Hi Crypto Network,

The reports of a Chinese crackdown on the Shanghai offices of the world’s leading crypto exchange Binance created FUD —fear, uncertainty, and doubt— among the traders. This resulted in a sharp drop in Bitcoin prices, which dragged the whole sector along with it. Though Binance issued a denial, it could not resurrect the prices.

Whenever Bitcoin prices fall, two sets of voices emerge. The naysayers are quick to write Bitcoin’s obituary while the optimists reiterate their support for cryptocurrencies. Peter Schiff tweeted that he spots a head and shoulders pattern. If the pattern completes, Bitcoin could plummet to $1,000 levels. On the other hand, Cardano founder Charles Hoskinson said that cryptocurrencies are the future and they will change the world. He anticipates Bitcoin to rise to $10k and eventually to $100k in the future.

Grayscale Investments, the asset management subsidiary of Digital Currency Group, aims to achieve the status of a reporting company if approved by the United States Securities and Exchange Commission. Grayscale’s managing director Michael Sonnenshein said that in Q3 of this year, 84% of the inflows into the fund were from non-crypto hedge funds. This is a positive sign as it shows that institutional players are looking to diversify into the new asset class.

As we remain bullish on the long-term prospects of cryptocurrencies, we believe the traders should view the current fall as a buying opportunity. However, it is better to buy after a bottom has been confirmed instead of buying in a falling market. Do we spot a bottom on any of the major cryptocurrencies? Let’s analyse the charts.

BTC/USD

Bitcoin broke below the critical support zone of $7,701 to $7,427 on November 22, which triggered our suggested stop loss. The selling has dragged the price to the support line. This line had acted as a strong support previously, hence, we anticipate the bulls to defend it aggressively once again.

The rebound from the support line will face stiff resistance at the $7,427 to $7,701 zone and above it at the 20-day EMA. If the bulls push the price above the 20-day EMA, a move to the resistance line is likely. We will turn positive on a break above the resistance line.

However, if the price turns down from the 20-day EMA, the bears will attempt to resume the downtrend and extend the decline to $5,600. We will wait for a new buy setup to form before recommending a trade in it.

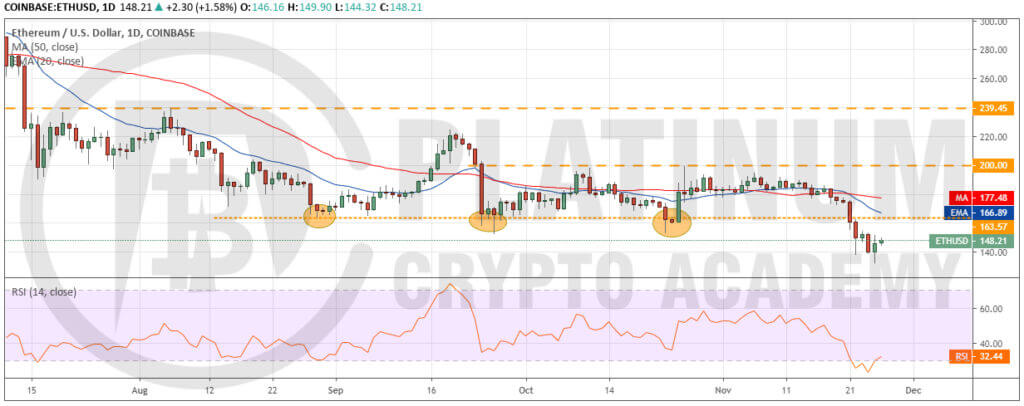

ETH/USD

Ether plunged below the support at $163.57 on November 21 and continued its downward journey, finally finding support close to $131.80. With the break of $163.57, the downtrend has resumed. However, from the oversold levels, the bulls are currently attempting a pullback, which is likely to face a stiff resistance close to $163.57.

If the price turns down from $163.57, the bears will attempt to sink the price below $131.80. If successful, a drop to the strong support at $120 is possible.

Our bearish view will be invalidated if the bulls push the price back above $163.57 and sustain it. Such a move will indicate that the current fall was a bear trap. We will wait for a new buy setup to form before recommending a trade in it.

