Hi Crypto Network,

The world is drowning under a huge debt pile, which continues to rise at a staggering pace. The Institute of International Finance reported that the global debt will hit $255 trillion by the end of this year.

This is an unsustainable situation, which will culminate in a financial crisis that will shake the belief in fiat currencies and the current financial system. People are likely to turn to Bitcoin and other cryptocurrencies as they are decentralised and cannot be manipulated.

Bitcoin, which was only limited to the tech-savvy a few years back is fast joining the mainstream. The number of Bitcoin ATMs installed across the world has topped the 6,000 mark. However, the distribution is not uniform, with about three-quarters of the machines installed in North America and only 2% is in Asia. Remaining 20% are installed in Europe. This shows the massive scope for growth in the future.

Fundstrat’s Tom Lee believes that “cryptocurrencies are network value assets, meaning the more people hold the asset, the greater the value.” According to him, currently, about half a million people own and use Bitcoin. If the number doubles, the price of Bitcoin will quadruple. Therefore, he expects Bitcoin to easily reach $25,000 in valuation.

Though the long-term targets are attractive, the price action in the short-term looks uncertain. Most major cryptocurrencies have turned down and are threatening to break below their strong support levels. What are the critical levels to watch out for and how should traders position themselves? Let’s analyse the charts.

BTC/USD

Bitcoin has been losing ground in the past few days. The price has broken below both the moving averages and has re-entered the descending channel. This is a negative sign as it indicates that the breakout of the channel was a bull trap.

The cryptocurrency has support at $7,701-$7,427 zone. A breakdown of this zone will be a huge negative as it will drag the price to $5,600 level. The moving averages are on the verge of a bearish crossover and the RSI has dipped into the negative territory, which shows that bears are in command.

Our negative view will be invalidated if the price reverses direction from the current levels and rises above the overhead resistance of $9,071. Such a move will indicate buying on dips closer to the support levels. For now, the traders can keep the stop loss on the long positions at $7,295.

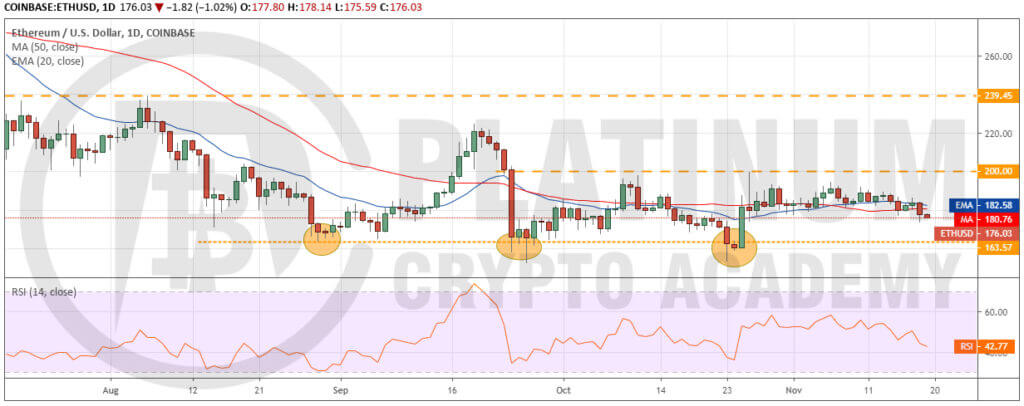

ETH/USD

Compared to other top cryptocurrencies, Ether has been relatively stable. It has not given up much ground, which is a positive sign. This shows that the bulls are not panicking and getting out of their positions in a hurry.

The price remains stuck in the $200 to $163.57 range. Both moving averages are flat and the RSI has dipped into the negative territory. This shows that the price might dip to the bottom of the range in the short-term. However, as the support of the range has held on three previous occasions, we anticipate it to hold this time too.

If the price bounces off $163.57, the cryptocurrency might extend its stay inside the range. We will watch the price action at the support and might suggest long positions on a strong rebound off it. Contrary to our assumption, if the altcoin plummets below $163.57-$152.11 support zone, the downtrend will resume. Alternatively, if the price turns around and breaks out of $200, the traders can initiate long positions as suggested in our previous analysis.

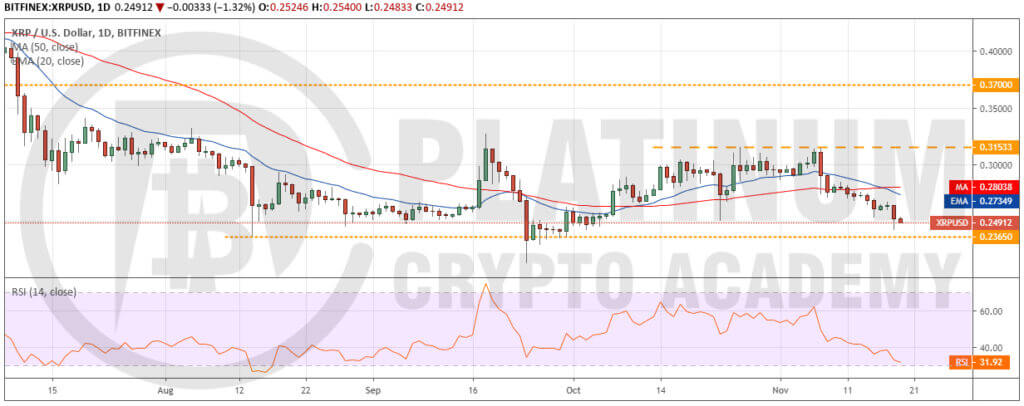

XRP/USD

XRP has been consistently falling for the past few days. The moving averages have completed a bearish crossover and the RSI has dipped close to the oversold zone, which shows that the bears are firmly in the driver’s seat.

The immediate support is at $0.23650, below which a retest of $0.21262 is possible. If this level also cracks, the downtrend will resume. Therefore, traders can keep the stop loss on the long positions at $0.23.

However, if the bulls defend the support at $0.23650, the cryptocurrency might remain range-bound for a few more days. It will pick up momentum after it scales above the overhead resistance of $0.31533.

BCH/USD

The failure of the bulls to propel the price above the overhead resistance of $308.21 attracted selling. A break below the 20-day EMA started the down move, which picked up momentum on a break below $255.06. The sharp dip on November 18 triggered our stop loss suggested in the previous analysis.

The 20-day EMA has started to turn down and the RSI has dipped into the negative zone, which shows that bears are in command. If the price sustains below $242, it can dip to the next support at $201.66.

Conversely, if the bulls defend the support at $242, another attempt to push Bitcoin Cash towards the overhead resistance of $308.21 is likely. We will wait for the price to form a new buy setup before proposing a trade in it once again.

LTC/USD

Litecoin has broken below the moving averages, which is a bearish sign. It shows a lack of buyers at higher levels. The cryptocurrency can now gradually dip to the $50.25-$47.22 support zone. A breakdown of this zone will be a huge negative as it will resume the downtrend. Therefore, we suggest traders keep the stop loss at $47.

Conversely, if the bulls defend the support zone, the altcoin will extend its stay inside the $61.75-$50.25 range. The flattish moving averages also point to a consolidation in the short-term. The cryptocurrency will pick up momentum on a breakout of $61.75-$66.19 resistance zone. Above this zone, a move to $80.26 is possible.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.