Hi Crypto Network,

Platinum’s top aim is to help you secure and grow your wealth through multiple currency-related opportunities.

Having been established in the financial space for well over a decade, and trading cryptocurrencies for a number of years, our mentors and analysts are the ideal options for anyone who would like to create or improve on their additional revenue streams and portfolios.

Our cryptocurrency education services provide expert tutelage on the markets and will get you where you need to be in order to take advantage of the opportunities that the crypto market presents.

The past week has seen a slew of positive news flow in favor of cryptocurrencies. Bloomberg sources report that investment firm Fidelity will start Bitcoin trading for institutional clients within a few weeks. In a recent survey of institutional investors, Fidelity found that 22% already had investments in cryptocurrencies. 47% of the respondents believe that digital assets can be a part of their portfolio. The end of the bear market and the arrival of Fidelity is likely to boost institutional investment and thereby prices of cryptocurrencies in the next few months.

While Bitcoin has been garnering most of the attention, the altcoins are not left behind. An unnamed official of the U.S. Commodity Futures Trading Commission (CFTC) expects Ether futures to see the light of the day if it meets the regulator’s requirements. Though Bitcoin futures have still not made a huge impact on Bitcoin prices, with the arrival of institutional players, we believe that the futures market will grow and will be used as a hedging tool.

Though most voices are gradually becoming positive, the traditional investors continue to be skeptical of cryptocurrencies. Billionaire investors Warren Buffet and Charlie Munger have both reiterated their criticism of digital assets. However, these legendary investors have been slow in recognizing technology companies due to which they missed investing in Google, Microsoft, Amazon, and purchased Apple after many years. Therefore, we take their criticism with a pinch of salt.

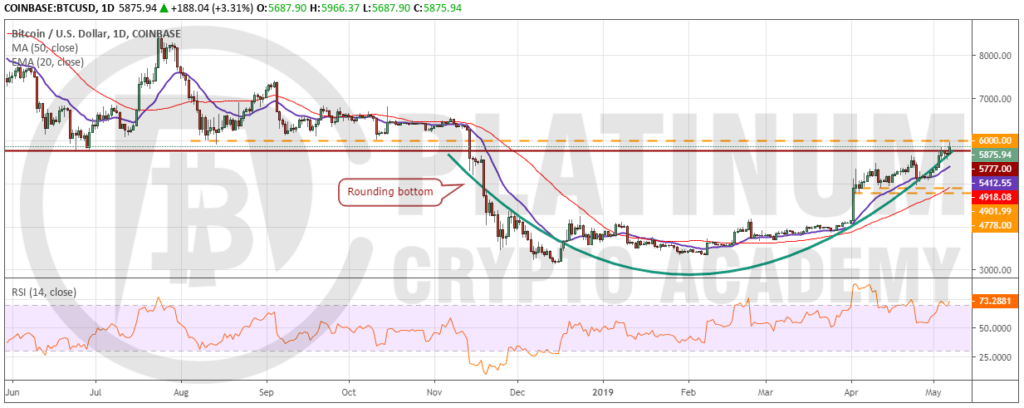

BTC/USD

Bitcoin has formed a rounding bottom pattern. With the breakout and close (UTC time) above $5,777, this bullish reversal pattern will complete that has a target objective of $8,425.11. However, it is unlikely to be a straight dash to this level because $6,500 and $7,400 will act as stiff resistance en route. Still, with both the moving averages trending up and the RSI in the overbought zone, the path of least resistance is to the upside.

Contrary to our assumption, if the leading digital currency fails to hold above $5,777 to $6,000 resistance zone, it can start a minor correction or enter into a consolidation.

The trend will turn in favor of the bears if the price sinks below $4,778. Though we are bullish, we don’t find a trade setup that offers a good risk to reward ratio at the current levels. Hence, we shall wait for a dip to suggest any trade in it.

