Hi Crypto Network,

After innumerable delays, Bakkt finally announced that it will launch futures trading on September 13. This is a huge positive for the crypto community as it is likely to attract institutional investors.

This news stalled the slide in Bitcoin and other cryptocurrencies. The markets will keenly watch the interest Bakkt generates and if it is able to attract big players, we expect Bitcoin to resume the uptrend.

Another important project, Libra by Facebook has been caught in a regulatory tangle. However, leading cryptocurrency exchange Binance has announced a project on similar lines. Its open blockchain project “Venus” plans to develop localized stablecoins across the developed and developing nations. Binance is confident of clearing the regulatory hurdles backed by its established global compliance measures.

We anticipate Bitcoin to be buoyed by the news and events around the globe in the short-term. Hence, volatility is likely to remain high for a few days.

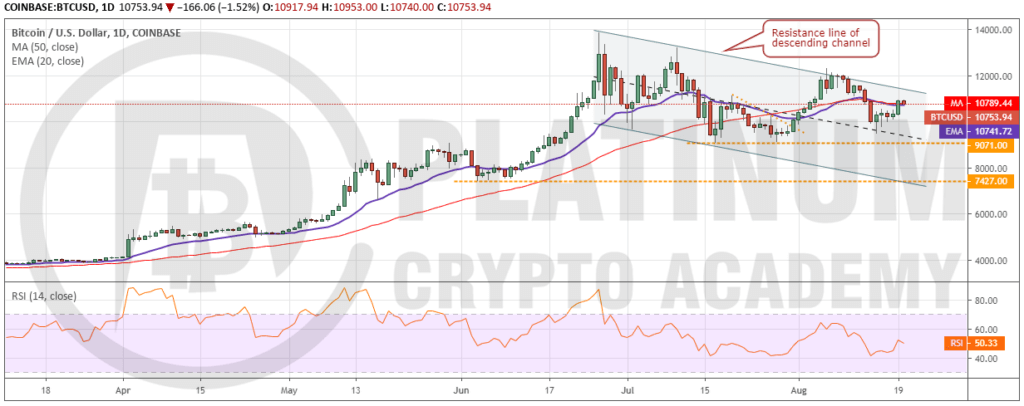

BTC/USD

Bitcoin turned down from the resistance line of the ascending channel on August 13 and broke below the moving averages. It declined close to the critical support level of $9,071 on August 15 but bounced off sharply from it. This is a positive sign as it shows that bulls are keen to buy on dips to strong support levels.

We now expect the bulls to again attempt to break out of the resistance line of the descending channel. If successful, we might see a change in trend and a rally to $12,000. Above this level, a move to $14,000 will be on the cards.

If the price sustains above the descending channel for three days, traders with a medium-term objective can initiate long positions with stops below $9,000. Short-term traders, however, can keep the stops just below the moving averages because if the cryptocurrency re-enters the channel, it will lose momentum.

Contrary to our assumption, if bulls fail to push the price above the descending channel, a retest of $9,071 is possible. A breakdown of this support will be a huge negative and can result in a fall to $7,427. Such a move will also dent sentiment and will delay the next leg of the up move.

