Hi Crypto Network,

The trade war between the US and China has escalated in the past few days. After the US raised tariffs on Chinese products, China retaliated by weakening its currency, the yuan, to levels not seen since 2008.

This led to fears of a currency war between the top two economies of the world. The US Fed cut rates in its last meeting and might be forced to do more cuts if the trade war with China intensifies. This will debase the currencies and will attract investors towards cryptocurrencies.

Fundstrat Global Advisors co-founder Tom Lee believes that rate cuts by the US Fed and geopolitical issues can turn investors towards Bitcoin. Lee expects Bitcoin to reach its previous high of $20,000 by the end of this year.

In the short-term, Max Keiser, a former Wall Street trader and host of the RT program Keiser Report, believes that confidence in central banks and governments is at the lowest level in decades and this bodes well for Bitcoin. He believes the leading cryptocurrency can hit $15,000 in this week itself.

Along with being a store of value, investors are also using Bitcoin as a safe-haven asset. Its recent uptick along with the other perceived safe-haven assets underlines its growing clout. While the fundamentals are suggesting a resumption of the uptrend, what do the charts project? Let’s find out.

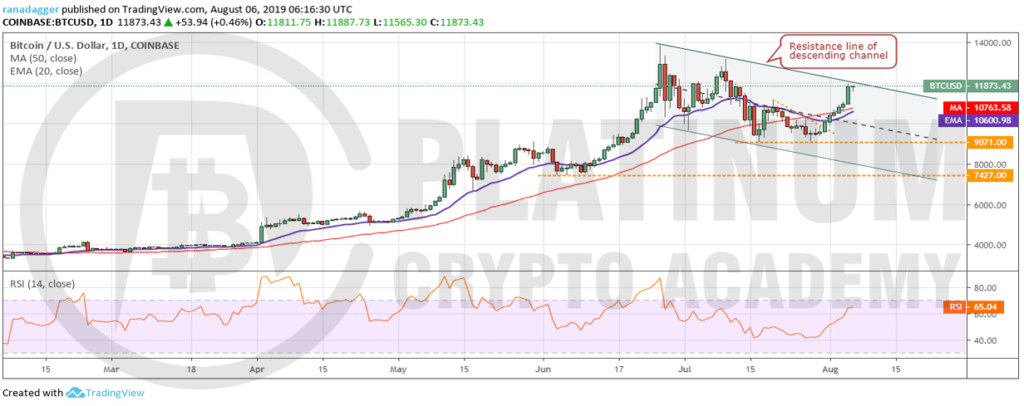

BTC/USD

Bitcoin is currently trading inside a descending channel. It bounced off the support at $,9071 on July 28 and rose above the 20-day EMA on August 01, which was a bullish sign. We had mentioned in our previous analysis that the digital currency will gain strength after it crosses 20-day EMA and that is what happened. Both moving averages are trending up and the RSI is in positive territory. This suggests that bulls have an advantage in the short-term.

The price has reached the resistance line of the descending channel, which might offer some resistance. If bulls propel the price above the channel, the digital currency can move up to the recent highs of $13,868.44. A breakout to a new yearly high will be a major positive as it will force the traders sitting on the sidelines to jump in. The next target on the upside is $17,178.

Our bullish view will be invalidated if bears defend the resistance line of the channel and plummet the price below both moving averages. In such a case, the cryptocurrency can again correct to $9,071. A break of this level can drag the price to $7,427.

