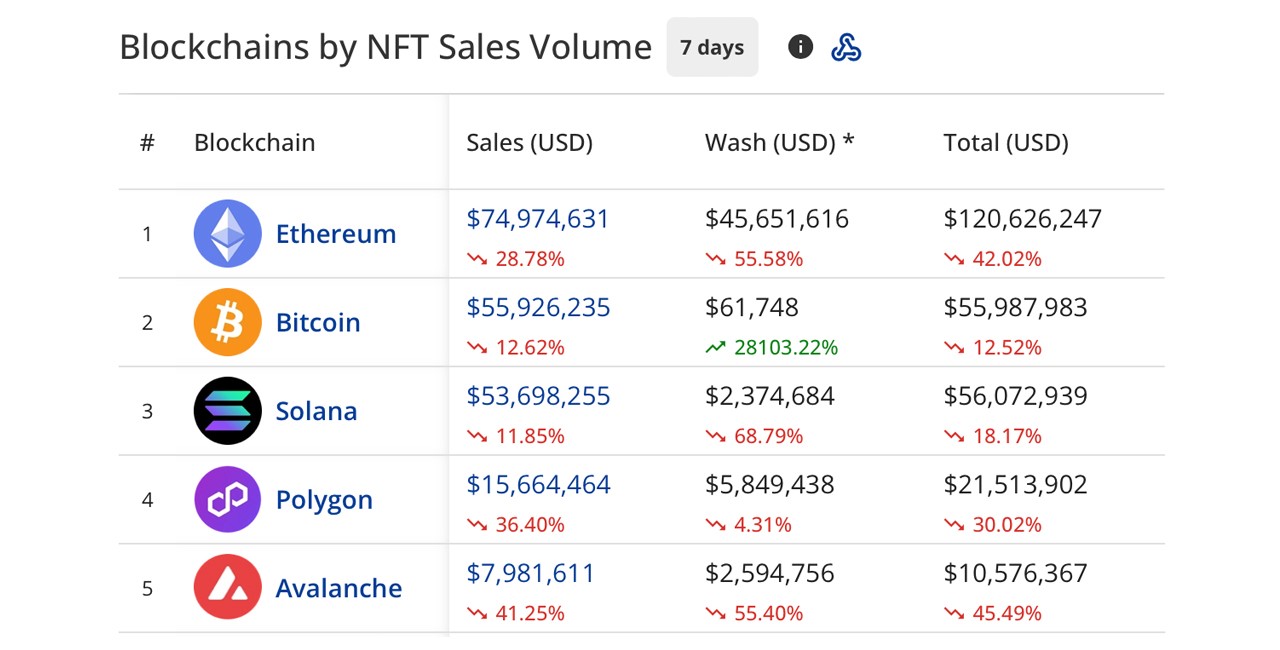

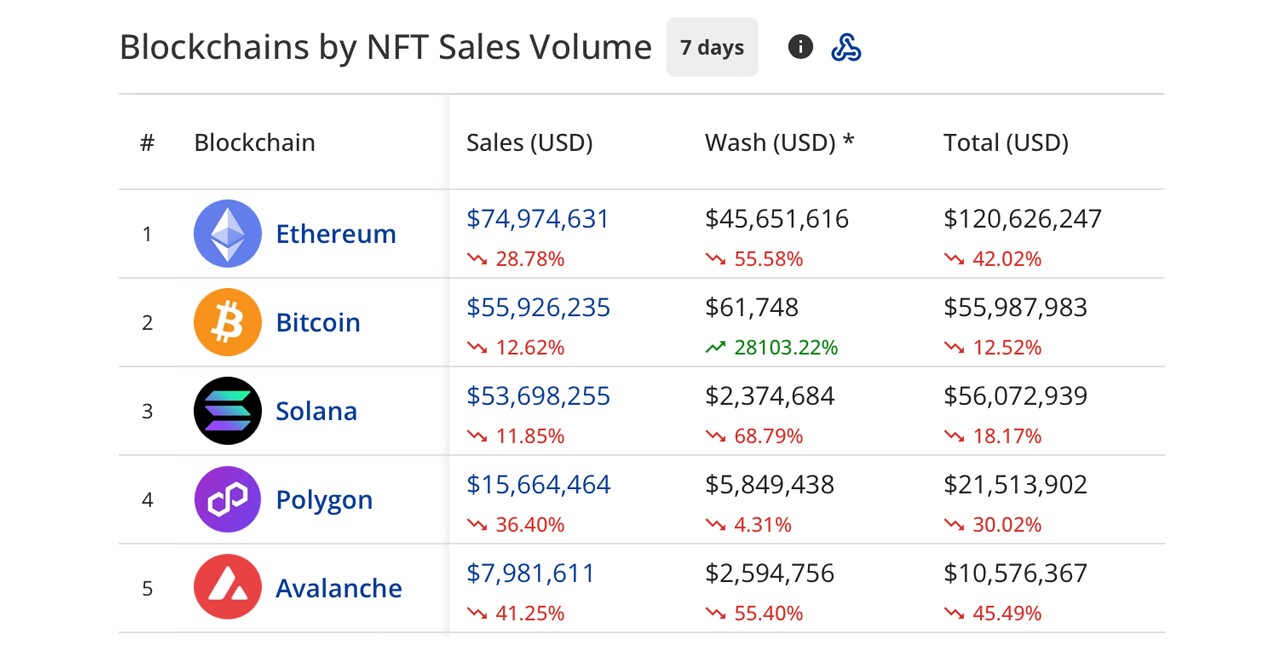

Between January 20 and January 27, 2024, the non-fungible token (NFT) market experienced a significant downturn, with sales plummeting by 21.25% compared to the preceding week. This decline was particularly pronounced on the leading blockchain platforms facilitating these transactions, namely Ethereum and Bitcoin, both of which saw substantial drops in their seven-day sales. Ethereum’s sales plummeted by 28.78%, while Bitcoin experienced a 12.62% decrease in its weekly sales volume. These figures underscore a notable shift in market dynamics within the NFT space during this period.

