Avalanche stands out as a smart-contract-enabled, cutting-edge blockchain platform often regarded as a competitor to Ethereum. Renowned for its efficiency and speed, the Avalanche blockchain and its infrastructure for hosting decentralized applications (DApps) and nonfungible tokens (NFTs) have garnered significant attention from both developers and investors.

This article offers an in-depth exploration of Avalanche’s native cryptocurrency, AVAX, and the broader Avalanche ecosystem. It covers various facets, including the project’s background, AVAX governance and voting mechanisms, tokenomics, staking opportunities, and its prospective trajectory.

What sets Avalanche apart?

Avalanche positions itself as a platform akin to its peers such as Cardano and Solana, seeking to address the longstanding challenge in blockchain technology of achieving a harmonious blend of speed, scalability, security, decentralization, and interoperability.

Functioning as an ecosystem for DApp development, token creation, and blockchain-based gaming, Avalanche empowers projects to construct their customized and interoperable autonomous chains. Additionally, the platform facilitates the establishment of bridges to ensure compatibility with Ethereum and other chains. The overarching objective is to demonstrate the network’s capacity to facilitate large-scale swift transactions.

AVAX: The Backbone of Avalanche

At the heart of the Avalanche ecosystem lies AVAX, the platform’s native cryptocurrency. AVAX serves multiple functions, including facilitating network transactions, engaging in governance processes, staking for rewards, and serving as a store of value. Notably, AVAX witnessed a staggering 275% surge in market share in 2023, while the network surpassed the significant milestone of processing over $1 billion in total transactions.

A Comprehensive Look at Avalanche’s Journey

The roots of Avalanche can be traced back to May 2018 when a visionary group of developers, affectionately known as “Team Rocket,” unveiled the initial concepts behind the Avalanche protocol in an enlightening article. Following this seminal moment, Turkish-American computer scientist Emin Gün Sirer took the helm, founding Ava Labs in 2019 with the explicit mission to bring the Avalanche vision to fruition.

The project embarked on a remarkable fundraising journey, commencing with a notable initial coin offering (ICO) in 2020 that garnered an impressive $42 million. This was swiftly followed by a substantial venture funding round in 2021, which saw an influx of $230 million. Among the noteworthy investors backing Avalanche are industry giants like Polychain and Three Arrows Capital. These pivotal investments fueled the development of Avalanche’s cryptocurrency ecosystem, culminating in the highly anticipated mainnet launch in September 2020.

Unveiling the Mechanics of Avalanche

Avalanche sets out to address the inherent challenges confronting blockchain technology by introducing three groundbreaking features. Firstly, it adopts an alternative proof-of-stake (PoS) consensus mechanism, which represents a departure from conventional consensus models. Additionally, Avalanche leverages subnetworks and operates on a mainnet comprising three distinct blockchains, a departure from the singular blockchain approach adopted by many predecessors.

Consensus Mechanism

At the core of Avalanche lies its innovative consensus mechanism, which builds upon the foundation of classic PoS principles. This mechanism empowers each validation node to function as an independent voting entity responsible for determining the acceptance or rejection of new transactions.

The consensus process is facilitated through a technique known as “repeated random subsampling,” wherein each node selects a small cohort of fellow validators to collectively assess and validate transactions. This iterative process continues until the network attains a predetermined threshold of confidence regarding the transaction’s validity.

Avalanche’s consensus protocol is meticulously engineered for scalability, boasting a remarkably low margin of error. Furthermore, it distinguishes itself by exhibiting lower energy consumption relative to many other blockchain networks, as nodes remain active solely during the voting phase for transaction validation.

