Hi Crypto Network,

The total market capitalization of the crypto space rallied from about $184 billion on Jan. 3 to a high of $250 billion on Jan. 19. That is a 35% gain within a short span of time. Usually, fast-paced rallies do not last long, hence, for the long-term health of the markets, it is better to have rallies with intermittent corrections.

Bitcoin has been following the Stock-to-Flow model fairly accurately. The model’s creator, an analyst known as PlanB, believes that the price of Bitcoin is likely to average around $8,200 until the halving event in May of this year. Thereafter, the model projects the price to shoot up to about $100,000 within two years. While the target is extremely bullish, only time will tell whether Bitcoin reaches there or not.

Acclaimed veteran trader Peter Brandt believes that Bitcoin has bottomed out and is unlikely to drop to $6,000. In a market discussion with Cointelegraph, Brandt said that the fall in Bitcoin’s price has driven the weak hands out of the market and the strong hands have accumulated at the recent lows. Brandt also advised crypto traders not to aim for short-term gains but position themselves for long-term gains in Bitcoin.

With China moving closer to launching a digital yuan, the US Securities and Exchange commissioner Hester Peirce said that a lot of innovations are happening in China as the government there recognizes the potential of the technology. She called upon the US to learn from it.

The crypto markets have currently entered a corrective phase. Let’s look at the critical levels to watch on the downside that can provide support.

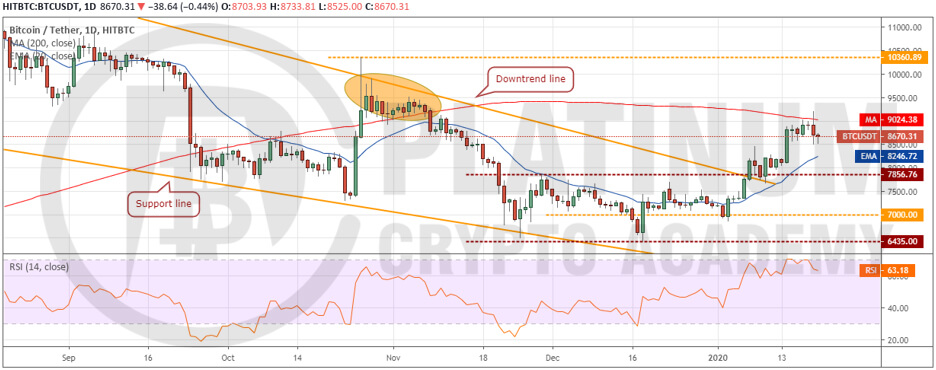

BTC/USD

The bulls scaled above the 200-day SMA at $9,036 on Jan. 19 but could not hold on to the gains. The price quickly turned down and Bitcoin (BTC) formed an outside day candlestick pattern, which suggests that bears are active at higher levels.

The price can now dip to the 20-day EMA at $8,247, which is likely to act as a strong support. The upsloping 20-day EMA and the RSI in the positive territory suggest that bulls are in command.

If the price bounces off sharply from the 20-day EMA, the bulls will again attempt to carry the BTC/USD pair above the 200-day SMA. If successful, a rally to $10,360.89 will be on the cards.

Contrary to our assumption, if the bears sink the price below the 20-day EMA, a drop to $7,856.76 is possible. This is an important level to watch out for because if it breaks down, the next support is at $7,000. For now, the traders can retain the stop loss on their long positions at $7,600.

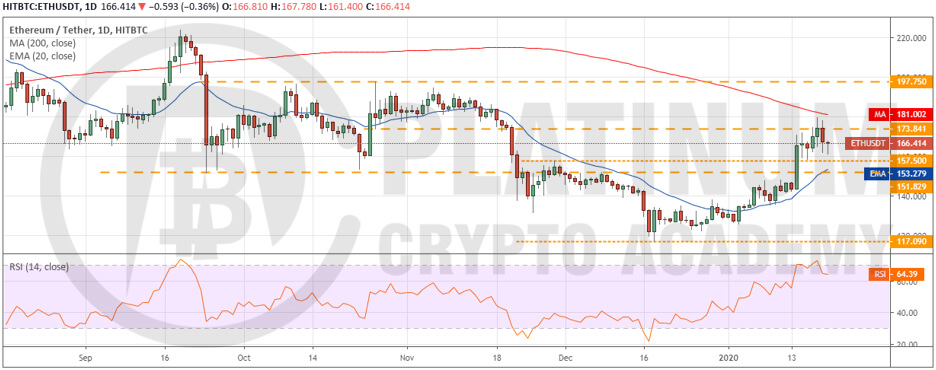

ETH/USD

Ether (ETH) broke above the overhead resistance at $173.841 on Jan. 18 and 19 but could not scale above the 200-day SMA at $182. This shows that the bears are aggressively defending the 200-day SMA.