NFT Market Witnesses Substantial Decrease

At the outset of 2024, NFT sales experienced a slight dip of 1.31%, falling below the figures recorded during the final week of 2023. While the subsequent week saw a minor uptick in NFT sales, approximately by 0.05%, the most recent week encountered a notable decline of 5.05% in sales of digital collectibles.

This week stands out as the most significant downturn observed in 2024, with sales plummeting by over 21% compared to the preceding seven days. According to data from cryptoslam.io, the total sales volume amounted to $228,327,660 during this period.

This downturn marks a significant departure from the year-end surge witnessed in NFT sales during 2023, primarily propelled by transactions on the Bitcoin blockchain. Throughout November and December of 2023, Bitcoin’s NFT sales dominated the market, maintaining its lead into the first week of January 2024.

However, recent weeks have depicted a notable shift, with Ethereum reclaiming its position as the frontrunner in NFT sales volume. Over the past seven days, Ethereum’s NFT sales amounted to $74.97 million, reflecting a substantial 28.78% decrease from the previous week. This reversal underscores the dynamic nature of the NFT market, characterized by fluctuating trends and evolving preferences among collectors and investors.

In contrast, Bitcoin observed a 12.62% decrease week-over-week, recording $55.92 million in sales during the same seven-day period. Following closely, Solana secured the third position with $53.69 million in sales, marking an 11.85% decline from the previous week.

Polygon’s NFT sales, claiming the fourth spot, amounted to $15.66 million but experienced a substantial 36.40% drop. Meanwhile, Avalanche secured the fifth position with $7.98 million in sales, witnessing a notable 41.25% decline in its NFT market activity.

Each of the top five blockchains leading the week’s sales experienced double-digit losses, reflecting a broader market trend. Additionally, among the top ten, Ronin, the blockchain supporting Axie Infinity, notably saw a significant 209.09% surge, reaching $1.76 million in NFT sales, offering a contrasting narrative amidst the overall decline.

Exploring the Top NFT Collections and Notable Sales Trends

In the dynamic world of digital collectibles, certain NFT collections stand out for their popularity and market performance. This week, we delve into some of the high-ranking NFT collections and notable sales trends shaping the landscape.

Cryptopunks Reign Supreme:

At the forefront of the NFT market sits the iconic Cryptopunks series, known for its pixelated characters and historical significance in the NFT space. This week, Cryptopunks soared to new heights, recording a staggering $13.67 million in sales over the past seven days. This marks a notable increase of 32.23% from the previous week, reaffirming its status as a top player in the digital collectibles arena.

Expanding the Narrative:

Beyond Cryptopunks, the NFT landscape is rich with diverse collections, each offering unique artistic styles and narratives. From generative art to virtual real estate, the possibilities are endless in the world of digital collectibles. As collectors continue to explore new avenues and discover emerging artists, the market continues to evolve and expand.

Tracking Trends and Market Dynamics:

Keeping a pulse on high-ranking collections and top sales trends provides valuable insights into the ever-changing dynamics of the NFT market. From shifts in buyer preferences to emerging trends in creative expression, understanding these nuances is essential for both collectors and creators alike.

Looking Ahead:

As the NFT ecosystem continues to mature, we anticipate further innovation, collaboration, and growth within the space. With new collections emerging and existing ones evolving, the future promises exciting opportunities for collectors, creators, and enthusiasts alike.

Bitcoin’s Miscellaneous Rankings saw a total of $9 million in sales, marking a modest 3.75% decrease compared to the previous week. Making its mark in the third position, Solana’s Froganas collection surged ahead with an impressive $7.04 million in sales, showcasing a remarkable increase of 420.77% from the preceding week.

Coming in at the fourth spot, Solana’s Cryptoundeads collection achieved $6.75 million in sales, although it faced a notable decline of 58.82%. Meanwhile, Avalanche’s Dokyo NFT collection secured the fifth position with $5.85 million in sales, experiencing a 33.70% drop in sales volume compared to the previous week.

During the previous week, the most expensive digital collectible was Cryptopunk #6,940, which was sold for $507,618 exactly seven days ago. Just four days ago, BNB’s Lockdealnft #18,858 was purchased for $147,157, while an Axie Infinity NFT commanded a price of $143,559 earlier this week.

Another notable sale included an Uncategorized Ordinal, which changed hands for $88,386, and a Cardano’s Meld Diamond Hand #2,813 was acquired for $56,186. The significant sales of Cryptopunk #6,940 and the Axie Infinity NFT notably contributed to the surge in sales within their respective blockchain networks.

The market for blockchain-based digital collectibles endured a challenging phase throughout 2022, and much of 2023 also saw a decline in NFT sales until the year’s end. While Bitcoin’s entry into the NFT sales sphere initially provided a boost to overall sales, recent weeks have seen a decrease not only in BTC-focused NFT sales but also a notable 28.15% drop the week before.

NFTs based on Solana and Polygon displayed an upward trend in sales during the latter part of 2023; however, they have recently faced modest declines in their overall digital collectible sales volume. Whether this trend of decreasing NFT sales persists or if there will be a resurgence in the market remains uncertain.