Hi Crypto Network,

Bitcoin has done exceedingly well in its first major crisis. It has outperformed gold, US equities and crude oil by a wide margin in 2020. This is likely to grab the attention of institutional investors who want to diversify their portfolio away from traditional assets.

Even if a few institutional players allocate a small portion of their portfolio to Bitcoin, the crypto market is likely to skyrocket higher.

The Chicago Mercantile Exchange, or CME, data suggests that institutional investors might have already started building their positions in Bitcoin. The number of large open interest holders rose to 66, which is a new record. Similarly, Bitcoin futures and Bitcoin options open interest hit a new high recently. These suggest that the institutions are actively trading in Bitcoin derivatives.

Robert Kiyosaki, author of the book Rich Dad, Poor Dad, has tweeted a bullish projection on gold, silver, and Bitcoin. He predicts gold to rally from $1,700 levels currently to $3,000 in a year. Similarly, for silver, Kiyosaki has a target of $40 from the current level of $17 in five years. While these do look attractive, Kiyosaki believes that Bitcoin will be a huge outperformer and can rally to $75,000 in 3 years.

Bitcoin halving and the subsequent price action has boosted sentiment of the crypto community. Crypto data company The TIE has reported that the 30-day average daily sentiment score — the number of positive reviews versus negative reviews — is at a 2.5 year high.

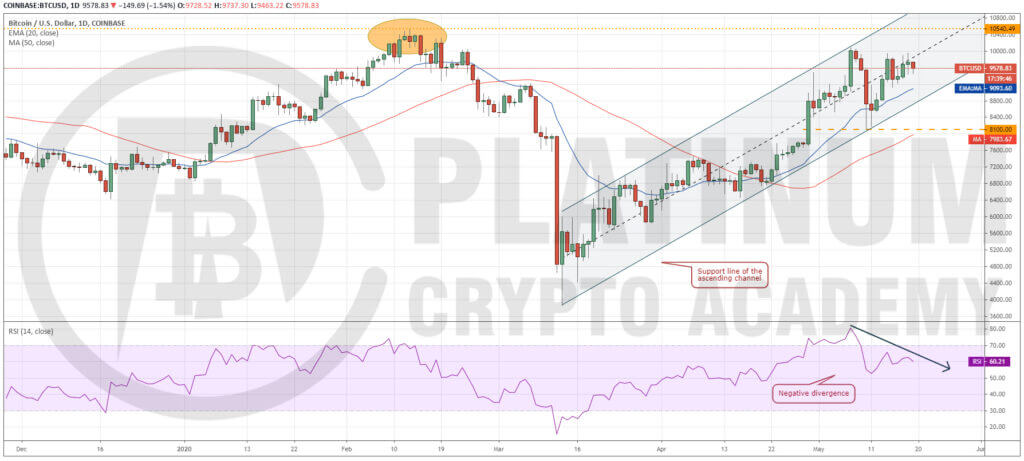

BTC/USD

Bitcoin’s chart shows that the trend is up. However, the bulls are finding it difficult to propel the price above the $10,000 level. This suggests that the bears are aggressively defending this level.

After repeated failures to clear this level, the short-term traders are likely to book profits that can drag the price to the next support at the 20-day EMA. The RSI has also formed bearish divergence, which suggests a pullback might be around the corner.

Nevertheless, as the trend is up, dips should be viewed as buying opportunities. Traders can wait for the price to rebound off the 20-day EMA before initiating long positions.

The first target objective is a move back to $10,000 and if that is cleared, a rally to $10,500 is also possible. This level is again likely to act as a strong hurdle but if crossed, it will signal the start of a long-term uptrend.

The first signs of a change in trend will be signalled when the bears sink the BTC to USD pair below the support line of the ascending channel. If this support cracks, a drop to $8,100 is likely.

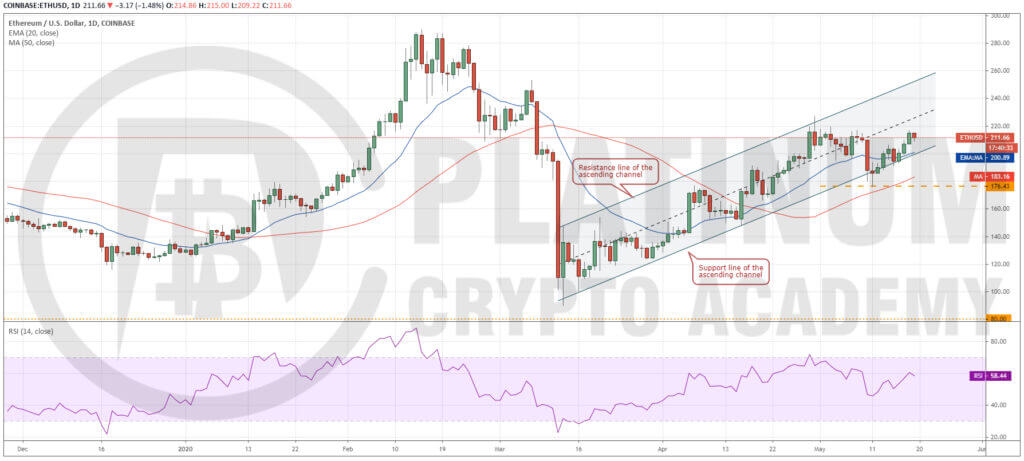

ETH/USD

Ether broke above the 20-day EMA on May 13 and traders who purchased on our recommendation given in the previous analysis would be sitting on profits. The biggest altcoin hit a high of $216.99 on May 18, which was very close to our first target objective of $220.

Although the bears are defending the $220 levels, the positive thing is that the bulls have not ceded ground. This suggests that the bulls are likely to make one more attempt to push the price above $220.