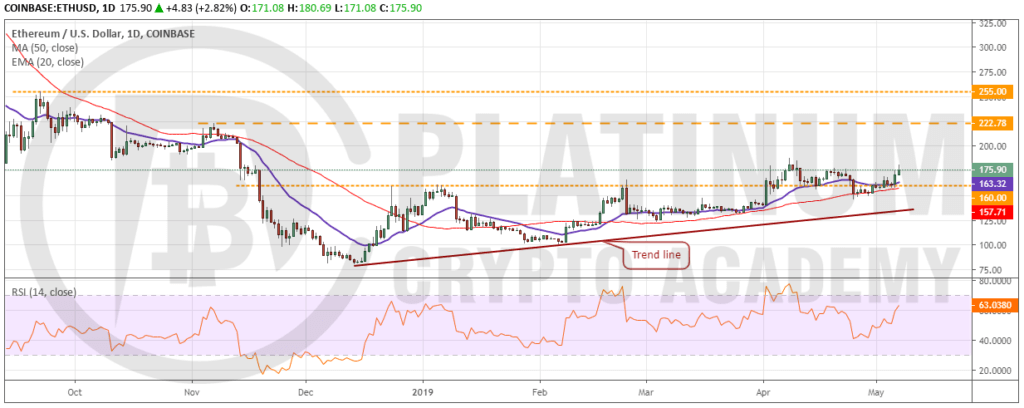

ETH/USD

Ethereum bounced from the 50-day SMA and has built upon its gains after breaking out of the triangle at $160. It now has a minor resistance at $187.62 above which it can pick up momentum and rally to $222.78 and above it to $255. The 20-day EMA, which was flattening out has started to turn up once again and the RSI has jumped into the positive territory. This shows that the bulls have the advantage in the short-term. Therefore, we retain the buy recommendation given in the earlier analysis.

Our bullish view will be invalidated if the digital currency reverses direction from the current levels or from the overhead resistance of $187.62 and re-enters the triangle. This will indicate a lack of buyers at higher levels. The next few days are important as they will set the stage for the next leg of the move.

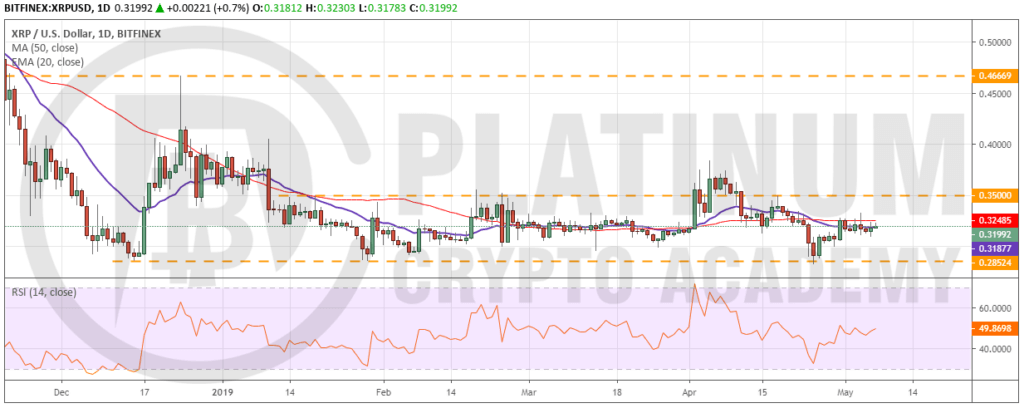

XRP/USD

Among the major coins, Ripple has been a huge underperformer. It has failed to participate in the current recovery and continues to languish in the $0.28524 and $0.35 range. Both the moving averages are flat and the RSI is close to the midpoint. This suggests that the consolidation might extend for a few more days.

The first sign of strength will be a breakout of $0.35. The cryptocurrency is likely to pick up momentum after it ascends $0.38353. Longer the time spent in the range, stronger will be the eventual breakout. We might propose long positions on a breakout and close (UTC time) above $0.35.

On the other hand, if the digital currency turns down from the current levels or from the overhead resistance, it can plummet to the lows at $0.28524. A breakdown of this can result in a retest of the yearly low at $0.24653.

