Hi Crypto Network,

The coronavirus pandemic has resulted in a state of panic across the world. This has resulted in a sharp selloff in the equity markets, which have seen their worst corrections in decades. The commodity markets and even gold have not been spared in the carnage, which shows that the traders are not differentiating between risky assets and safe havens.

To counter the spread of the virus, various cities and in some cases, the whole nation has been locked down. This will put huge economic stress on the economy and some analysts expect that a recession is likely. The US Federal Reserve has launched a massive quantitative easing program and resorted to two emergency rate cuts this month. However, the equity markets have not obliged with a reversal.

This shows that the markets either want more stimulus or are not convinced that this is the right approach to tackle the current situation. While the added stimulus might provide some respite in the short-term, it is likely to pose a serious problem in the future, which might lead to another crisis.

The crypto markets, barring the massive sell-off on March 12, have been holding up quite well. This shows that long-term investors believe that this asset class will benefit the most as investors lose confidence in the central banks. In the short-term, cryptocurrencies might witness sharp volatile moves but this fall is one of the best opportunities to buy for the long-term. The traders can wait for a bottom to be confirmed before buying. Let’s analyse the charts of the major cryptocurrencies to spot the critical levels to watch out for.

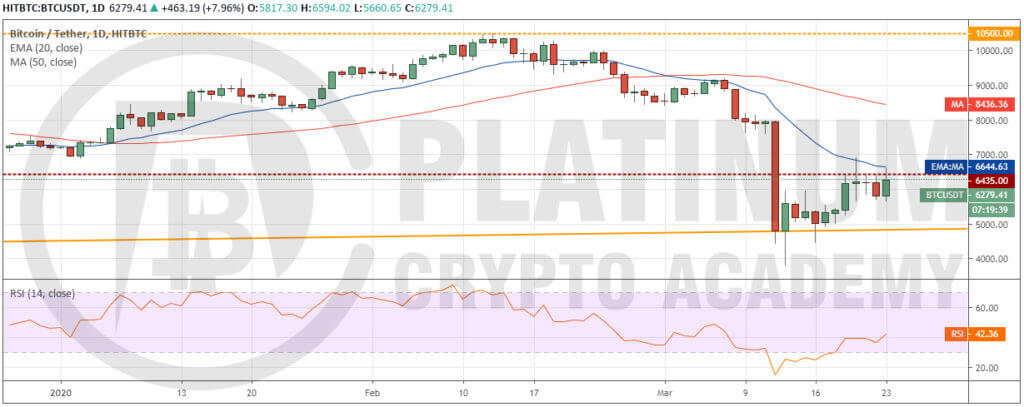

BTC/USD

Bitcoin (BTC) turned down from the 20-day EMA at $6,835 on March 20. However, since then, the price has been consolidating close to the overhead resistance at $6,435. This is a positive sign as it shows that the bulls are not closing their positions in a hurry.

Consolidation near the critical resistance increases the possibility of a breakout of it. Therefore, we anticipate the bulls to push the price above the 20-day EMA. If the BTC/USD pair can close (UTC time) above the 20-day EMA, it is likely to rally to the 50-day SMA at $8,435.70.

Therefore, we suggest traders buy on a close (UTC time) above the 20-day EMA and keep a stop loss at $5,600.

Contrary to our assumption, if the price again turns down from the 20-day EMA, a drop to $5,660 is possible. Below this level, a drop to $5,000 is likely.

ETH/USD

Ether (ETH) is currently trading between $117.090 and $155.612. A bounce off the support at $117.090 can carry the price to the resistance at $155.612. The 20-day EMA is also located close to this level, hence, we expect the bears to defend this level once again.

If the price again turns down from $155.612, the ETH/USD pair will extend its stay inside the range. Nonetheless, if the bulls can push the price above $155.612, we anticipate a move to the 50-day SMA at $208.90.

Therefore, traders can buy on a close (UTC time) above $155.612 and keep the stop loss at $117. If this level cracks, a drop to $100 is possible.

XRP/USD

XRP turned down from $0.17595 on March 20. However, the bulls are attempting to keep the price above $0.1450. If successful, we expect the bulls to make another attempt to break above $0.17468.

On a close (UTC time) above $0.17468, the XRP/USD pair can rally to $0.23532 and above it to $0.250. Therefore, the traders can buy on a close (UTC time) above $0.17468 and keep a stop loss at $0.140.

Contrary to our assumption, if the price turns down from $0.17468 once again, a drop to $0.145 is possible. A break below this level will tilt the advantage in favor of the bears.

BCH/USD

Bitcoin Cash (BCH) has been struggling to break above the 20-day EMA at $236. However, the positive thing is that the bulls have not given up much ground. We expect the bulls to make another attempt to break above the 20-day EMA and the resistance line of the descending channel.

If successful, we expect a change in trend. Above the channel, a move to the 50-day SMA at $332 and above it to $400 is possible. Therefore, the bulls can purchase the breakout and close (UTC time) above the channel with a close stop loss at $196.

Contrary to our assumption, if the bulls fail to sustain the price above the channel, the BCH/USD pair might again dip down to $190 and below it to $166.

BSV/USD

Bitcoin SV (BSV) has been struggling to break above the 20-day EMA for the past three days. However, the positive thing is that the bulls have not given up much ground. This increases the possibility of a break above the 20-day EMA at $171.5.

If the BSV/USD pair breaks out and closes (UTC time) above the 20-day EMA, it can move up to the 50-day SMA at $242. Above this level, the up move can extend to $326.8.

Therefore, we suggest traders buy on a close (UTC time) above the 20-day EMA with a close stop loss at $146. A break below this level will be a huge negative as it can drag the price to $120 and below that to $100.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.