Hi Crypto Network,

Tron (TRX) founder and CEO Justin Sun have paid a record-breaking sum of $4,567,888 to win a charity auction to have dinner with legendary investor Warren Buffett. It would be interesting to see if Sun can change Buffet’s extremely negative opinion regarding cryptocurrencies.

In May, most equity markets and other asset classes perceived as risky have declined on escalating trade tensions between the US and China. However, Bitcoin has led the crypto markets higher during the same period. In doing so, it has clearly overtaken safe assets like gold. This shows that cryptocurrencies are uncorrelated to the other traditional assets, which make it an interesting play. The analytical firm Delphi Digital has termed bitcoin as the “King of the Assets Class Hill”.

Facebook is in talks with the United States regulator the Commodity Futures Trading Commission (CFTC) regarding its stablecoin that is likely to be launched in 2020. Facebook is laying the groundwork for its stablecoin, which is likely to increase the reach of cryptocurrencies, considering its huge client base.

However, the central banks across the world continue to be sceptical of cryptocurrencies. In a recent speech, Jens Weidmann, head of Germany’s central bank warned that extensive use of cryptocurrencies could lead to serious consequences.

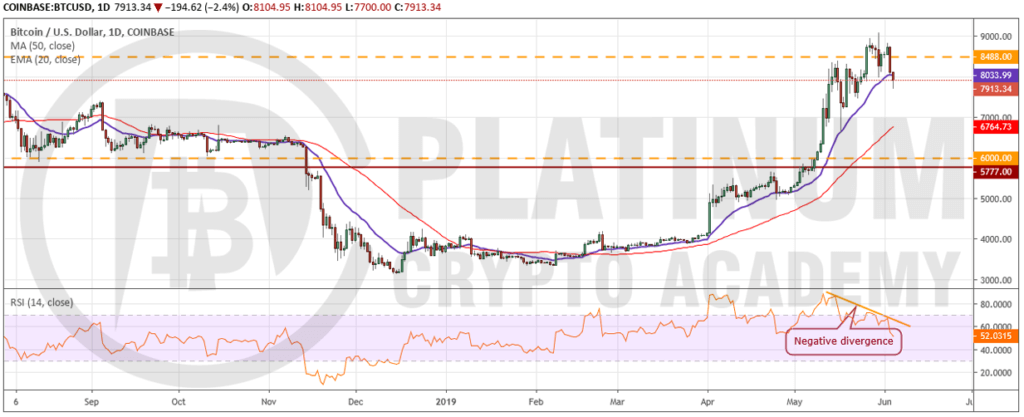

BTC/USD

Bitcoin has turned down from $9,090 levels and broken below the 20-day EMA. The RSI has also formed a negative divergence. This indicates that the momentum is weakening. If the price stays below the 20-day EMA for three consecutive days, it can sink the cryptocurrency to the 50-day SMA.

On the other hand, if the bulls buy the dip and recover above the 20-day EMA quickly, the digital currency will again attempt to climb above the overhead resistance zone of $8,488-$9,090. If successful, the next target to watch on the upside is $10,000.

Currently, the 20-day EMA is flattening out and the RSI has dipped to the midpoint. This points to a probable consolidation in the short-term. We believe that the current dip will offer a low-risk opportunity to the investors to buy for the long-term. However, we shall wait for the correction to end before proposing a trade in it.

