Hi Crypto Network,

Bitcoin trading volume has picked up in the first few days of the new year. The 7-day average daily trading volume has surged by 126%, according to market research firm Arcane Research. This shows that the new year is seeing some fresh allocations into the crypto space.

The CME Group tweeted that Bitcoin futures open interest in the first four trading days of 2020 was higher by almost 69% compared to year-end 2019. This shows that institutional investors have also been active in the new year. We expect the institutional activity to increase further with the launch of Bitcoin futures options trading by the CME Group on January 13.

Analysts at market research firm Fundstrat Global Advisors expect Bitcoin to rally over 100% in 2020. According to them, the positive effects of halving, due in May of this year, has not yet been priced in. Some of the other factors that can aid the rally are upcoming US Presidential elections later in the year and the worsening geopolitical situation.

The start to the new year has been positive with most major cryptocurrencies, led by Bitcoin, showing signs of bottoming out. What are the critical levels to watch out for? Let’s analyse the charts.

BTC/USD

Bitcoin broke out of the falling wedge pattern on January 6, which signals a change in trend from down to up. It followed it up with a break above the overhead resistance at $7,870.10 on January 7, which completed a double bottom pattern. This setup has a minimum target objective of $9,214.20.

The 20-day EMA is sloping up and the RSI is in the positive territory, which shows that bulls are in command. There is a minor resistance at $8,500, above which a move to $9,500 and above it to $10,540.49 is likely.

Contrary to our assumption, if the bulls fail to sustain the price above $8,500, the cryptocurrency can drop to $7,870.10, which is likely to act as a strong support. Our bullish view will be invalidated if the bears sink the price below the moving averages.

ETH/USD

Ether has pulled back to the downtrend line, which is likely to act as a stiff resistance. A breakout of this line will signal a trend change. The moving averages are on the verge of a bullish crossover and the RSI is in the positive zone, which suggests that bulls are back in the game.

Above the downtrend line, there is a minor resistance at $157.73 but we expect it to be crossed. The next target to watch out for is $200.

Conversely, if the altcoin turns down from the downtrend line, it can dip to the moving averages and below it to $131.80. The downtrend will resume on a breakdown of the recent low at $116.25. However, we give it a low probability of occurring.

XRP/USD

Though the bulls pushed XRP above the overhead resistance at $0.21262 on January 6, they could not build upon it. However, the positive thing is that the subsequent dip to the 20-day EMA was purchased. This shows that the sentiment has changed from sell on rallies to buy on dips.

The bulls have again pushed the price above $0.21262. If they can carry the price above $0.22555, a move to $0.2365 is possible. The altcoin is likely to pick up momentum on a breakout of $0.2365.

Our bullish view will be invalidated if the price turns down from the current level or from $0.2365 and breaks below the moving averages.

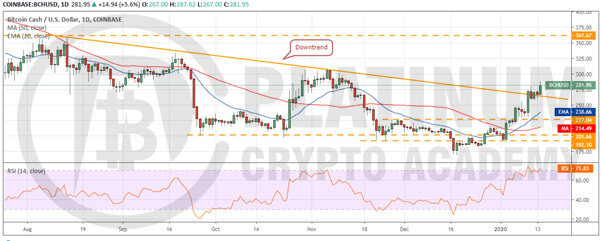

BCH/USD

The pullback in Bitcoin Cash has risen above the downtrend line, which indicates a change in trend. The upsloping 20-day EMA and the RSI in the overbought zone show that the bulls are in command.

There is minor resistance at $308.21 and above it $333.93 but we expect them to be crossed. The next target to watch out for is $361.67.

Our bullish view will be negated if the bulls fail to sustain the price above the downtrend line. If the price dips back below the downtrend line, it will indicate a lack of buyers at higher levels. A break below 20-day EMA will signal weakness.

BSV/USD

Bitcoin SV has rallied sharply from a low of $112.14 on January 9 to a high of $209 on January 14 at press time. That is 86% gains within six days. Due to the rally, the altcoin has become the fifth most valuable cryptocurrency in terms of market capitalization.

The cryptocurrency has been easily scaling above the overhead resistance levels, which shows that it is backed by momentum. If the bulls can sustain the price above $188.69, a dash to the lifetime high at $255.62 is likely.

We anticipate stiff resistance at the highs. The traders who own long positions should trail the stops closely because the rally is boosted by the news from the ongoing trial between Craig Wright and Ira Kleiman, brother to Wright’s deceased business partner David Kleiman.

Any adverse news is likely to see a sharp turnaround. A drop below $188.69 will be the first sign that the momentum is weakening.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur