Hi Crypto Network,

The U.S. Securities and Exchange Commission (SEC) rejected the proposal for a Bitcoin ETF filed by Bitwise Asset Management in conjunction with NYSE Arca. According to the SEC, it was not convinced that the design was such that it will “prevent fraudulent and manipulative acts and practices.”

Though this was a negative development, we liked that the markets did not react negatively to this news.

The SEC dealt another blow when it secured a restraining order against the Telegram Group and its subsidiary TON, from selling or distributing its Gram tokens, which was to go live on October 31. Continued scrutiny and stiff opposition from the regulators around the world have forced several companies to break ties with Facebook’s Libra project. Within the past few days, Pay Pal, Visa, Mastercard, Stripe, eBay, Mercado Pago and Booking Holdings have left the project.

Among the slew of negative news, the chairman of the United States Commodity Futures Trading Commission (CFTC) Heath Tarbert gave the investors something to cheer about. He said that the CFTC views Ether as a commodity. He also said that forked entities – like Bitcoin Cash and Ethereum Classic – should be treated the same as the original asset. This move will remove regulatory uncertainty and attract institutional players who have been sitting on the sidelines to invest. Do we find any buy setups in any of the top five cryptocurrencies? Let’s analyse the charts.

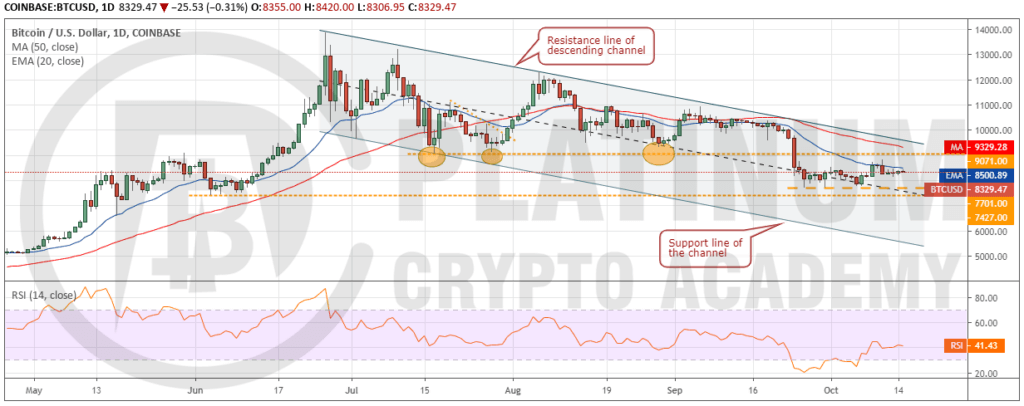

BTC/USD

Though Bitcoin broke above the 20-day EMA on October 11, the bulls could not sustain the higher levels. This shows that bears are defending overhead resistance levels. However, a small positive is that Bitcoin has not given up much ground and has been trading just below the 20-day EMA for the past three days. This indicates that buyers are entering on minor dips and are not waiting for a deeper fall to initiate long positions.

However, unless the bulls push the price above the 20-day EMA within the next couple of days, a dip to $7,701 will be on the cards. If the bears sink the price below $7,701-$7,427 support zone, a drop to the support line of the channel is likely. Such a move will be a huge negative and will rule out the possibility of a year-end rally.

Conversely, if the bulls propel the price above the 20-day EMA, a move to the resistance line of the channel is likely. A breakout of the channel will indicate a change in trend. Traders can initiate long positions as recommended in our previous analysis.

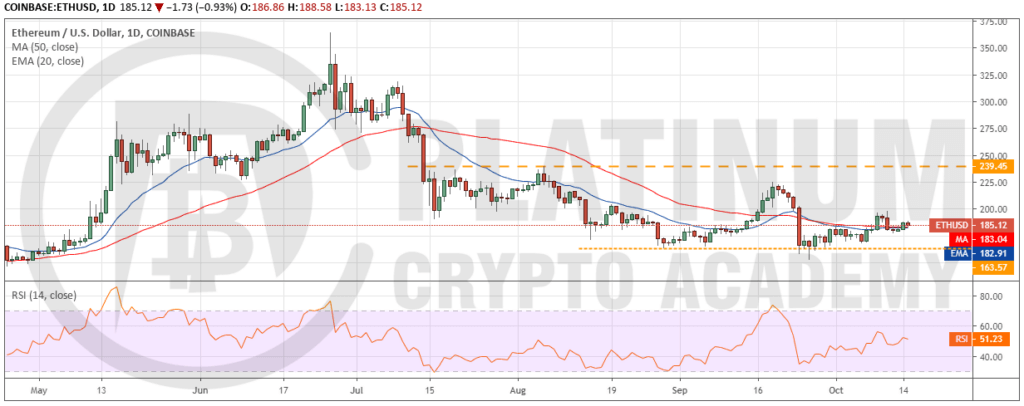

ETH/USD

Ether broke out and closed above the 50-day SMA on October 09, which triggered our buy recommendation given in the previous analysis. However, it could not build on the gains and quickly succumbed to selling pressure on October 11.

However, the bears could not sink the price much below the moving averages, which shows buying at lower levels. Currently, the price has again risen above the moving averages but lacks momentum. This indicates that Ether might consolidate in a tight range for the next few days.