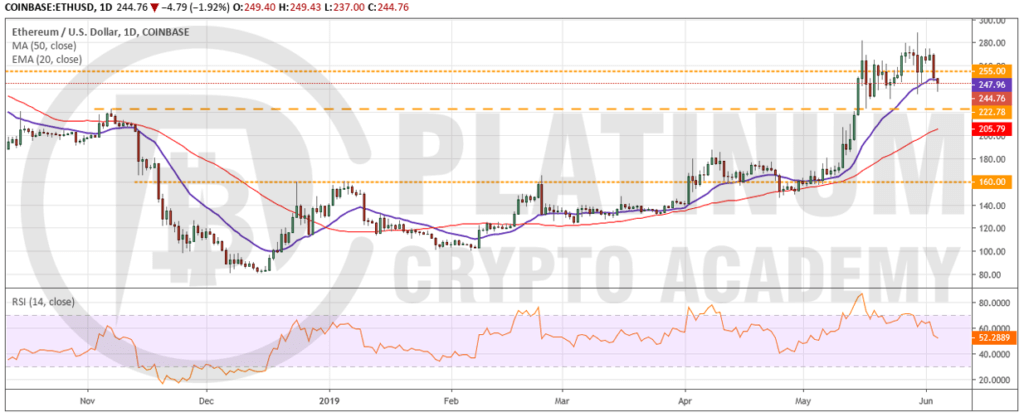

ETH/USD

Ethereum failed to hit the $300 mark where we had asked the traders to book profits in our previous analysis. It turned down from $288.77 on May 30 and triggered our suggested stop loss of $245 on the remaining long positions.

Thereafter, the bulls again attempted to resume the up move but hit a wall just below $280 level. The cryptocurrency has turned down and plunged below the 20-day EMA. It can now drop to the next support at $222.78.

The 20-day EMA is flattening out and the RSI has declined to the midpoint. This suggests a range bound trading action in the near term.

Our view will be invalidated if the digital currency reverses direction from the current level and rallies above $280-$288.77 resistance zone. Currently, we do not find any bullish pattern.

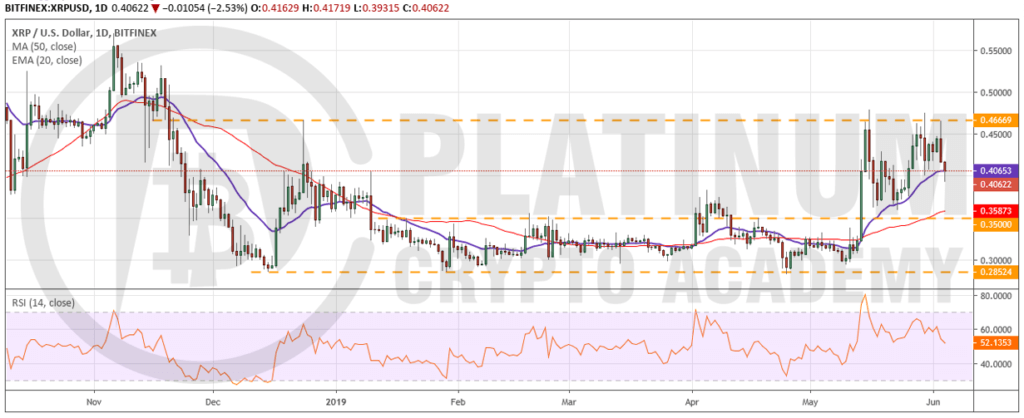

XRP/USD

XRP failed to break out and sustain of the overhead resistance of $0.46669 on May 30 and June 03. As a result, it has turned down sharply and plunged below the 20-day EMA. If the price closes (UTC time) below the 20-day EMA, it will indicate weakness and a probable fall to the next support at the 50-day SMA.

Conversely, if the bulls manage to keep the cryptocurrency above the 20-day EMA, we anticipate another attempt to scale above $0.46669. If successful, a rally to its target objective of $0.6270 is possible.

Currently, both the moving averages are flattening out and the RSI has dipped to just above the 50 level. This points to a consolidation in the short-term. Traders who are long on our earlier recommendation can retain the stop loss at $0.34. If the bulls struggle to scale the price above $0.46669 in the next attempt, traders can close 50% of the long positions above $0.45 and hold the rest with the stop at $0.34.