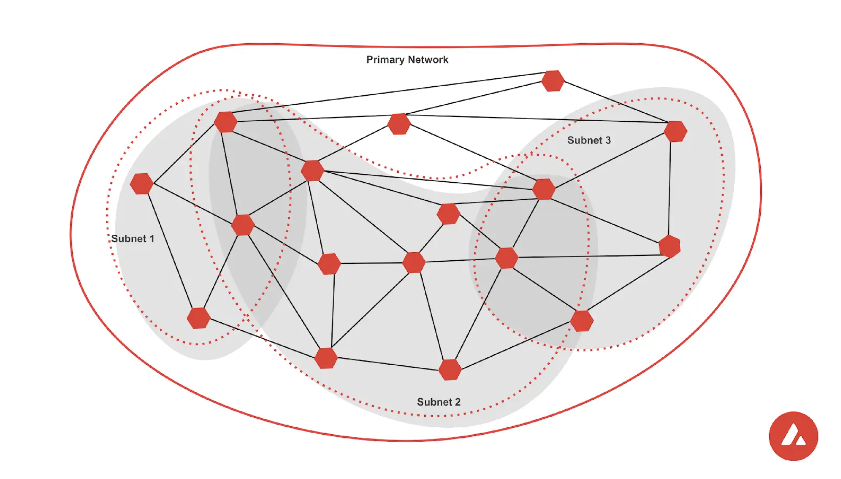

Subnetworks

Within the Avalanche ecosystem, developers wield the power to initiate their tailored blockchains, complete with bespoke regulations. These autonomous chains rely on subnetworks, also known as subnets, which comprise selected nodes tasked with validating distinct sets of blockchains. Notably, subnetworks play a dual role, participating both in the validation process of the Avalanche mainnet and in their designated chains. This feature draws parallels with other scaling solutions in the blockchain realm, such as Polkadot’s parachains and Ethereum’s consensus layer enhancement.

Three Layer-1 Foundational Blockchains

At the nucleus of the Avalanche ecosystem reside three fundamental blockchains. Firstly, the Exchange Chain (X-Chain) facilitates the creation and exchange of assets, including the native AVAX token. Secondly, the Contract Chain (C-Chain) serves as the breeding ground for Avalanche smart contracts, where they are meticulously crafted and executed. Lastly, the Platform Chain (P-Chain) assumes the pivotal role of coordinating validators and subnets. Token mobility across these three chains is paramount for network functionality.

The trifecta of chains positions Avalanche as a Layer-1 solution, diverging from Layer-2 counterparts that offload transaction validation off-chain, relying on rollup mechanisms for expedited processing.

Cross-Chain Functionality in Avalanche

A cornerstone of the Avalanche platform, the Contract Chain (C-Chain) leverages the Ethereum Virtual Machine (EVM), enabling seamless cross-chain interoperability for projects and tokens within the Avalanche ecosystem. Furthermore, Avalanche adopts Solidity for its smart contracts, akin to Ethereum, complemented by multiple cross-chain bridges facilitating interconnectivity.

Scalability of the Avalanche Network

Avalanche’s robust infrastructure, characterized by its three Layer-1 chains and proprietary consensus mechanism, endows the blockchain with unparalleled speed and scalability. Leveraging a directed acyclic graph (DAG) structure for its X-Chain, which handles token transactions, Avalanche adopts a non-linear approach, resulting in enhanced processing efficiency.

Avalanche proudly boasts the capability to process a staggering 6,500 transactions per second (TPS), a monumental feat when compared to Ethereum’s current throughput of approximately 15 TPS. While Ethereum’s ongoing upgrades hold promise for accelerated TPS speeds, Avalanche stands as a testament to the present and future of high-speed blockchain transactions.

Network Governance

AVAX holders wield authority in network governance, with any network node granted the capability to propose governance initiatives. Avalanche adopts on-chain voting mechanisms for pivotal network parameters, including staking parameters, minting rates, and transaction fees. However, it employs voting selectively, contributing to a partially decentralized governance model.

AVAX Staking Mechanisms and Liquidity Pools

Participants holding AVAX tokens have the opportunity to stake their assets to validate transactions on the network, consequently earning freshly minted AVAX coins as rewards. Validator incentives hinge on proof-of-uptime and proof-of-correctness criteria.

Network validators do not receive transaction fees; instead, these fees are systematically burned to bolster the scarcity of AVAX. Avalanche’s robust validator incentives have garnered acclaim, with the network disbursing over $275 million in AVAX rewards to more than 1,000 validators in 2023 alone.