If the consolidation ends with a drop below the critical support of $163.57, a retest of September 26 lows of 152.11 will be on the cards. If this level also cracks, the downtrend can extend to $122. Therefore, traders can protect their long positions with a stop loss of $163.

The advantage will tilt in favour of the bulls if they can propel the price above $197.93. Above this level, a rally to $224.71 and above it to $239.45 is possible.

XRP/USD

XRP broke out of the overhead resistance at $0.28524 on October 14. This triggered our buy recommendation given in the previous analysis. The cryptocurrency can now move up to $0.32732 and above it to $0.37. The 20-day EMA is sloping up and the RSI has jumped into the positive territory, which shows that bulls have an advantage in the short-term.

Contrary to our assumption, if the bulls fail to sustain the price above the moving averages, a dip to $0.2365 is possible. If this level cracks, a retest of $0.21262 is likely. Therefore, traders can keep the stop loss on the long position at $0.23. If the price moves up to $0.32732, the traders can trail the stops higher to reduce their risk.

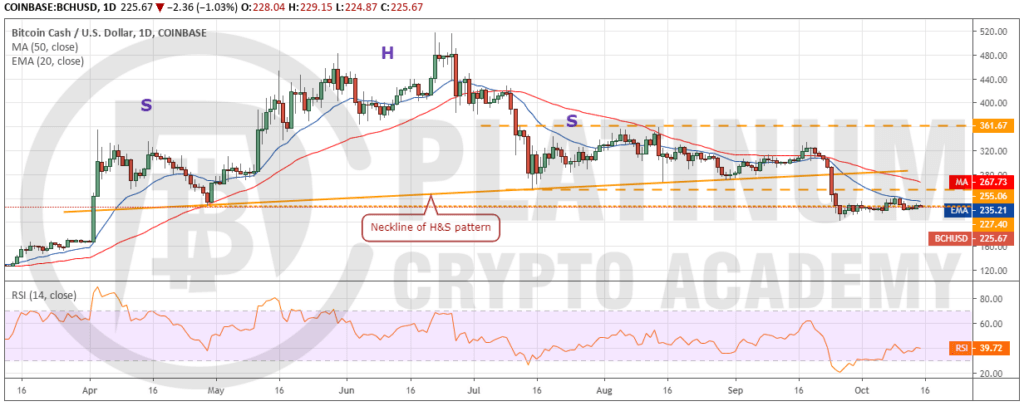

BCH/USD

Bitcoin Cash has been trading close to $227.40 for the past few days. This shows a balance between the bulls and the bears. Both parties are uncertain of the next direction, hence, they are playing it safe. The bulls are not buying aggressively because the cryptocurrency has broken down after forming a bearish setup. On the other hand, the bears are not selling aggressively because the price has not picked up momentum after breaking down of the head and shoulders pattern.

If the bulls can push the price above $242, a rally to the 50-day SMA and above it to the neckline of the H&S pattern is likely. We anticipate a stiff resistance at this level. If the price turns down from the neckline, the bears will attempt to resume the down move. However, if the bulls can scale the price above the neckline, a move to $361.67 is likely.

On the contrary, if the bulls fail to propel the price above the 20-day EMA, the bears will attempt to sink the price below the immediate support of $201.66. A break below this support can drag the price to $166.98. We do not find any buy setups at current levels; hence, we remain neutral on it.

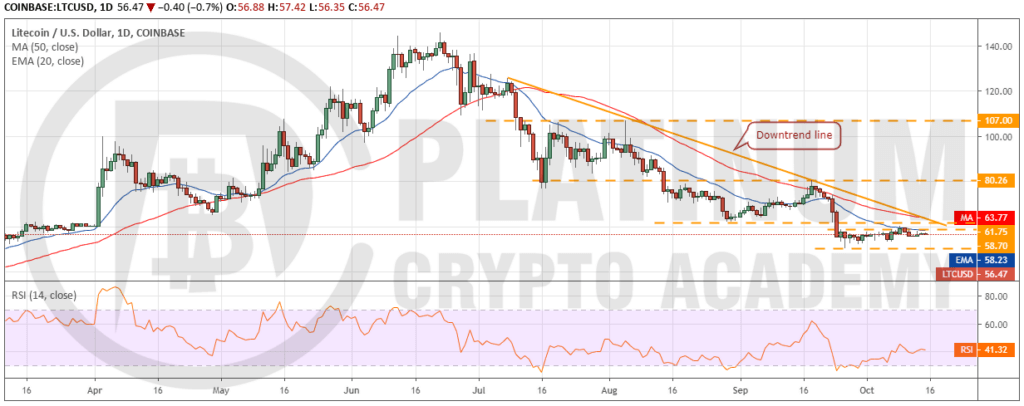

LTC/USD

Litecoin continues to consolidate between $58.70 and $50.25 for the past few days. This shows a balance between bulls and bears. If the bulls can push the price above $60.13, a rally to the downtrend is likely.

A break above the downtrend line and the 50-day SMA will indicate a change in trend. Therefore, traders can buy on a breakout and close above the 50-day SMA and keep a stop loss of $50. The first target on the upside is $80.26. If this level is scaled, the rally can extend to $107 in the long-term.

Conversely, if the consolidation resolves to the downside with a break below $50.25, the downtrend will resume and the next level to watch will be $40.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.