The price turned down sharply on Jan. 19 but found support closer to $157.50. This shows that bulls are using the dips to accumulate.

With buyers emerging close to $157.50 and sellers near the 200-day SMA, the possibility of a range-bound action for the next few days increases. A break above the 200-day SMA can carry the ETH/USD pair to $197.75 while a break below $157.50 can sink the price to the 20-day EMA at $153.

The pair will turn negative on a break below $151.829. Therefore, traders can retain the stop loss on the remaining long positions at $150.

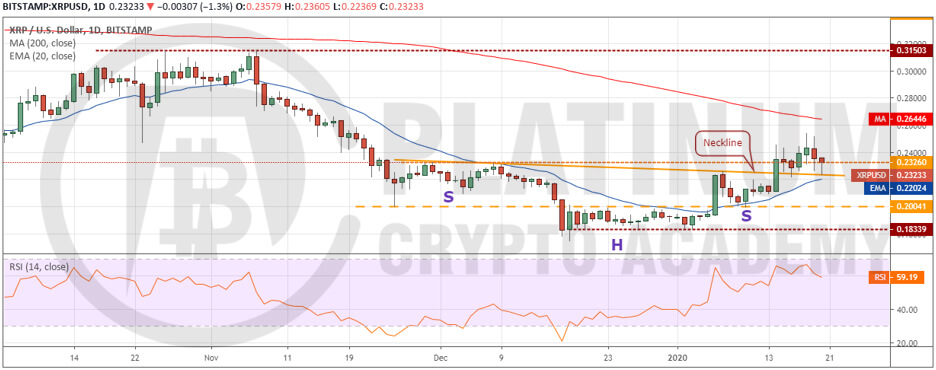

XRP/USD

XRP could not pick up momentum after breaking out of the neckline of the inverted head and shoulders (H&S) pattern. The altcoin turned down from $0.25401, which shows a lack of demand at higher levels.

The XRP/USD pair has bounced off the neckline of the bullish setup, which suggests that bulls are using the dips to accumulate. The 20-day EMA is placed just below the neckline, hence, this level is likely to act as a strong support. If the bulls can carry the price above the 200-day SMA, a move to $0.31503 is possible.

Conversely, if the bears sink the price below the 20-day EMA, a drop to $0.20041 is possible. For now, the traders can keep the stop loss on the long positions at $0.1995.

BCH/USD

Bitcoin Cash (BCH) rallied above the overhead resistance at $360 on Jan. 17. The bulls again pushed the price higher on Jan. 18 but could not reach our target objective of $423.40. The price turned down from $403.88.

The reversal on Jan. 18 dragged the price back below $360, which shows aggressive selling at higher levels. Currently, the price is stuck between $306.78 and $360.

If the bulls can push the price back above $360 a retest of $403.88 and above it $423.40 is possible. On the other hand, a break below $306.78 can drag the price to $270.15.

In our previous analysis, we had suggested traders trail the stops on the remaining long positions higher after the price broke above $360. We anticipate the trailing stops have been hit. The traders can wait for a new buy setup to form before initiating long positions again.

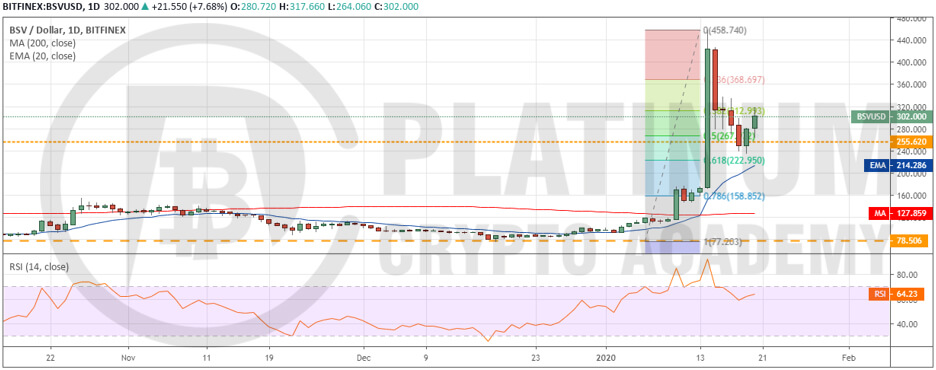

BSV/USD

Bitcoin SV (BSV) dipped below $255.62 on Jan. 18 but found support at $236, which is just above the 61.8% Fibonacci retracement level of the rally from $77.203 to $458.74. The bulls are currently attempting to resume the up move.

We anticipate the BSV/USD pair to hit a roadblock close to $335. If the price turns down from this level, the pair is likely to consolidate for a few days before making its next directional move.

Our view will be invalidated if the price turns down from the current levels or the overhead resistance and dips below the 20-day EMA at $214. As we expect a range-bound action for the next few days, we suggest traders remain on the sidelines.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.