Hi Crypto Network,

In the previous bull market, retail traders were the main buyers. However, in the current rise, it looks like the institutional investors are loading up on Bitcoin.

As the price moves up, traditional investors are finding it difficult to ignore the leading cryptocurrency. Emerging markets fund manager and founder of Mobius Capital Partners LLP, Mark Mobius, who had been a critic of Bitcoin earlier said in a recent interview that if the leading digital currency continues to grow, he will be forced to add it to his portfolio.

The assets under management of Grayscale Bitcoin Trust (GBTC) shares, which was about $2.1 billion in May has ballooned to $2.66 billion. This also underlines the growing interest among large traders.

Facebook’s Libra project has provided a much-needed boost to the sector. However, it has also divided the regulators across the world. Now, the Chinese central bank is said to be developing its own cryptocurrency to counter Libra. The fundamentals in the sector have been improving rapidly. But as the price moves up, it increases the probability of a pulldown on any adverse news. Therefore, traders should protect their long positions with a suitable stop loss.

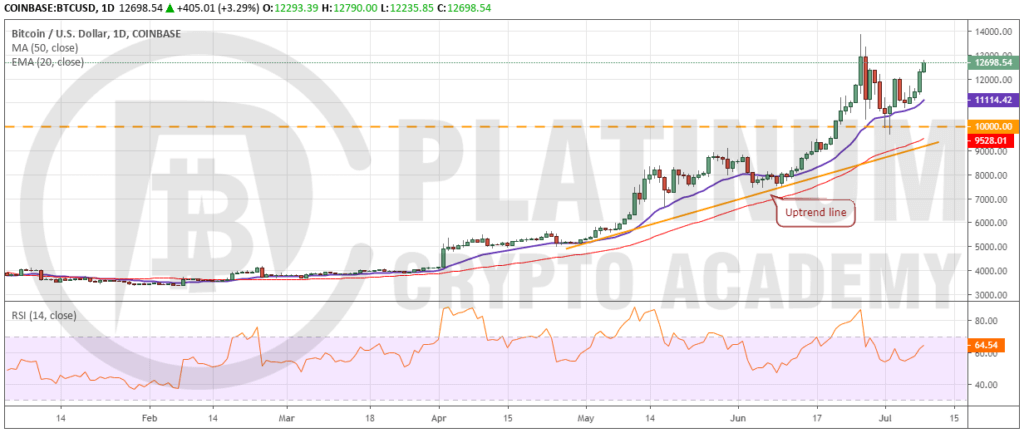

BTC/USD

We had mentioned in our previous analysis that the dip was a good buying opportunity. We had expected the fall to reach 50-day SMA but it reversed direction from $9,651. Subsequently, on July 05, the leading cryptocurrency again took support at the 20-day EMA, which is a bullish sign.

The bounce from the 20-day EMA has risen above the immediate resistance of $12,444.77. It is now likely to retest the recent highs of $13,868.44. If the bulls succeed in scaling above this level, it is likely to attract further buying from the traders who have missed the rally or who have sold out in the recent rise, hoping to buy at lower levels.

Above $13,868.44, the next level to watch is $17,178. If this level is also crossed, a new lifetime high will be on the cards. However, vertical rallies can reverse direction quickly. Therefore, traders who own long positions should trail the stop loss to protect at least 75% of the paper profits.

Contrary to our assumption, if the bears defend the overhead resistance at $13,868.44, the digital currency might remain range-bound for a few days.