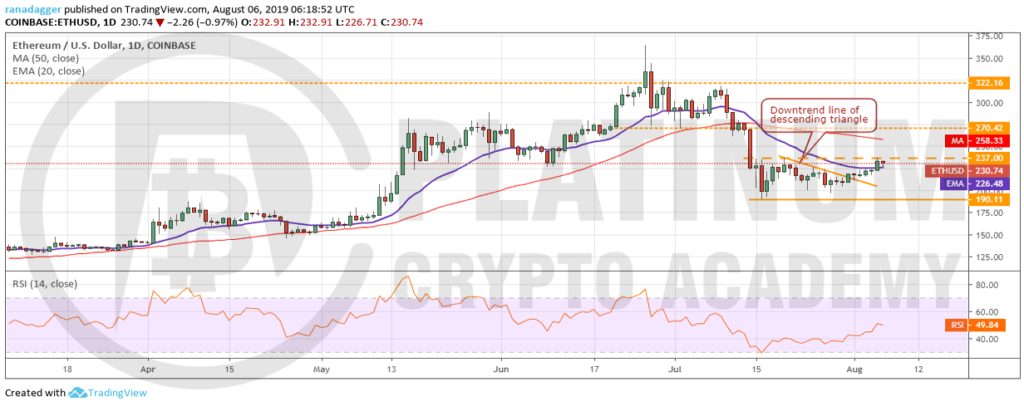

ETH/USD

The bulls broke out of the downtrend line of the descending triangle on July 31, after which the price continued to move up gradually. Though it scaled above the 20-day EMA on August 05, it has not been able to ascend the horizontal resistance of $237. The 20-day EMA has flattened out and the RSI has risen close to the centre, which points to a consolidation in the near term.

If traders have purchased on a close ( UTC time) above 20-day EMA, the stop loss can be kept at $189 because a break of this level can sink the cryptocurrency to $143.64. On the upside, if bulls push the price above $237, the rally can reach $270.42. If this level is scaled, a retest of $322.16 will be on the cards.

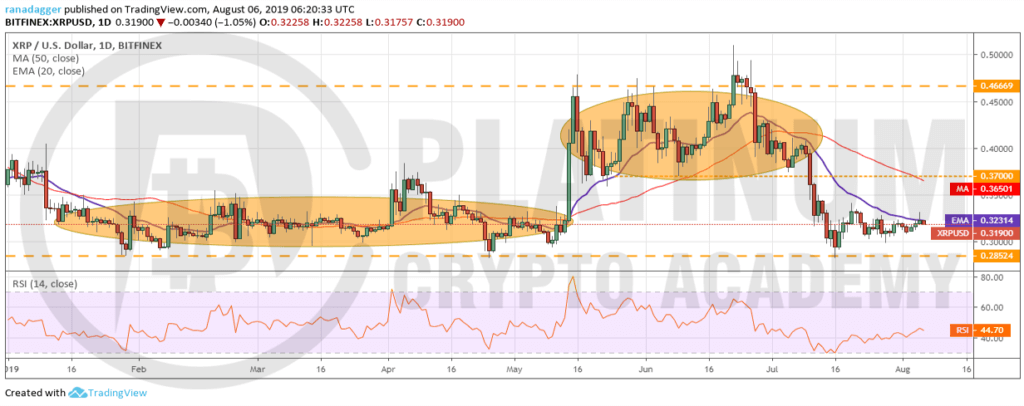

XRP/USD

Though bulls pushed the price above 20-day EMA on August 05, they could not sustain it. The price has again dipped below the moving average, which shows a lack of demand at higher levels. If bulls fail to propel the price above the 20-day EMA within the next two to three days, we expect bears to sink it back to $0.30. The 20-day EMA is sloping down and RSI is in the negative zone, which suggests that bears still hold the advantage.

However, if the cryptocurrency scales above 20-day EMA, it can move up to the 50-day SMA. The previous support of $0.37 will act as a resistance but once it is crossed, a move to $0.46669 is possible. As XRP is trading in a range and has been an underperformer in the past few months, we suggest swing traders wait for the price to sustain above 20-day EMA before initiating long positions. Nevertheless, investors can continue to hold their positions with the stops below $0.28524.

