Hi Crypto Network,

German investment bank Deutsche Bank in its “The Future of Payments” reports has suggested that “cash is unlikely to disappear anytime soon”. However, the bank believes that cash is losing ground to digital solutions and “non-sovereign cryptocurrencies pose a threat to political and financial stability.”

The report also said that if China launches a digital yuan, it could pose a threat to the US dollar.

Bank of Japan deputy governor Masayoshi Amamiya has said that technical innovation is happening at a fast pace. If the public demand for a central bank backed digital currency soars in Japan, the central bank must be ready to issue it. This shows how several developed economies are toying with the idea of launching their own government-backed digital currency.

Meanwhile, the recovery in crypto prices is attracting institutional investors. Data from Skew shows that total Bitcoin futures open interest across major crypto exchanges has topped $4 billion. BitMEX at $1.43 billion and OKEx at $1.11 billion head the list. Even Bitcoin futures options volumes have picked up month-on-month, according to platform Deribit.

A huge open interest build up shows confidence among market participants that a rally is imminent. However, if the spot price fails to rally higher, it might lead to the liquidation of these positions, which in turn, will pressure the markets. Does the chart project a further rally or does it show the possibility of a pullback in the near-term? Let’s analyse the charts.

BTC/USD

The bulls are facing stiff resistance at $9,600. However, the positive thing is that they have not given up much ground, which suggests that the buyers are not hurrying to close their positions. The price might now dip to the 20-day EMA, which is likely to act as a strong support.

If the price bounces off the 20-day EMA, Bitcoin is likely to break above $9,600 and rally towards its target objective of $10,540.49. Both moving averages are sloping up and the RSI is in the positive territory, which suggests that bulls have the upper hand.

We also spot a rounding bottom pattern that will complete on a breakout and close (UTC time) above $9,600. This bullish setup has a target objective of $12,770.

The momentum will weaken if the bears sink the price below the 20-day EMA. Below this level, the decline can extend to the next strong support at $7,870.10. If this level cracks, the trend will turn in favour of the bears.

ETH/USD

The bulls have carried Ether to the overhead resistance at $200. We expect the bears to defend this level aggressively. The price might now dip to the immediate support at the 20-day EMA.

If the price bounces off this support, the possibility of a break above $200 increases. We spot a possible rounding bottom formation, which will complete on a breakout and close (UTC time) above $200. This setup has a target objective of $283.75.

However, the bulls might face stiff resistance at $224.71 and again at $239.45. Therefore, traders should watch these levels closely. Our bullish view will be invalidated if the bears sink the altcoin below the 20-day EMA and the critical horizontal support at $157.73.

XRP/USD

XRP surged on February 2 and broke above the overhead resistance at $0.25457. However, the altcoin failed to pick up momentum, which shows a lack of buyers at higher levels. The failure to sustain the price above $0.25457 is likely to drag it to the 20-day EMA.

The bulls have held the dips to the 20-day EMA since January 27. Therefore, we expect the bulls to defend this support once again. If the price bounces off the 20-day EMA, the buyers will once again attempt to carry the price to the first target objective of $0.282. Above this level, the rally can extend to $0.31533.

Conversely, if the bears sink the price below the 20-day EMA, the digital currency can dip to $0.21262. A break below this level will be a huge negative and will turn the trend in favour of the bears.

BCH/USD

Bitcoin Cash has been consolidating between $363 and $396 for the past few days. This is a positive sign as it shows that the traders are buying the dips to the support at $361.67. A consolidation near the overhead resistance increases the possibility of a breakout of it.

If the bulls can scale the price above $405, the uptrend will resume. The next level to watch out for will be $440 and above it $500. With both moving averages sloping up and the RSI in positive territory, the advantage is with the bulls.

Contrary to our assumption, if the bears sink the price below the 20-day EMA, the cryptocurrency will lose momentum. The trend will turn negative on a break below the recent low at $296.69.

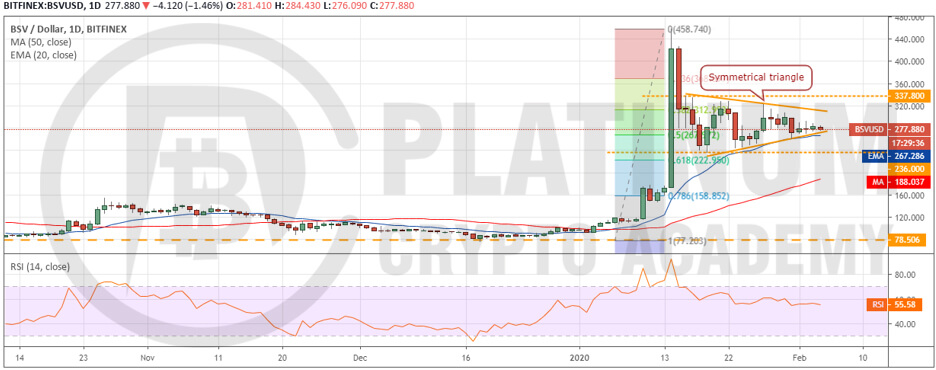

BSV/USD

Bitcoin SV has been trading inside a symmetrical triangle for the past few days. Usually, this setup behaves as a continuation pattern but sometimes, it even acts as a reversal pattern. Therefore, it is advisable to take positions only after the price breaks out of the triangle.

For the past four days, the bulls have been holding the support line of the triangle. However, they have not been able to achieve a strong bounce off it. This shows a lack of demand at higher levels.

If the price does not move up within the next couple of days, the bears are likely to sink the price below the triangle. Following the breakdown, the next support to watch out for is $236. If this support also cracks, the decline can extend to $158.852.

Conversely, if the bulls can carry the price higher, a breakout of the triangle is possible. Above the triangle, a move to $337.80 is likely.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.