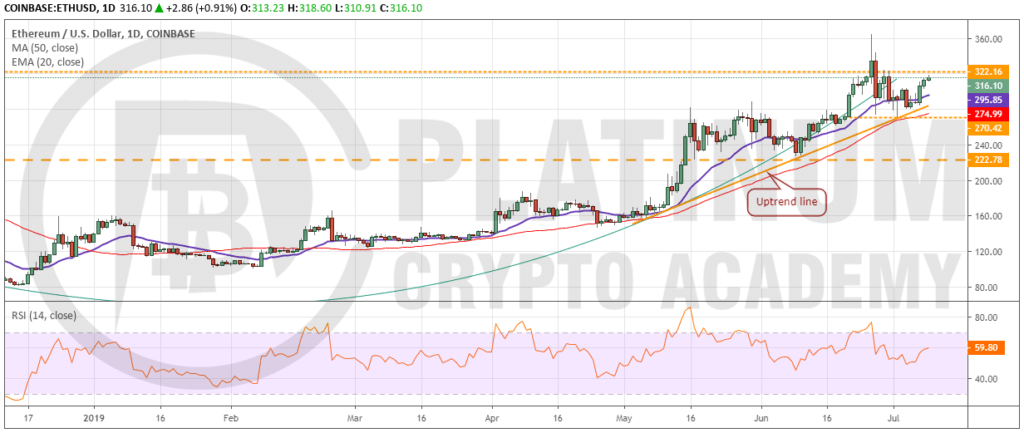

ETH/USD

As suggested in the previous analysis, Ether found support close to the 50-day SMA. The bulls will once again attempt to scale above the overhead resistance of $322.16. If successful, it will complete a rounding bottom pattern that has a target objective of $563.72.

Therefore, we recommend traders wait for the price to close (UTC time) above $322.16 to initiate long positions. The stop loss for the trade can be kept at $270, which is just below the recent low. As there is stiff resistance at $500, traders can keep it as the initial target objective. With both moving averages turning up and the RSI in positive territory, it is advantage bulls.

Our positive view will be invalidated if buyers fail to sustain above $322.16. In such a case, the bears will again attempt to sink the digital currency below the 50-day SMA.

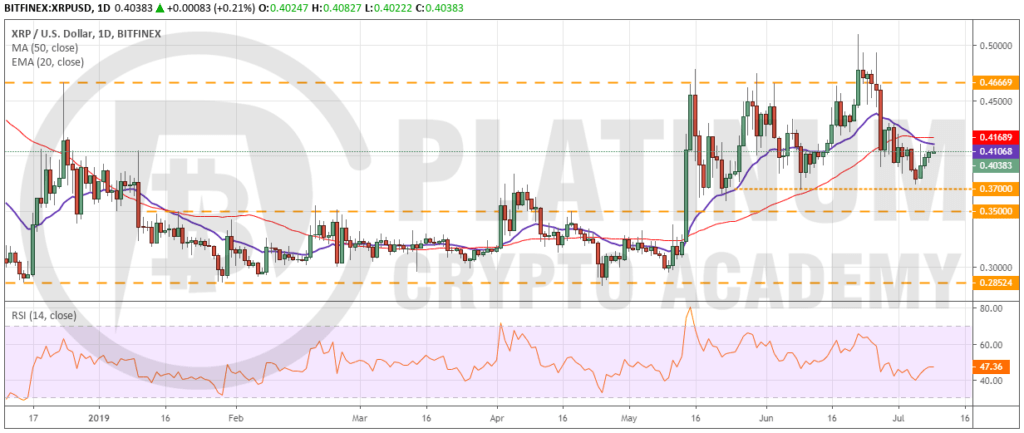

XRP/USD

XRP has bounced off the first support at $0.37. Currently, the bulls are trying to push the price above the moving averages. If successful, the cryptocurrency can rally to the top of the range at $0.46669, which is likely to act as a stiff resistance once again.

Both moving averages are flattening out and the RSI is just below 50, which points to a consolidation in the short-term.

If, however, the bulls fail to propel the price above the moving averages, we expect the bears to attempt to break below the support zone of $0.37 to $0.35. If this zone cracks, the digital currency will become very negative. We suggest traders avoid taking a position in it until it starts a new uptrend.