AVAX Tokenomics

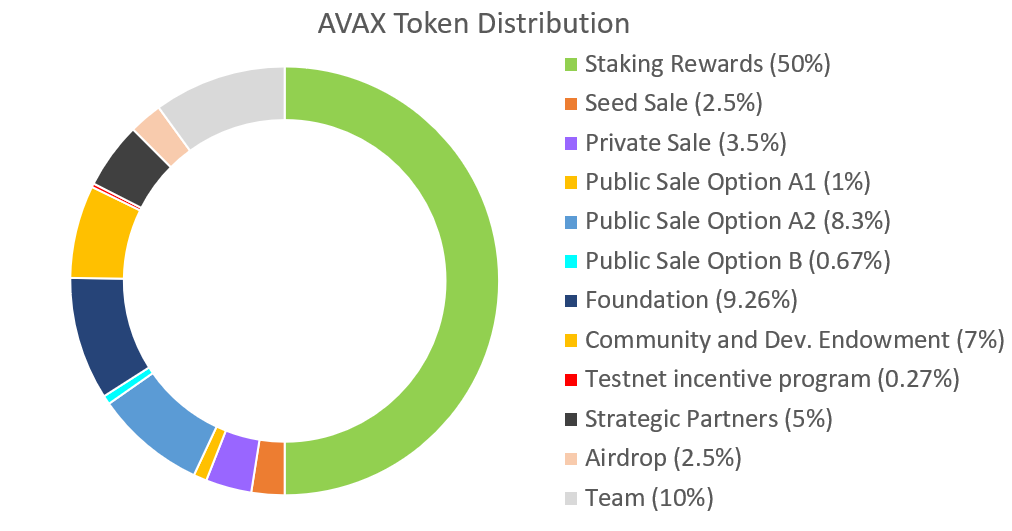

The total supply of AVAX tokens is capped at 720 million. Upon the mainnet’s launch in 2020, half of the tokens were minted and distributed. Of this allocation, 10% was allocated to the Avalanche team, 9.26% to the foundation, and 5% to strategic partners, with the remainder allocated to ICO recipients and other development endeavors. Subsequently, the remaining token supply is continuously generated as staking rewards.

Avalanche C-Chain applications

The Avalanche C-Chain serves as the home for an array of decentralized applications (DApps), decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and gaming ventures developed within the Avalanche blockchain ecosystem. Notable projects within this realm encompass decentralized exchanges like Trader Joe and WooFi, the GMX prediction market, and the cross-chain messaging system Synapse.

Among these endeavors is the omnichain initiative Stargate Finance, designed for facilitating cross-chain liquidity transfers. Its recent integration with Avalanche underscores the platform’s potential for expanded utility in 2024. While Avalanche currently hosts over 500 DApps, it lags behind Ethereum and BNB Smart Chain, each boasting around 5,000 DApps.

Continued Development of the Avalanche Ecosystem

The evolution of the AVAX ecosystem persists, with Avalanche spearheading the development of two pivotal technologies: HyperSDK and Avalanche Warp Messaging (AWM), both leveraging elastic subnets. HyperSDK holds promise for enhancing throughput, while AWM aims to bolster interoperability, fostering developer adoption.

In November 2023, Avalanche received a significant boost with the commitment of $10 million in AVAX from developer Colony Lab. This investment is earmarked for bolstering network growth through validator creation and investment in the Colony Avalanche Index (CAI), a yield-bearing token index within the network.

Partnerships and Adoption Milestones

Avalanche has forged strategic alliances with industry heavyweights such as Amazon Web Services and Tencent Cloud, underscoring burgeoning mainstream interest. Additionally, successful proof-of-concept demonstrations with financial titans like JPMorgan and Apollo underscore Avalanche’s growing credibility.

Recent Developments and Market Performance

Avalanche’s introduction of inscription (ARC-20) tokens in June 2023 has garnered substantial attention, with over 100 million inscriptions recorded on the Avalanche blockchain. The platform witnessed a surge in transaction volume, with users spending over $4 million in fees over a five-day period in December 2023 to create and transfer tokens and NFTs via inscriptions.

The Future Outlook

Amidst a notable surge in AVAX’s price from $11.32 to over $48 between November 2023 and January 2024, Avalanche’s position as a layer-1 blockchain has garnered increased attention. Bolstered by its throughput capabilities, novel consensus mechanism, and developer-friendly environment, Avalanche presents a compelling alternative to Ethereum. While Ethereum maintains dominance owing to its established security and extensive developer ecosystem, Avalanche, alongside other emerging blockchains like Cardano and Solana, remains a contender poised to challenge Ethereum’s supremacy in the smart contract arena.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.