Hi Crypto Network,

The rally in the crypto markets in the past week reminds us of the previous bull market. The pace of the rise, especially in Bitcoin has surprised us. After many months, the markets have started to take note of the positive fundamental developments and have responded accordingly.

The most important was that Bakkt will start testing Bitcoin futures trading in early-July of this year. It is expected that the arrival of Bakkt will attract institutional traders.

The US Securities and Exchange Commission (SEC) is reviewing another application for a cryptocurrency ETF, which will include both Bitcoin an Ether and will trade on the NYSE if approved. Along with the institutional players, the possibility of Starbucks accepting Bitcoin and the launch of “FB Coin” by Facebook, will boost retail adoption.

After the current rally, it looks like Bitcoin is finally out of its bear phase. The next question is how high can Bitcoin go? Michael Novogratz, CEO of Galaxy Digital has been bullish on the leading digital currency for some time. He believes that it can cross its previous highs within 18 months. Similarly, a financial advisory firm Canaccord Genuity expects Bitcoin to reach $20,000 by 2021. American venture capital investor Tim Draper is even more bullish as he expects the price to hit about $250,000 by 2023.

While these projections are very bullish, we suggest traders only risk the amount they can afford to lose as cryptocurrencies can turn around in a jiffy. Let’s see what do our charts project?

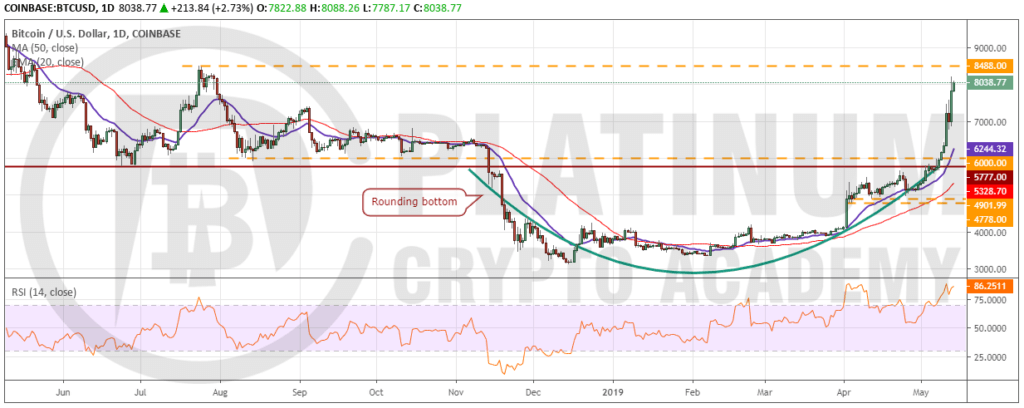

BTC/USD

After breaking out of the overhead resistance at $5,777 on May 08, Bitcoin skyrocketed above the intermediate resistances of $6,500 and $7,400 with ease. The bulls have carried the price close to the next resistance at $8,488. If the cryptocurrency ascends this level, it can extend its rally to $10,000.

A momentum backed up move can surprise on the upside but a vertical rally is unlikely to continue for long. We don’t expect a repeat of the previous bull market. Both the moving averages are trending up and the RSI is in the overbought zone. Soon, we should see a sharp pullback that can find support at the 20-day EMA and below it at $6,000.

We expect $6,000 to hold. This will act as a higher low and a new floor for the digital currency. Contrary to our opinion, if the bears sink the price below $6,000, the sentiment will turn bearish. The next few days are likely to remain volatile.

