Hi Crypto Network,

The crypto markets have emerged as a reliable alternative asset class during the current crisis. Along with gold, institutional investors have been flocking to Bitcoin. Traders boosted the price of Bitcoin on reports that President Trump has threatened to call the military to control the violent protests in several US cities. This news sent the price of Bitcoin skyrocketing above $10,000.

Crypto fund manager Grayscale Investments, which counts institutional investors as its major clients has been buying Bitcoin at a frantic pace. Since halving, Grayscale has purchased Bitcoin at a rate equivalent to 150% of the newly mined Bitcoin. This shows how with limited supply, any increase in demand could send crypto prices higher.

However, Goldman Sachs does not share a positive view of Bitcoin. In a leaked presentation to its clients, Goldman has said that “cryptocurrencies including Bitcoin are not an asset class.” They also warned against the high volatility in cryptocurrencies. Ironically, Bitcoin is one of the best-performing assets in 2020.

In the past few days, select altcoins have outperformed Bitcoin. This is an encouraging sign as it shows that the market participants are accumulating altcoins along with Bitcoin to hedge their portfolio. Let’s study the top five major cryptocurrencies and see if we can spot any buying opportunities.

BTC/USD

Bitcoin did not correct to the 50-day SMA as we had anticipated but it turned around from $8,632.93 on May 25. It formed a symmetrical triangle, which is a continuation pattern. With the strong breakout on June 1, the uptrend has resumed.

The pattern target of the triangle breakout is $11,772.3. However, the bears are unlikely to give up the $10,500 level without a fight. The bears have stalled the recovery at this level previously, hence, the bulls will have to put in the extra effort to scale it.

Currently, the price has pulled back from $10,428 levels but if the bulls can defend the $10,000 level, the BTC to USD pair is likely to break out above $10,500 and resume the uptrend.

The upsloping moving averages and the RSI in the positive territory suggest that bulls are in command.

Conversely, if the pair breaks below $10,000, a retest of the breakout level of the triangle is likely. If the pair bounces off this support, the bulls will make another attempt to break above $10,500. The rebound off the triangle could offer a buying opportunity to the traders who don’t own any positions.

However, if the price plummets back into the triangle, it will suggest that the current breakout was a bull trap. Hence, traders should avoid buying on the way down and should wait for the bounce to sustain before initiating long positions.

ETH/USD

We had recommended traders to buy on a breakout and close (UTC time) above the neckline of the inverse head and shoulders pattern in our previous analysis as we had anticipated a move to $255.

Traders who had bought on our suggestion would be sitting on profits. The trend remains up and in control of the bulls. If the momentum sustains, the ETH to USD pair can reach the resistance line of the ascending channel at $270.

Still, these are only possibilities. As the pattern target is close by, traders can book partial profits on their positions and trail the rest of the position with a suitable stop-loss.

This bullish view will be invalidated if the pair turns down from the current levels and breaks below the neckline. Such a move will indicate aggressive selling at higher levels.

XRP/USD

The bulls pushed XRP above the downtrend line on May 30. While this is a positive move, the higher levels are not attracting aggressive buying. This suggests that the bulls are not confident of a strong move up.

The only positive for the bulls is that they defended the downtrend line on May 31. This suggests buying on dips. If the buyers can drive the price above $0.21380, the XRP to USD pair is likely to rally to $0.22506 and then to $0.23571.

Aggressive traders can initiate long positions at $0.2150 with a stop-loss of $0.20. As the pair has been a huge underperformer in the past several months, the position size should be about 50% of usual.

The pair could pick up momentum on a break above $0.23571. That will offer an opportunity to the traders to add to their position or buy afresh.

Our bullish view will be invalidated if the pair turns down and plummets below $0.20. Below this level, a drop to $0.17426 is possible. If this level also gives way, the trend will turn down.

