Hi Crypto Network,

The world is currently gripped with the coronavirus outbreak. First, it was China but now the cases have surged in Italy, Japan, Iran, and South Korea. The World Health Organization has warned the countries to be prepared for a possible coronavirus pandemic. This is likely to drag global economic growth lower.

As a result, the global equity markets sold off on February 24. However, Bitcoin, which some people consider as digital gold has not benefitted from the crisis, whereas, gold has been in an upswing for the past few days. This shows that Bitcoin cannot be classified either as a safe haven or as a risky asset. It remains an uncorrelated asset that moves independently to any other asset class.

During the week, Binance CEO Changpeng Zhao said that Bitcoin’s price does not reflect the upcoming halving event. The halving will reduce the rewards for miners, which will increase the cost of mining each Bitcoin. Zhao believes that psychologically, miners will be unwilling to sell below the cost of production, therefore, this is likely to support Bitcoin prices. The halving will also reduce the supply, which will also be favourable for prices because the demand has been increasing for the past few months. However, Zhao did not rule out some consolidation close to the round figure of $10,000, which is a psychological resistance.

Tron CEO Justin Sun is bullish on the long-term prospects of cryptocurrencies and believes that Bitcoin can cross $100,000 in 2025. According to Sun, the bull market in Bitcoin is also likely to pull other altcoins higher. However, Berkshire Hathaway CEO and Chairman Warren Buffet does not share the enthusiasm of Sun. Buffet said that he does not have any cryptocurrency and would never buy one because according to him, they have zero value and they do not produce anything.

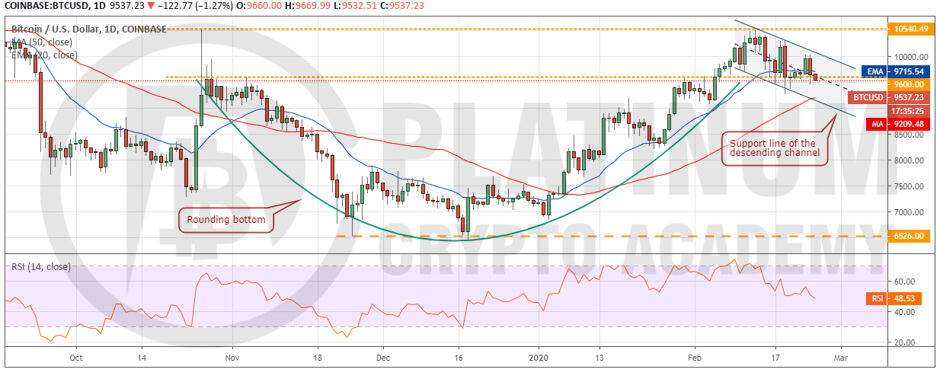

BTC/USD

The price turned down sharply on February 19 and plunged to a low of $9,280.98. This is a negative sign. Currently, the price is trading inside a descending channel. The bears are attempting to sink and sustain the price below the $9,600 support.

If successful, Bitcoin can dip to the support line of the channel, close to $9,200. The 50-day SMA is also close to this level at $9,210. Hence, we expect the bulls to defend this support aggressively.

The 20-day EMA has flattened out and the RSI has dipped to the midpoint, which suggests a consolidation for a few days. However, if the bears sink the price below $9,078.05, the sentiment will turn hugely negative and a drop to $8,200 will be on the cards.

Alternatively, if the price rebounds off the current levels or from the 50-day SMA and breaks above the channel, a retest of $10,522.51 is possible. A break above this level will signal resumption of the up move.

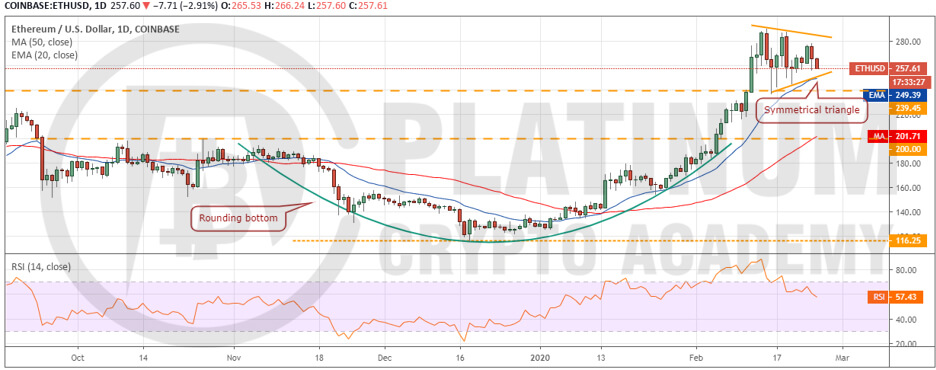

ETH/USD

Ether is one of the stronger major cryptocurrencies as it has not given up much ground from its recent highs. This shows that the bulls are in no urgency to close their positions. The price is currently trading inside a symmetrical triangle.

