Quick Links

The Importance of Pendle in the DeFi Ecosystem

Key Features and Functionalities

The Concept of Yield Tokenization

The Alchemy of Yield Tokenization

Real-World Applications in Pendle’s Ecosystem

Trading and Speculating on Yield

Real-World Application: A Platinum Trader’s Playbook

The Future of Pendle and Market Trends

Hey there, DeFi enthusiasts! Let’s dive into the world of Pendle Protocol, a groundbreaking platform in the decentralized finance (DeFi) landscape. If you’re like me, always on the lookout for innovative and efficient ways to manage your crypto assets, Pendle is a game-changer you need to know about.

What is Pendle Protocol?

Pendle Protocol is a cutting-edge yield management platform in the DeFi space. It’s not just another protocol; Pendle stands out for its unique approach to handling yield-bearing assets. The protocol allows users to maximize their returns and engage in more sophisticated financial strategies, something we’ve been craving in the DeFi world.

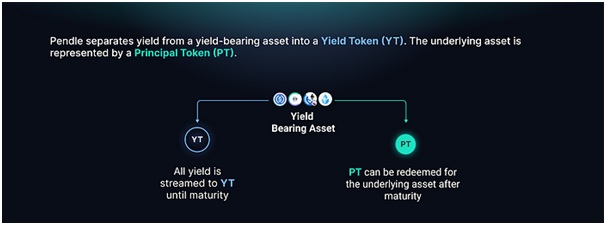

At its core, Pendle separates yield-bearing assets into two distinct components:

Principal Tokens (PT) and Yield Tokens (YT). This separation is a clever move, enabling users to handle the future yield of their assets independently from their initial principal. It’s like having a crystal ball that lets you peek into and trade based on the future income potential of your assets. Pretty cool, right?

The Importance of Pendle in the DeFi Ecosystem

Pendle Protocol isn’t just another addition to the ever-growing list of DeFi platforms. It’s a significant leap forward. By introducing the concept of yield tokenization, Pendle opens up a whole new realm of possibilities for yield management and speculation. This is particularly important as the DeFi space evolves to mirror more complex financial markets.

In traditional finance, instruments like interest rate derivatives are commonplace. Pendle brings this sophistication to DeFi, allowing us to speculate on and hedge against changes in yield rates. This is a big deal because it adds a layer of depth and complexity to DeFi that was previously missing. We’re not just talking about simple lending and borrowing anymore; Pendle introduces a nuanced approach to yield, making DeFi more appealing and relevant to a broader range of financial enthusiasts and professionals.

Moreover, Pendle’s innovation contributes significantly to the liquidity and efficiency of the DeFi market. By enabling the trading of future yields, Pendle ensures that capital isn’t sitting idle but is instead actively contributing to the market’s dynamism. This is crucial for the overall health and growth of the DeFi ecosystem.

So, whether you’re a seasoned DeFi trader or just starting to dip your toes into this exciting world, understanding Pendle Protocol is key. It’s not just about what Pendle does today; it’s about the doors it opens for tomorrow’s DeFi innovations. Stay tuned, as we’ll dive deeper into how Pendle works, its unique features, and how you can leverage this protocol to your advantage. Welcome to the future of yield management in DeFi!

Understanding Pendle Protocol

What is Pendle Protocol?

Alright, let’s get into the nitty-gritty of Pendle Protocol. Imagine you’re a chef in the DeFi kitchen, and Pendle is your latest, most versatile ingredient. Pendle Protocol is a unique platform in the DeFi space that specializes in what we call ‘yield tokenization.’ It’s like having a magic wand that can split your yield-bearing assets into two separate entities, giving you more control and flexibility over your investments.

Key Features and Functionalities

- Yield Tokenization: This is Pendle’s standout feature. It allows you to split your yield-bearing assets into Principal Tokens (PT) and Yield Tokens (YT). Think of it as dividing a cake into two layers; one represents your initial investment (PT), and the other represents the potential earnings from that investment (YT).

