Hi Crypto Network,

The release of Libra white paper by Facebook was the most important event of the past week in the crypto world.

Will this be the catalyst that will drive mass adoption of digital currencies and give legitimacy to space? Many crypto investors certainly think so. With the massive retail reach of Facebook, it does offer a great opportunity to the public to foray into the world of cryptos.

If Facebook’s crypto project turns out to be a success, it will compel the other financial institutions to jump in with their own services. The institutional investors who have largely been absent will be forced to diversify their portfolio using cryptocurrencies or risk being left behind. This is also likely to turn the attention of the investors to the existing projects that have solid use cases.

Additionally, the ongoing trade war between the US and China has reconfirmed cryptocurrencies as a safe haven bet. Research by Grayscale Investments shows that Bitcoin can act as a hedge during a global liquidity crisis due to its distinct set of properties. Let’s analyse the top five cryptocurrencies and see if we spot any buying opportunities.

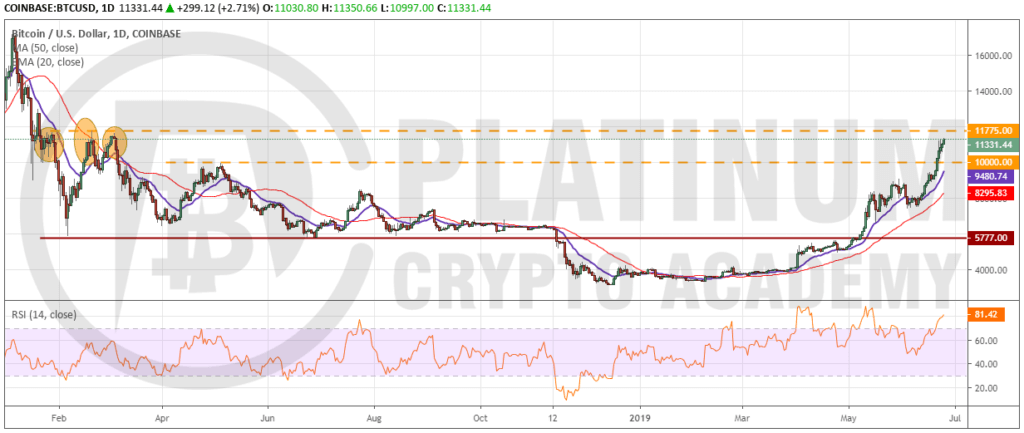

BTC/USD

Bitcoin is in a strong uptrend. It easily broke above the overhead resistance of $10,000 on June 21 and rallied above $11,000 on June 22. This shows that it is backed by strong momentum. Since starting this leg of the up move on June 10, it has seen only two closings in the red. This shows that the bulls are not waiting for a dip to buy and are not booking profits either. The next level to watch is $11,775.

Between January and March of last year, the cryptocurrency had reversed direction from $11,775 on three occasions. Currently, the RSI is in overbought territory, which also signals that the rally is overextended in the short-term and a pullback is possible. Hence, we anticipate a strong defence of this level by the bears.

Our assumption of a pullback will be invalidated if the momentum carries the price above $11,775. In such a case, the rally can extend to $12,985.55. However, a vertical rally without intermediate corrections increases the probability of a deep pullback. On the downside, the digital currency will find support at $10,000 and below it at the moving averages.