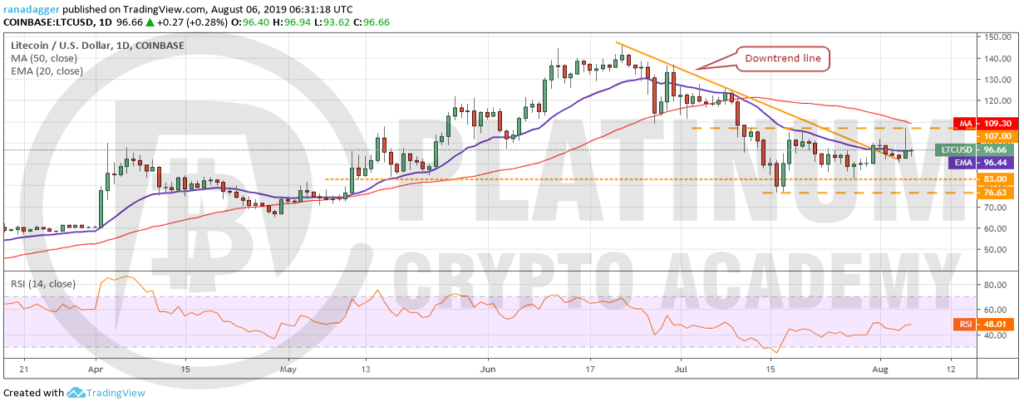

LTC/USD

Though Litecoin scaled above the downtrend line on July 31, bulls could not push the price above the critical overhead resistance of $107 on August 05. Hence, in our previous analysis, we had avoided suggesting long positions until the price scaled $107. The 20-day EMA is flattening out and the RSI is just below midpoint, which indicates a range formation for a few days.

Contrary to our assumption, if the cryptocurrency breaks out of $107, it is likely to pick up momentum and rally towards $125. Above this level, a retest of the recent highs at $146 is possible. On the other hand, if bears sink the price below the support zone of $83-$76.63, the correction can deepen to the next support zone of $60-$64.

We suggest traders wait for the price to breakout and close (UTC time) above $107 before initiating any long positions.

BCH/USD

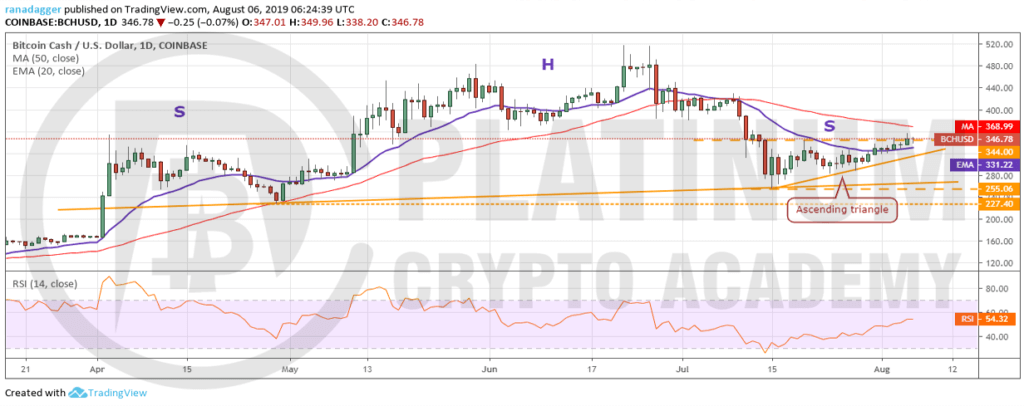

Bitcoin Cash has risen above 20-day EMA and is currently attempting to rise above the overhead resistance of $344. If the price breaks out and sustains above $344, it will complete an ascending triangle pattern that has a target objective of $432.94. If this level is scaled, the next target is $500. The 20-day EMA has started to slope up and the RSI has risen above 50, which shows that bulls are back in the game. The traders can buy above 50-day SMA and keep a stop loss of $310.

However, if bears sink the price below the uptrend line of the triangle, it can drop to $255.06 and below it at $227.4. A breakdown of this will complete a large bearish head and shoulders pattern, which will be a huge negative.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.