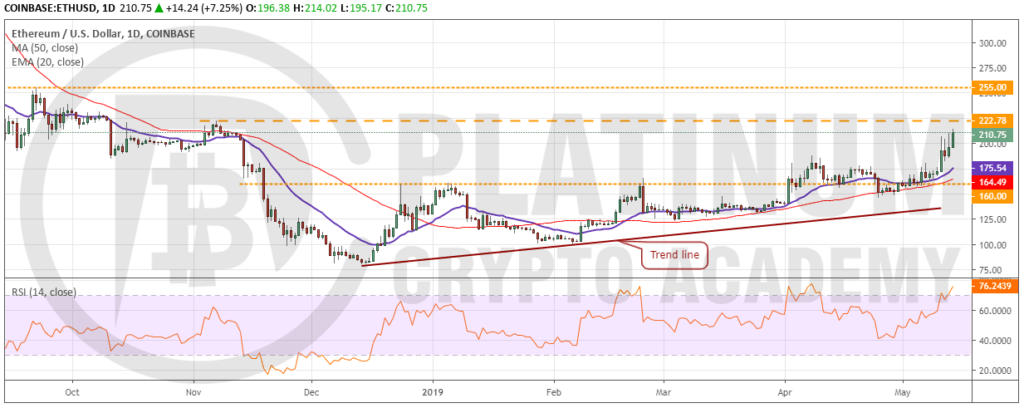

ETH/USD

Ethereum triggered our buy suggested in the earlier analysis. The bulls are now attempting to propel it to the first resistance of $222.78, above which the rally can extend to $255. The 20-day EMA has started to slope up and the RSI is in the overbought zone. This shows that the bulls have the upper hand.

Contrary to our assumption, if the bulls fail to push the price above $222.78, the digital currency might enter into a range. Therefore, traders can watch the price action at $222.78 and close half of the position if the bulls struggle to scale above this level. Simultaneously, the stop loss on the remaining position can be trailed higher to $155. We have kept the stop loss a little deep because we want to give some wiggle room for the cryptocurrency because if it breaks out of $255, it can reach $300 levels.

Our bullish view will be invalidated if the pair turns down from the current levels and plummets below both the moving averages.

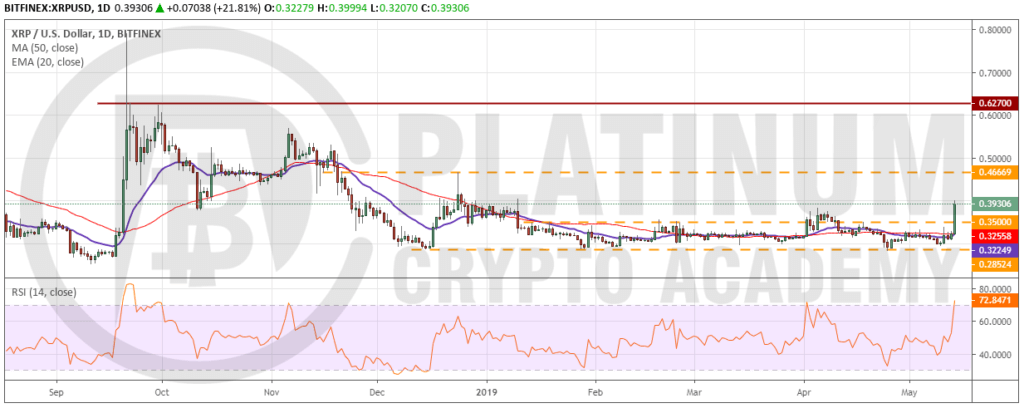

XRP/USD

After underperforming the markets for a long time, Ripple is trying to play catch up. It has broken out of the overhead resistance of $0.35 with force, which is a positive sign. If the bulls sustain the breakout, it will signal the end of consolidation and a probable start of a new trend. However, the laggards are usually the last to rally. This, at times, signals a short-term top. Therefore, instead of chasing the price higher, traders can wait for a successful retest of $0.35 to establish long positions. The initial stop loss can be kept at $0.28, which can be raised later. The levels to watch on the upside are $0.46669 and above it $0.6270.

Our bullish view will be negated if the bulls fail to sustain the cryptocurrency above $0.35. A fall below $0.35 will extend the consolidation.