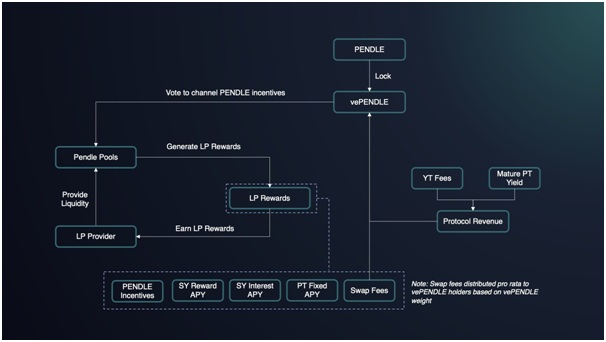

- Automated Market Maker (AMM): Pendle incorporates an AMM specifically designed for trading these tokenized yields. This means you can trade YTs and PTs with ease, just like you would trade any other crypto asset on a decentralized exchange.

- Flexible Investment Strategies: With Pendle, you’re not stuck with a one-size-fits-all approach. You can go long or short on yields, hedge your bets against yield fluctuations, or simply maximize your earnings. It’s like having a Swiss Army knife for yield management.

- Integration with Other DeFi Protocols: Pendle isn’t a lone wolf; it smartly integrates with other DeFi protocols. This means you can use assets from various platforms, expanding your yield-generating possibilities.

- Liquidity Provision and Incentives: As a liquidity provider on Pendle, you’re not just helping the platform; you’re also earning rewards. Pendle incentivizes users who contribute to its liquidity pools, making it a potentially profitable endeavour.

The Concept of Yield Tokenization

Yield tokenization, the heart of Pendle Protocol, is a revolutionary concept in DeFi. Here’s how it works:

- Splitting Assets: When you tokenize your yield-bearing asset in Pendle, it gets split into PT and YT. The PT represents the principal amount of your asset, while the YT represents the future yield that asset will generate.

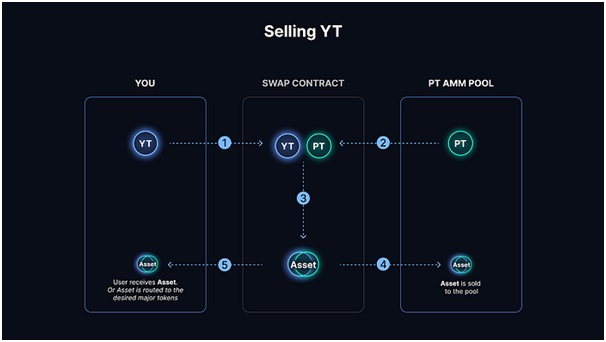

- Trading Flexibility: Once split, these tokens can be traded independently. This means you can sell your future yield (YT) while holding onto your principal (PT), or vice versa. It’s like having the ability to sell the fruits of a tree separately from the tree itself.

- Speculation and Hedging: This separation allows for sophisticated financial manoeuvres. You can speculate on the future yield of an asset, or hedge against potential yield decreases. It’s a level of flexibility that’s akin to advanced financial instruments in the traditional markets.

- Fixed and Variable Yields: Pendle caters to both fixed and variable yield preferences. You can lock in a fixed yield by holding onto PTs or speculate on variable yields with YTs. It’s like choosing between a steady income or playing the lottery with your earnings.

The Mechanics of Pendle

The Art of Splitting Yield-Bearing Assets: Principal Tokens (PT) and Yield Tokens (YT)

Imagine stepping into a world where your digital assets are not just static entities but dynamic, living things that can be split and reassembled to suit your financial goals. This is the realm of Pendle Protocol, where the usual yield-bearing assets undergo a transformative process, akin to a financial metamorphosis.