Though the triangle usually acts as a continuation pattern, it is difficult to predict the direction of the breakout. Therefore, the traders should be ready for both eventualities.

If the bulls can push the price above the triangle, the uptrend is likely to resume. The setup has a minimum target objective of $343.63. Both moving averages are sloping up and the RSI is in the positive territory, which suggests that bulls have the upper hand.

However, if the bears sink the price below the triangle, a drop to $236.37 and below it to $200 is possible. We anticipate the bulls to defend the $200 levels aggressively.

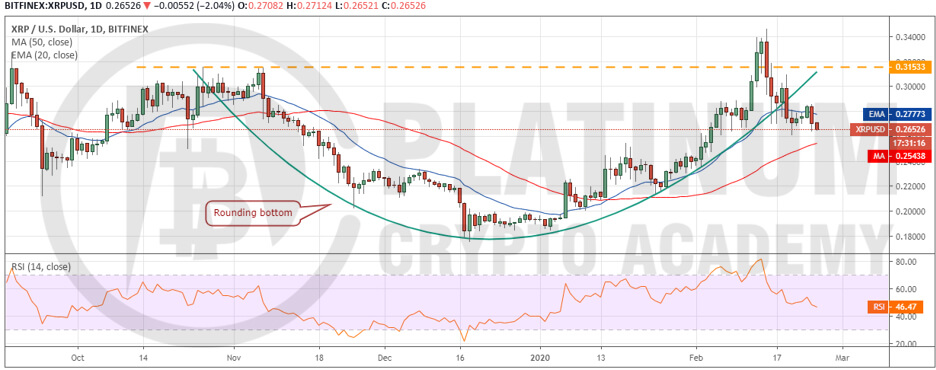

XRP/USD

XRP is among the weaker cryptocurrencies. It has dropped about 22.5% from its recent highs of $0.34639. The failure of the bulls to sustain the price above the 20-day EMA shows a lack of demand at higher levels.

The cryptocurrency can now drop to the 50-day SMA at $0.25. If this support also cracks, the decline can extend to $0.21411. The 20-day EMA has started to turn down gradually and the RSI has dipped below the 50 levels, which shows that the bears are making a comeback.

Our bearish view will be invalidated if the bulls defend the support at $0.26 and push the price above $0.28578. Above this level, a move to $0.31533 is possible. The cryptocurrency will pick up momentum after the price sustains above $0.31533.

BCH/USD

The bounce off the support at $361.67 fizzled out at the 20-day EMA on February 24. This shows that the bears are back in action. They are aggressively selling at the 20-day EMA. The price is likely to retest the support at $361.67 once again.

If the bears can sink Bitcoin Cash below this support, it will be a huge negative and can drag the price to $296.69. We expect the bulls to defend this support aggressively. Nonetheless, if this support also cracks, a drop to $200 will be on the cards.

Conversely, if the altcoin rebounds off $361.67, the bulls will once again attempt to push the price above the 20-day EMA. If successful, a move to $428.09 is possible. A break above this level will open the doors for a rise to $500.

We had suggested traders buy the dip to $361.67 and sell closer to $500. If the traders are holding long positions, they can keep the stop loss at $350. Long positions should be avoided if the $350 level cracks.

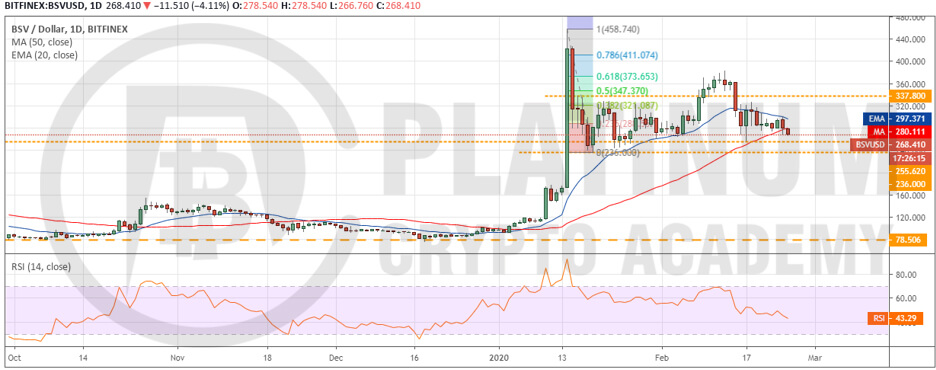

BSV/USD

Bitcoin SV has been trading below the 20-day EMA since February 16. This shows that the bears are aggressively selling any pullback to the 20-day EMA. The moving averages are on the verge of a bearish crossover, which is a negative sign.

The price can now retest the support at $236. If the bears can sink the price below this level, the trend will turn negative. The next support on the downside is $173.66.

However, if the bulls defend the support at $236, Bitcoin SV might remain range-bound for a few more days. It will signal strength above $337.80 and is likely to pick up momentum after it scales above$382.47.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.