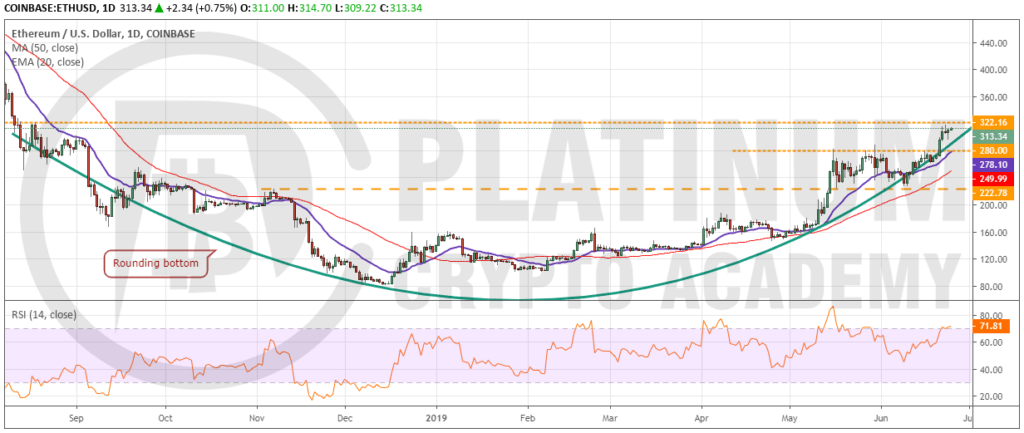

ETH/USD

We had suggested to buy on a breakout and close (UTC time) above $280 in our previous analysis. Ether broke out of $280 on June 21 and quickly rallied close to the overhead resistance of $322.16 on June 23, which was the target objective.

It has been consolidating near the overhead resistance for the past three days, which is a positive sign. If the bulls can breakout and close (UTC time) above $322.16, the digital currency will complete a rounding bottom pattern, which has a target objective of $563.72. As the price has already rallied close to 300% from the lows, we suggest caution. If the price breaks out of $322.16, instead of buying the breakout, traders can wait for a successful retest of the breakout levels before entering long positions. This will reduce the risk.

Contrary to our assumption, if the price fails to breakout and close (UTC time) above $322.16, it might remain range bound between $280 and $322.16. If $280 fails to provide support, the correction can deepen to 50-day SMA and below it to $222.78.

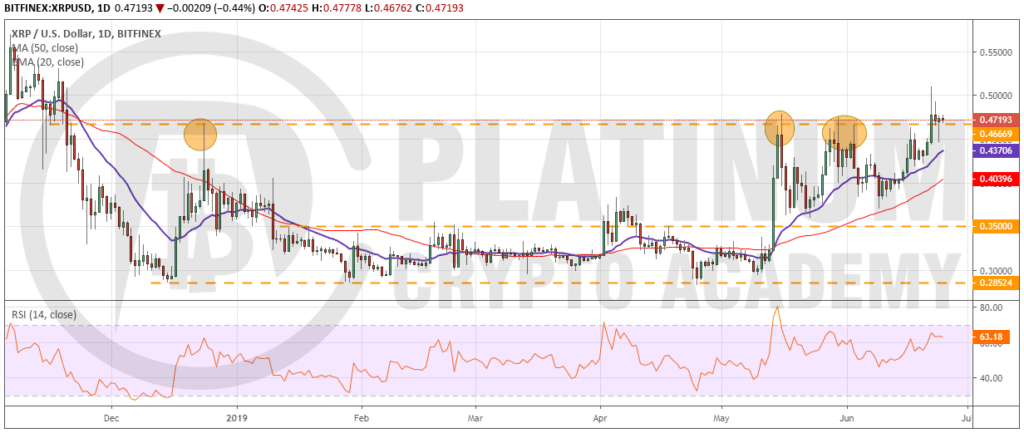

XRP/USD

XRP broke out of the overhead resistance of $0.46669 and rallied to an intraday high of $0.51 on June 22. However, it did not pick up momentum according to our assumption. It quickly gave back all its gains. The price has been consolidating near the breakout level of $0.46669 for the past two days. If the bulls resume the uptrend, the digital currency can move up to $0.53127 and above it to $0.570. If both these levels are scaled, the next target is $0.6270. Traders can watch the price action near the resistance levels and book partial profits if they find the price struggling to ascend it.

Currently, both the moving averages are sloping up and the RSI is in the positive territory. This shows that the bulls have the upper hand. Traders can trail the stop loss on the long position below the 20-day EMA.

If the bears sink the price below $0.46669 and 20-day EMA, a fall to the 50-day SMA is likely. If this support breaks down, the next support is way lower at $0.350.