If successful, a rally to $227.50 and above it to the resistance line of the channel at about $250 is likely. The traders can watch the price action at $220. If the bulls struggle to scale the price above it, partial profits can be booked and the stops on the rest of the position can be trailed to breakeven.

On the other hand, if the bulls scale the price above $220, the stops can be trailed higher to protect the paper profits.

The bearish scenario will come into play if the ETH to USD pair turns down from the current levels and plummets below the support line of the channel. If this level breaks, a drop to $176.43 is possible.

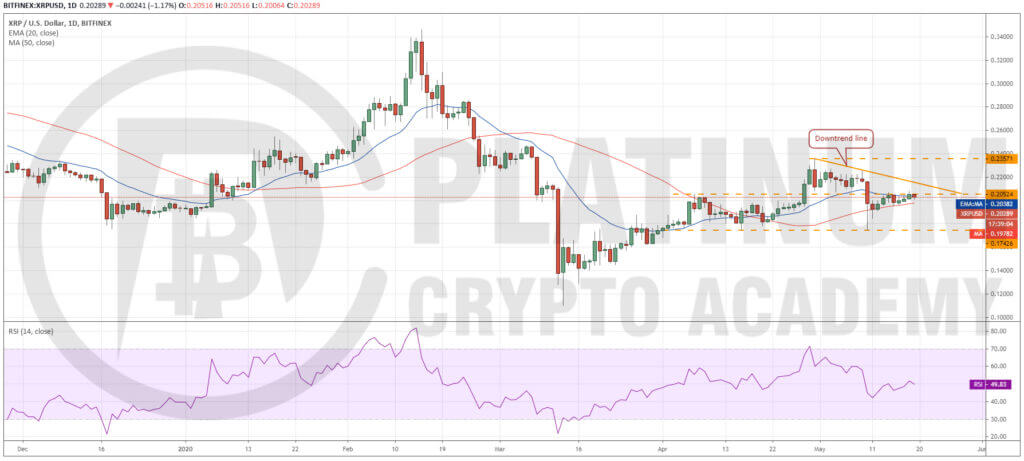

XRP/USD

XRP has been trading close to the overhead resistance at $0.20524 for the past few days but the bulls have not been able to propel the price above this level. This suggests a lack of aggressive buying by the bulls as they are not confident of higher levels.

If the bears sink the price below the 50-day SMA, a drop to $0.185 and below it to $0.17426 is possible.

Conversely, if the bulls can break out and sustain the XRP to USD pair above $0.20524, a move to the downtrend line is likely. This level is again likely to act as a stiff resistance but if crossed, a rally to $0.23571 is possible.

However, as the pair has been a huge underperformer and is not showing any defined trend, we do not find any reliable buy setup in it.

BCH/USD

There is nothing much happening in Bitcoin Cash. It has been stuck near the middle of the large $200-$280 range for the past few days. Both moving averages are flat and the RSI is close to the midpoint, which suggests a balance between demand and supply.

If the bulls can drive the price above $255, a rally to $280 is likely. The bears are likely to defend this level aggressively. Nonetheless, if the bulls can propel the BCH to USD pair above $280, a new uptrend is likely. Hence, traders can initiate long positions if the price sustains above $280.

Conversely, if the bears sink the price below $225, a drop to $200 is possible. This level has not been broken since March 23; hence, we expect the bulls to aggressively defend it. Traders can buy a bounce off $200 with a close stop-loss.

Trading inside a range can be volatile and difficult to predict, hence, we do not find any reliable buy setups at the current levels.

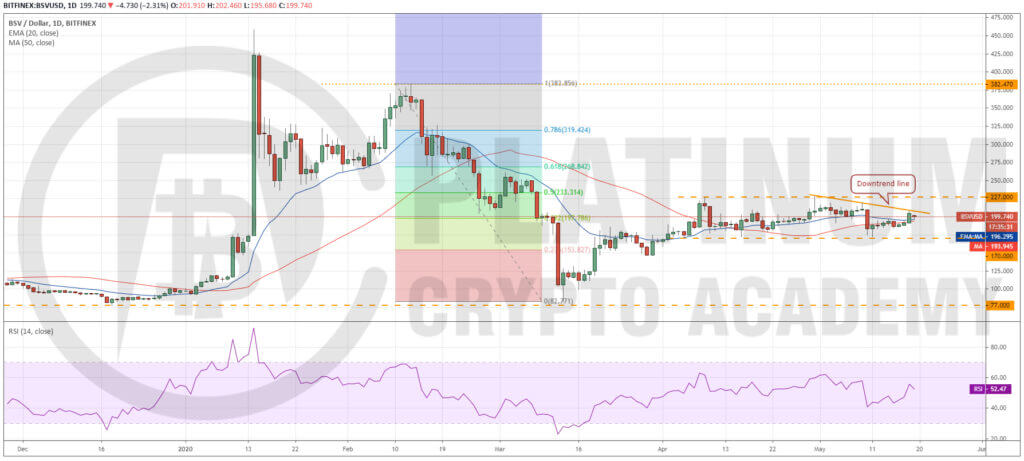

BSV/USD

Although the bulls broke above the 20-day EMA on May 18, they have not been able to scale above the downtrend line. However, the positive thing is that Bitcoin SV has not ceded ground, which suggests that the short-term traders are in no hurry to close their positions.

If the bulls can push the price above the downtrend line, a rally to $227 is possible. The bears are likely to mount a strong defence of this level, hence, traders who are long can book profit at these levels.

In case the strong momentum carries the price above $227, a new uptrend is possible. Traders who could not buy close to $170 can initiate long positions after the BSV to USD pair sustains above $227.

Conversely, if the pair turns down from the current levels and slides below $184, a retest of $170 is possible. Therefore, traders can trail their stops to breakeven.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.