In the heart of Pendle’s innovative ecosystem, your assets are delicately separated into two distinct entities: Principal Tokens (PT) and Yield Tokens (YT). It’s like taking a plant and separating its roots (PT) from its fruits (YT). The roots, or PTs, represent the original capital of your investment – the stable, dependable base. It’s the part of your investment that remains constant, your initial deposit that sits securely, unaffected by the market’s whims.

On the other hand, the fruits, or YTs, embody the future yield that your asset is expected to generate. These tokens are the soul of your asset, capturing the essence of its potential growth and earnings. YTs are more speculative, dancing to the tune of market fluctuations and yield predictions. They represent the excitement and the risk, the part of your investment that can bring unexpected rewards.

The Alchemy of Yield Tokenization

Pendle’s process of yield tokenization is akin to a financial alchemy, a transformative procedure that turns a single asset into two tradeable components. This process is not just a technical feat; it’s a strategic empowerment for DeFi enthusiasts like us.

By tokenizing your yield-bearing assets, you gain an unprecedented level of flexibility. You can choose to hold onto your principal for a stable investment or trade your YTs for immediate liquidity or speculative plays. This separation allows you to tailor your investment strategy to your risk appetite and financial goals.

Moreover, yield tokenization is a powerful tool for risk management. It enables you to hedge against yield volatility and diversify your DeFi portfolio. You can mix and match PTs and YTs from different assets, creating a balanced investment strategy that aligns with your market outlook.

Real-World Applications in Pendle’s Ecosystem

Let’s take a stroll through Pendle’s garden and see how this plays out with real assets. Consider stETH from Lido, a popular choice among yield farmers. In Pendle’s world, stETH is split into PT-stETH, representing your staked ETH, and YT-stETH, encapsulating your expected staking rewards. This separation allows you to manage your staked ETH independently from the rewards it generates.

Or take cDAI from Compound. When tokenized on Pendle, you get PT-cDAI, your lent-out DAI, and YT-cDAI, the interest you anticipate earning. This division gives you the freedom to decide how you want to handle your lent assets and the interest they accrue.

Trading and Speculating on Yield

Here, trading yield tokens is akin to playing a sophisticated game of chess, where each move is calculated, and the potential for reward is as thrilling as it is varied.

In Pendle’s unique ecosystem, trading yield tokens is a dance of strategy and foresight. You’re not just trading digital assets; you’re trading the future potential of these assets. It’s a marketplace where the yields of tomorrow are bought and sold today, where the anticipation of what an asset could yield becomes as valuable as the asset itself.

As a seasoned trader at Platinum Crypto Academy, I’ve always been on the lookout for innovative ways to maximize returns and manage risks in the DeFi space. Pendle Protocol, with its unique approach to yield tokenization, has opened up a new frontier for traders like me. Let me walk you through how I, as a Platinum crypto trader, take advantage of Pendle’s unique offerings.

- Strategic Yield Token Trading: In the dynamic world of Pendle, trading yield tokens is more than just a transaction; it’s a strategic decision. When I trade YTs, I’m essentially placing a bet on the future performance of an asset’s yield. For instance, if I’m bullish on Ethereum, I might buy YT-stETH, speculating that the staking rewards will increase. It’s a calculated move, based on my analysis of Ethereum’s market trends and potential growth.

- Shorting Yields with Precision: Pendle’s platform allows me to short yields with a level of precision that’s hard to find elsewhere. In a bear market, where yields are expected to plummet, I can short sell YTs of high-profile DeFi assets. This strategy hinges on my market insights and timing – selling high and aiming to buy back low. It’s a play that requires nerve and a deep understanding of market dynamics.

- Hedging with Principal Tokens: Stability is crucial in any investment strategy. That’s where PTs come in. By holding PTs, like PT-cDAI, I focus on the inherent value of the asset, insulated from yield volatility. This approach is particularly appealing in turbulent markets, where predictability is a rare commodity. It’s about finding balance and ensuring a portion of my portfolio is shielded from the unpredictability of yields.