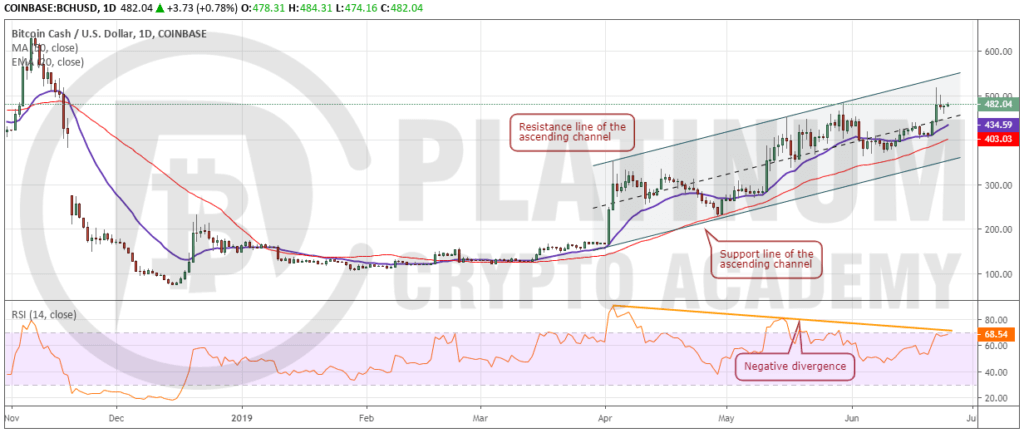

BCH/USD

Bitcoin Cash continues to move up inside the ascending channel. It bounced off the 20-day EMA on June 21 and rallied above the overhead resistance of $483.33 on June 22. However, the resistance line of the channel is proving to be a major hurdle and the price turned down from it. However, the positive thing is that the pullback has been shallow and the price has been consolidating close to $480 for the past two days.

If the level holds, we anticipate another attempt by the bulls to breakout of the channel. If successful, it is likely to pick up momentum and quickly move up to $638.55. Though the up sloping moving averages suggest that the bulls are in command, the negative divergence on the RSI throws a point of caution that the momentum might be weakening.

The cryptocurrency will lose momentum if the bears sink it below the 20-day EMA. If the 50-day SMA also fails to provide support, a drop to the support line of the channel is probable. Currently, we do not find any reliable buy setups that offer a good risk to reward ratio, hence, we are not recommending a long position in it.

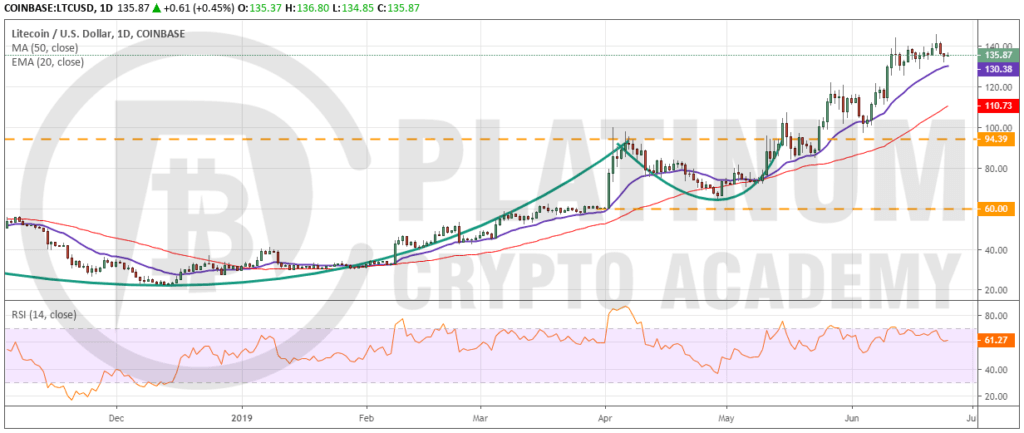

LTC/USD

Litecoin attempted to rise above $140 mark on June 22 but could not sustain the higher levels. This shows a profit booking on rallies. Currently, the price has pulled back to the 20-day EMA, which is strong support. If the price bounces off the 20-day EMA, we anticipate another attempt by the bulls to propel the price to the next target objective of $166.61.

Conversely, if bears sink the digital currency below the 20-day EMA, it can plunge to the 50-day SMA. If this support also cracks, the correction can reach $94.39. Therefore, traders who are long on our earlier recommendation can keep the stop loss on the position below the 20-day EMA.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.