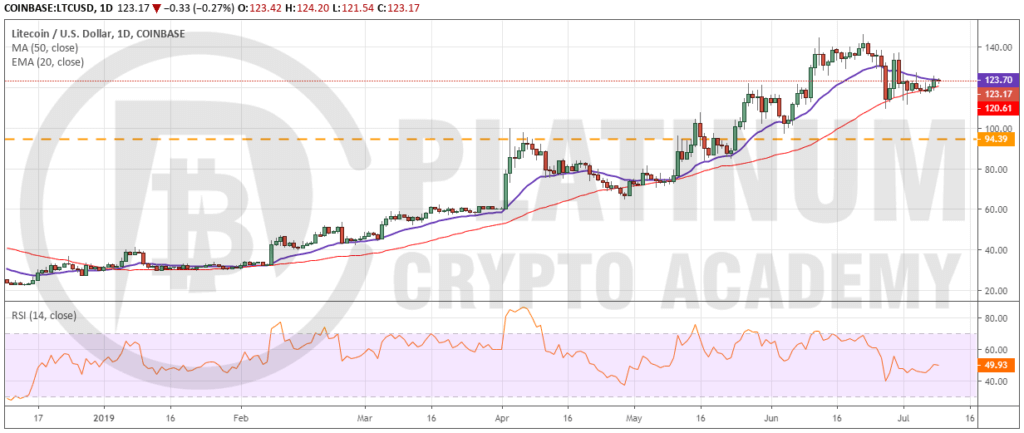

LTC/USD

Litecoin has been trading above the 50-day SMA for the past few days. Though the support has held, the bulls have not been able to push the price higher. This shows a lack of demand at higher levels. Both the moving averages have flattened out and the RSI is at the midpoint. This points to a range-bound action between $109 and $140 in the near term.

If the bears sink the price below $109, the fall can extend to $94.39, which is critical support. However, as a breakdown of $109 will start a lower high and lower low pattern, we suggest trades avoid buying in a hurry.

On the other hand, if bulls carry the price above $146, it will resume the uptrend that has a target objective of $180. We don’t spot any buy setups at the current levels; hence, we are not suggesting a trade in it.

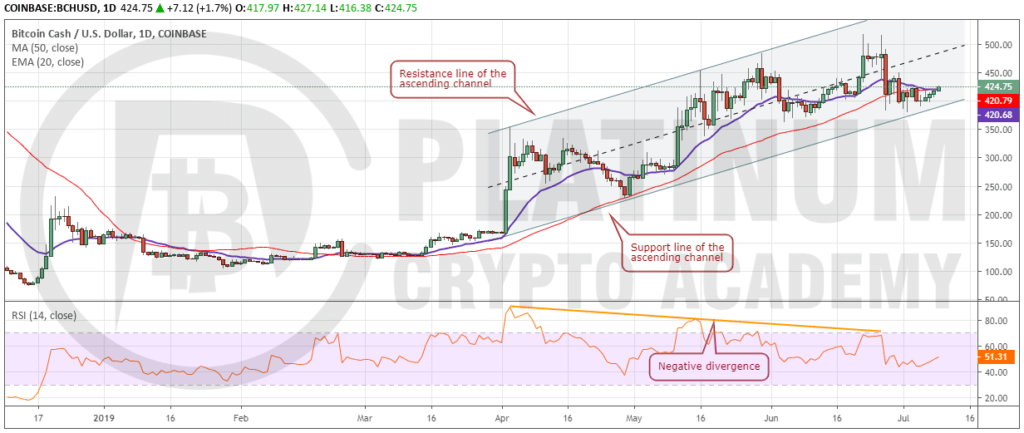

BCH/USD

The price has rebounded from close to the support line of the ascending channel, which is a positive sign. It shows that the bulls are keen to buy on dips. The bulls are currently attempting to push the price above the moving averages.

If successful, the price can move up to $450 and above this level, the rally can extend to $515, which is likely to act as a stiff resistance. Therefore, traders can wait for the price to close (UTC time) above $430 and buy with a stop loss of $380. Please keep the trade size only about 50% of usual because the cryptocurrency is in a weak uptrend.

Contrary to our expectation, if the bears reverse direction from the current levels and plummet below the support line of the channel, the trend will turn in favour of the bears.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.