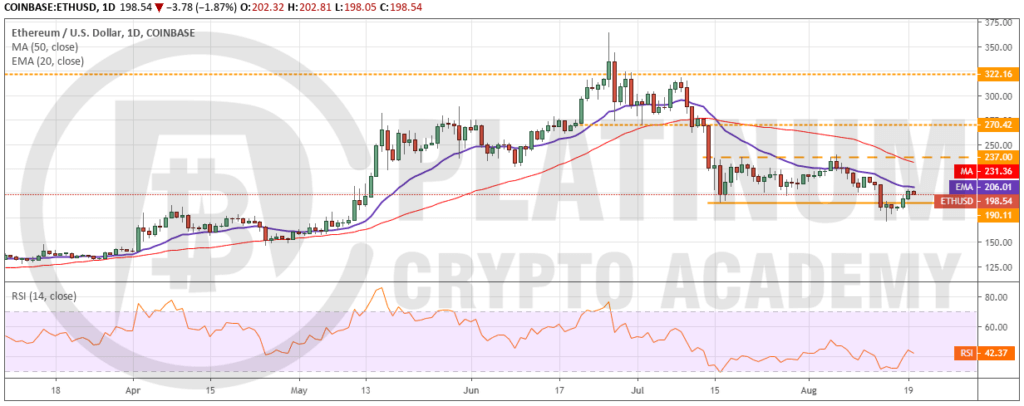

ETH/USD

Ether broke below the support of the range at $190.11 on Aug. 14 and triggered our recommended stop loss on the long position. However, the bears could not build up on the breakdown as the price quickly climbed back above the breakdown level. This shows strong demand at lower levels.

Currently, the recovery is facing resistance at 20-day EMA. If the price turns down from this level, bears will again attempt to break below the support zone of $190.11-$171. A breakdown of this zone can drag the price to $143.64.

Conversely, if bulls scale 20-day EMA, the cryptocurrency can move up to $237. This level has been a major roadblock for the bulls. Hence, we anticipate a stiff resistance once again. If the price turns down from $237, the digital currency might remain range bound for a few more days. However, if bulls propel the price above $237, we expect the uptrend to resume. We suggest traders wait for the price to sustain above $237 before buying.

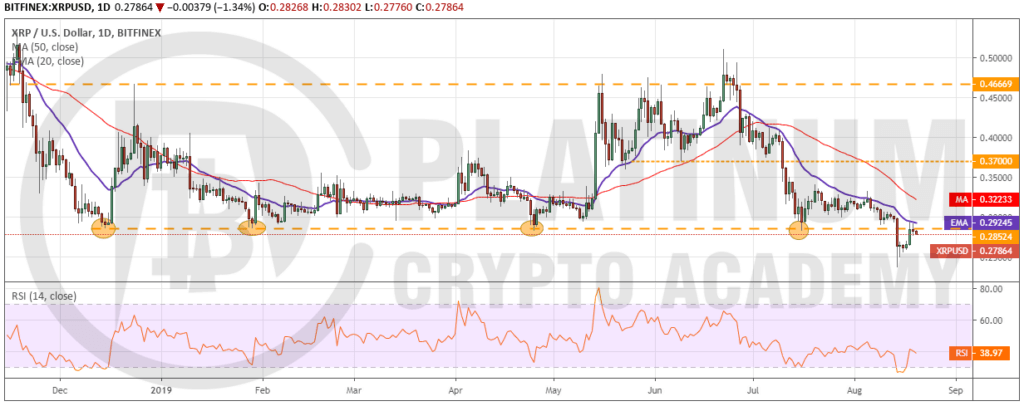

XRP/USD

XRP dropped to a new yearly low of $0.2365 on August 14, which was just above out target objective of $0.228, as suggested in the previous analysis. Currently, it is attempting to rise back above the breakdown level of $0.28524. If it re-enters the range and sustains it for three days, the latest breakdown will turn out to be a bear trap.

However, if the price turns down from 20-day EMA, the bears will try to resume the downtrend and sink it below $0.2365. Both moving averages are sloping down and RSI continues to be in negative territory. This suggests that the bears are still in command.

Therefore, we suggest traders wait for the price to breakout of 20-day EMA and sustain above it for three days before turning positive. The target objective on the upside is $0.37 and above it $0.46669.

