When to take profit cryptocurrency is a major search term for those who are actively trading the crypto markets. With Bitcoin (BTC) on the cusp of $9,000, and Ethereum (ETH) over $634, the cryptocurrency market continues to climb. BTC is currently trading at around $8,892, having broken $9,000 last week.

According to CoinMarketCap, Bitcoin dominance is around 38.4%, down from a monthly high of around 44%. One question that I keep hearing is “when do I cash out and take profits from cryptocurrency market?” Today’s Crypto Beginners blog addresses this very question in detail.

WHEN TO TAKE PROFIT CRYPTOCURRENCY?

When to take profit or holding the position is a question that haunts every cryptocurrency market trader. Most traders are not able to decide when it’s the right time to sell their holdings or just part of them, and many times they end up feeling regret when they didn’t sell while the time was right. Guessing the exact low or the exact high is nearly impossible for any cryptocurrencies traders.

WHAT’S THE KEY – WHEN TO TAKE PROFIT CRYPTOCURRENCY

The first cryptocurrency market trading rule to be remembered is that you don’t lose money when you take out profits from the Cryptocurrency Market. Selling partial positions from time to time and earning profits is not bad in the Cryptocurrency Market. If the price continues to rise, you will still have holdings to sell and earn additional profits. It is all about diversifying your portfolio and averaging the price to end up in positive numbers at the end.

WHAT DO SEASONED TRADERS DO?

If you check the cryptocurrency market trading history of any seasoned trader you will realise they have bought the currency of their choice at various prices. They are buying crypto coins when they were available from a low. They make an investment every couple of days, or whenever they sense a good opportunity cropping up. In this way, one can get a good average for the purchase of crypto coins in the Cryptocurrency Market.

Now when the price of the crypto coins goes above their average, they start slowly selling off the coins. By selling 10% to 20% of their holdings every time the price rises, they start recovering their investments and booking profits from Cryptocurrency Market. They continue to follow the pattern until the price hike continues in the cryptocurrency market. After that, they either hold the position or again sell in case the price of crypto coins falls.

ANOTHER WAY IS TO DOLLAR-COST AVERAGE YOUR COINS

(HODLING)

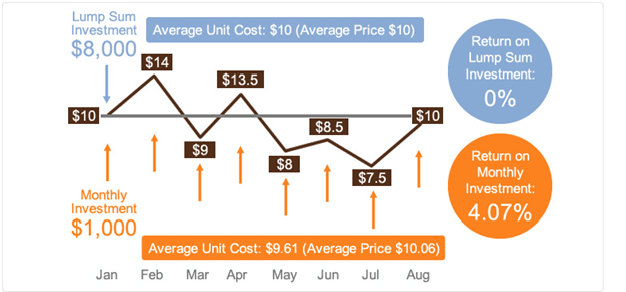

Dollar cost averaging Bitcoin and cryptocurrencies can be a very good strategy for newcomers to the crypto-investment space. Using the DCA method means purchasing a fixed dollar amount of Bitcoins no matter what the price happens to be. Further, the DCA technique requires purchasing the fixed dollar price using a scheduled calendar as well.

HODLING APPROACH-WHEN TO TAKE PROFIT CRYPTOCURRENCY

The ‘HODLer’s approach’ is far less stressful than those who day trade or play intra-range strategies. It must be noted though by just HODLing there is a chance of missing profiting opportunities in Cryptocurrency Market. Those who purchase Bitcoin currency or other cryptocurrencies using the DCA (Dollar Cost Average) technique don’t have to watch the charts all the time or set price alarms, so they can catch rises and dips. DCA investors are investing in the digital asset for the long haul, and everyday price volatility is meaningless to the HODLer to a degree

This investment method might not give you the greatest return per se, but it does mitigate risk. Dollar cost averaging is highly appropriate when you’re about to invest in a volatile cryptocurrency market, like Cryptos, that you can’t the time or can’t find a clear point of entry. Moreover, for the method to be effective you need to invest for the long-term and expect the cryptocurrency market to grow.

TO DOLLAR COST AVERAGE INTO THE CRYPTOCURRENCY MARKET, SIMPLY FOLLOW THESE STEPS:

- Determine the total amount you want to invest in the Cryptocurrency Market.

- Choose the cryptocurrencies you want to invest in the Cryptocurrency Market.

- Determine the time intervals between each investment and what % you’ll be investing in each investment (more time = less risk).

- Stay disciplined and stick to your plan.

HOW TO GET THE PROFITS EARNED TO THE BANK ACCOUNT?

Many new traders are not sure about the exact procedure by which they can get the profits earned into their bank account. It can be done in multiple ways.

- The first way is to open an account at a cryptocurrency market exchange. You need to get identified by the exchange before you deposit your Bitcoin currency or any other crypto coin in that exchange. After depositing the crypto-coin, the crypto exchange will transfer the money to your bank account.

- Many countries also have crypto ATMs where you can go, simply deposit your crypto coin and either withdraw cash or get the amount transferred to your bank account.

- Another procedure is to find a reliable online vendor for cryptocurrency market. You need to make an account on their website which will then act as an exchange for your cryptocurrency market transactions.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Richard Baker

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer:

The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.