Quick Links

Few corporate entities have made as significant an impact as MicroStrategy. With its aggressive Bitcoin acquisition strategy, the company has become a beacon for crypto enthusiasts and investors alike. This article delves deep into the intricate relationship between MicroStrategy and Bitcoin, shedding light on the company’s strategic moves and the implications for advanced crypto investors.

MicroStrategy: An Introduction

MicroStrategy is a global leader in business intelligence, mobile software, and cloud-based services. Founded in 1989 by Michael J. Saylor and Sanju Bansal, the company provides advanced software solutions that enable organizations to make informed decisions by analyzing vast amounts of data. Their primary product, the MicroStrategy platform, offers tools for analytics, mobile, and security, allowing businesses to generate reports, dashboards, and other data visualizations.Over the years, MicroStrategy has evolved to stay at the forefront of the tech industry, especially in the realm of big data and business analytics. Their software solutions are utilized by many Fortune 500 companies to derive insights from their data and drive business strategies.

In recent years, MicroStrategy has gained significant attention in the financial and cryptocurrency sectors due to its substantial investment in Bitcoin. Under the leadership of CEO Michael Saylor, the company has adopted Bitcoin as a primary treasury reserve asset, making it one of the largest corporate holders of the cryptocurrency. This strategic move has positioned MicroStrategy as a key player in the crypto space and has further elevated its profile among investors and the broader tech community.In essence, MicroStrategy is a blend of cutting-edge software solutions and bold financial strategies, making it a unique and influential entity in both the tech and financial worlds.

MicroStrategy’s Bitcoin Holdings: A Glimpse into the Numbers

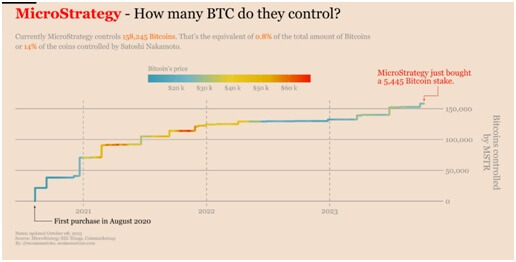

As of July 31, 2023, MicroStrategy’s Bitcoin arsenal stood at a staggering 152,800 BTC, acquired at a total cost of $4.53 billion, averaging $29,672 per Bitcoin. This acquisition spree has been consistent, with the company adding 12,800 bitcoins to its coffers since Q1 for a sum of $361.4 million, translating to $28,233 per Bitcoin. Such aggressive accumulation has led MicroStrategy to own approximately 0.75% of all bitcoins in circulation.

But the story doesn’t stop there. In the ever-evolving chapters of MicroStrategy’s Bitcoin narrative, the period following Q1 2023 saw them adding another 12,800 bitcoins to their coffers. This addition, costing them $361.4 million, was a testament to their unwavering belief in Bitcoin’s potential, even as they averaged a slightly lower price of $28,233 per coin.Zooming out to the broader Bitcoin landscape, MicroStrategy’s acquisitions have made them the proud owners of approximately 0.75% of all bitcoins in circulation. In the decentralized world of Bitcoin, where ownership is fragmented among millions, this is no small feat. It’s akin to a single ship claiming a vast stretch of uncharted waters.

Beyond the numbers, there’s a strategic undercurrent to MicroStrategy’s Bitcoin voyage. They view this digital gold not just as an investment but as a hedge, a shield against the potential devaluation of traditional fiat currencies. This long-term vision has anchored their consistent forays into the Bitcoin market, even during times when the waters were particularly choppy.The current market value of their holdings, hovering over $4.6 billion, is a testament to their strategic acumen. But more than just personal gain, MicroStrategy’s Bitcoin endeavours have left ripples across the broader cryptocurrency market. As one of the most significant corporate holders, their moves often sway market sentiments, influencing both Bitcoin’s price and its perception among investors.

In essence, MicroStrategy’s Bitcoin journey is more than just a financial endeavour. It’s a narrative of belief, strategy, and pioneering—a tale that continues to inspire and shape the cryptocurrency world.

MicroStrategy’s Bitcoin acquisition isn’t a mere speculative play. The company firmly believes in Bitcoin’s potential as a hedge against fiat currency devaluation. This conviction isn’t based on short-term price projections but on a long-term vision of Bitcoin becoming a universally accepted form of money. The company’s strategy is clear: they will only liquidate their Bitcoin holdings if there’s a pressing need for operational capital, tax obligations, or debt repayments.

Financial Implications and Risks

While the company’s Bitcoin-centric approach has garnered significant attention, it’s not without its risks. MicroStrategy’s outstanding debt and convertible notes amount to a whopping $2.2 billion, with about half of this sum due as early as 2025. In a scenario where financing markets are unfavourable and the company’s cash reserves are depleted, they might be compelled to liquidate some of their Bitcoin holdings to generate dollars for debt repayment.

However, it’s essential to note that the company’s leadership doesn’t view “buying too much Bitcoin” as a risk. Instead, the real risk lies in imprudent buying, which could divert investors to other avenues for Bitcoin exposure. The potential approval of a spot Bitcoin ETF could also pose challenges for MicroStrategy. While such an ETF wouldn’t offer the same leverage yield as MicroStrategy, it might attract a portion of institutional investors.

The Case for Holding Bitcoin on Corporate Balance Sheets

The transformative potential of Bitcoin has not just caught the attention of MicroStrategy but has also resonated with a myriad of other businesses. The decentralized nature of Bitcoin, combined with its fixed supply, makes it a lucrative asset for companies looking to diversify their portfolios and hedge against potential economic downturns. Moreover, with lower transaction fees, quick payment processing, and the elimination of chargebacks, Bitcoin offers a more efficient and cost-effective payment solution, especially for international transactions.

However, the journey into the crypto realm is not without its challenges. The volatile nature of Bitcoin’s price, coupled with security concerns and complex tax implications, requires businesses to tread with caution. Yet, the potential benefits, including asset protection, adaptable taxation rules, and the opportunity to tap into a new customer base, make a compelling case for its inclusion on balance sheets, in essence, MicroStrategy’s Bitcoin journey is more than just a financial endeavour. It’s a narrative of belief, strategy, and pioneering—a tale that continues to inspire and shape the cryptocurrency world.

Conclusion

MicroStrategy’s bold foray into the Bitcoin realm has made it a pivotal player in the crypto space. For advanced crypto investors and traders, understanding MicroStrategy’s moves offers valuable insights into the broader market dynamics and potential investment strategies. As the crypto landscape continues to evolve, MicroStrategy’s role as a significant Bitcoin holder will undoubtedly influence market sentiments and trends.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.