s capital-efficient LTV ratio of 90.9%.

USDH and HBB tokens

USDH a censorship-resistant stablecoin native to the Solana network and serves various functions similar to other stablecoins in the DeFi ecosystem. Their functions include bonding for tokens, pairing for liquidity, and as a store of value.

USDH is backed by collateral at all times, including SOL, ETH, mSOL, BTC, RAY, FTT, and SRM. USDH token holders can deposit them in the Stability Pool and qualify for a share of liquidation revenue when the market slumps. The liquidation is meant to keep the system healthy by covering bad debt.

HBB Tokens

HBB token is the native token on the Hubble Protocol and has a total supply of 100,000,000 HBB. They are awarded to USDH token holders who stake them in order to earn additional token rewards.

The tokens also play a role in the governance of the protocol. HBB token holders can stake them and earn additional rewards, as well as participate in decision-making on the platform by voting on various proposals on the platform. This allows holders to be stakeholders in determining the protocol’s future based on their preferences.

HBB token holders who stake them earn 85% of the total USDH generated on the protocol.

Hubble Governance

Hubble will transition into a community-supported governance model similar to any other DAO. The democratisation of the platform allows users to make proposals for new products and improvements, suggest and vote on the protocol’s modifications, and delegate implementation of key functions to the core team.

There are three main reasons why the Hubble Protocol has opted for decentralised governance:

- Empower users. The protocol intends to empower users and early adopters who are influenced and choose to stake their assets in the Stability Pool.

- Build trust. The platform has decentralised decision-making, meaning no single individual or entity is in charge of decision-making. This prevents any malicious behaviours from an individual or group.

- Community guidance. The decentralisation model is meant to iron out any inadequacies that come with centralised governance and welcome the input of all community members.

Decentralisation ensures that all community members have a fair say in the decision-making process. It offers everyone a say in determining the future of the protocol.

Initially, the Hubble Protocol will have a centralised governance model before transitioning to become fully decentralised. The decentralisation will ensure the decision-making process is delegated to the community. The community will be able to vote on two types of proposals:

- Vote on code suggestions to be executed by the community.

- Members will also vote on general directive recommendations every quarter. Developers will be in charge of implementing proposals voted on by the community.

How safe is Hubble?

Hubble’s borrowing platform has already passed three security audits from Kudelski, Arcadia, and Smart State. Third-party reviews will help Hubble create a more secure platform. After the audit and implementation of the necessary recommendations, Hubble will make the changes known to everyone. The protocol has also gained the support of leading investors within the cryptocurrency community and the Solana ecosystem.

How much yield can I earn using Hubble?

This depends on the yield strategy you opt into for your tokens. When these integrations go live, users will be able to either stake their tokens or lend them on different protocols across Solana.

Conclusion

Hubble Protocol is designed to strengthen the DeFi community by minting a censorship-resistant stablecoin, USDH. It will also support its community by distributing the fees generated on the system with all HBB token holders. In the future, Hubble will also have a governance model that ensures all community members have a say in determining the future of the protocol.

Hubble intends to explore more opportunities in the DeFi space due to the innovative and progressive nature of the DeFi landscape. The protocol will also work towards offering increasing its service base to meet the rising demand for peer-to-peer financial services.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.