Hi Crypto Network,

The wait for a Bitcoin ETF just got a little longer. The United States Securities and Exchange Commission (SEC) has said that it needs more time to consider the proposed rule change and dish out a ruling.

Bitcoin’s price has hardly reacted to this news, which shows that the crypto markets have matured and are no longer influenced by the SEC’s decision.

The geopolitical events like protests in Hong Kong, Brexit, the ultra-dovish policies of central banks around the world and the trade war between the US and China are likely to affect the price action in Bitcoin.

As the popularity of cryptocurrencies increase, large number of corporations are looking to come up with their own crypto product. Though most of these are unlikely to be completely decentralized offerings, still the involvement of the large global enterprises will hasten the adoption of cryptocurrencies into the society.

It is not only the corporates who are trying to join the crypto revolution. Mu Changchun, deputy director at People’s Bank of China has said that China is ready with a prototype of a digital currency that adopts blockchain architecture. If China releases its own digital currency in the near future, it will force the other developed nations to have an accommodative stance on cryptocurrencies, which will be a huge positive. While the fundamental news is positive, is it a good time to buy? Let’s analyse the charts of the top five cryptocurrencies.

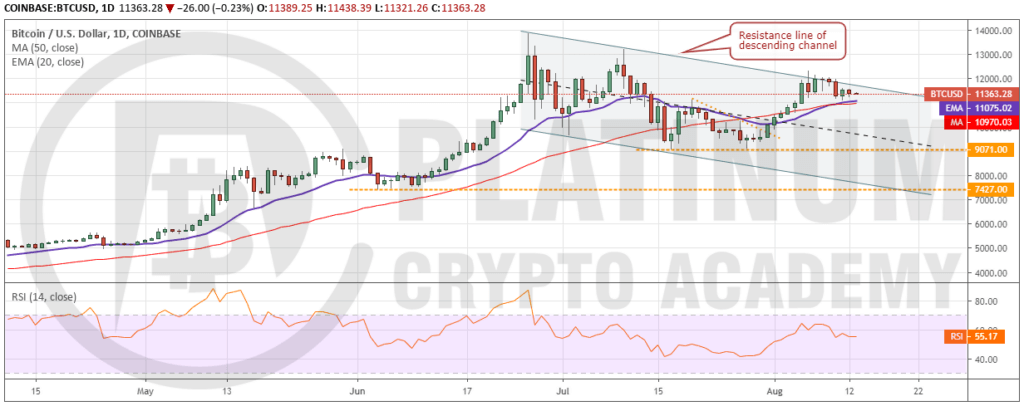

BTC/USD

Bitcoin has been consolidating near the resistance line of the descending channel as we had projected in our previous analysis. Though it has not broken out of the channel, we like the way it has held above the moving averages. This shows that bulls are in no hurry to book profits yet. We expect the cryptocurrency to make a decisive move this week.

If the price slides below both moving averages, the trend will weaken and a drop to $9,071 will be on the cards. $9,071 is an important level to watch because if this gives way, the fall can extend to $7,427.

Conversely, if bulls push the price above the channel and sustain the levels, a rally to $13,868.44 is possible. There is a minor resistance at $13,202.63 but we expect it to be crossed. Both moving averages are sloping up gradually and RSI is just above 50, which suggests that bulls have a slight advantage in the short-term.