Real-World Application: A Platinum Trader’s Playbook

Let me give you a snapshot of how these strategies play out in real-world scenarios:

- Going Long on stETH YTs: Believing in Ethereum’s long-term potential, I invest in YT-stETH. It’s a move that aligns with my bullish outlook on Ethereum’s adoption and technological advancements. I’m essentially betting on Ethereum’s future, expecting the staking rewards to increase over time.

- Shorting in a Downturn: During market downturns, I employ a shorting strategy on YTs. For example, if I predict a decrease in the yields of a popular DeFi asset, I’ll short its YTs. It’s a high-stakes strategy that requires constant market analysis and a readiness to act swiftly.

- Conservative Plays with cDAI PTs: In times of high market volatility, I turn to PTs for a more conservative approach. Holding PT-cDAI allows me to focus on the principal value, providing a stable anchor in my portfolio amidst the market’s ebb and flow.

In my journey as a Platinum crypto trader, Pendle has become an indispensable tool in my arsenal. It’s not just about the trades I make; it’s about the strategic choices behind each trade. Pendle’s innovative approach to yield tokenization has given me, and traders like me, a new playground to test our strategies, hone our skills, and ultimately, aim for higher returns in the ever-evolving DeFi landscape.

The Future of Pendle and Market Trends

Pendle’s Evolving Role in the DeFi Landscape

As a crypto trader who’s seen various trends come and go in the DeFi space, I’m particularly excited about the trajectory of Pendle Protocol. Pendle isn’t just a fleeting trend; it’s a pioneering platform that’s carving out its niche in the DeFi ecosystem. Its unique approach to yield tokenization positions it at the forefront of financial innovation, bridging the gap between traditional finance and DeFi.

Looking ahead, Pendle’s role in DeFi is poised to become even more significant. As the DeFi space matures, the demand for sophisticated financial instruments like those offered by Pendle is only going to increase. Traders and investors are constantly seeking new ways to optimize returns and manage risks, and Pendle’s innovative solutions cater precisely to these needs.

Anticipating Future Developments and Expansions

From my vantage point, the future of Pendle is bright and filled with potential. I anticipate several key developments and expansions:

- Integration with More DeFi Platforms: Pendle’s future lies in its ability to integrate seamlessly with a broader range of DeFi platforms. This expansion will provide users with more options for yield tokenization, further enhancing Pendle’s appeal.

- Introduction of New Financial Instruments: I expect Pendle to introduce more complex financial instruments, catering to the evolving needs of DeFi users. These could include new forms of derivative products, further blurring the lines between traditional finance and DeFi.

- Expansion into New Blockchains: While Ethereum has been the primary playground for Pendle, expanding into other blockchains could be a game-changer. This move would tap into new markets and user bases, significantly increasing Pendle’s reach and impact.

Market Trends and Predictions

As for market trends and predictions, here’s where I see things heading:

- Increased Demand for Yield Tokenization: The concept of yield tokenization is still in its infancy, but it’s set to become a major trend in DeFi. As more users understand its benefits, platforms like Pendle will see increased adoption.

- Rising Interest in Fixed Income Products: In a world where volatility is the norm, fixed income products like those offered by Pendle will become increasingly popular. They provide a much-needed stability option in the portfolios of DeFi investors.

- Growing Institutional Interest: As DeFi continues to mature, I predict a surge in institutional interest, particularly in platforms like Pendle that offer advanced financial instruments. This shift will bring more liquidity and credibility to the DeFi space.

In conclusion, Pendle Protocol is well-positioned to capitalize on these emerging trends. Its innovative approach to yield management and its potential for expansion and integration make it a key player to watch in the DeFi arena. As a crypto trader, I’m keeping a close eye on Pendle, ready to leverage its capabilities to stay ahead in the dynamic world of DeFi. The future looks promising, and Pendle is undoubtedly a major part of it.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.