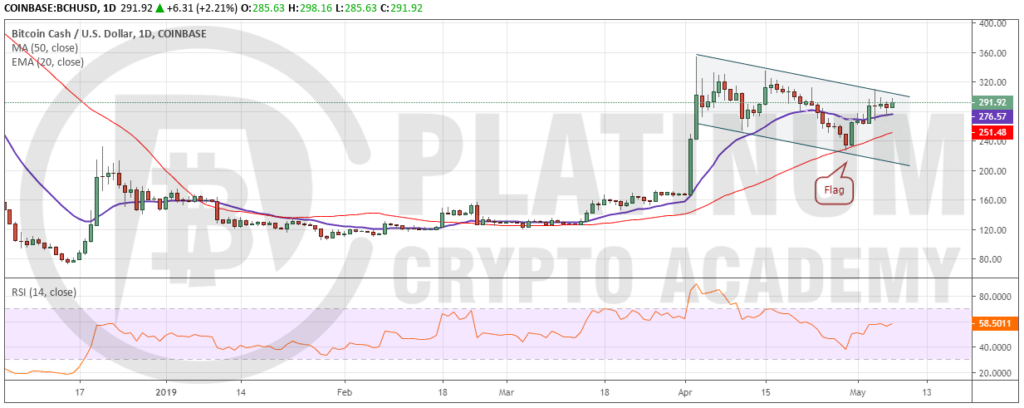

BCH/USD

Bitcoin cash rebounded sharply from the 50-day SMA. It has formed a flag, which is a bullish pattern. A breakout of the flag will resume the uptrend and can push the price to $414.59 and above this to $497.19. The digital currency has a history of vertical rallies; hence, it might surprise on the upside. The 20-day EMA has started to slope up once again and the RSI has risen into the positive zone. This shows that the bulls have regained the upper hand in the short-term. Aggressive traders can buy on a breakout and close (UTC time) above the flag and keep an initial stop loss of $260.

On the other hand, if the price fails to break out of the flag, it can fall to the 20-day EMA and below it to the 50-day SMA. The trend will turn negative if the bears sink the price below the flag.

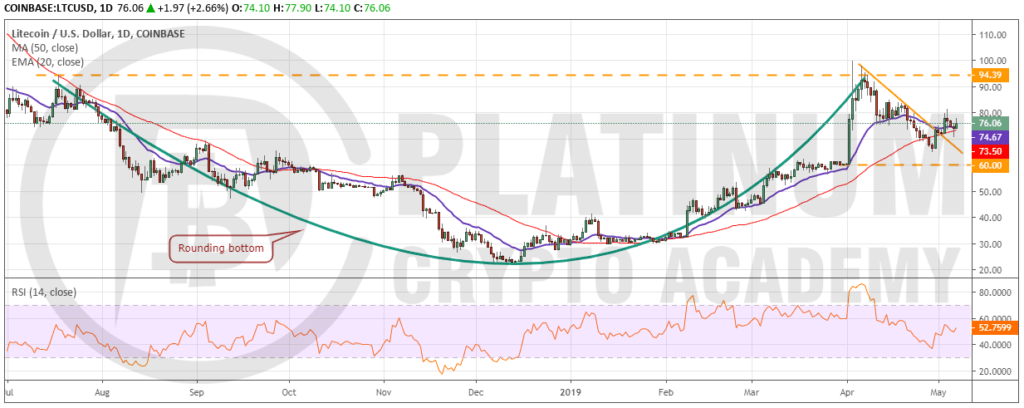

LTC/USD

Litecoin bounced from $64.86 and has broken out of the downtrend line and both the moving averages. This has turned the advantage in favor of the bulls. If the price sustains above the moving averages, a move to $84.73 followed by a rise to $94.39 is probable.

The cryptocurrency has formed a cup and handle pattern that will complete on a breakout and close (UTC time) above $94.39. The target objective of this breakout is $166.61. Therefore, we shall suggest buying on a breakout and close (UTC time) above $94.39 with an initial stop loss of $64, which can be raised later.

However, if the bulls fail to ascend the overhead resistance of $94.39, the digital currency might remain range bound between $64.86 and $94.39 for a few days. The 20-day EMA is flat and the RSI is just above the 50 levels, which shows a balance between demand and supply. The trend will turn negative if the bears sink the price below $60.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Richard Baker Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.