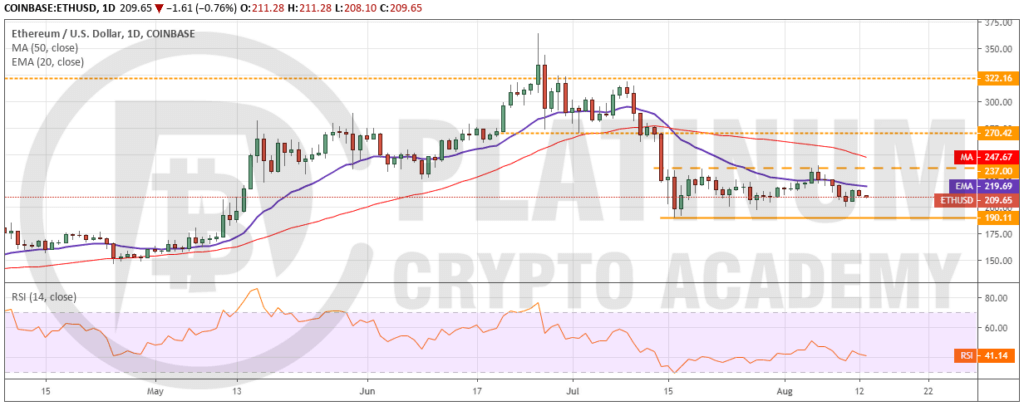

ETH/USD

Ether has been consolidating between $190.11 and $237 for about a month. The bulls failed to push the price above the resistance of the range on August 6, which shows a lack of demand at higher levels. Both moving averages are sloping down and RSI is in negative territory, which suggests that bears have the upper hand.

If bears sink the digital currency below $190.11, it will start a downtrend that can extend to $143.64. Therefore, traders who have initiated long positions on our earlier recommendation can keep the stop loss at $189.

On the other hand, if the support at $190.11 holds, Ether might extend its stay inside the range. The next up move will start on a breakout and close (UTC time) above $237. Following the breakout, the target to watch on the upside is $270.42 and above it $322.16.

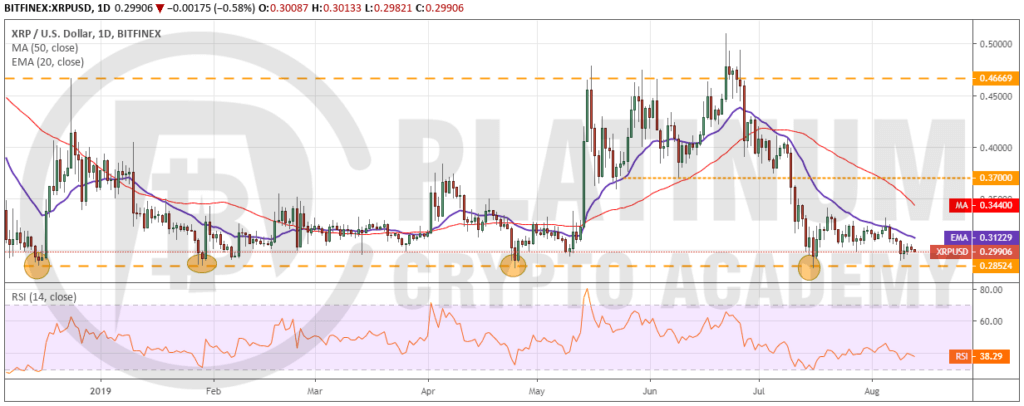

XRP/USD

The failure to breakout of 20-day EMA has attracted sellers and XRP is back below $0.30. It is likely to retest the support at $0.28524 in this week. If the support holds, bulls will try to push the price above 20-day EMA and carry it to the 50-day SMA. Such a move will signal demand at lower levels and might offer a buying opportunity if the cryptocurrency sustains above 50-day SMA.

On the other hand, if the support at $0.28524 breaks down, it will be a huge negative because this support has held on four occasions since mid-December last year. The next level to watch on the downside is $0.2280.

Both moving averages are trending down and the RSI continues to be in the negative zone. This shows that bears have the upper hand. Therefore, we suggest traders wait for a buy setup to form before attempting a long position in it.