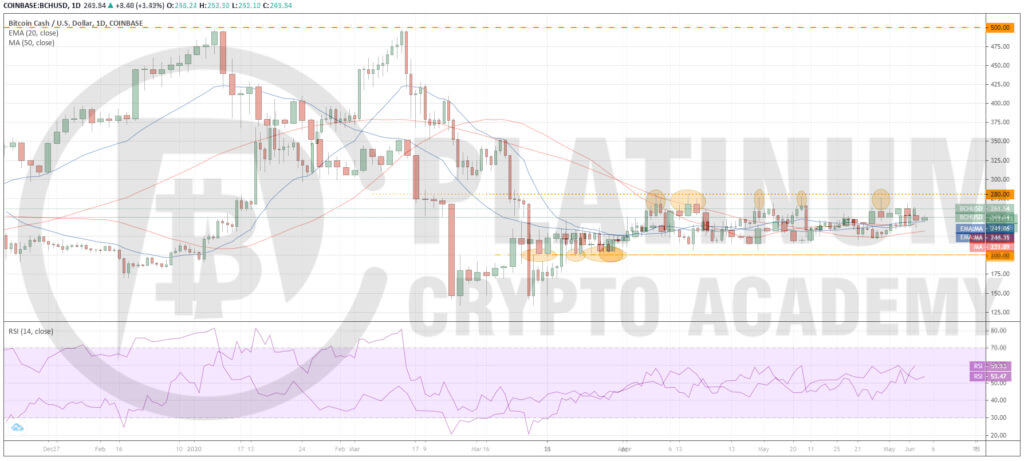

BCH/USD

Bitcoin Cash climbed above the moving averages on May 30. Although the bears attempted to sink the price back below the moving averages on May 31, the bulls bought the dip. This suggests that the sentiment has turned positive in the short-term.

The BCH to USD pair can now rally to $280. This level has been acting as a stiff barrier for the past many days. The price has turned down from this resistance on three occasions. Hence, the bears are likely to mount another strong defence at this level.

If the price turns down from $280, the range-bound trading is likely to extend for a few more days. Conversely, if the momentum can drive the pair above $280, it will signal the start of a new uptrend. Hence, this would offer a buying opportunity to the traders.

This view will be invalidated if the price turns down from the current levels and plunges below the moving averages. Such a move can drag the price back to $220.

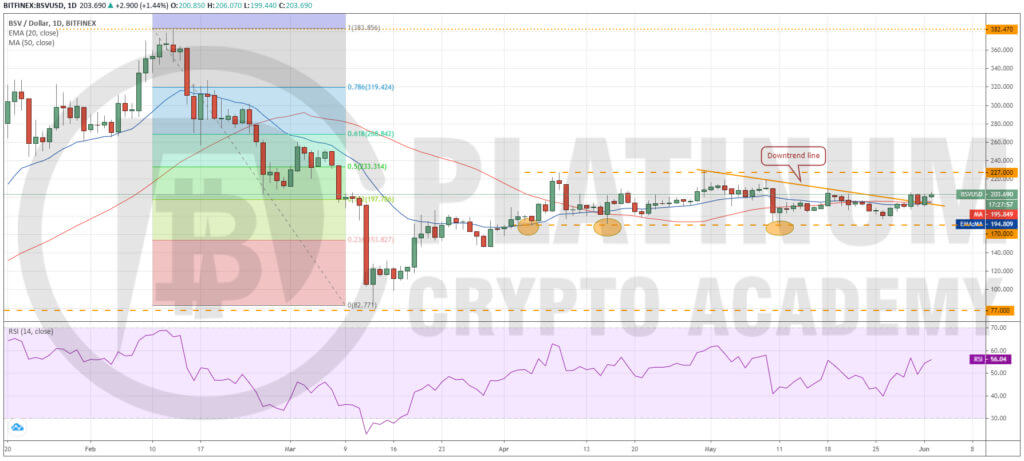

BSV/USD

Bitcoin SV continues to be one of the most listless major cryptocurrencies. It has been stuck inside the $170-$227 range for about two months. On May 30, the bulls pushed the price above the downtrend line, which suggests some buying interest is returning.

Although the bears attempted to sink the price back below the downtrend line on May 31, the bulls defended the level aggressively.

If the bulls can sustain the BSV to USD pair above $205, the momentum is likely to pick up. The next level to watch on the upside is $227. This level has acted as a stiff resistance on two previous occasions; hence, the bears will try to stall the rally at $227 once again. If successful, the range-bound trading will continue for a few more days.

On the other hand, if the bulls can push the price above $227, a new uptrend is likely. This could offer a buying opportunity to the traders.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.