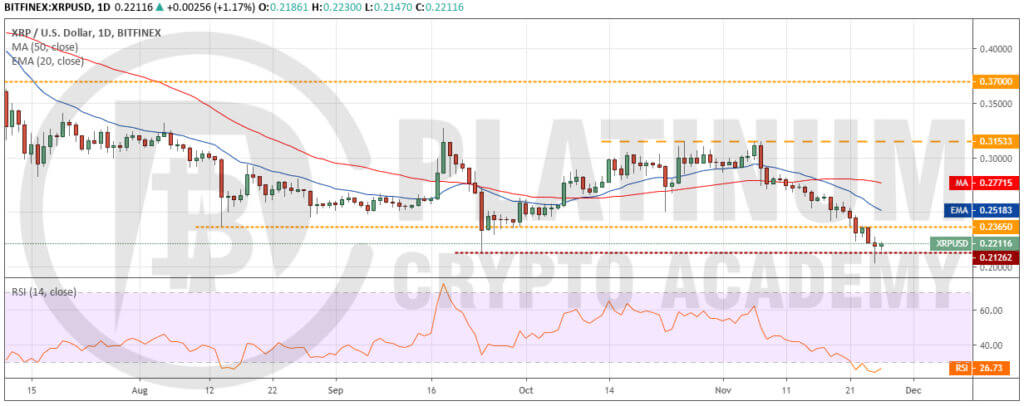

XRP/USD

XRP broke below the critical support at $0.2365 on November 22, which triggered our suggested stop loss at $0.23. The incessant selling dragged the price to a new yearly low at $0.20256, from where the bulls are attempting a rebound. The 20-day EMA is sloping down and the RSI is in the oversold territory, which shows that bears are in command.

If the price sustains above $0.21262, a pullback to the 20-day EMA is possible where we anticipate a stiff resistance. If the next dip slides below $0.20256, a fall to $0.17 is possible. A new low signals weakness. Therefore, we will wait for a reversal pattern to form before recommending a trade in it.

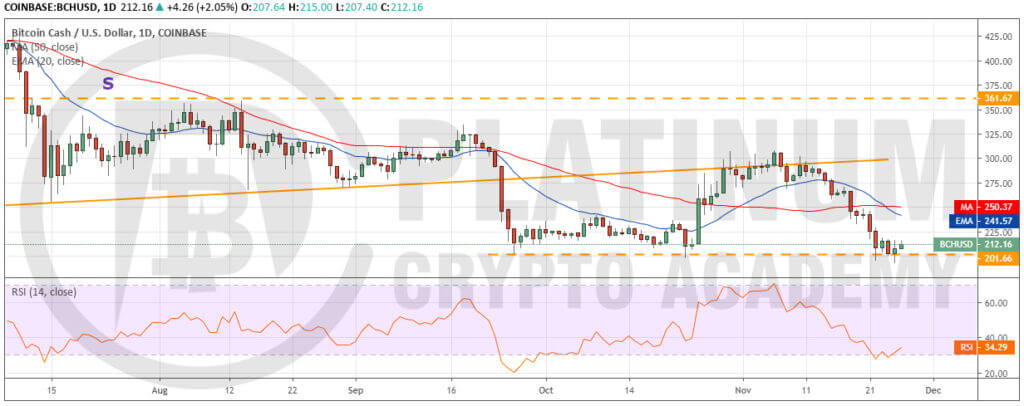

BCH/USD

Bitcoin Cash continued its journey southwards and reached the critical support at $201.66 on November 22. The attempts to sink the price below this support level did not materialise as selling dried up at lower levels.

The bulls are currently attempting a rebound off $201.66. We anticipate the recovery to face stiff resistance at the 20-day EMA, which is sloping down. The next down move will give us a better idea whether the bottom is in place or not.

If the price slips and sustains below $201.66 in the next fall, the decline can extend to $166.98. Alternatively, if the next dip finds support above $201.66, it will indicate demand at lower levels. We will wait for a new buy setup to form before proposing a trade in it.

LTC/USD

Litecoin plunged below the $50.25 to $47.22 support zone on November 22, which triggered our suggested stop loss at $47. The subsequent attempts at recovery have been facing resistance at the previous support turned resistance of $47.22. With the 20-day EMA sloping down and the RSI in negative territory, the advantage is with the bears.

If the bulls fail to propel the price above the $47.22 to $50.25 zone, the bears will again attempt to resume the downtrend. A break below $42.16 can drag the price down to the strong support at $30.

Conversely, if the bulls can push the price back above $50.25 quickly and sustain it for three days, it will indicate that the current dip is a bear trap. That will offer an attractive buying opportunity. Hence, we will watch the price action for the next few days before suggesting long positions once again.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.