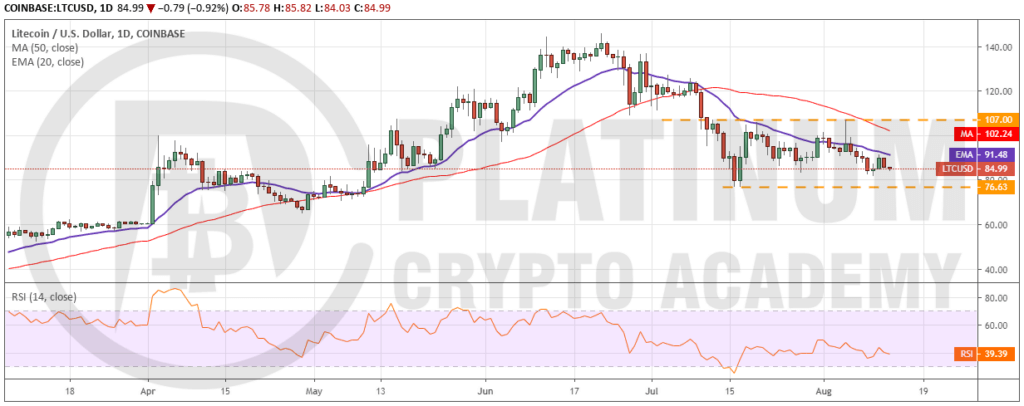

LTC/USD

Litecoin is looking weak. Both moving averages are trending down and RSI is in the negative zone, which shows that bears have the upper hand. The price can now dip to $76.63, which is a critical support. If this level breaks down, the cryptocurrency can plummet to the next support zone of $60-$64.

Conversely, if bulls defend the support at $76.63, a range-bound action for a few days is likely. The digital currency will signal strength on a breakout of $107. Above this level, we anticipate a move to $140. Though there is a minor resistance at $125, we expect it to be crossed. We will wait for the price to stop falling before proposing a trade in it. Until then, we suggest traders remain on the sidelines.

BCH/USD

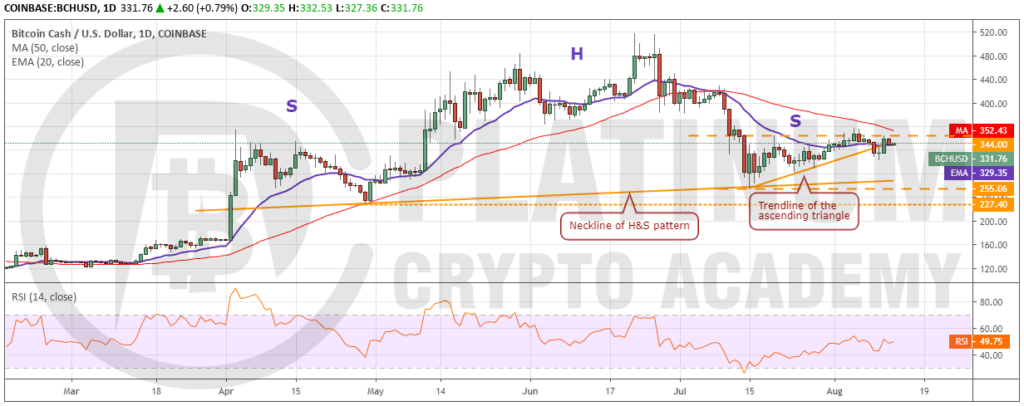

Bitcoin Cash has not been able to breakout and sustain above the overhead resistance of $344, which shows profit booking at higher levels. As the price has broken down of the trendline of the ascending triangle, the pattern is invalidated.

The bulls are currently attempting to push the price above $344 once again. The 50-day SMA is also placed just above $344. If the price scales above the 50-day SMA, it might run up to $432.94 and if this level is crossed, the next target is $500. Therefore, traders can buy on a breakout and close (UTC time) above 50-day SMA and keep the stop loss at $300.

However, if the price turns down from current levels and dips below $300, it can drop to the neckline of the head and shoulders (H&S) pattern. If the price closes (UTC time) below the neckline, the bearish H&S pattern will complete, which can result in a quick fall to $166.98 and lower.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.