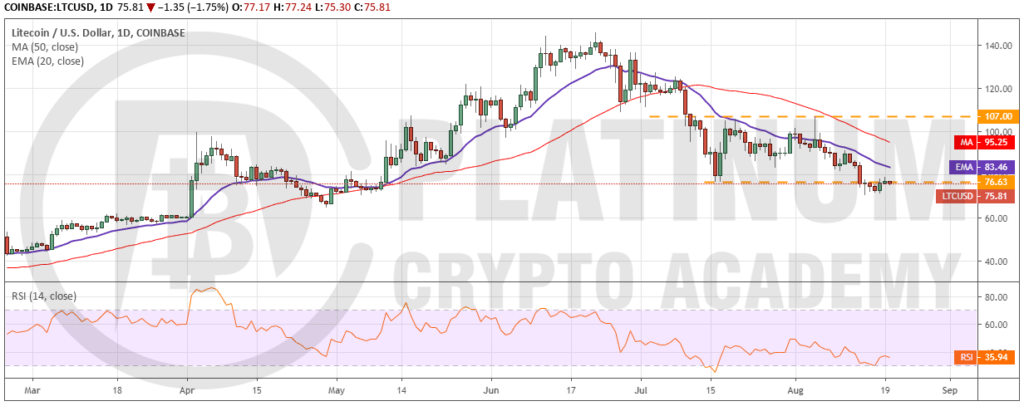

LTC/USD

Litecoin broke down of the support at $76.63 on August 14. This is a bearish sign. However, the price did not continue its downward journey because bulls are attempting to push the price back above $76.63.

If the price climbs back above $76.63, it will indicate buying at lower levels. A breakout and close (UTC time) above 20-day EMA will confirm that the downtrend is over. Above 20-day EMA, a move to 50-day SMA and above it to $107 is possible. As the range is large, we might suggest long positions for short-term traders to benefit from this up move. The trend will turn positive on a breakout and close (UTC time) above $107.

Conversely, if bulls fail to sustain above $76.63, we expect another round of selling by the bears, which is likely to drag the cryptocurrency to the next support zone of $60-$64.

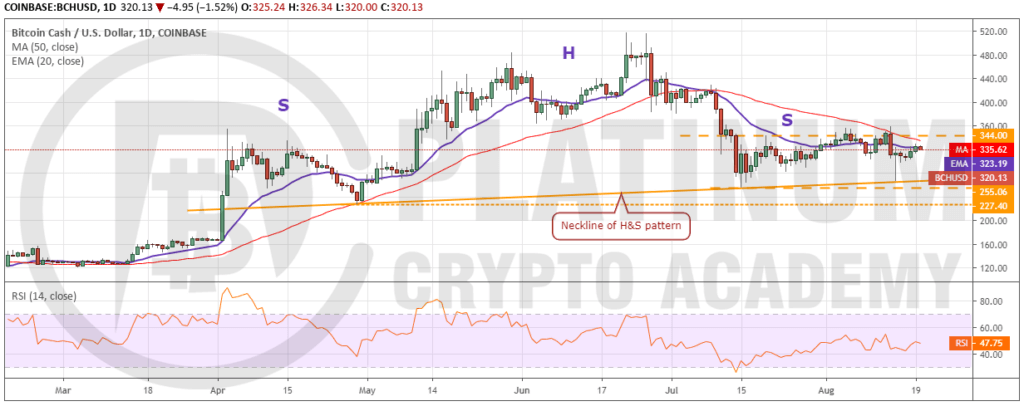

BCH/USD

Bitcoin Cash broke out of the 50-day SMA on August 14 but failed to close (UTC time) above it. Hence, our buy suggested in the previous analysis did not trigger. The failure to breakout of the overhead resistance attracted selling that dragged the price to the neckline of the head and shoulders (H&S) pattern on August 15. From there, the price bounced sharply, which is a positive sign. It shows that bulls are keen to defend this level. However, a failure to breakout and sustain above $344 might attract another round of selling and a retest of the neckline.

If the price breaks down and closes (UTC time) below the neckline, it will complete the H&S pattern, which will be a huge negative. The first support to watch on the downside will be $166.98.

On the other hand, if the cryptocurrency breaks out and sustains above $344, it is likely to pick up momentum and rally to $432.94. If this level is crossed, a retest of the yearly highs at $517.75 is possible.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.