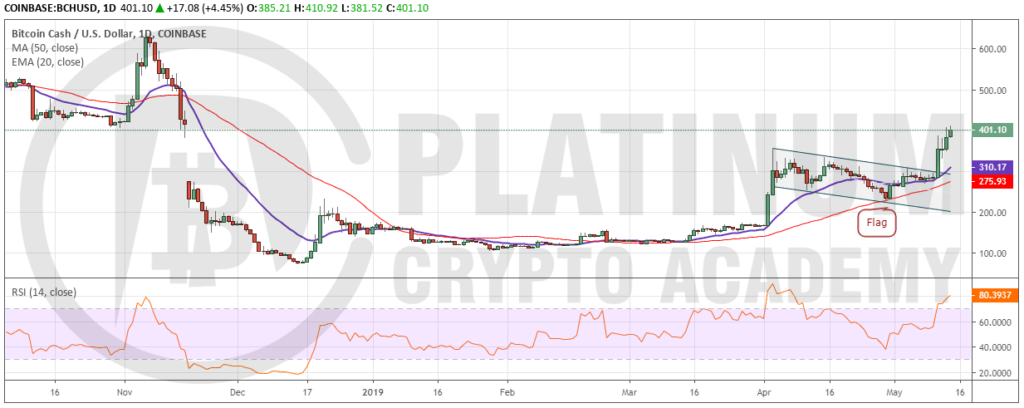

BCH/USD

We were positive on Bitcoin cash in our previous analysis as it had formed a bullish flag. It, however, surged after breaking out of the flag on May 11. We had suggested buying on a close above the flag, but the close on that day was way higher. Hence, we consider that no positions were initiated.

Nevertheless, for traders who bought without waiting for the close, the first target to work on the upside is $414.59 and above it $497.19. As the cryptocurrency has a history of vertical rallies and waterfall declines, the traders should keep trailing their stops to reduce their risk and to lock in some paper profits.

Currently, both the moving averages are trending up and the RSI is in the overbought zone. This suggests that the bulls have the upper hand. Our bullish view will be invalidated if the price reverses direction from the current levels and plunges below the 20-day EMA.

LTC/USD

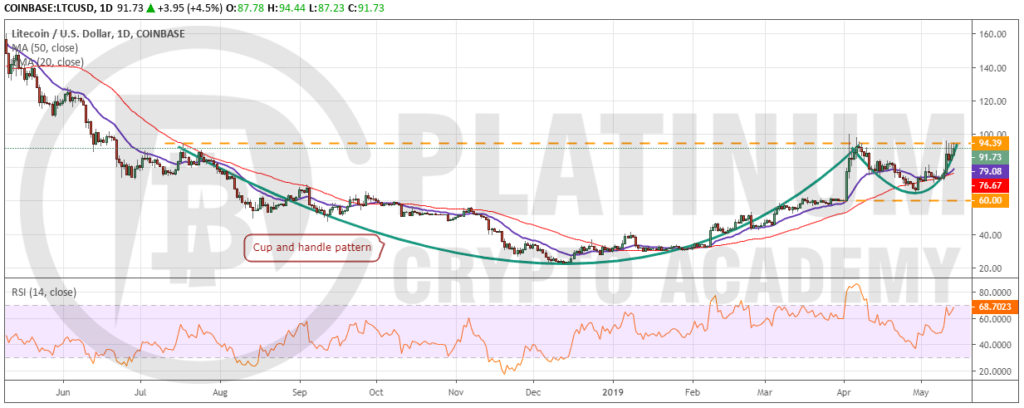

Litecoin soared above the overhead resistance on May 11. However, the bulls could not sustain the breakout. The cryptocurrency has been consolidating near the overhead resistance since then. This is a bullish sign, as it shows that the bulls are in no hurry to book profits. Soon, we expect another attempt to scale above $94.39.

If successful, it will complete a cup and handle pattern that has a target objective of $166.61. Hence, we retain the buy proposed in our previous analysis.

Our assumption will prove to be incorrect if the price reverses direction from the current levels and breaks below the moving averages. The trend will turn negative below $64.86.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Richard Baker Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.