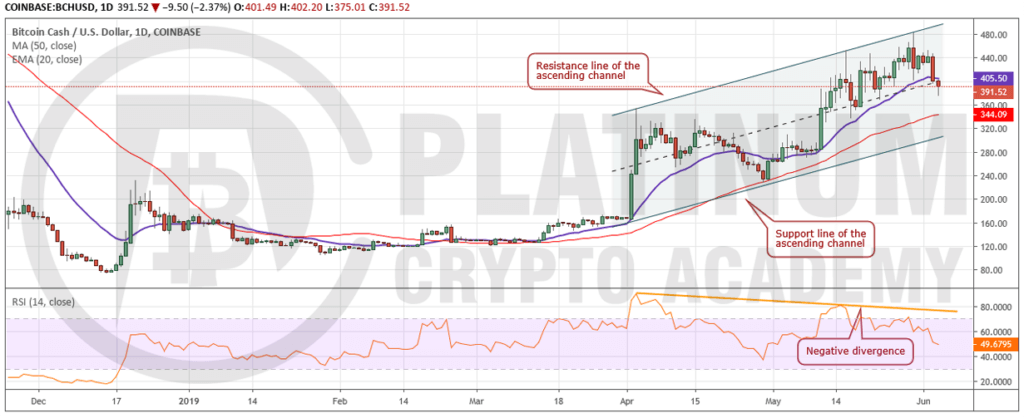

BCH/USD

The bulls failed to propel Bitcoin Cash above the ascending channel on May 30. The price turned down sharply and plummeted to the 20-day EMA. The subsequent attempt to bounce off the 20-day EMA did not find buyers at higher levels and the bears finally broke below the support on June 03. If the price sustains below the 20-day EMA, the next stop is the 50-day SMA and if that also cracks, a revisit to the support line of the channel is likely.

Our short-term bearish view will be invalidated if the digital currency reverses direction from the current levels and ascends the resistance line of the channel. In such a case, a rally to $638.55 is probable. However, we give this a very low probability of occurring. We shall wait for the correction to end before suggesting a trade in it.

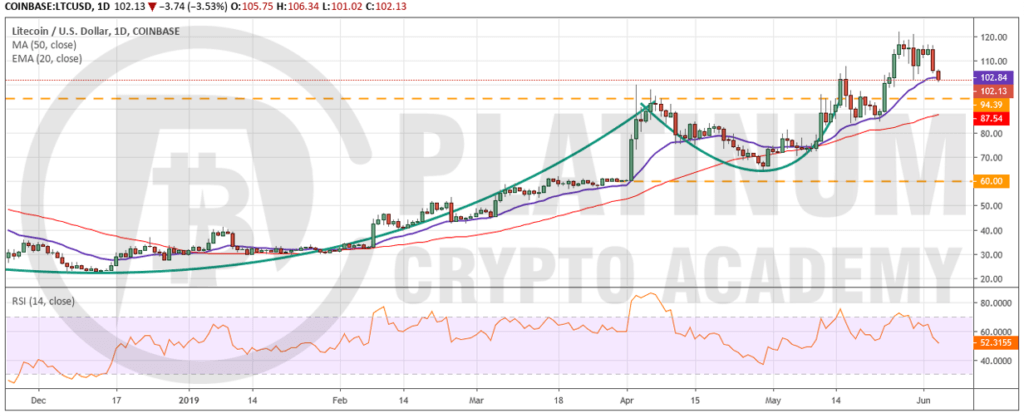

LTC/USD

Litecoin has turned down from the minor resistance at $120. The bulls are attempting to hold the 20-day EMA. If successful, we expect another attempt to break out of $120 and a rally to $166.61. On the contrary, if the bears sink the price below the 20-day EMA, a fall to $94.39 is likely. We expect the bulls to hold this level.

The 20-day EMA is flattening out and the RSI has declined close to the center, which points to a range formation in the short-term. The cryptocurrency might consolidate between $94.39-$120 for a few days. Traders who had initiated long positions on our earlier recommendation can keep the stop loss at $80. We shall soon trail it higher.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Richard Baker Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.